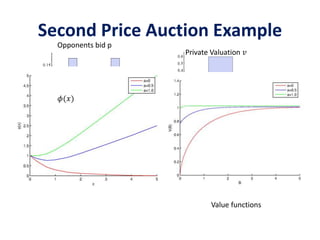

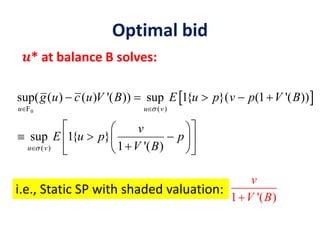

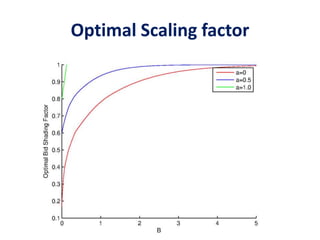

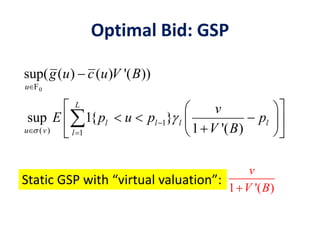

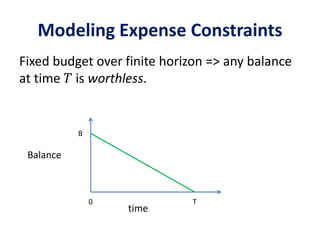

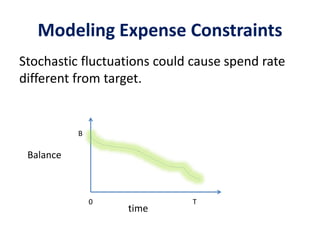

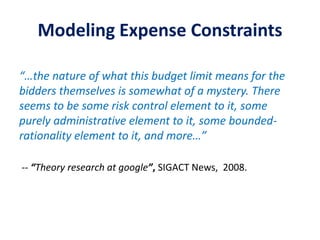

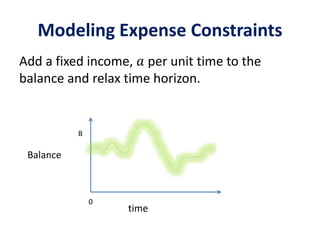

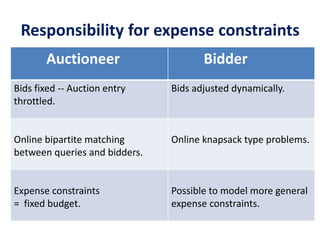

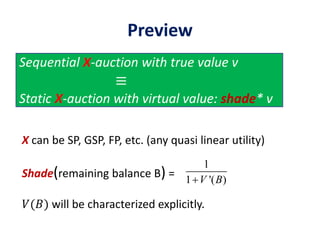

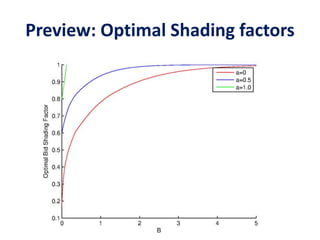

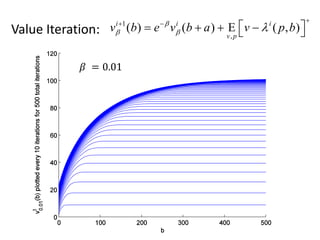

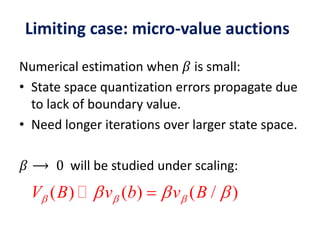

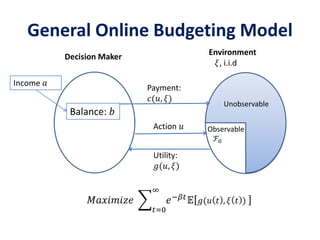

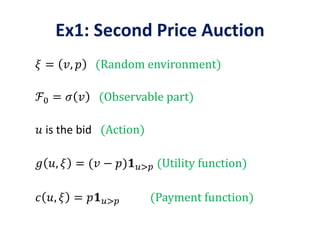

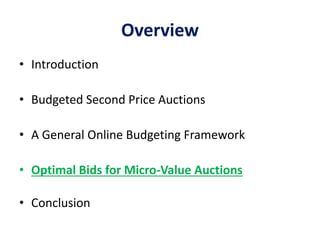

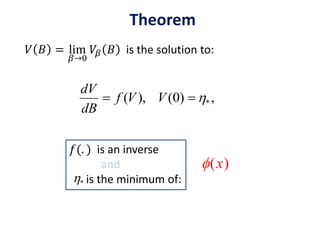

The document discusses expense-constrained bidder optimization in repeated auctions, focusing on budgeted second price auctions and online budgeting frameworks. It introduces models for optimal bid strategies under fixed income and variable auction conditions, emphasizing utility maximization while considering expense constraints. The conclusion highlights the model's applicability to online budgeting challenges and the relationship between optimal bids and virtual valuations.

![Model: Budgeted Second Price

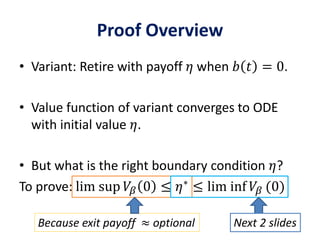

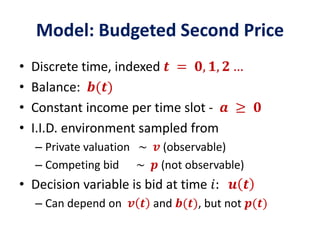

• 𝒃 𝒕 + 𝟏 = 𝒃 𝒕 + 𝒂 – 𝒑 𝒕 𝟏 𝒖 𝒕 > 𝒑 𝒕

Constraint: 𝑏 𝑡 ≥ 0 ∀ 𝑡 a.s.

• Utility: 𝒈 𝒕 = 𝒗 𝒕 − 𝒑 𝒕 𝟏 𝒖 𝒕 > 𝒑 𝒕

• Objective function: 𝒕=𝟎

∞

𝒆−𝜷𝒕

𝔼[𝒈 𝒕 ]](https://image.slidesharecdn.com/adauctions-150717001145-lva1-app6892/85/Adauctions-14-320.jpg)

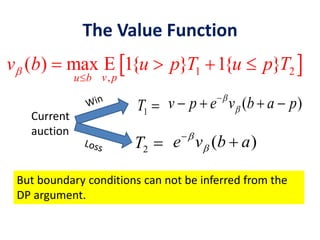

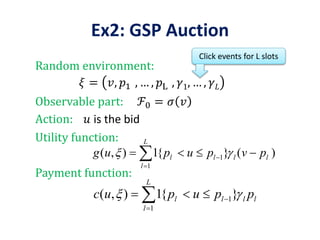

![The Value Function

𝒗 𝜷 (𝒃) = 𝒔𝒖𝒑

𝓤 𝒕=𝟎

∞

𝒆−𝜷𝒕

𝔼[𝒈 𝒕 ] | 𝒃 𝟎 = 𝒃

• 𝑣 𝛽 (𝑏) : max utility starting with balance 𝑏

• Can use dynamic programming (“one step look

ahead”) to write out a functional fixed point

relation.](https://image.slidesharecdn.com/adauctions-150717001145-lva1-app6892/85/Adauctions-15-320.jpg)

![Limiting Regime: 𝛽 ⟶ 0

( ) ( ) ( / )V B v b v B

Notation:

(( ]) [ , )E g ug u

(( ]) [ , )E c uc u ](https://image.slidesharecdn.com/adauctions-150717001145-lva1-app6892/85/Adauctions-26-320.jpg)

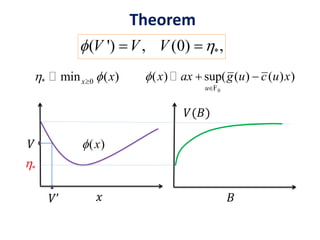

![𝜙 𝑥 = 𝑎𝑥 + sup

𝑢∈ℱ0

( 𝑔(𝑢) − 𝑐(𝑢)𝑥)

= 𝑎 𝑥 + sup

𝑢∈𝜎(𝑣)

𝔼 𝟏 𝑢>𝑝(𝑣 − 𝑝 1 + 𝑥 )

= 𝑎 𝑥 + 𝔼 (𝑣 − 𝑝 1 + 𝑥) +

Application to Second Price Auctions

𝐸[𝟏 𝑢>𝑝 𝑣 − 𝑝 ]

𝐸[𝟏 𝑢>𝑝p]](https://image.slidesharecdn.com/adauctions-150717001145-lva1-app6892/85/Adauctions-29-320.jpg)