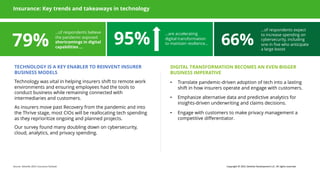

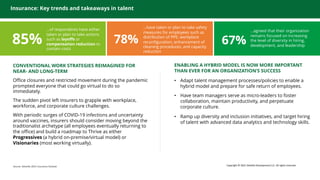

The Deloitte 2021 Financial Services Industry Outlook highlights how the pandemic has reshaped the financial services sector, accelerating digital transformation and reshaping workforce strategies. Key trends include increased focus on digital capabilities, technology investment for resilience, and redefining talent management to support remote and hybrid work models. The report emphasizes the importance of leveraging technology and innovative leadership to enhance operations and customer engagement as firms adapt to the new economic realities.