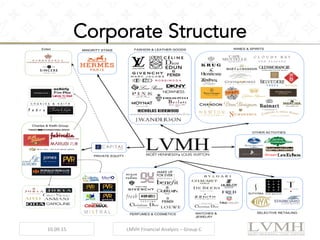

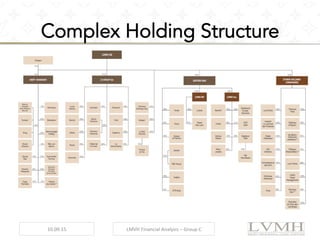

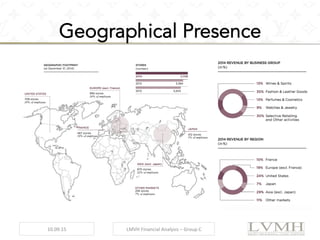

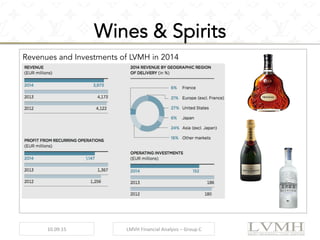

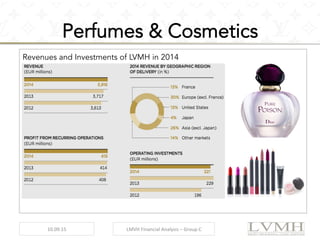

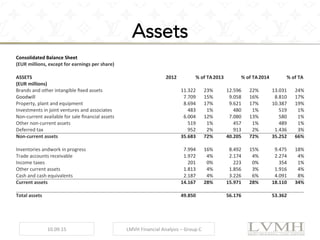

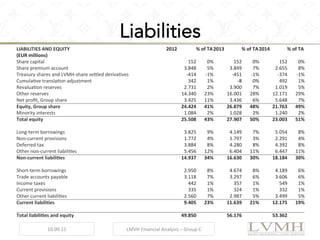

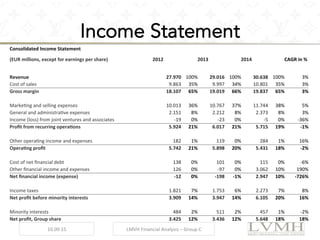

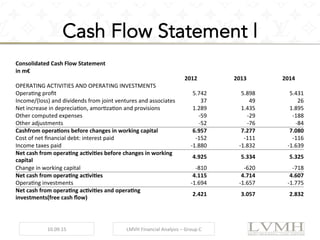

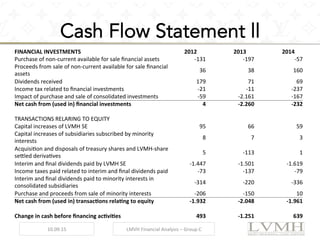

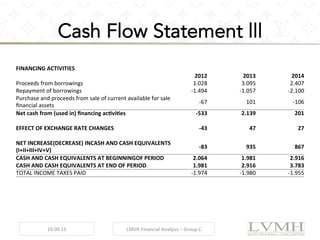

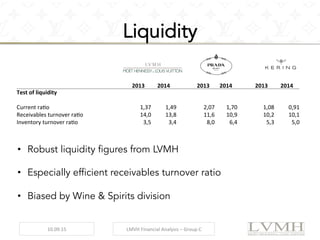

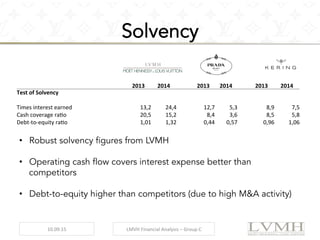

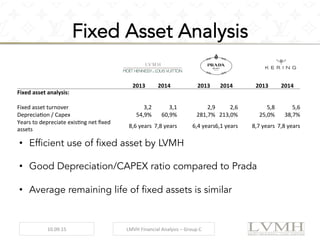

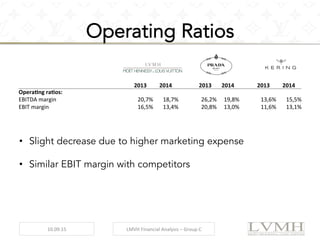

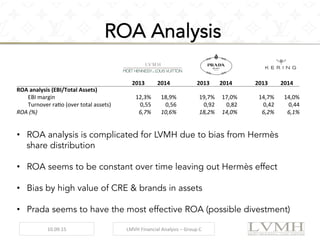

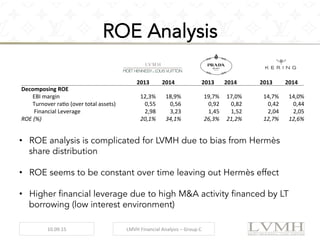

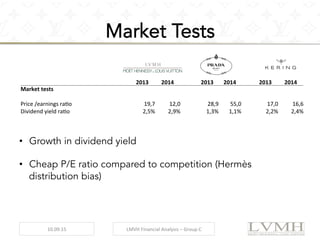

The document provides a comprehensive financial analysis of LVMH Moët Hennessy Louis Vuitton, a French luxury conglomerate founded in 1987, focusing on its corporate structure, market strategies, and financial performance across various brand sectors. It highlights the company's dependency on consumer trends, challenges in brand loyalty, and details key acquisitions that shaped its growth under CEO Bernard Arnault. Additionally, it includes insights into LVMH's asset management, liquidity, solvency, and operational ratios from 2012 to 2014, illustrating its robust financial health and strategic positioning in the luxury market.