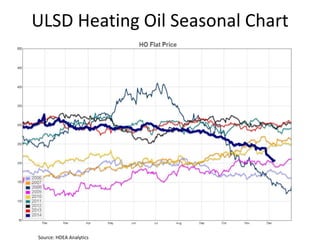

The document provides an overview of the global economic outlook for ethanol producers. It discusses factors such as crude oil and corn prices, US and global ethanol supply and demand fundamentals, export market conditions in countries like Canada and Brazil, and seasonal price trends for ethanol. It analyzes how economic conditions in key countries may impact their ethanol imports. The outlook suggests ethanol inventories may increase in early 2015 unless production rises or exports are stronger than expected.