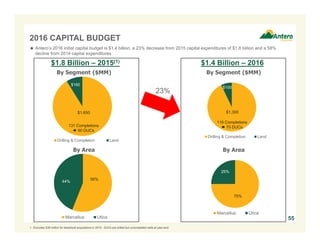

The document provides an overview of Antero Resources Corporation. It begins with forward-looking statements and disclaimers about projections. It then notes that the company has updated its 2016 production and operating cost guidance, increasing projected growth to 20% and lowering costs. The acquisition of additional acreage from a third party is discussed, which adds over 66,000 net acres and over 5 trillion cubic feet of reserves. This significantly increases Antero's core drilling locations and provides growth for its midstream subsidiary, Antero Midstream. The economics of developing the acquired acreage are attractive, with projected returns of 51-77% depending on gas prices.