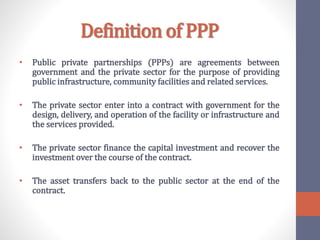

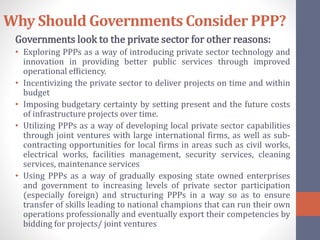

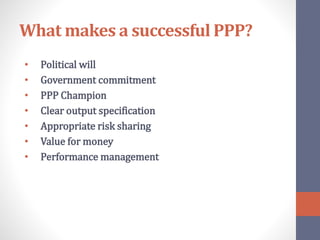

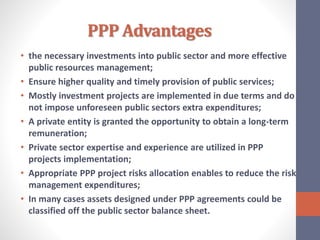

Public-private partnerships (PPPs) are agreements between governments and the private sector to provide public infrastructure and services, with private entities financing the projects and transferring assets back to the public sector at the contract's end. Governments consider PPPs for enhanced efficiency, technology integration, and local capability development while ensuring budgetary certainty and timely delivery. Successful PPPs demand political will, a clear framework, risk sharing, and project prioritization, although they come with potential disadvantages, such as higher costs and complex long-term agreements.