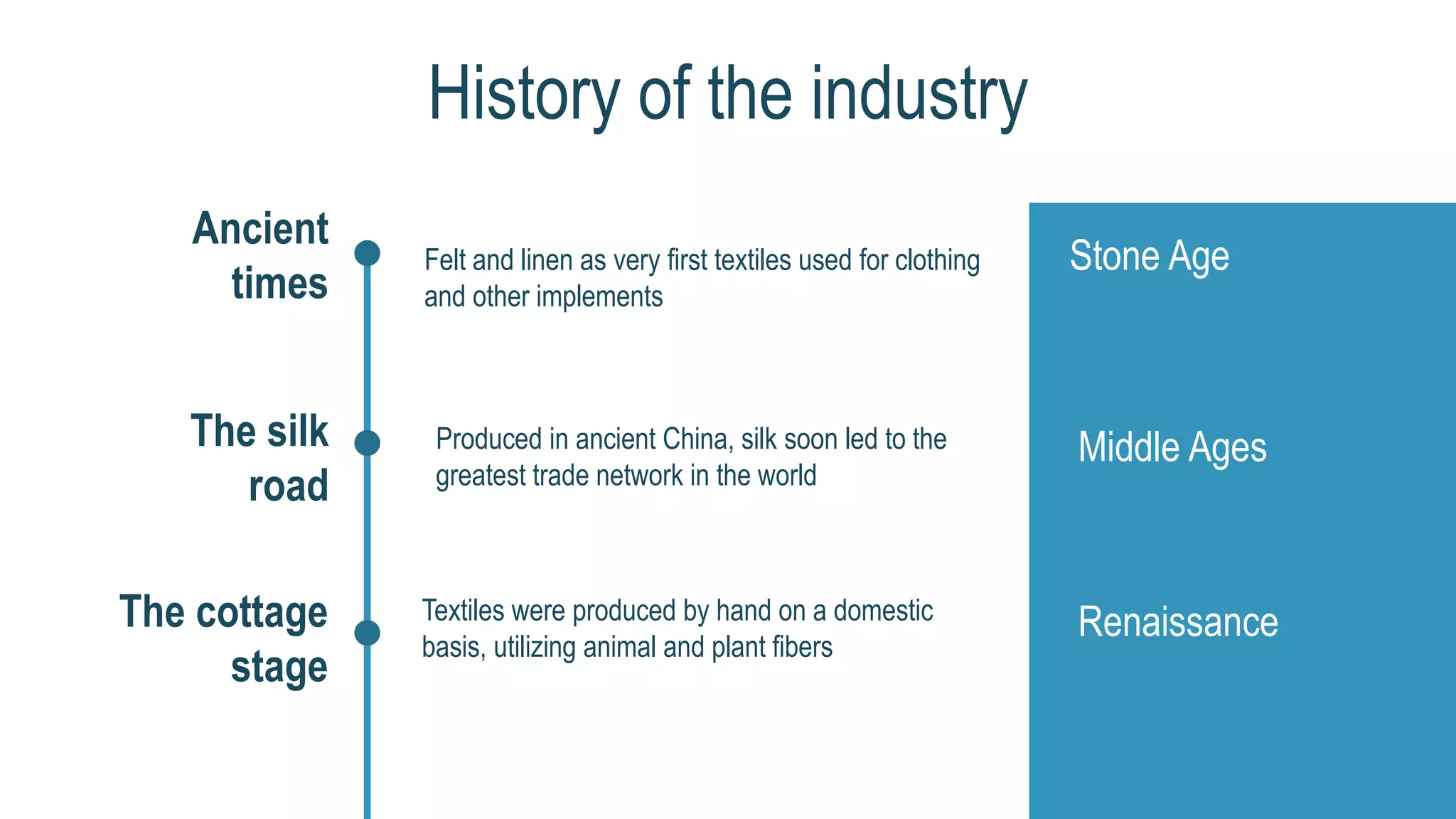

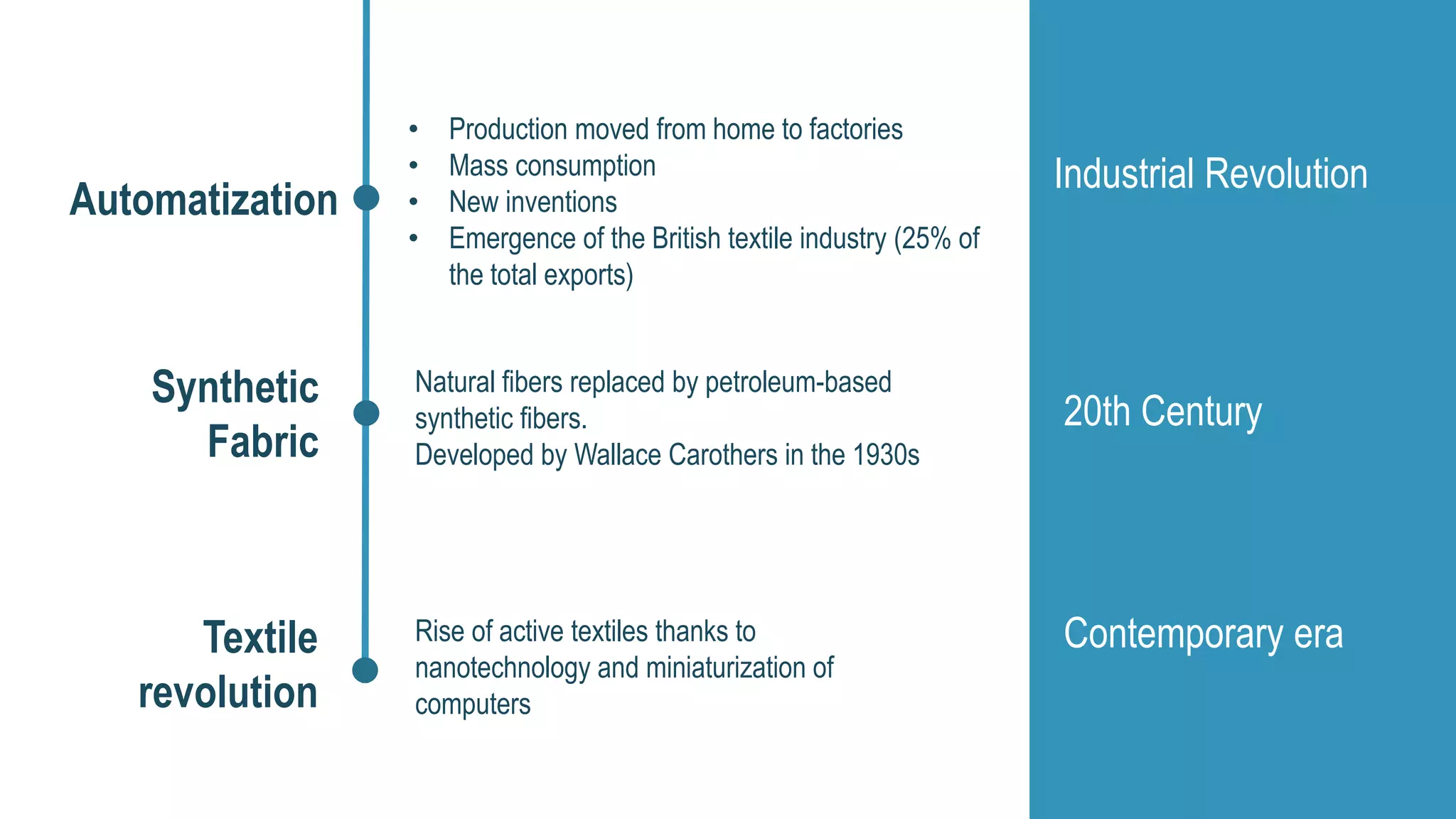

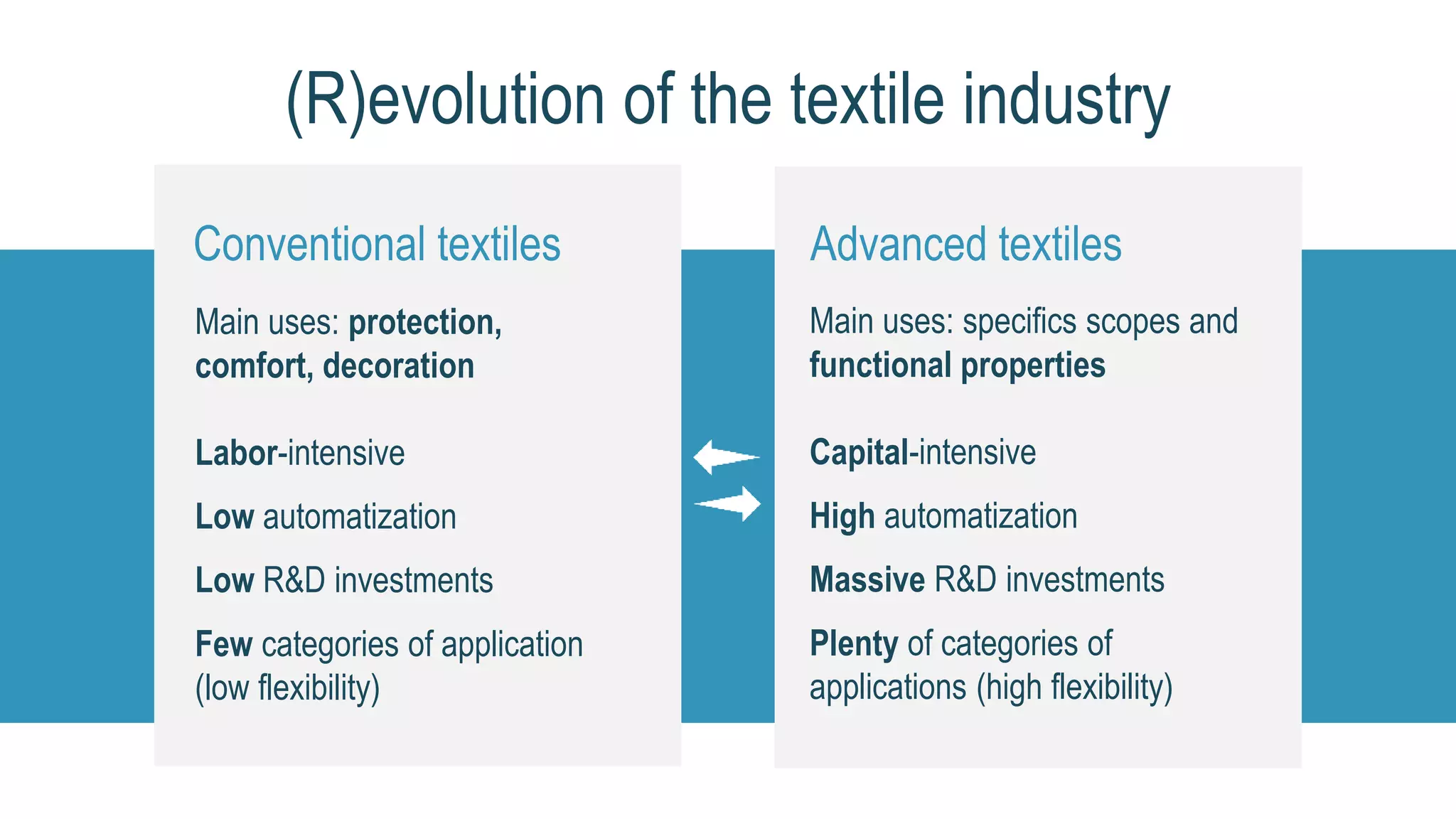

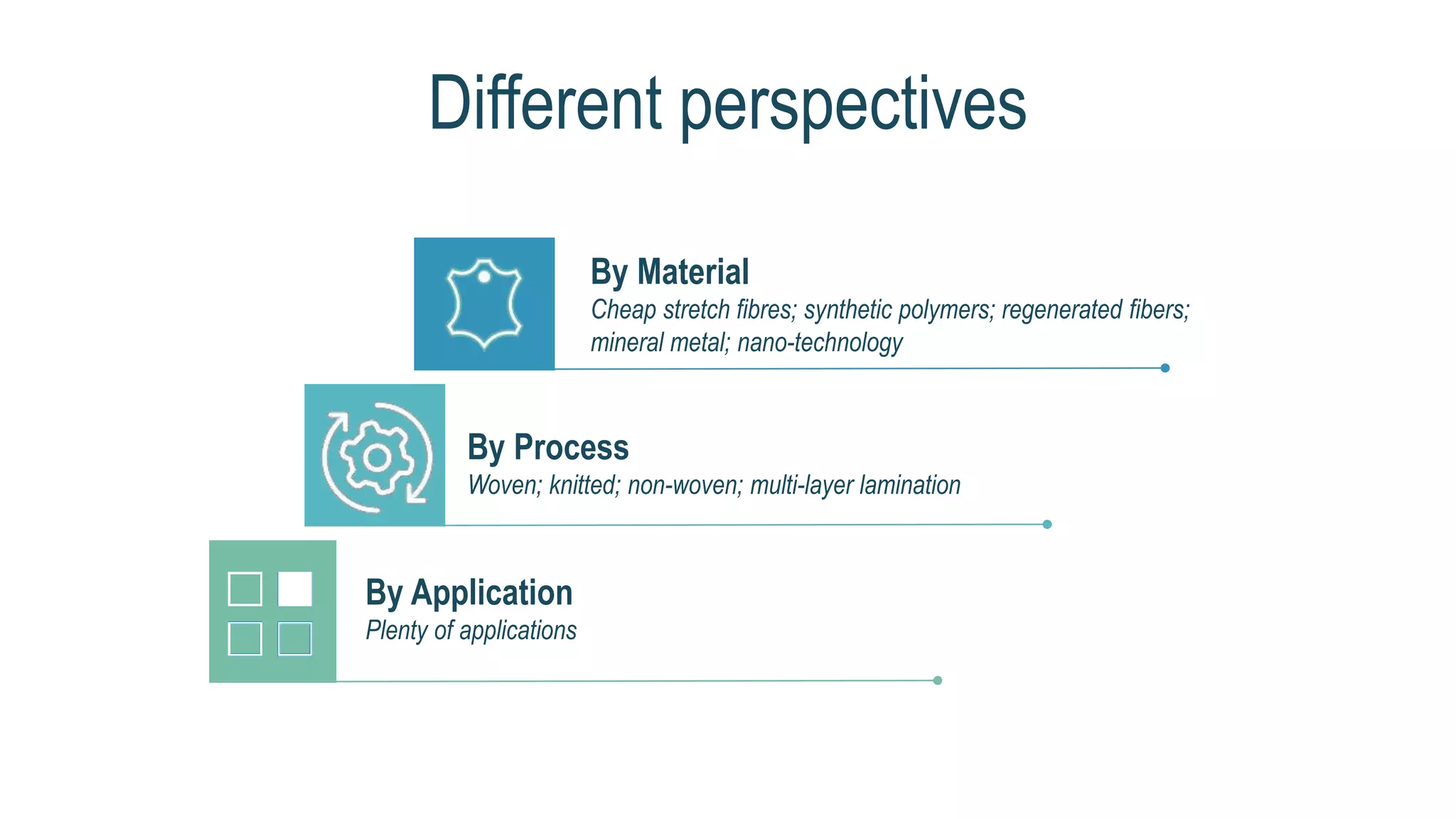

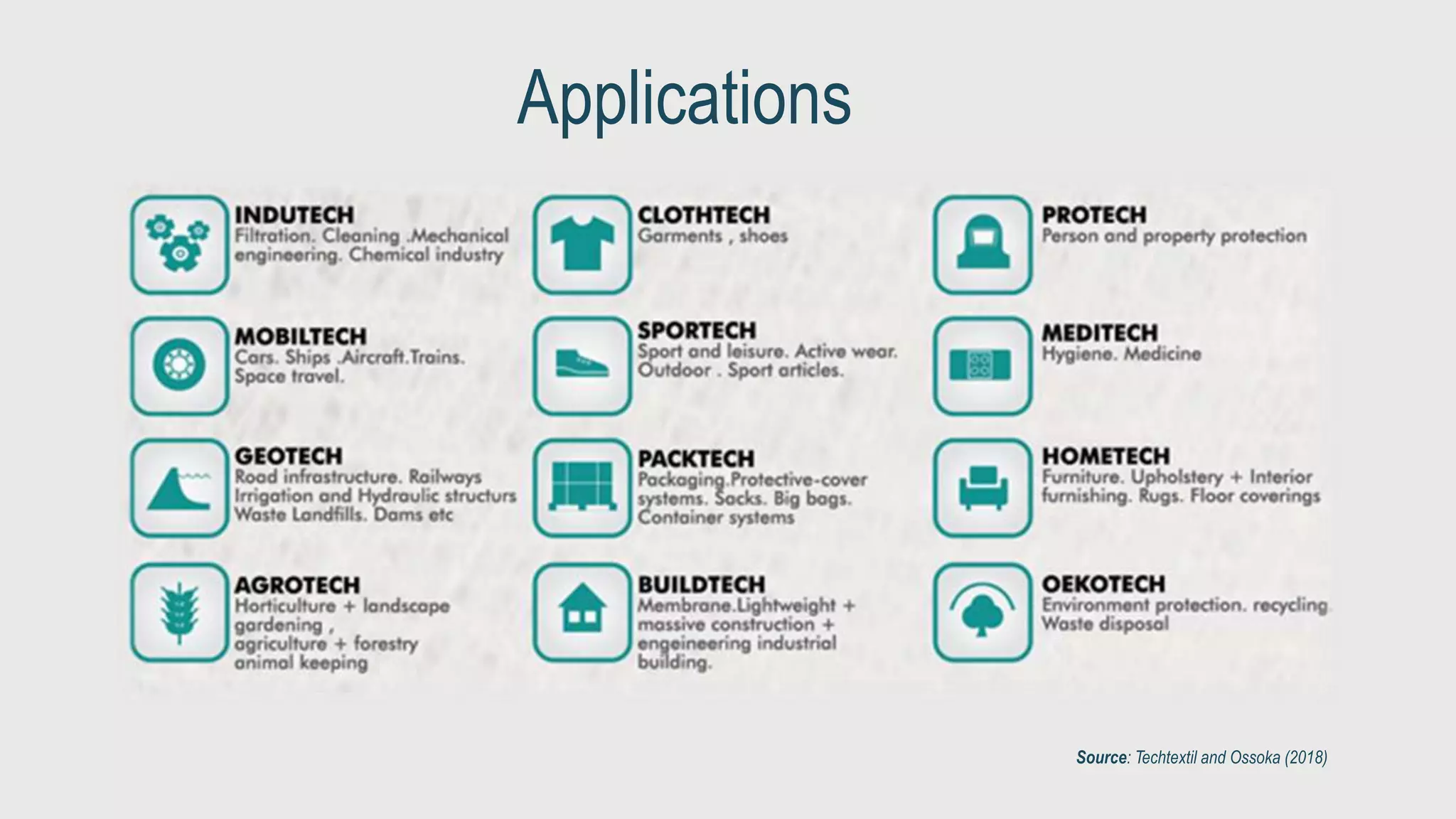

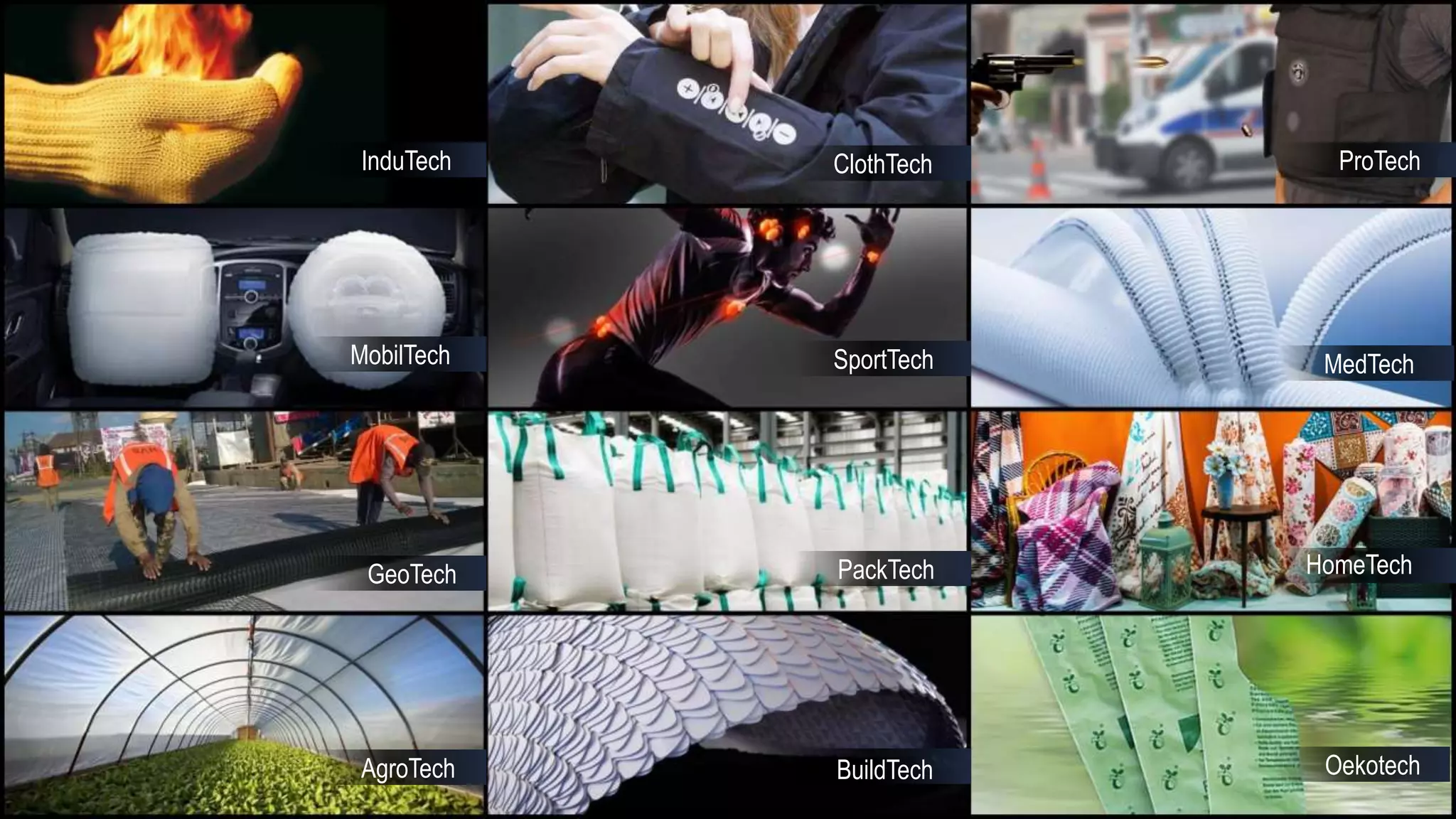

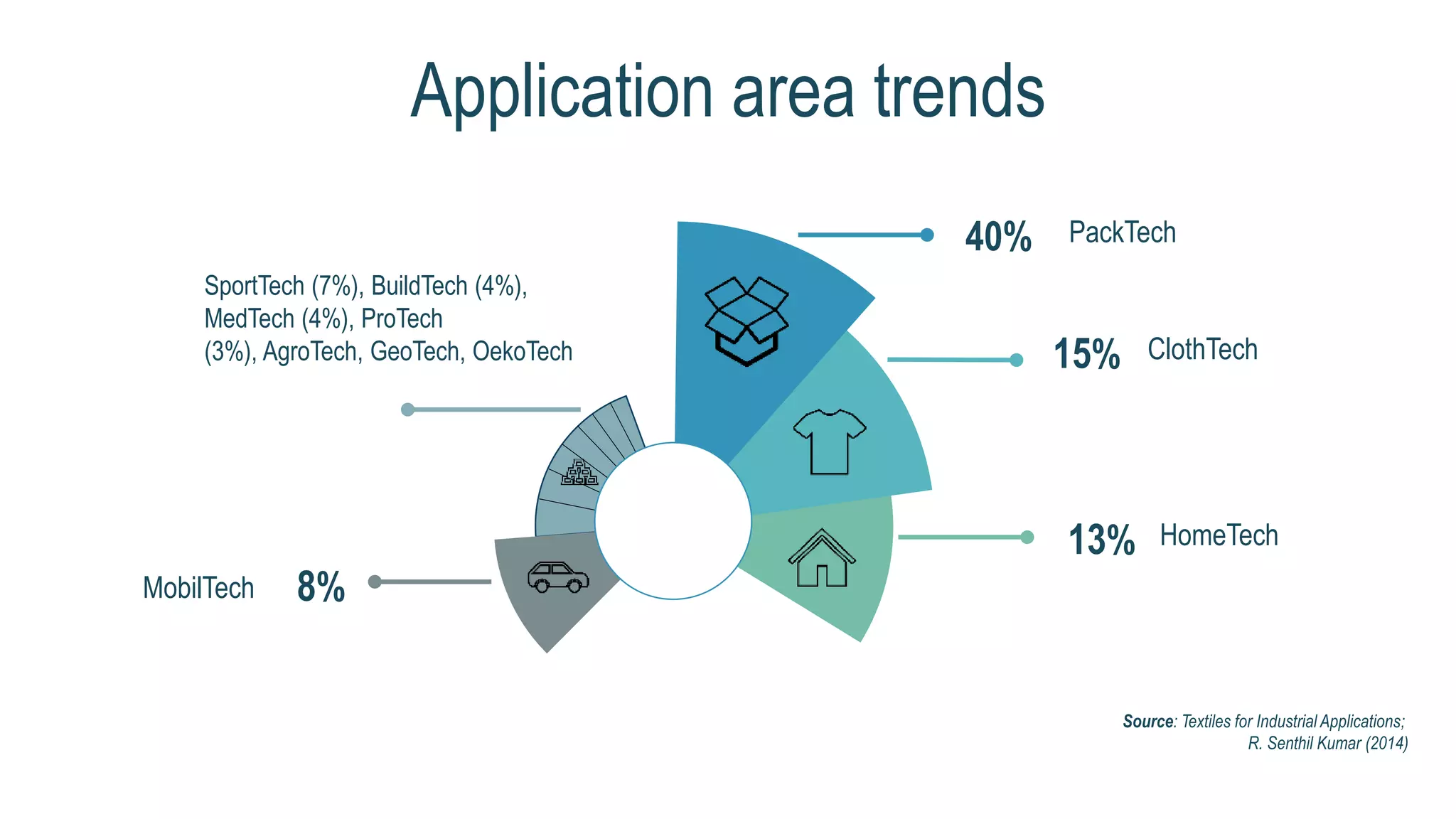

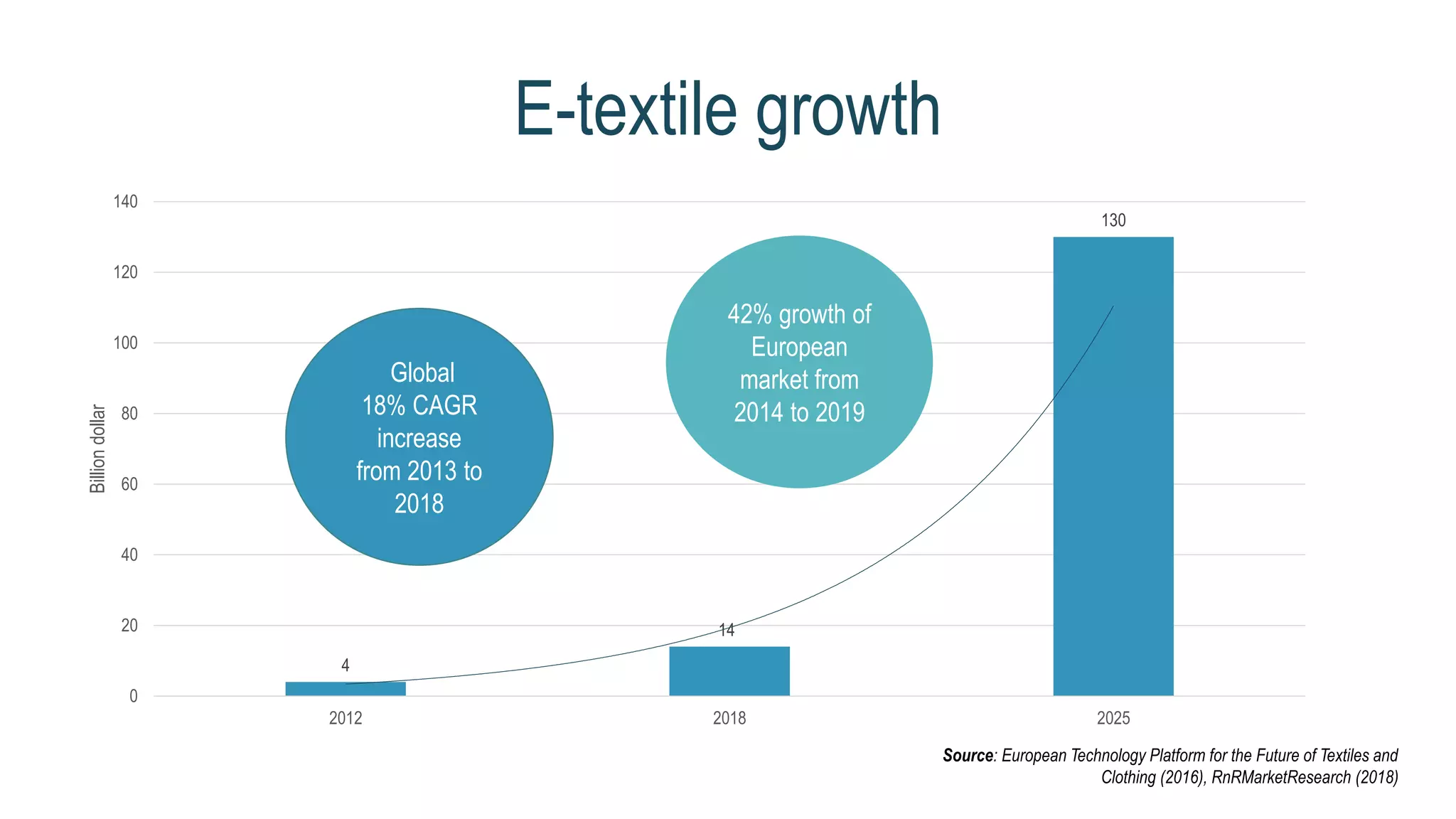

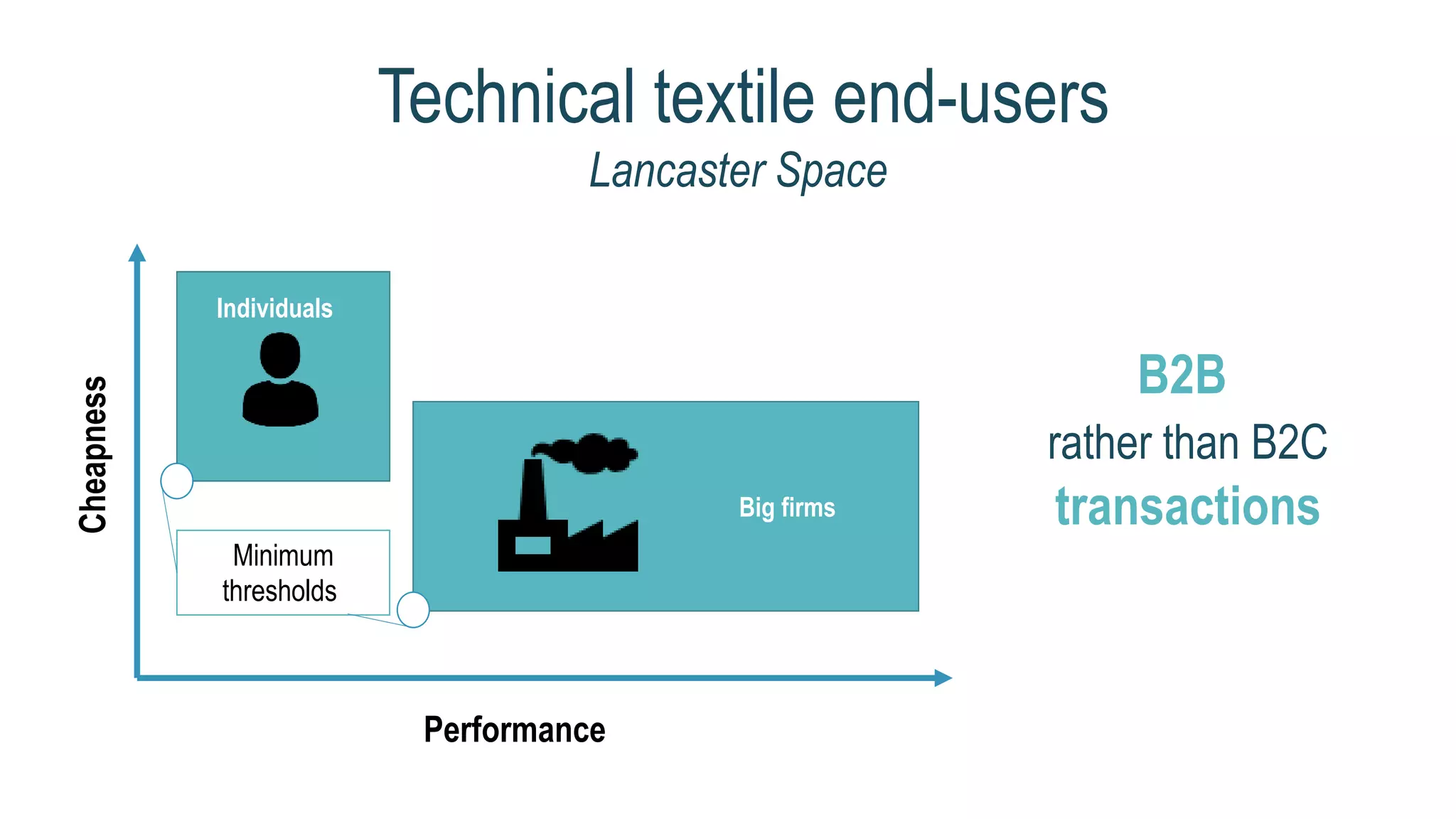

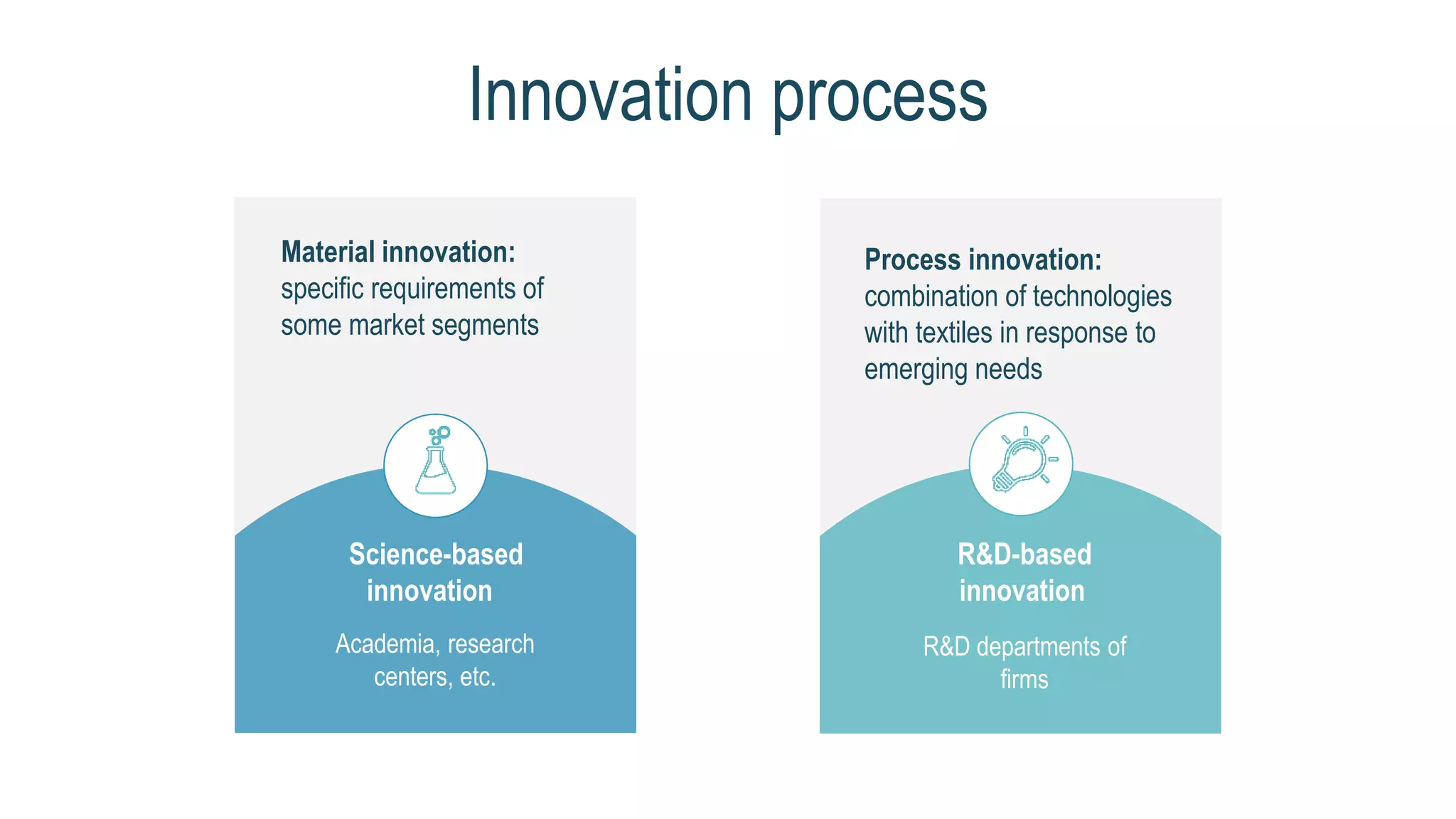

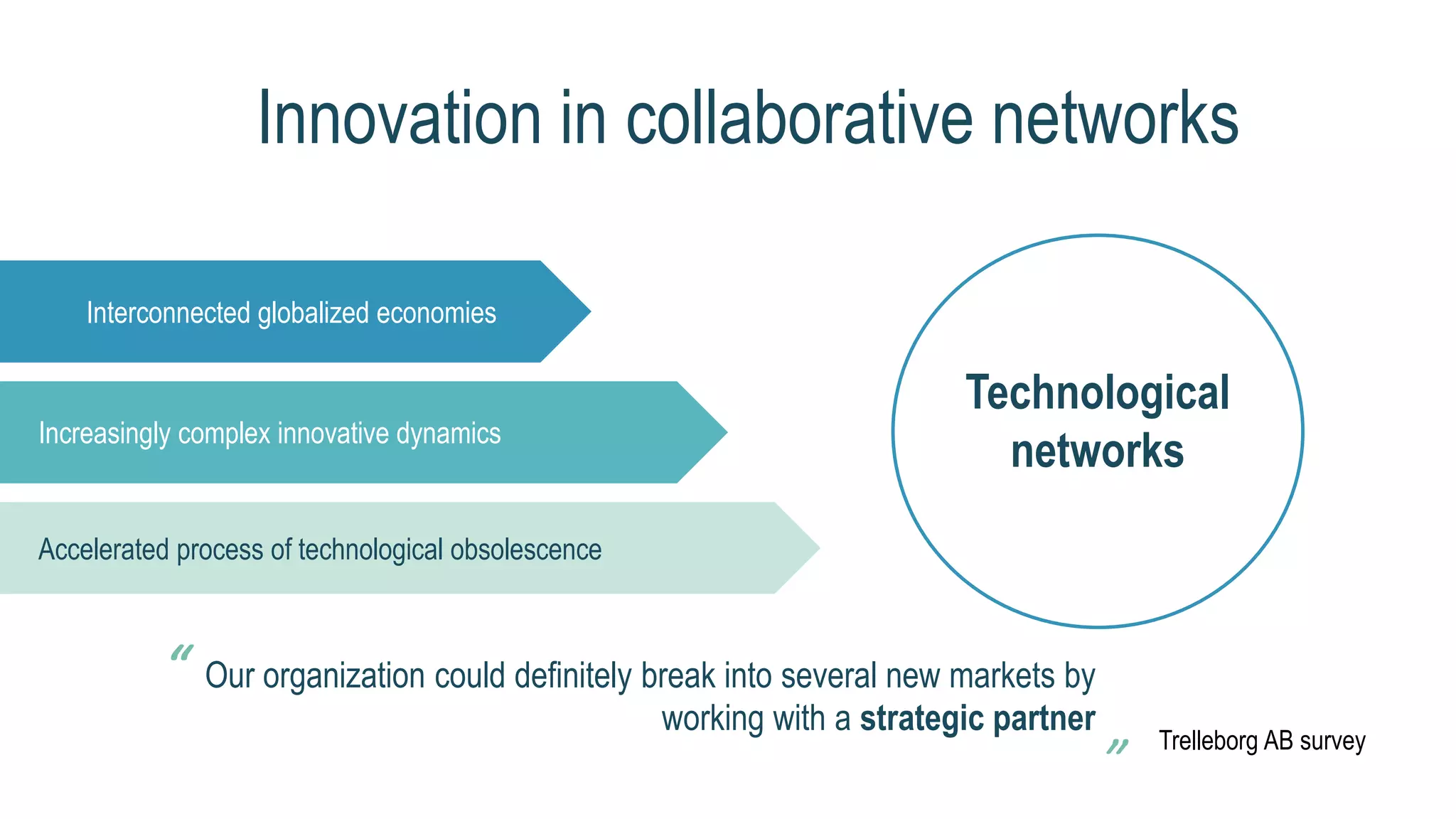

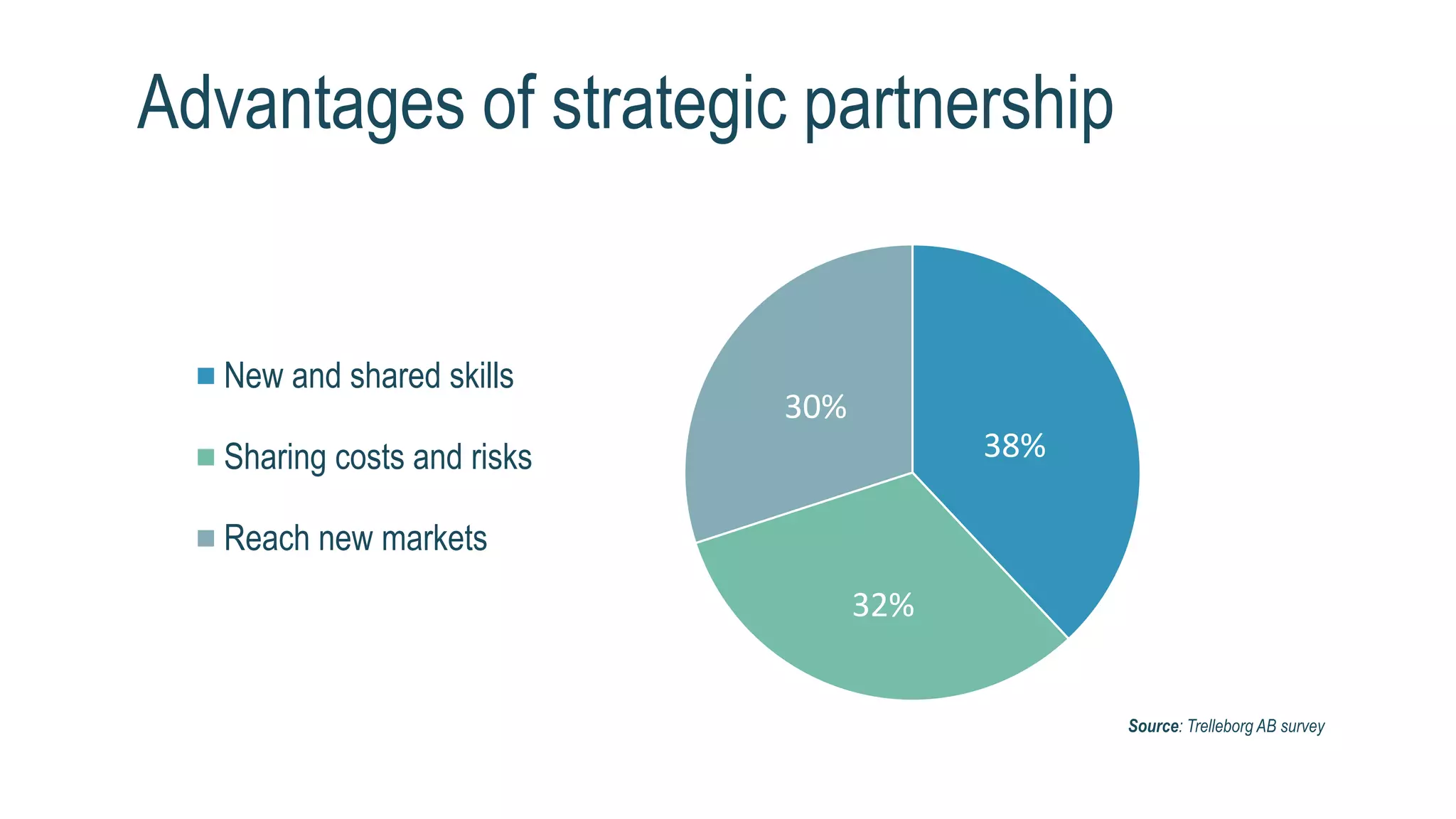

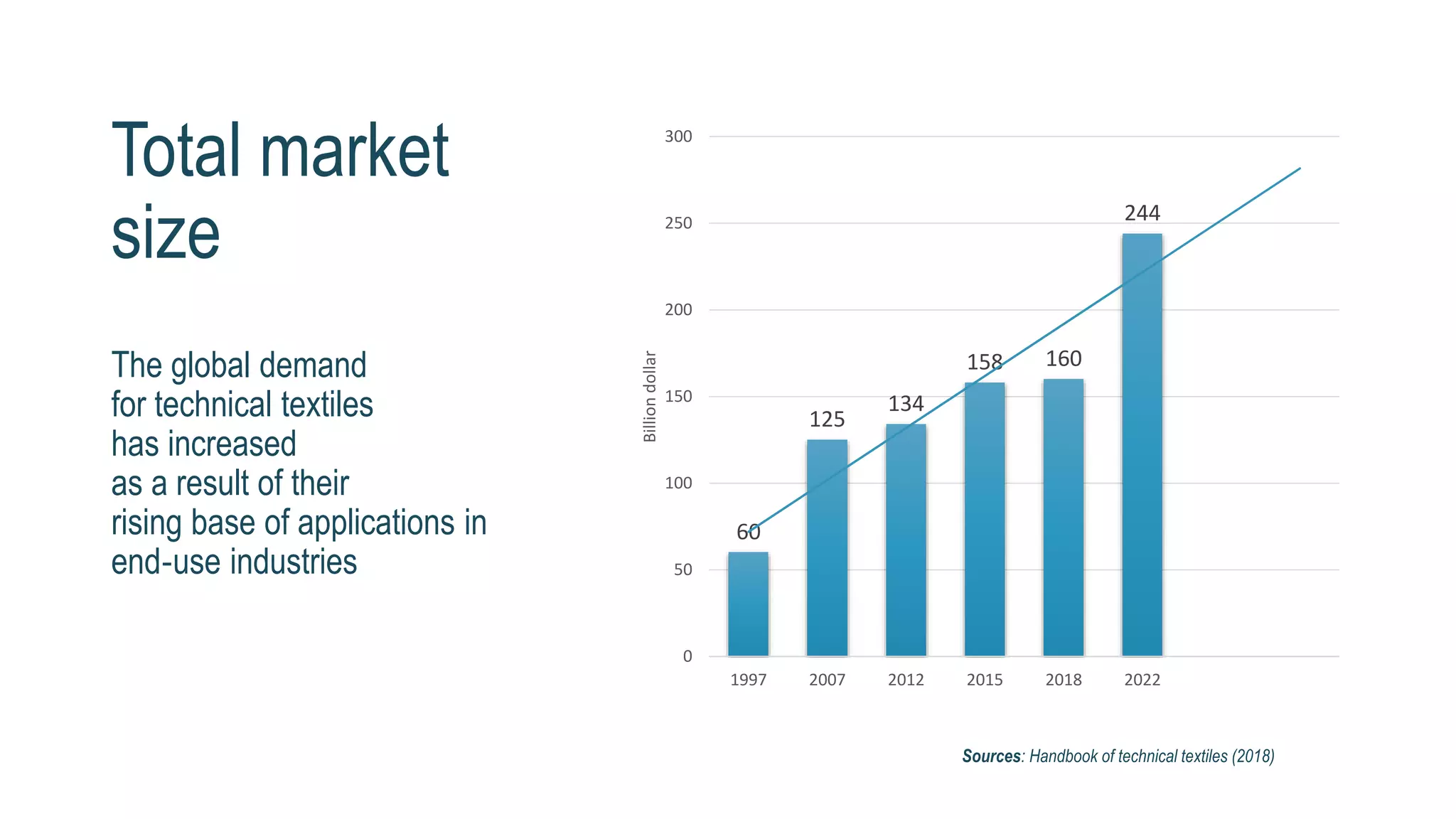

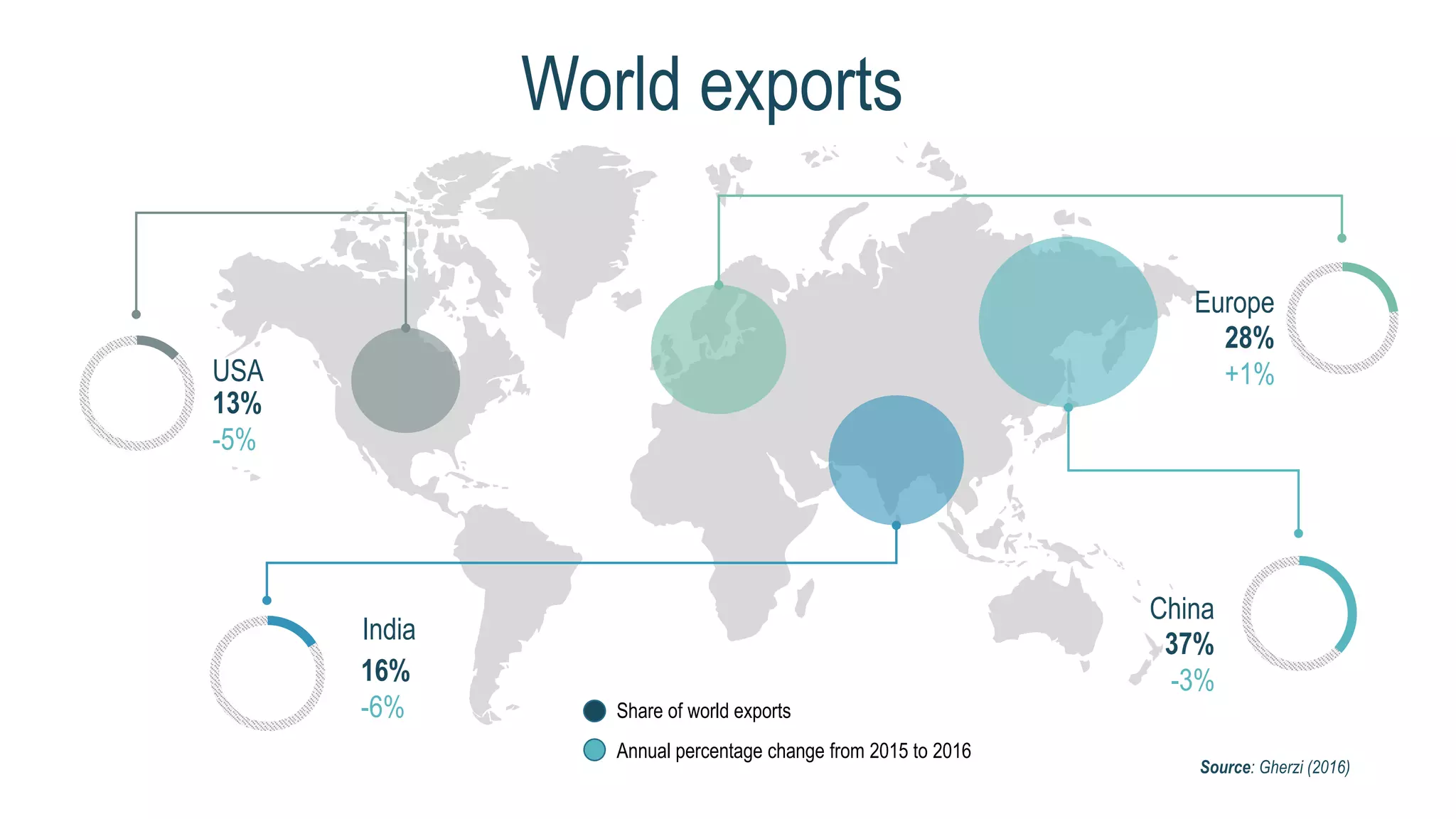

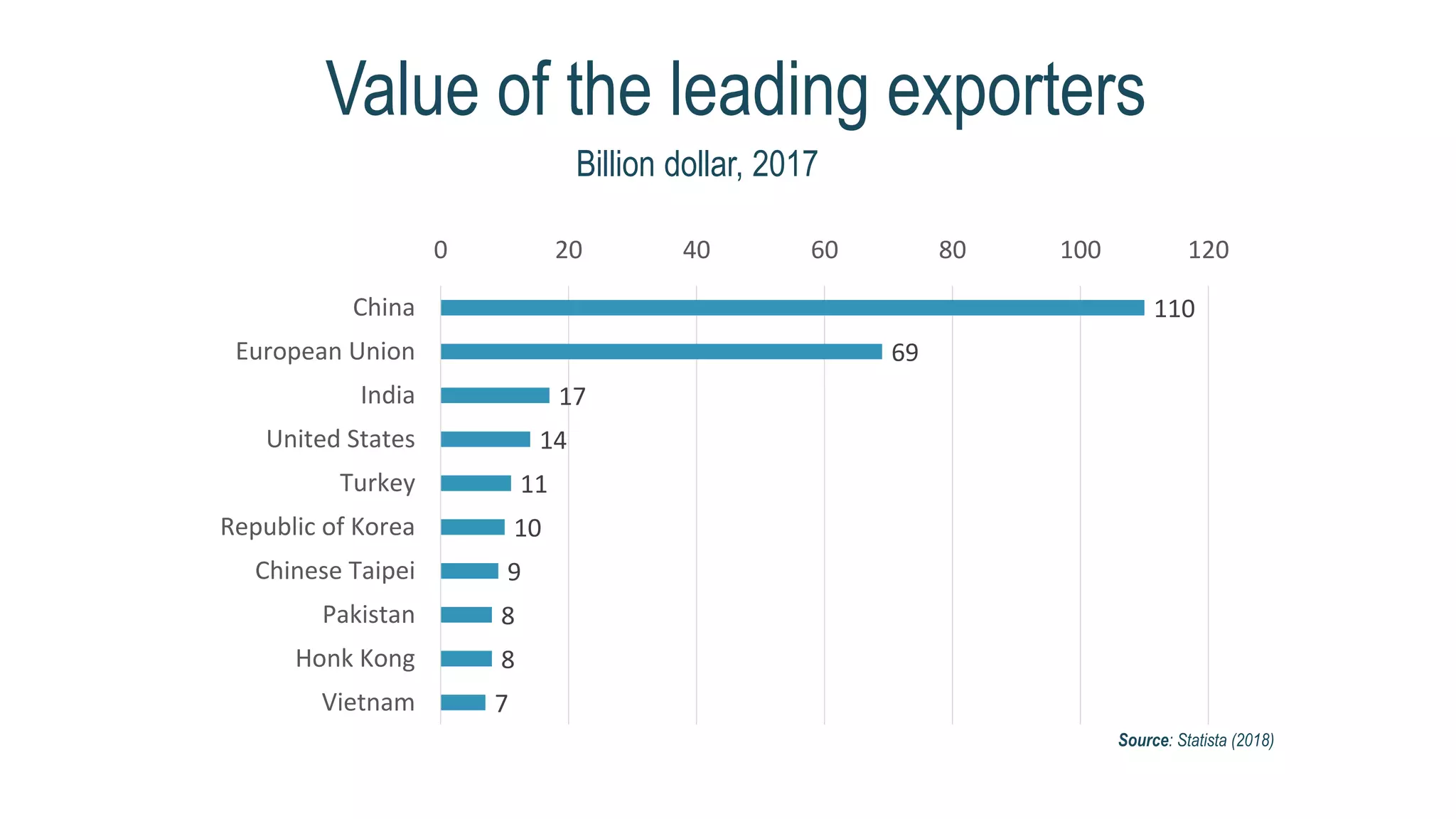

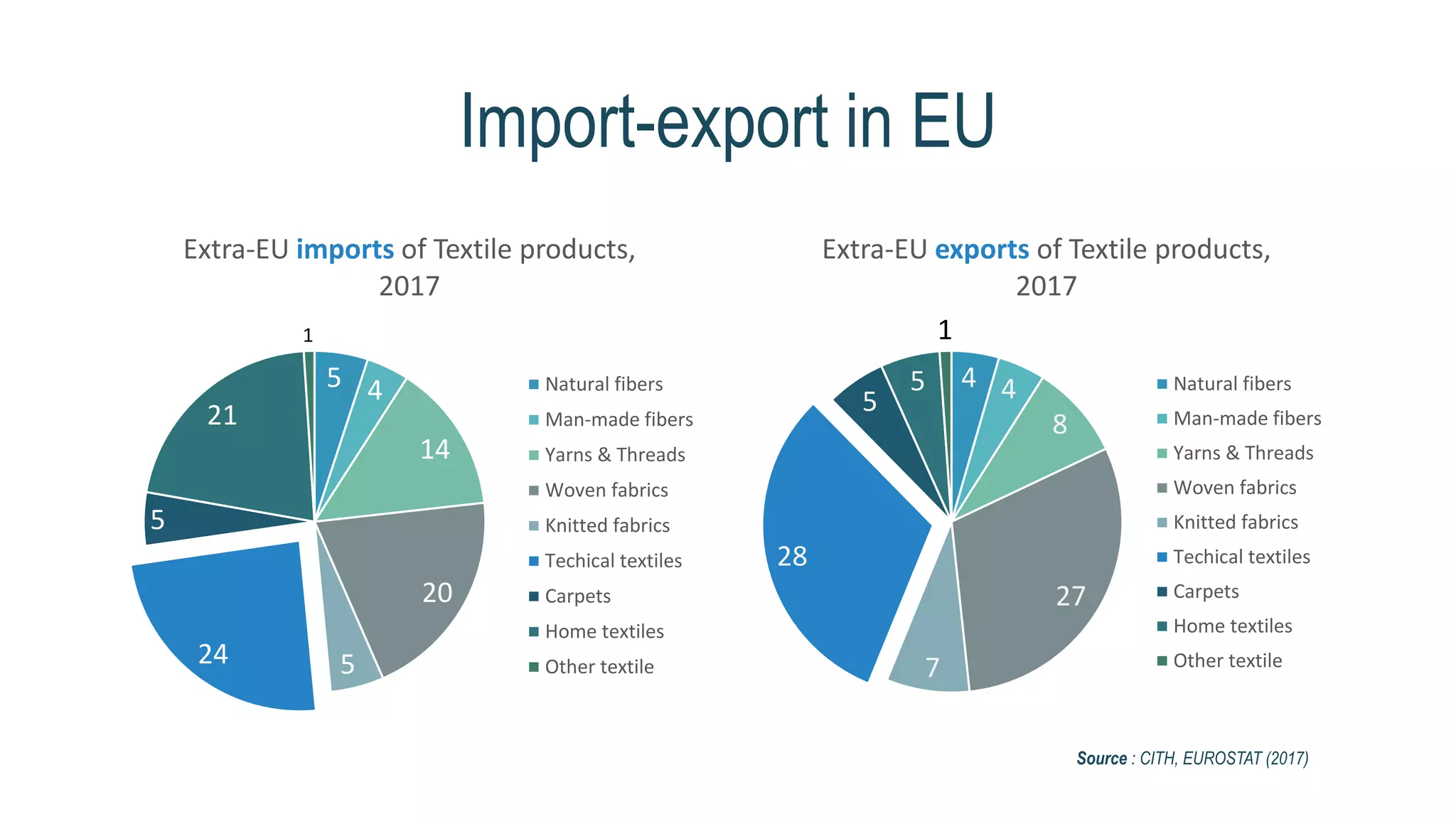

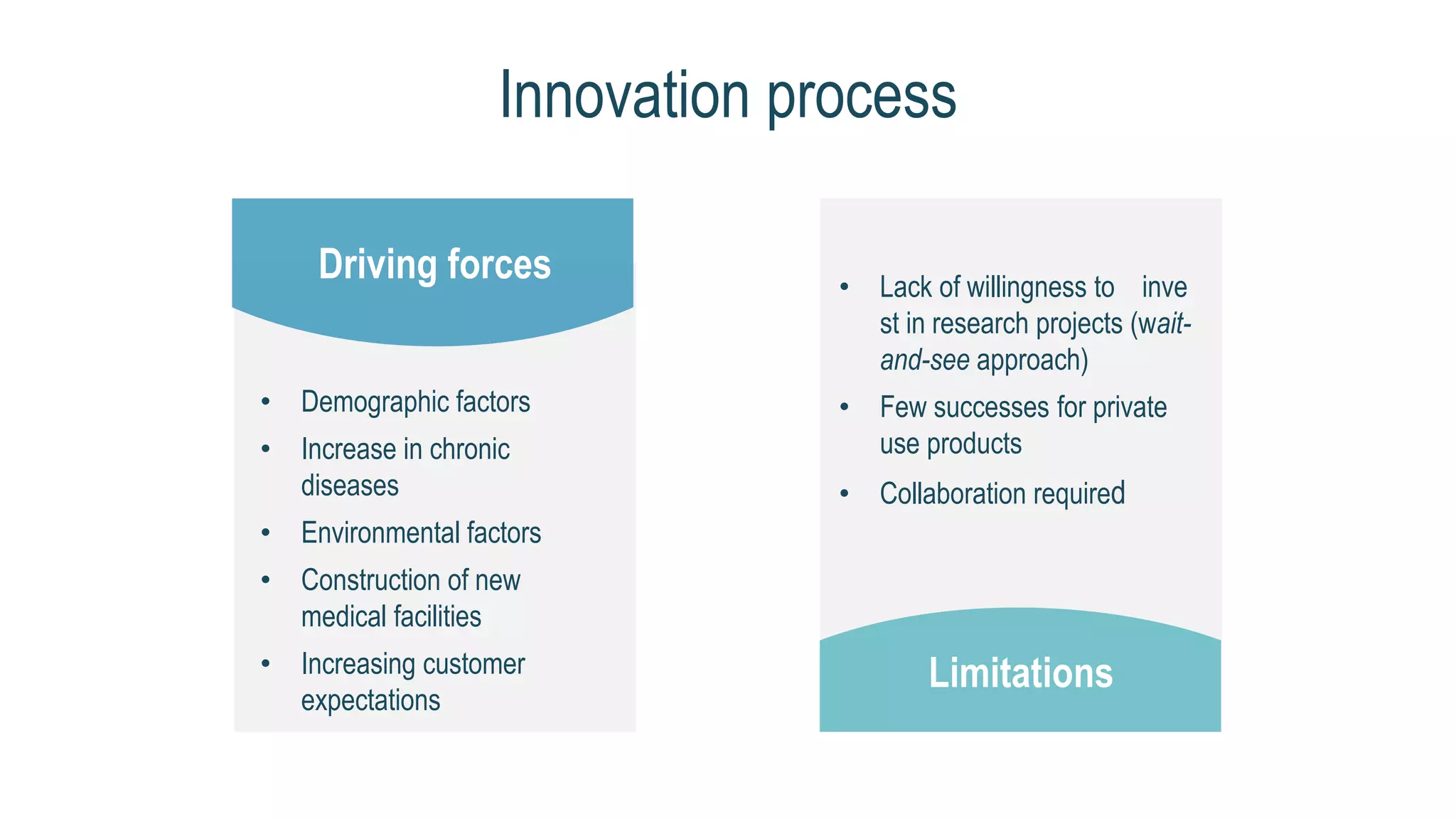

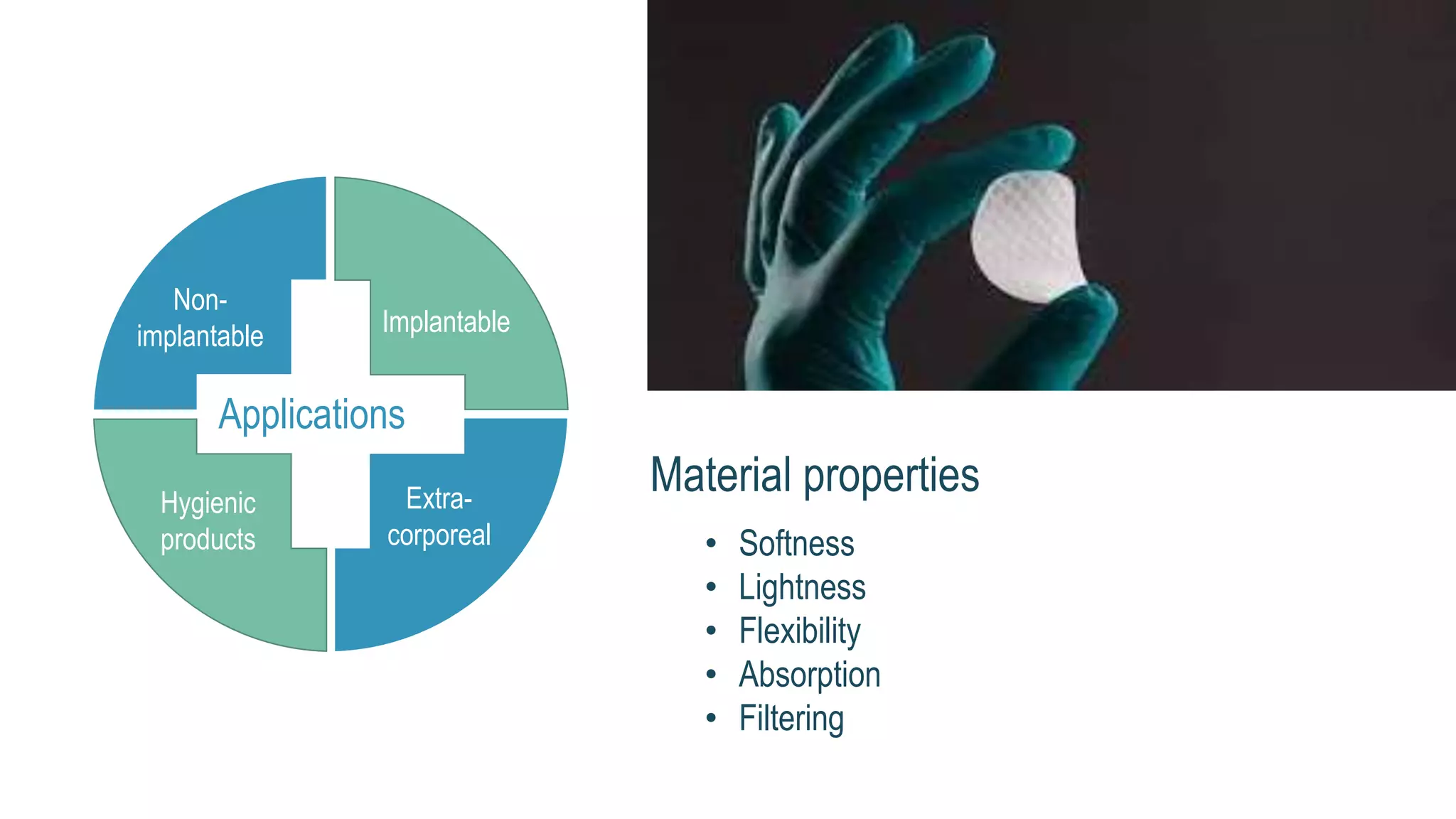

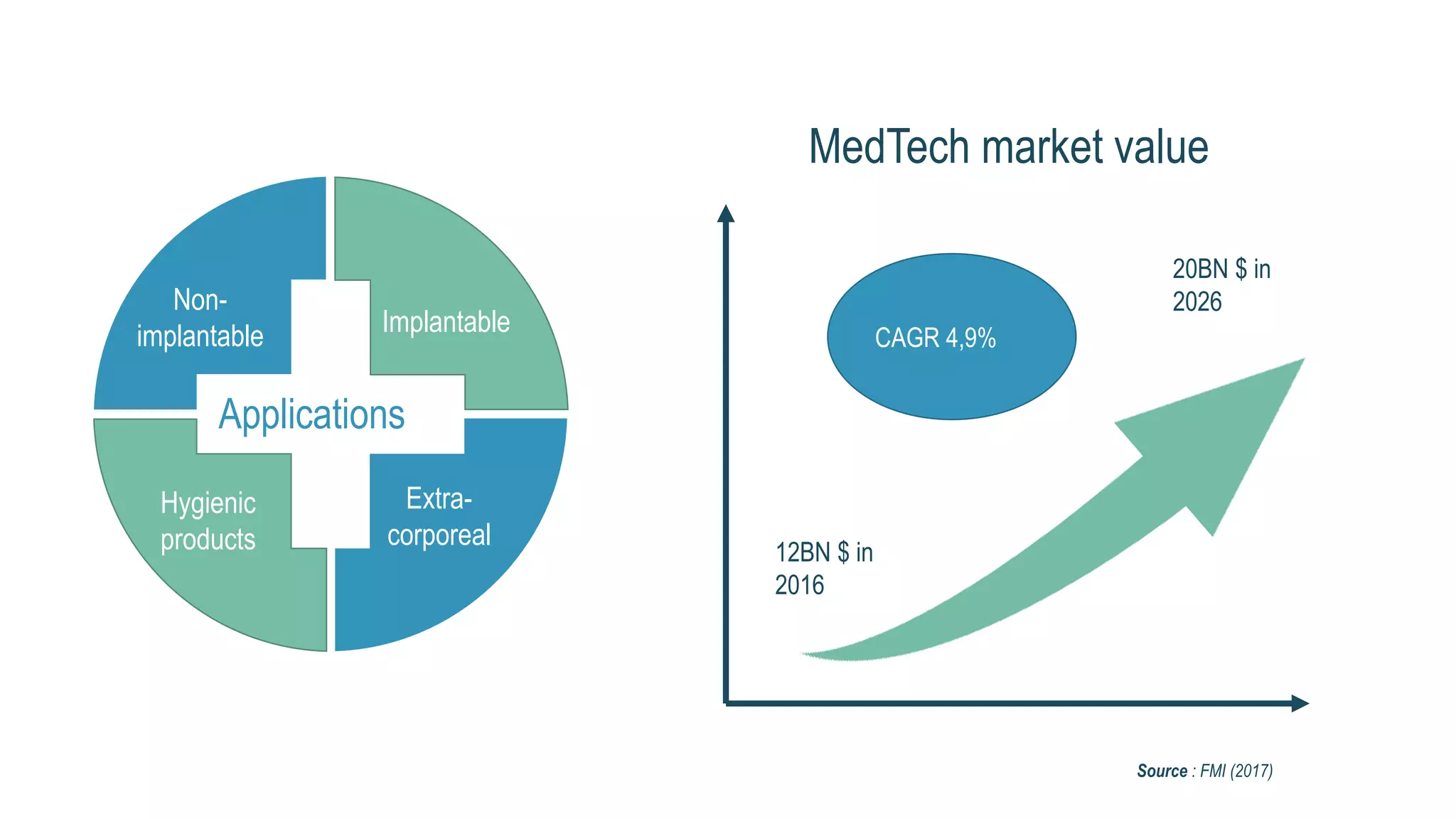

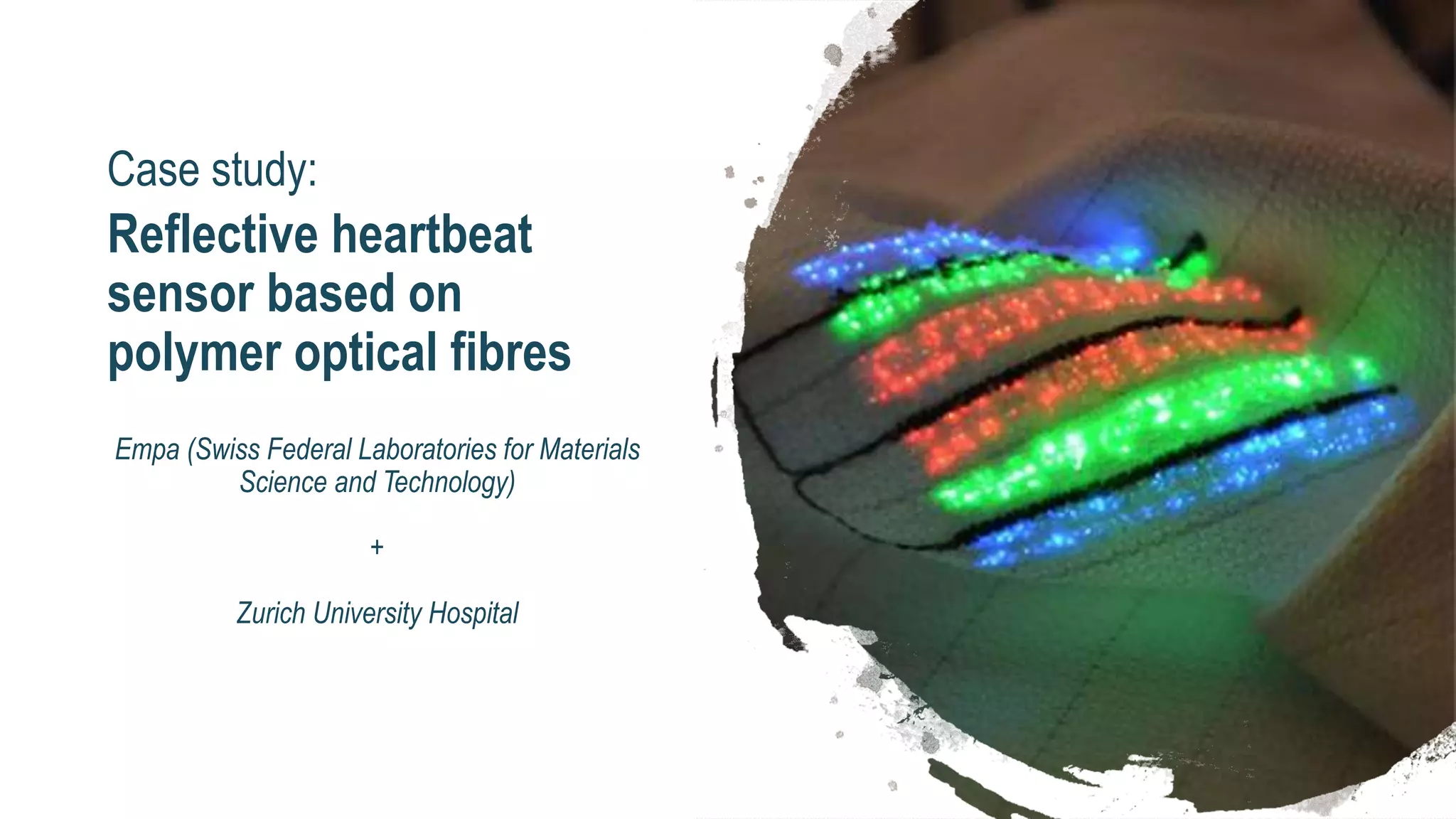

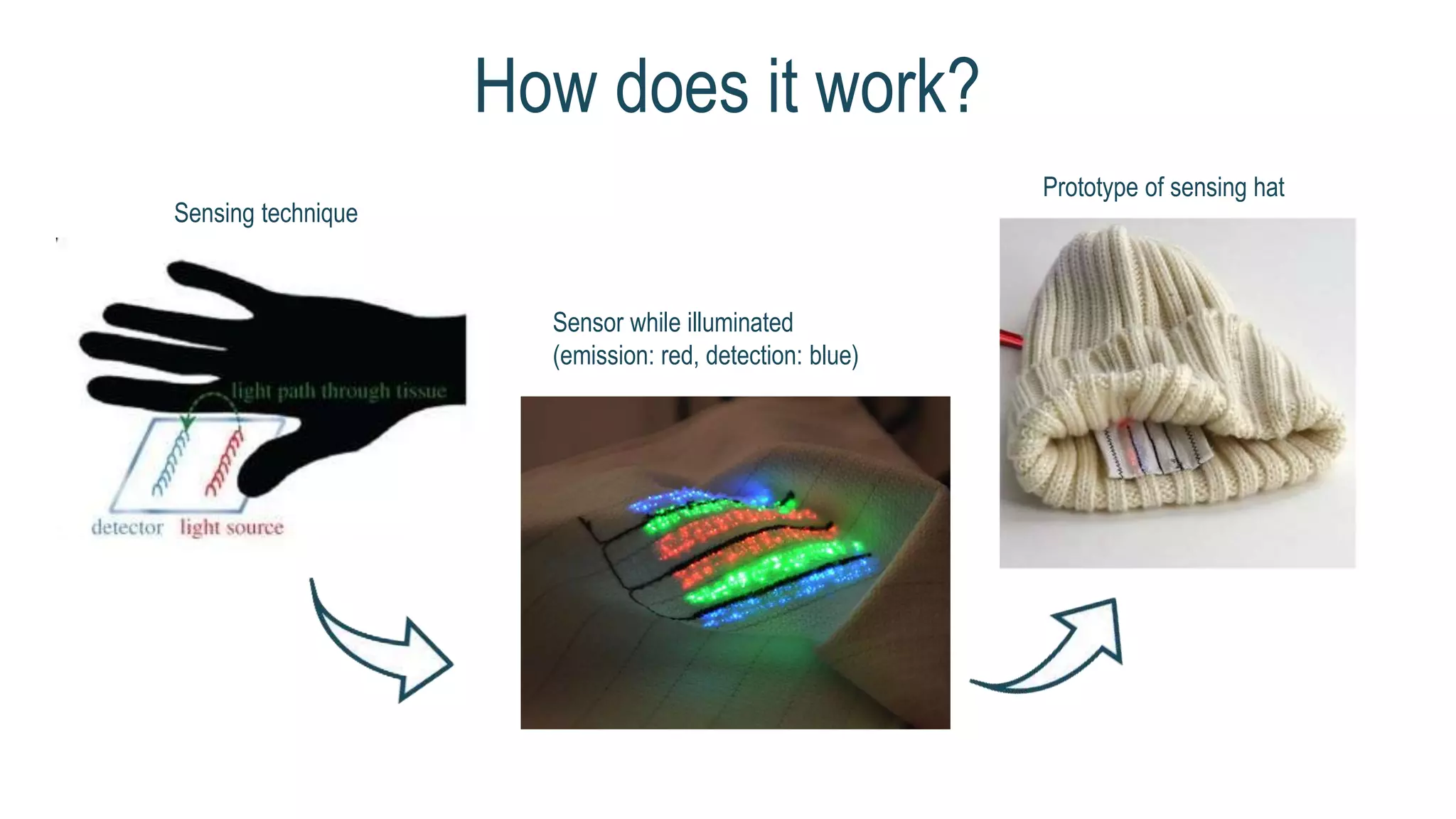

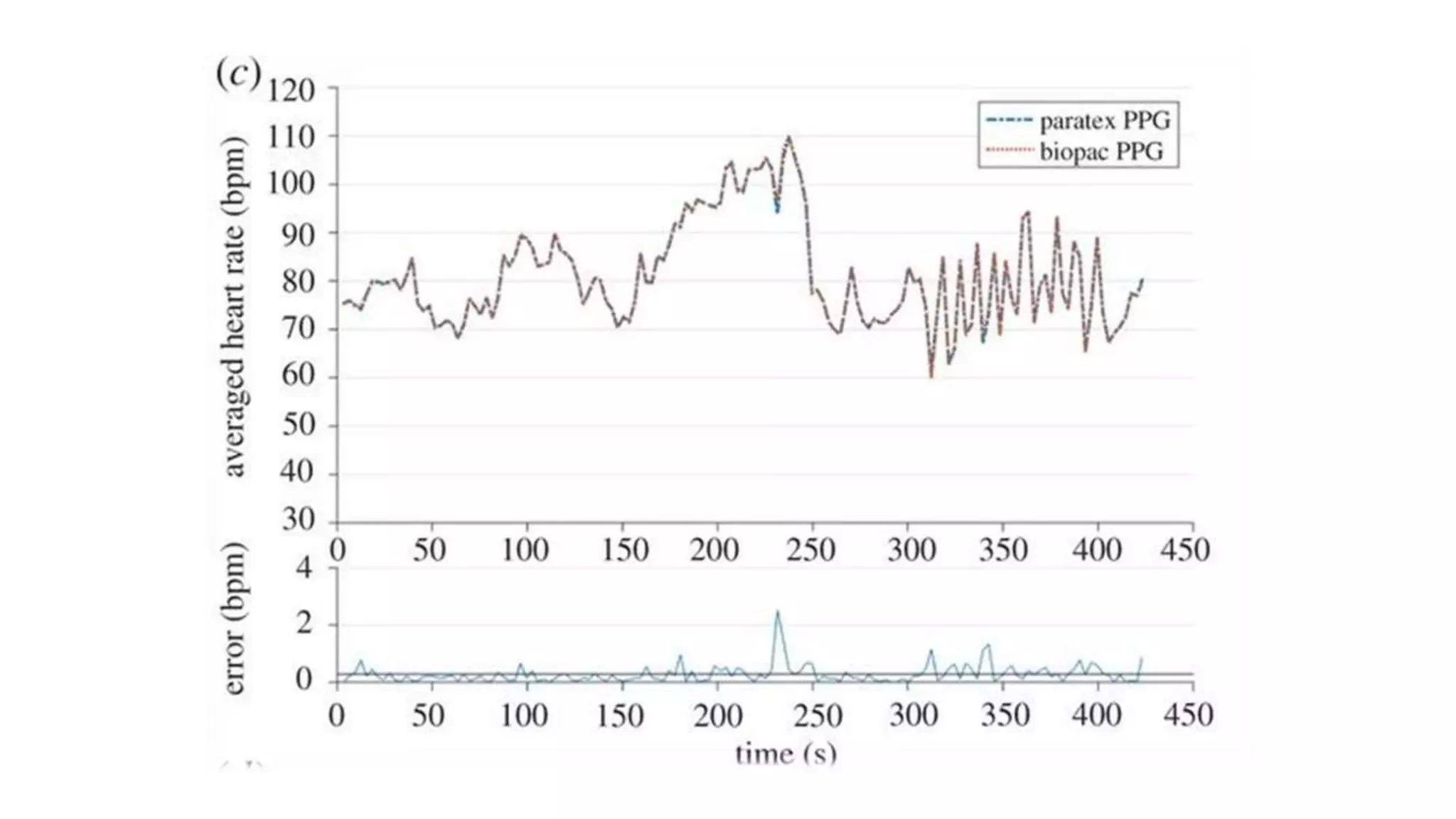

This document summarizes an academic report on advanced textiles. It discusses the history and evolution of textiles from ancient times to the present, focusing on the transition from natural to synthetic fibers and the rise of active textiles. Key definitions and applications of advanced textiles are provided across various sectors such as medical, sports, packaging and more. The ecosystem and innovation process in the industry is described involving manufacturers, end-users, academia, and partnerships. Industry characteristics like market size, trade patterns, and growth forecasts for different regions are presented. The focus section analyzes opportunities in the medical textiles sector for non-implantable, implantable and extracorporeal applications, highlighting a case study on reflective heartbeat sensors.