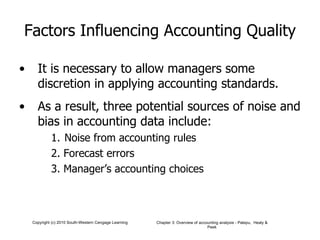

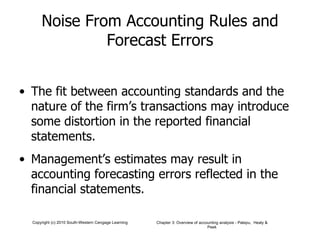

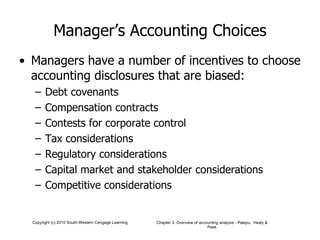

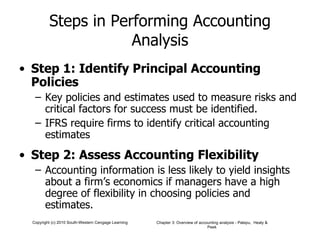

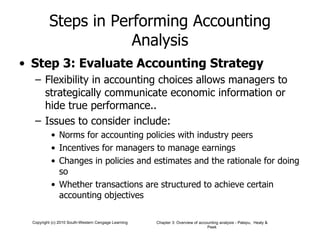

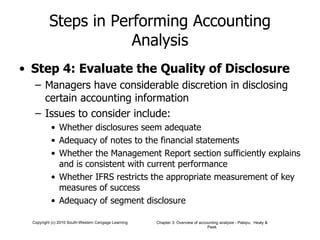

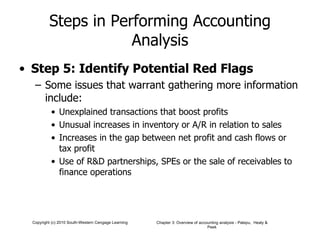

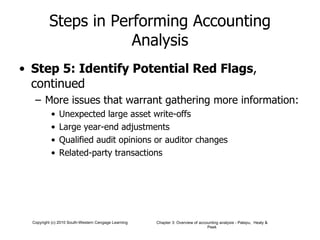

The document provides an overview of key concepts in accounting analysis. It discusses factors that influence the quality of financial reports, international financial reporting standards, external auditing requirements, and public enforcement of standards. It also outlines six steps for performing accounting analysis: 1) identify principal accounting policies, 2) assess accounting flexibility, 3) evaluate accounting strategy, 4) evaluate disclosure quality, 5) identify potential red flags, and 6) undo accounting distortions. Throughout, it emphasizes the importance of understanding a company's accounting choices and incentives to effectively analyze its financial information.