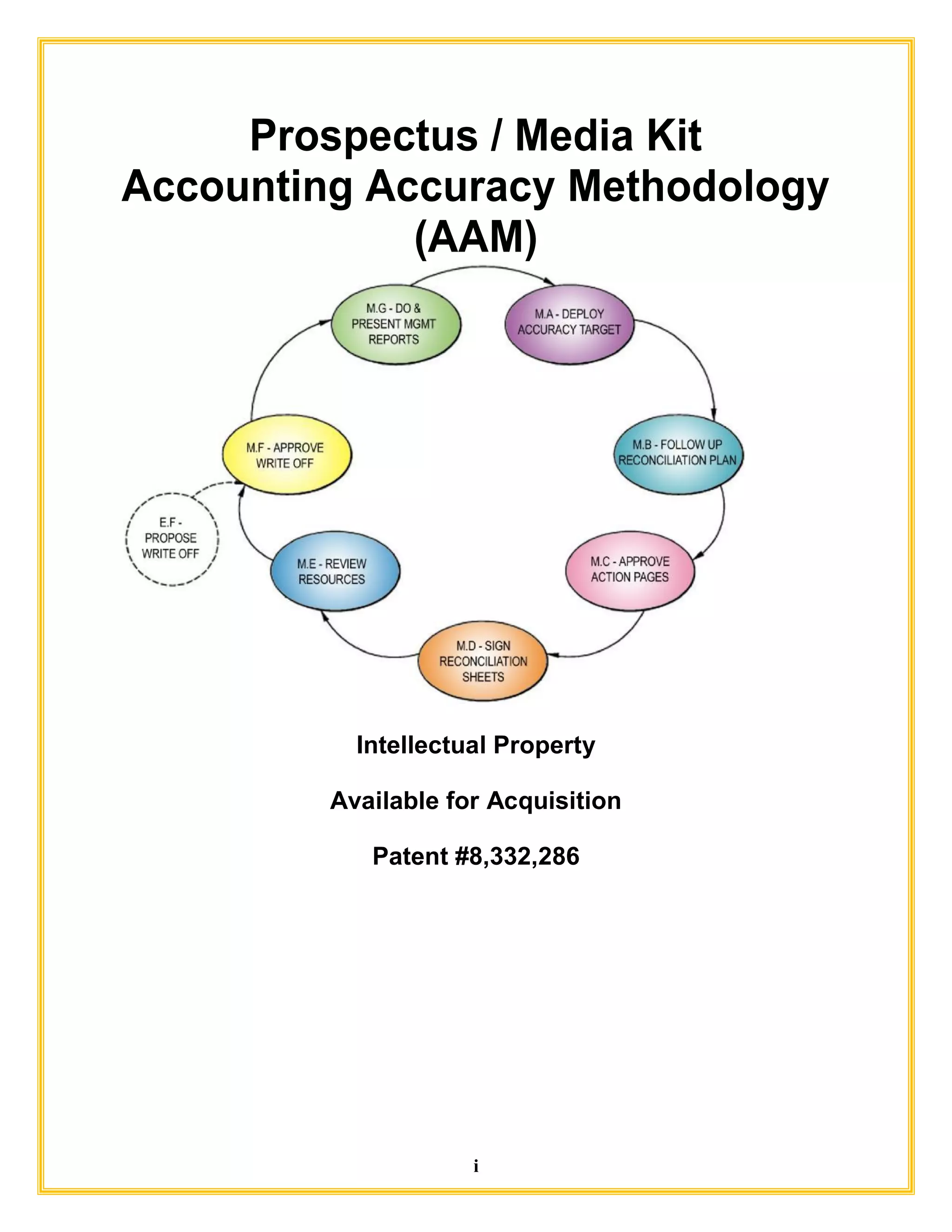

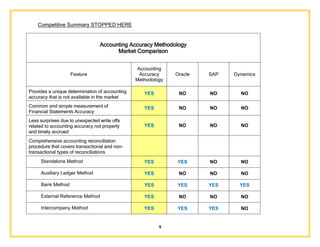

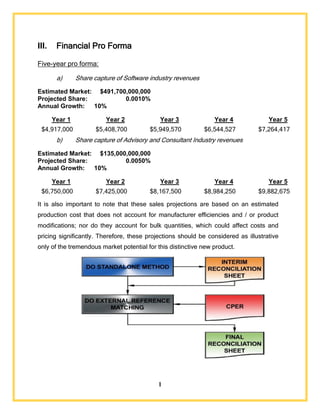

This prospectus introduces the Accounting Accuracy Methodology (AAM), a patented technology available for licensing. The AAM determines the accuracy of financial statements using a comprehensive account reconciliation process involving nine different reconciliation methods. These methods cover transactional and non-transactional interactions between ledger accounts and supporting documents. The AAM provides a unique way to measure and improve financial statement accuracy that is not available in other accounting software. It represents a breakthrough opportunity for any company that licenses it.

![6

V. Licensing Opportunities & Patent Information

Currently, we are seeking a licensing arrangement involving the patent to make, use,

manufacture, market, and distribute the Accounting Accuracy Methodology. Please

contact Broker_Name, Executive Vice President at BrokerCompany, at (305) 469-7768

or e-mail him at ricardoglopes@outlook.com to discuss this rare and lucrative new

product opportunity.

Intellectual Property Information

Mr. Ricardo A. Georg Lopes holds United States Utility Patent No. 8,332,286 filed on

April 27, 2009[RL1], and issued on December 11, 2012. This patent for the Accounting

Accuracy Methodology expires in 2029, commensurate with the filing date. This patent

has 10 claims that protect the exclusive design and function of the Accounting Accuracy

Methodology.](https://image.slidesharecdn.com/39b011fb-1f16-4010-a139-1127dbd73303-160202161446/85/Accounting_Accuracy_Methodology-5-17-320.jpg)