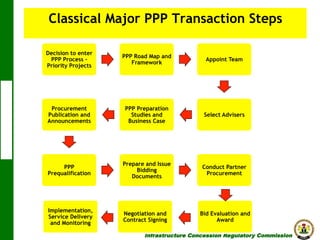

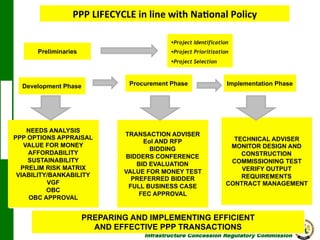

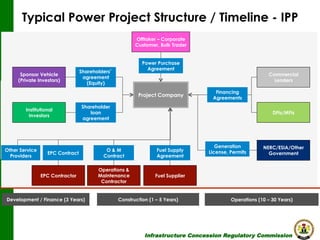

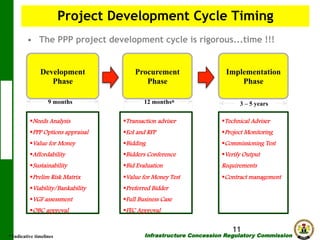

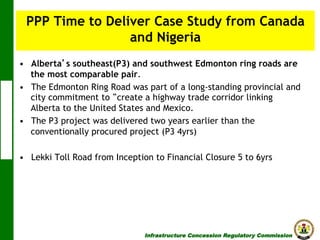

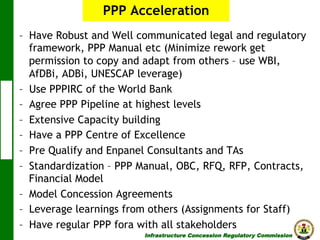

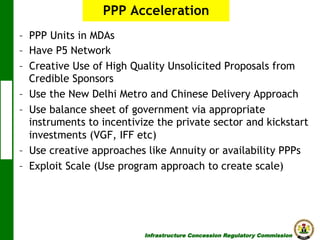

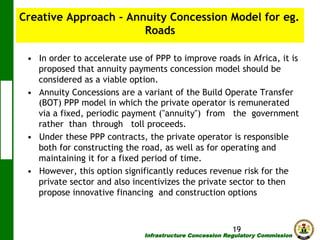

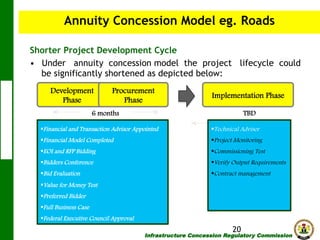

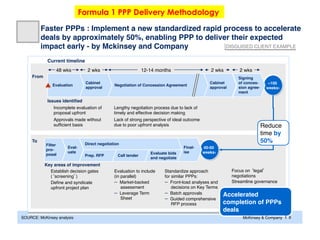

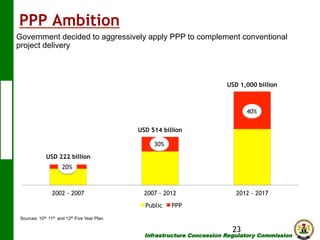

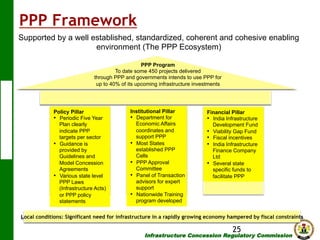

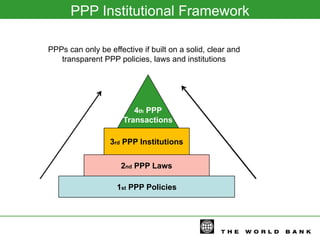

The document discusses options for accelerating public-private partnership (PPP) procurement in emerging markets to deliver infrastructure projects faster while maintaining quality and value for money. It notes that the typical PPP project development cycle takes 2-3 years, posing a challenge given political pressures to deliver infrastructure quickly. Various acceleration options are presented, including standardized processes, pre-qualified consultants, model contracts, and annuity concession models that reduce revenue risk for private partners. The goal is to reduce timelines by 50% while increasing value and capacity through PPPs.