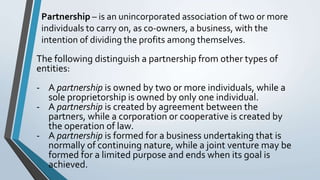

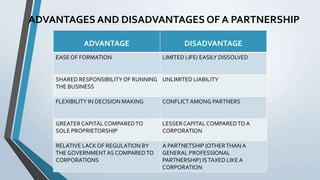

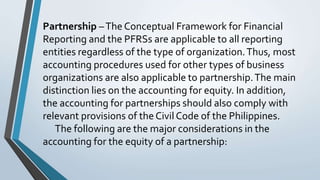

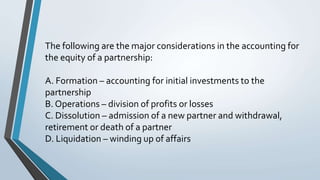

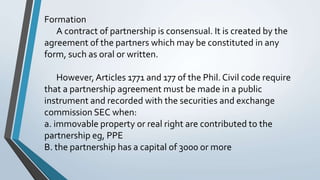

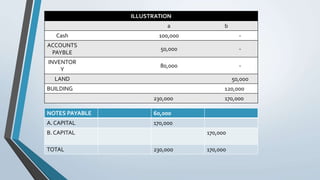

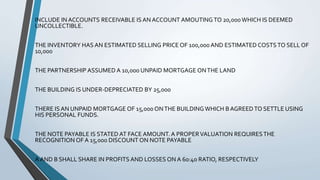

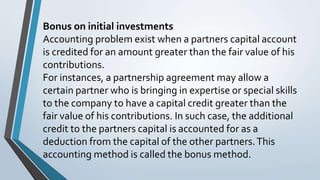

The document discusses partnership formation, defining partnerships as unincorporated associations of two or more individuals who co-own a business and share profits. It highlights key features such as ease of formation, mutual agency, and unlimited liability, along with advantages and disadvantages compared to other business entities. Also covered are important accounting considerations for partnerships, including initial investment, profit sharing, the impact of new partners, and the treatment of capital accounts.