1) A business combination occurs when two or more previously separate companies come under single management control. This can happen through subsidiaries, asset transfers, or forming a new corporation.

2) The combining companies may retain separate legal entities as subsidiaries of a parent company.

3) Goodwill arises in a business combination when the cost of an acquisition exceeds the fair value of identifiable net assets. Goodwill is no longer amortized under accounting standards.

![4 c

5 d

Solution E1-2 [AICPA adapted]

1 d

Plant and equipment should be recorded at $45,000, the $55,000 fair value less the

$10,000 excess fair value of net assets acquired over investment cost.

2 c

Investment cost $800,000

Less: Fair value of net assets

Cash $ 80,000

Inventory 190,000

Property and equipment-net 560,000

Liabilities (180,000) 650,000

Goodwill $150,000

Solution E1-3

Stockholders' equity - Pillow Corporation on January 3

Capital stock, $10 par, 300,000 shares outstanding $3,000,000

Additional paid-in capital

[$200,000 + $1,500,000 - $5,000] 1,695,000

Retained earnings 600,000

Total stockholders' equity $5,295,000

Entry to record combination:

Investment in Sleep-bank $3,000,000

Capital stock, $10 par $1,500,000

Additional paid-in capital 1,500,000

Investment in Sleep-bank $ 10,000

Additional paid-in capital 5,000

Cash $ 15,000

Check: Net assets per books $3,800,000](https://image.slidesharecdn.com/acctsolutionmanforbeams-120720075238-phpapp01/85/Acct-solution-man-for-beams-2-320.jpg)

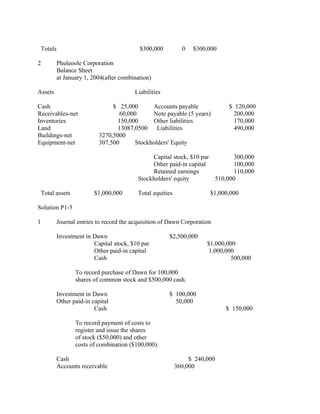

![(30,000 shares x $20) + $25,000 direct costs of combination $625,000

Book value acquired (440,000)

Excess cost over book value acquired $185,000

Excess allocated to:

Current assets $ 40,000

Remainder to goodwill 145,000

Excess cost over book value acquired $185,000

Pine Corporation

Balance Sheet at January 2, 2004

Assets

Current assets

($130,000 + $60,000 + $40,000 excess - $40,000 direct costs) $ 190,000

Land ($50,000 + $100,000) 150,000

Buildings-net ($300,000 + $100,000) 400,000

Equipment-net ($220,000 + $240,000) 460,000

Goodwill 145,000

Total assets $1,345,000

Liabilities and Stockholders' Equity

Current liabilities ($50,000 + $60,000) $ 110,000

Common stock, $10 par ($500,000 + $300,000) 800,000

Additional paid-in capital

[$50,000 + ($10 x 30,000 shares) - $15,000 costs of

issuing and registering securities] 335,000

Retained earnings 100,000

Total liabilities and stockholders' equity $1,345,000

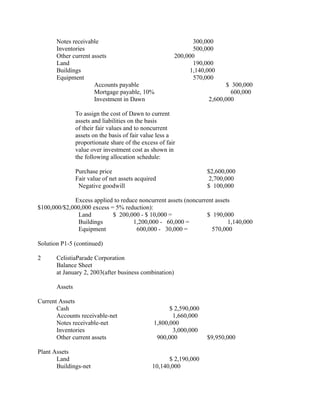

Solution P1-2

Preliminary computations

Cost of acquiring Seabird ($825,000 + $100,000 direct costs)

$925,000](https://image.slidesharecdn.com/acctsolutionmanforbeams-120720075238-phpapp01/85/Acct-solution-man-for-beams-5-320.jpg)

![Fair value of assets acquired and liabilities assumed 670,000

Goodwill from acquisition of Seabird $255,000

Pelican Corporation

Balance Sheet

at January 2, 2003

Assets

Current assets

Cash [$150,000 + $30,000 - $140,000 expenses paid] $ 40,000

Accounts receivable-net [$230,000 + $40,000 fair value] 270,000

Inventories [$520,000 + $120,000 fair value] 640,000

Plant assets

Land [$400,000 + $150,000 fair value] 550,000

Buildings-net [$1,000,000 + $300,000 fair value] 1,300,000

Equipment-net [$500,000 + $250,000 fair value] 750,000

Goodwill 255150,000

Total assets $3,805680,000

Liabilities and Stockholders' Equity

Liabilities

Accounts payable [$300,000 + $40,000] $ 340,000

Note payable [$600,000 + $180,000 fair value] 780,000

Stockholders' equity

Capital stock, $10 par [$800,000 + (3328,000 shares x $10)] 1,13080,000

Other paid-in capital

[$600,000 - $40,000 + ($825700,000 - $330280,000)] 1,055980,000

Retained earnings 500,000

Total liabilities and stockholders' equity $3,805680,000](https://image.slidesharecdn.com/acctsolutionmanforbeams-120720075238-phpapp01/85/Acct-solution-man-for-beams-6-320.jpg)

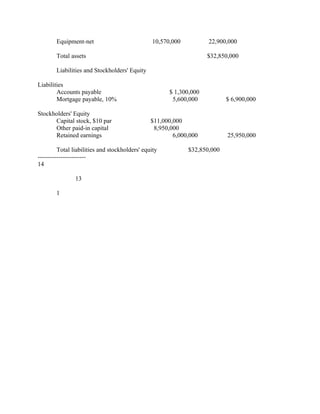

![Solution P1-3

Persisnrow issues 25,000 shares of stock for Sineco's outstanding shares:

1a Investment in Sineco $750,000

Capital stock, $10 par $250,000

Other paid-in capital 500,000

To record issuance of 25,000, $10 par

shares with a market price of $30 per

share in a purchase business combination

with Sineco.

Investment in Sineco $ 30,000

Other paid-in capital 20,000

Cash $ 50,000

To record costs of combination in a

purchase business combination with Sineco.

Cash $ 110,000

Inventories 640,000

Other current assets 100,000

Land 100,000

Plant and equipment-net 3500,000

Goodwill 21280,000

Liabilities $ 50,000

Investment in Sineco 780,000

To record allocation of investment cost

to identifiable assets and liabilities

according to their fair values and the

remainder to goodwill. Goodwill is

computed: $780,000 cost - $5700,000

fair value of net assets acquired.

1b Persismrow Corporation

Balance Sheet

January 2, 2004 (after purchase business combination)

Assets

Cash [$70,000 + $110,000] $ 8 80,000

Inventories [$50,000 + $640,000] 1190,000

Other current assets [$100,000 + $100,000] 200,000

Land [$80,000 + $100,000] 180,000

Plant and equipment-net [$650,000 + $3500,000] 1,000 950,000](https://image.slidesharecdn.com/acctsolutionmanforbeams-120720075238-phpapp01/85/Acct-solution-man-for-beams-7-320.jpg)

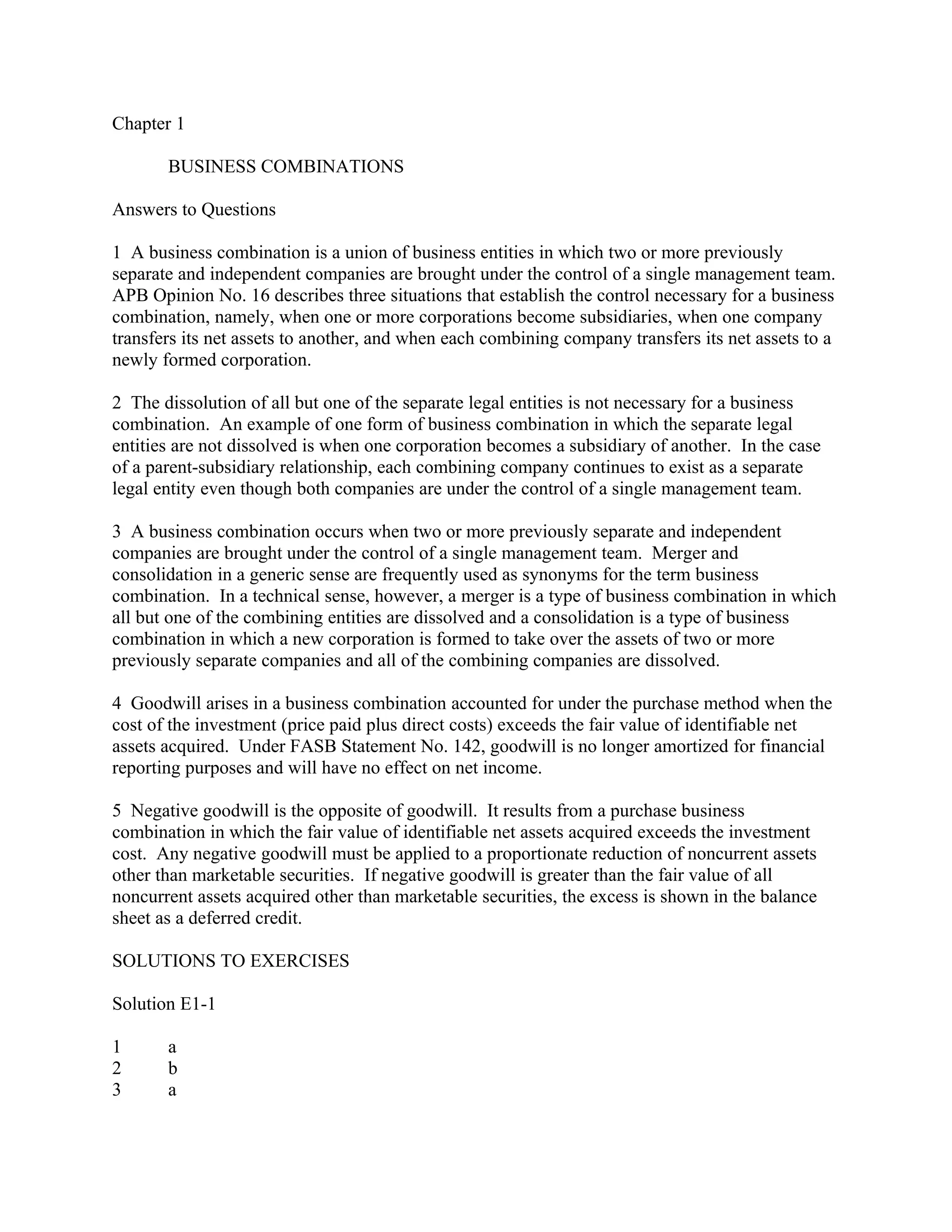

![Goodwill 21280,000

Total assets $1,780,000

Liabilities and Stockholders' Equity

Liabilities [$200,000 + $50,000] $ 250,000

Capital stock, $10 par [$500,000 + $250,000] 750,000

Other paid-in capital [$200,000 + $500,000 - $20,000] 680,000

Retained earnings 100,000

Total liabilities and stockholders' equity $1,780,000

Solution P1-3 (continued)

Persisnrow issues 15,000 shares of stock for Sineco's outstanding shares:

2a Investment in Sineco (15,000 shares x $30) $450,000

Capital stock, $10 par $150,000

Other paid-in capital 300,000

To record issuance of 15,000, $10 par

common shares with a market price of

$30 per share.

Investment in Sineco $ 30,000

Other paid-in capital 20,000

Cash $ 50,000

To record costs of combination in the

purchase of Sineco.

Cash $ 110,000

Inventories 640,000

Other current assets 100,000

Land 8095,000

Plant and equipment-net 280285,000

Liabilities $ 50,000

Investment in Sineco 480,000

To assign the $480,000 cost of Sineco

to current assets and liabilities on

the basis of their fair values and

to noncurrent assets on the basis of fair

value less a proportionate share of the

excess of fair value over investment cost

as follows:

Fair value of net assets acquired $5070,000

Investment cost 480,000](https://image.slidesharecdn.com/acctsolutionmanforbeams-120720075238-phpapp01/85/Acct-solution-man-for-beams-8-320.jpg)

![Excess fair value over cost $ 920,000

Excess allocated to reduce:

Land ($100,000/$4500,000 x $290,000) $ 205,000

Plant and equipment ($3500,000/$4050,000 x $290,000) 1570,000

Reduction in fair value of noncurrent assets $ 920,000

2b Persismrow Corporation

Balance Sheet

January 2, 2004(after purchase business combination)

Assets

Cash [$70,000 + $10,000] $ 80,000

Inventories [$50,000 + $460,000] 1190,000

Other current assets [$100,000 + $100,000] 200,000

Land [$80,000 + $8095,000] 17560,000

Plant and equipment-net [$650,000 + $2850,000] 9305,000

Total assets $1,480,000

Liabilities and stockholders' equity

Liabilities [$200,000 + $50,000] $ 250,000

Capital stock, $10 par [$500,000 + $150,000] 650,000

Other paid-in capital [$200,000 + $300,000 - $20,000] 480,000

Retained earnings 100,000

Total liabilities and stockholders' equity $1,480,000

Solution P1-4

1 Schedule to allocate investment cost to assets and liabilities

Investment cost, January 1, 2004 $300,000

Fair value acquired from Sen ($360,000 x 100%) 360,000

Excess fair value acquired over cost $ 60,000

Allocation:

Initial Final

Allocation Reallocation Allocation

Cash $ 10,000 --- $ 10,000

Receivables-net 20,000 --- 20,000

Inventories 30,000 --- 30,000

Land 1050,000 $(157,0500) 8542,0500

Buildings-net 15200,000 (2230,5000) 12770,5000

Equipment-net 150,000 (22,500) 127,500

Accounts payable (30,000) --- (30,000)

Other liabilities (70,000) --- (70,000)

Excess fair value (60,000) 60,000 ---](https://image.slidesharecdn.com/acctsolutionmanforbeams-120720075238-phpapp01/85/Acct-solution-man-for-beams-9-320.jpg)