This document provides an overview of accounting concepts including:

1. The objectives of accounting are to keep systematic records, ascertain results of operations, and ascertain the financial position of a business.

2. Accounting functions include record keeping, assisting management decision making, and complying with legal requirements.

3. There are two main methods of accounting - single entry and double entry systems. Double entry allows for the preparation of trial balances and financial statements.

![BBM – Accounting for Managers

91

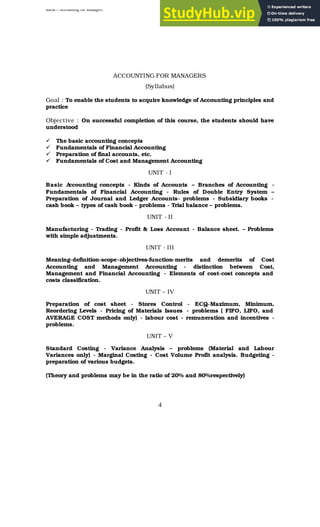

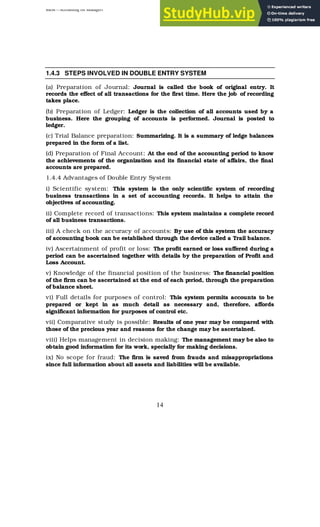

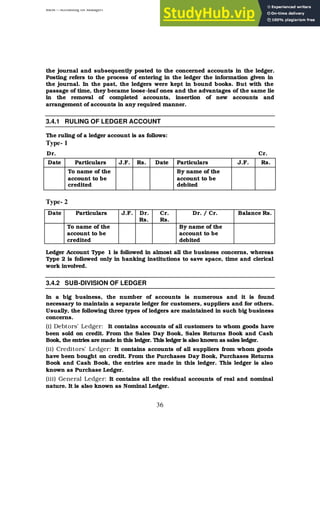

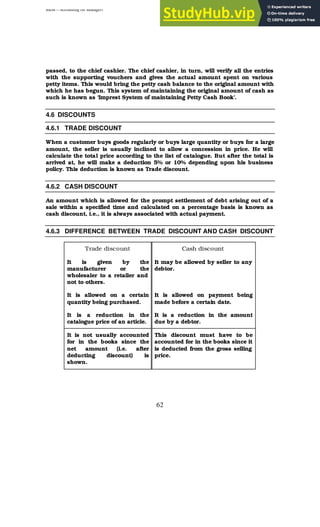

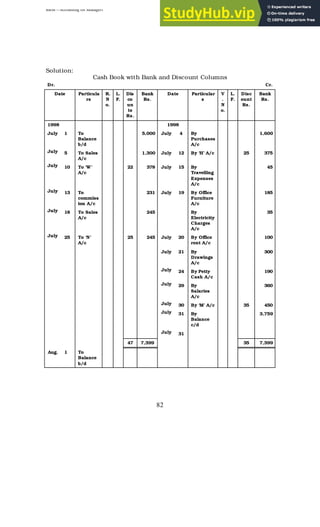

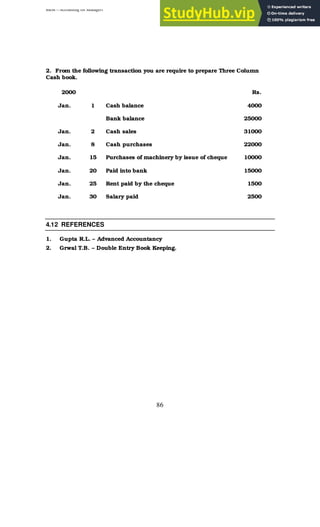

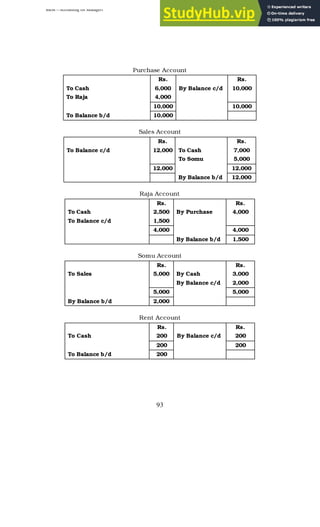

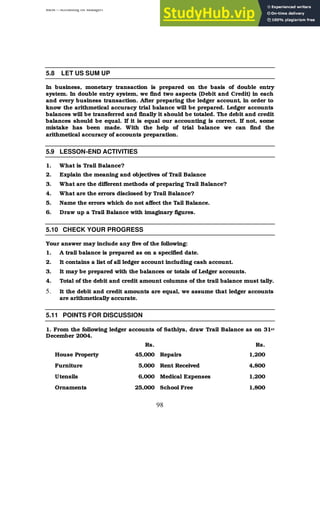

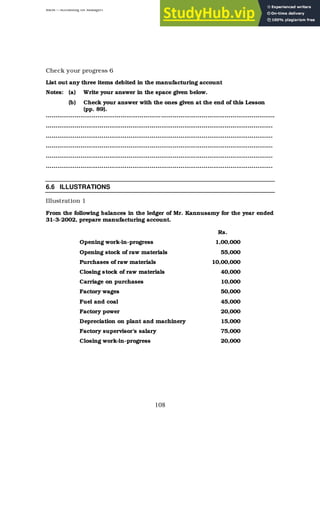

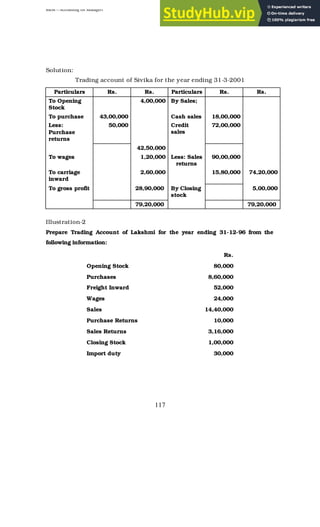

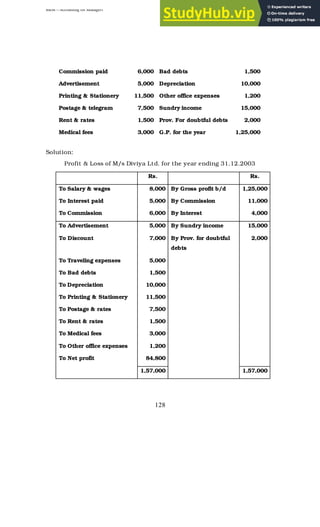

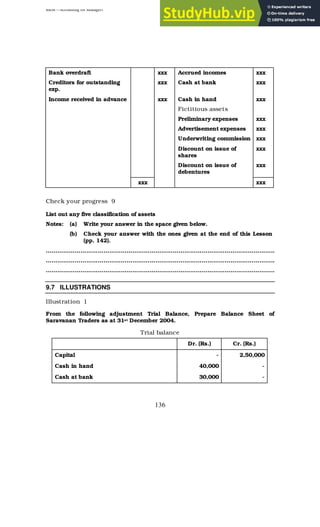

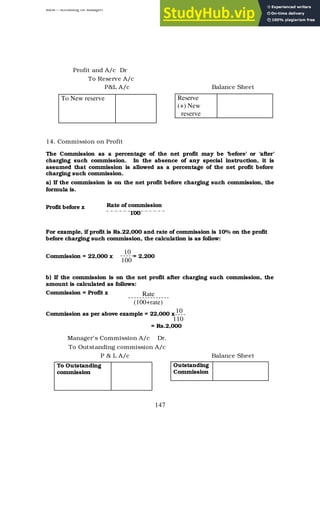

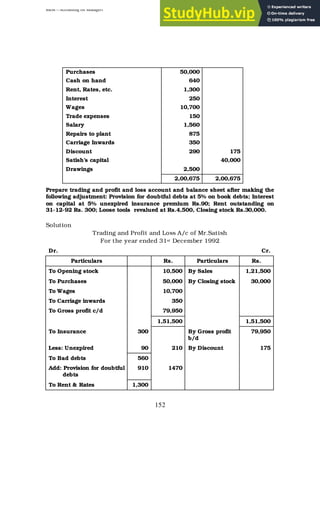

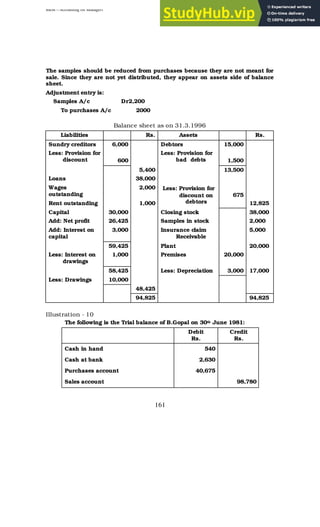

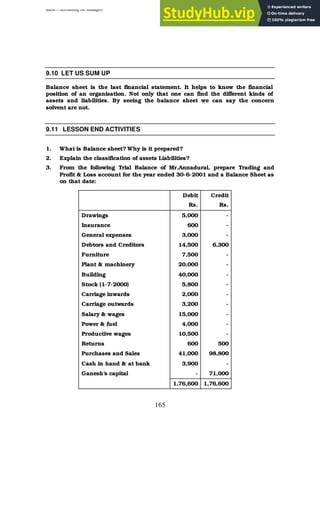

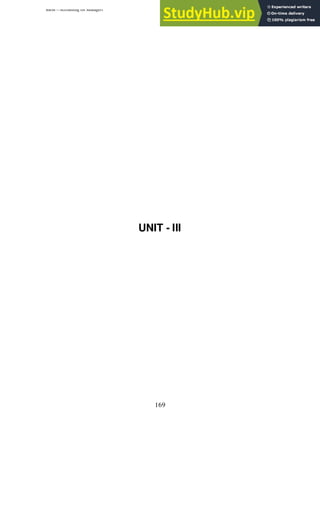

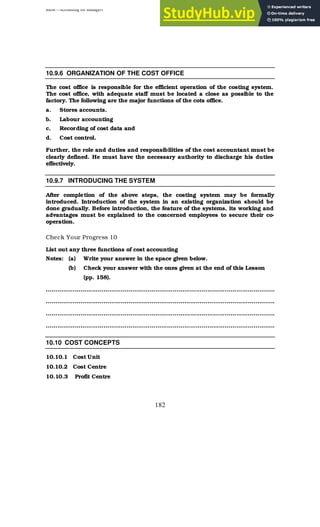

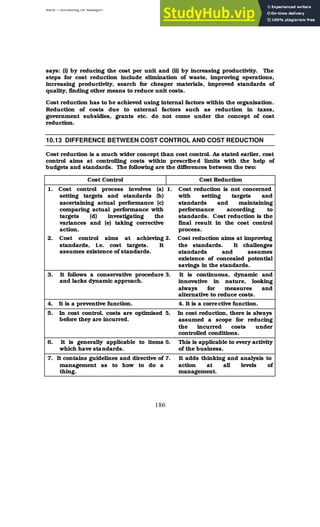

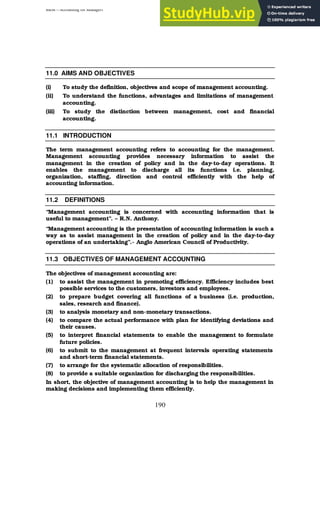

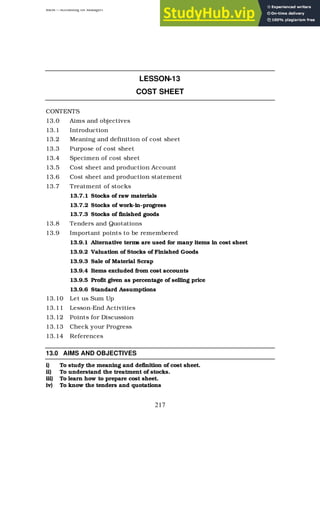

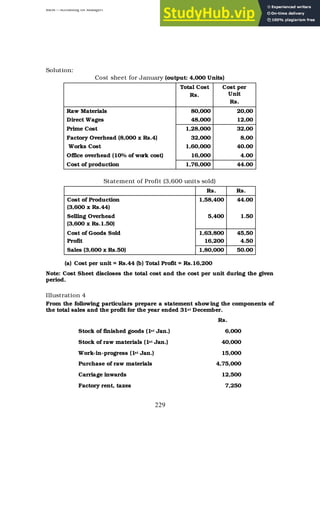

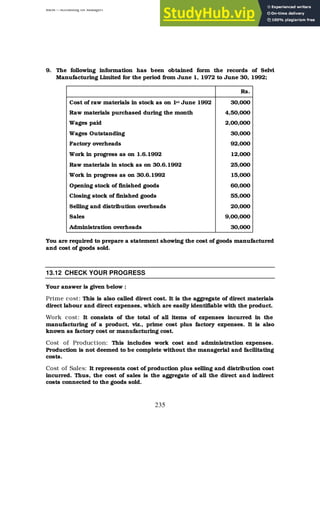

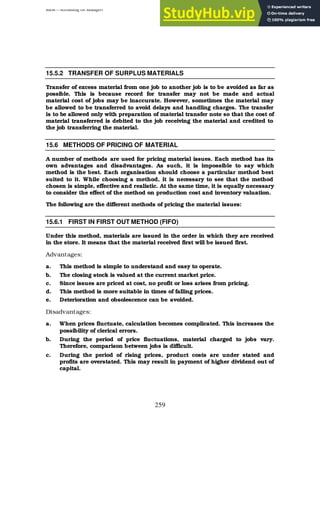

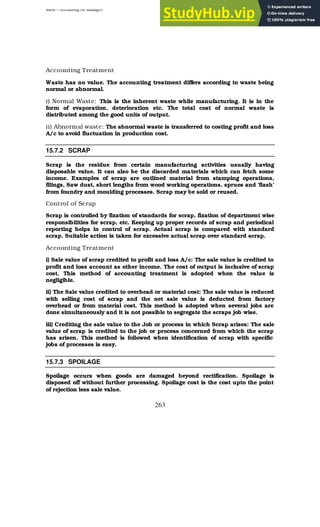

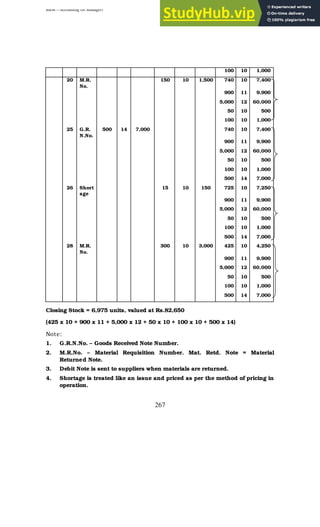

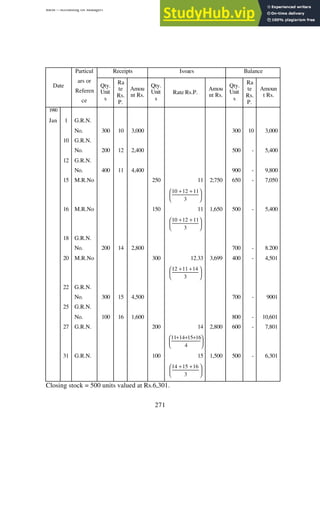

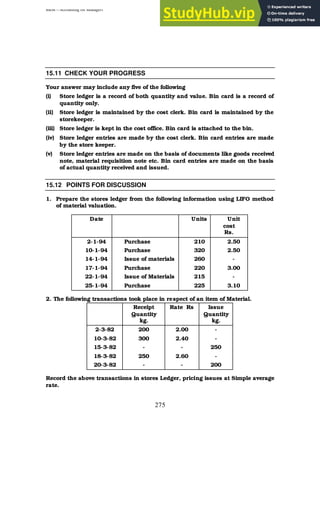

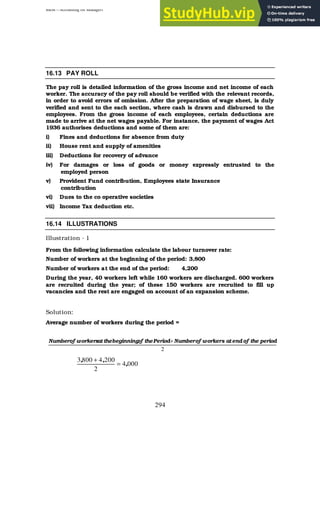

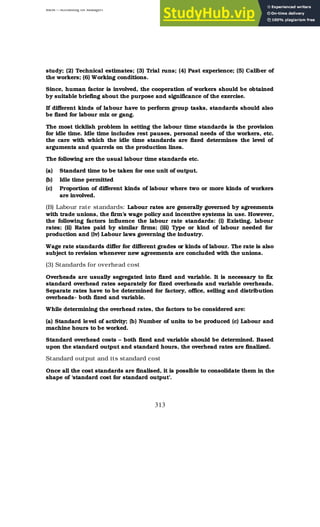

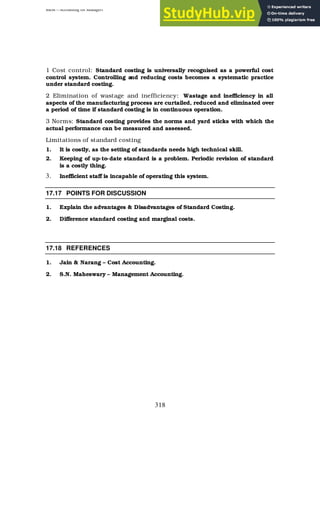

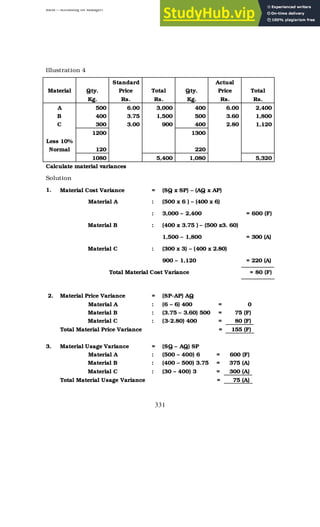

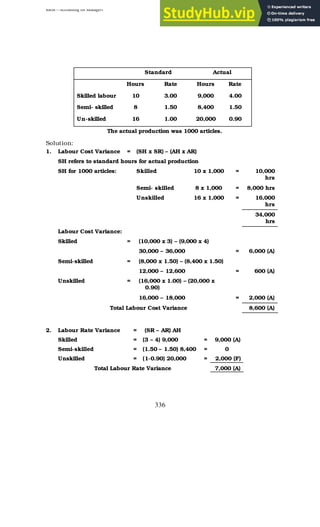

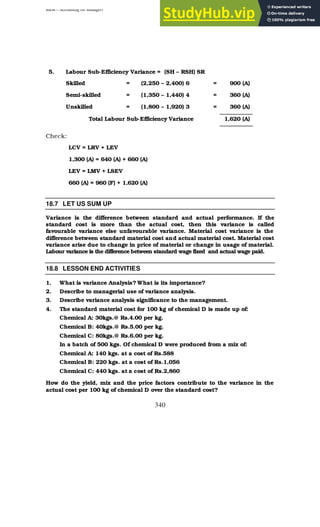

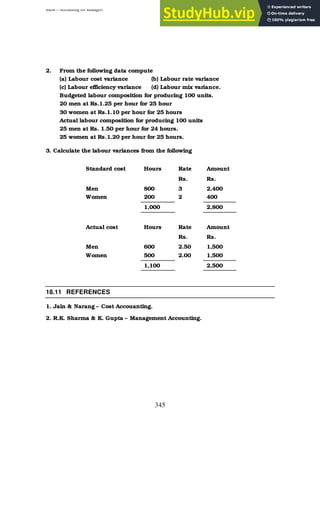

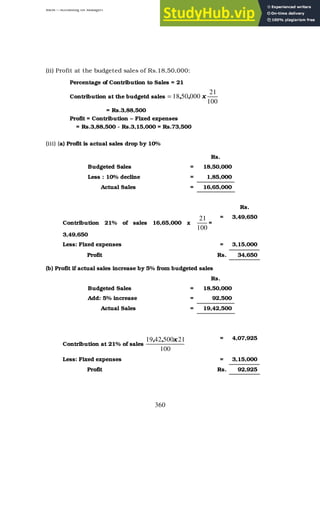

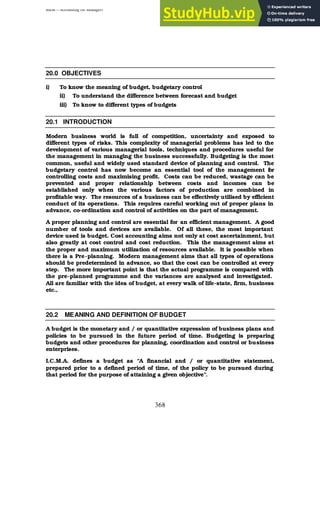

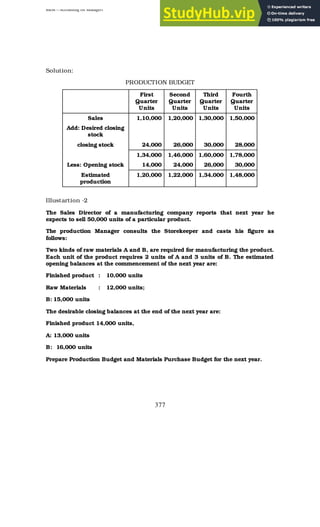

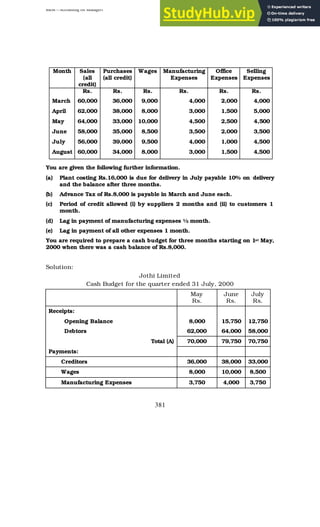

5.7 ILLUSTRATIONS

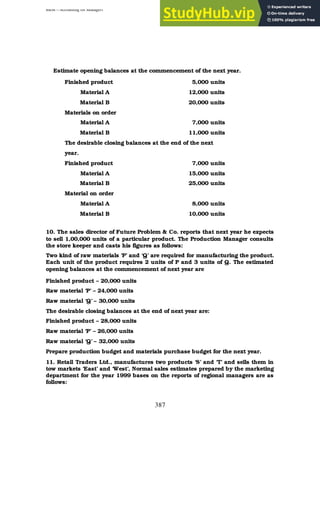

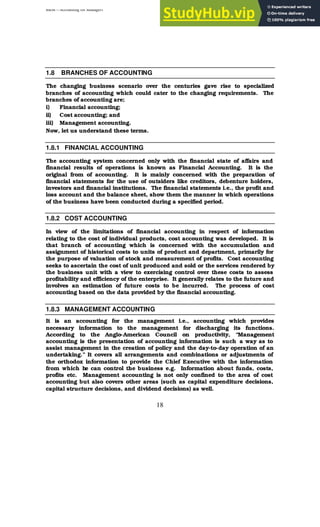

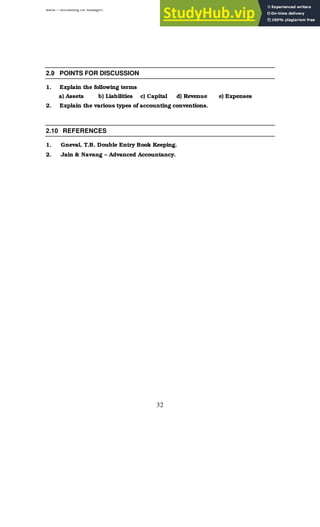

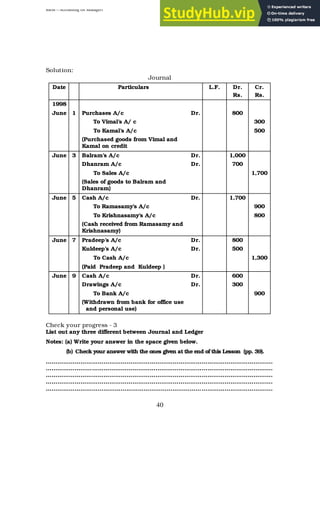

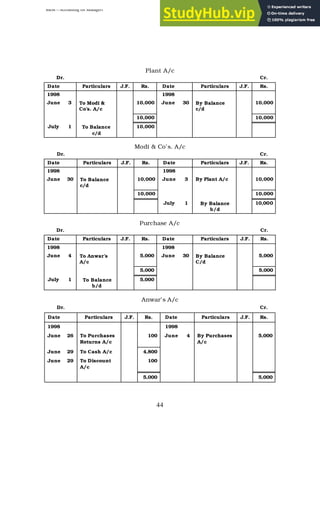

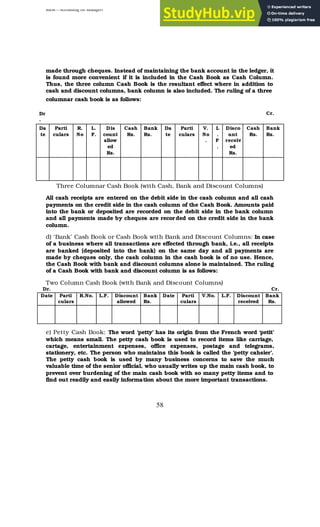

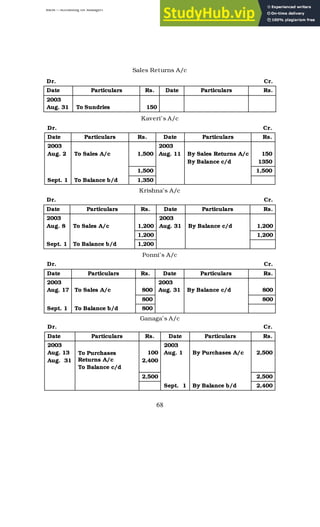

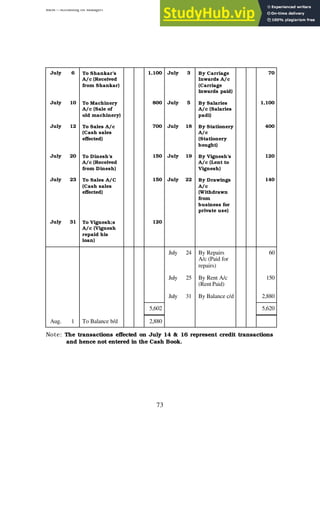

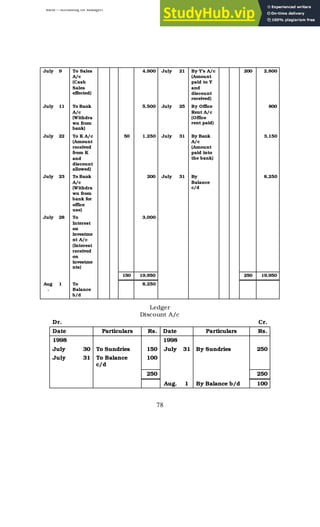

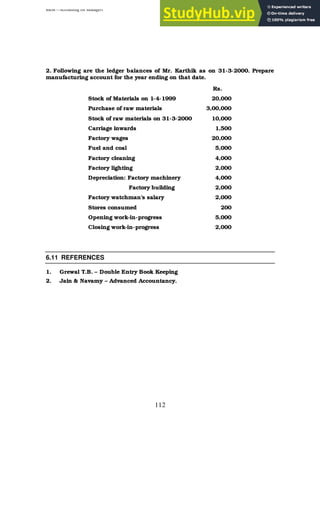

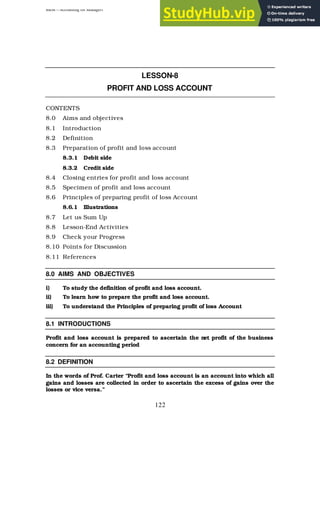

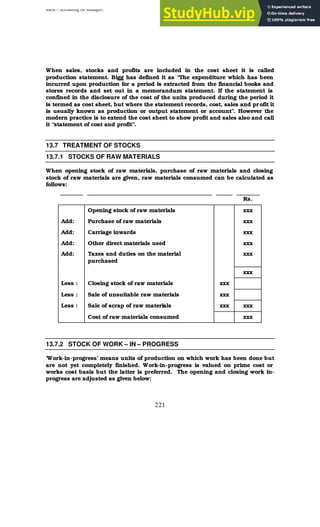

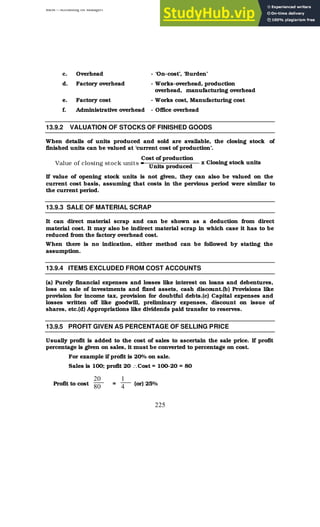

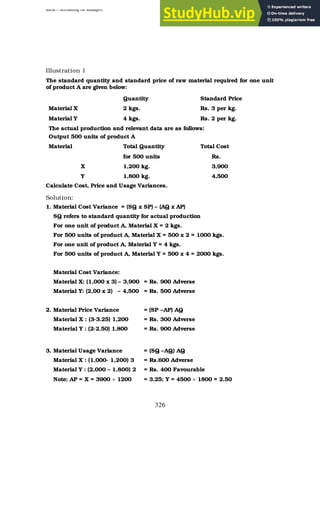

Illustration 1

From the following transactions, pass journal entries, prepare ledger accounts

and also prepare Trial Balance under (i) Balance method (ii) Total method.

Rs.

1. Anil started business with 8,000

2. Purchased furniture 1,000

3. Purchased goods 6,000

4. Sold goods 7,000

5. Purchased from Raja 4,000

6. Sold to Somu 5,000

7. Paid to Raja 2,500

8. Received from Somu 3,000

9. Paid rent 200

10. Received commission 100

Solution

Journal Entries

Particulars L.F Dr. Cr.

Cash A/c

To Capital A/c

[Started business]

Dr. 8,000 8,000

Furniture A/c

To Cash A/c

[Purchased furniture]

Dr. 1,000

1,000

Purchases A/c

To Cash A/c

[Purchased goods]

Dr. 6,000

6,000

Cash A/c

To Sales A/c

[Sold goods for cash]

Dr. 7,000

7,000

Purchases A/c

To Raja A/c

[Purchased goods]

Dr. 4,000

4,000](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-91-320.jpg)

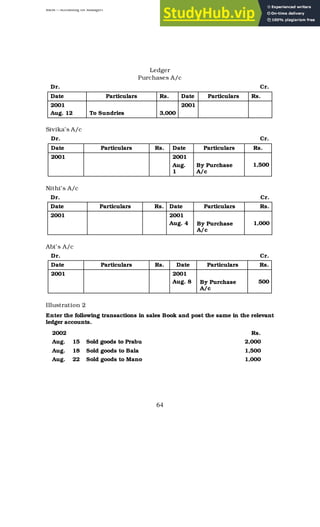

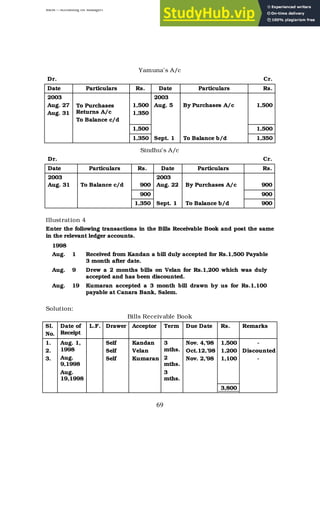

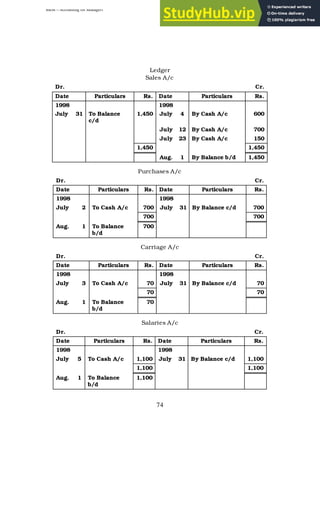

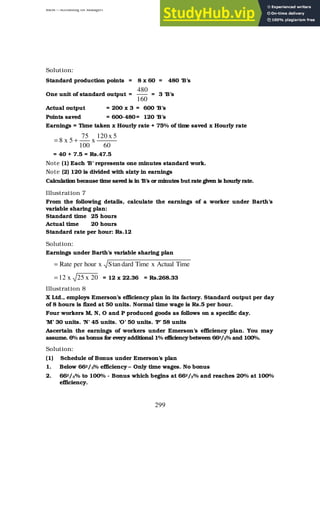

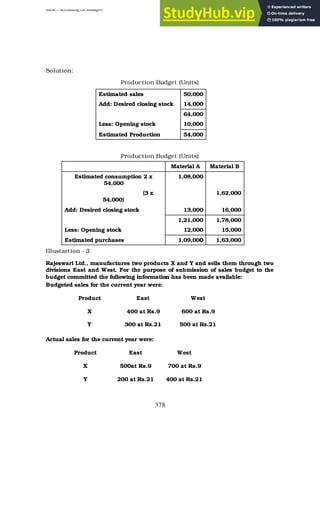

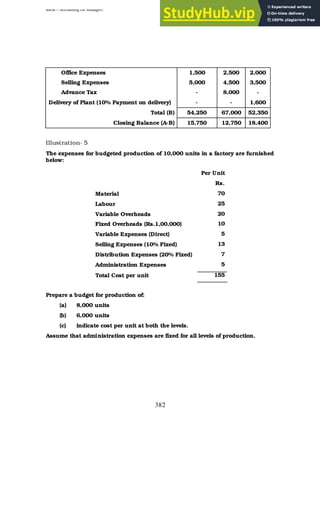

![BBM – Accounting for Managers

92

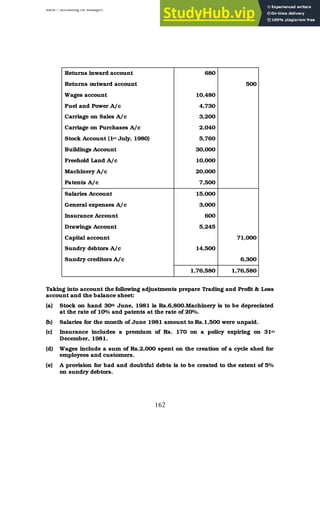

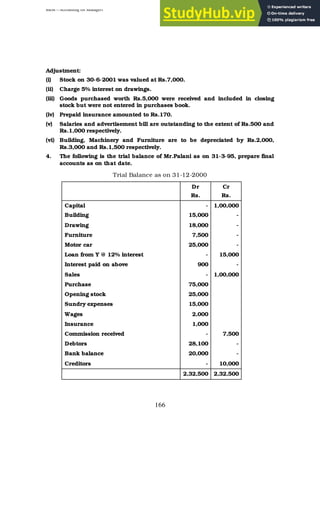

Somu A/c

To Sales A/c

[Sold goods on credit]

Dr. 5,000

5,000

Raja A/c

To Cash A/c

[Paid cash]

Dr. 2,500

2,500

Cash A/c

To Somu A/c

[Received from Somu]

Dr. 3,000

3,000

Rent A/c

To Cash A/c

[Paid rent]

Dr. 200

200

Cash A/c

To Commission received A/c

[Received commission]

Dr. 100

100

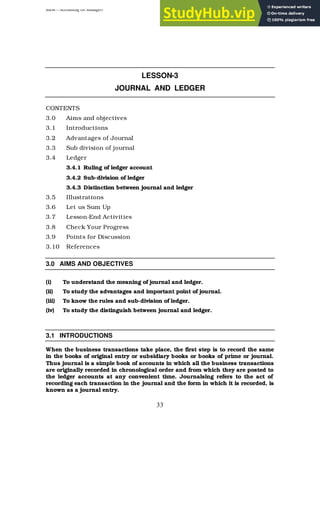

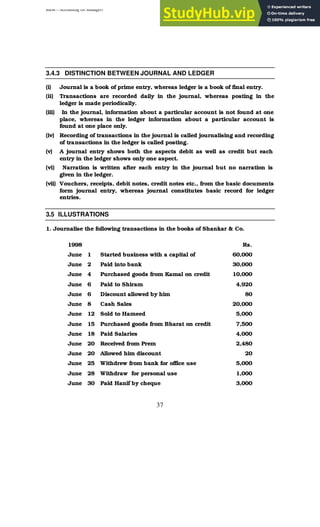

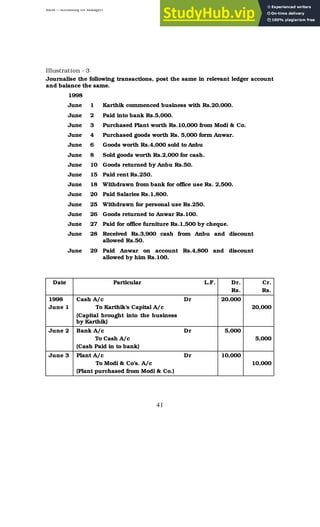

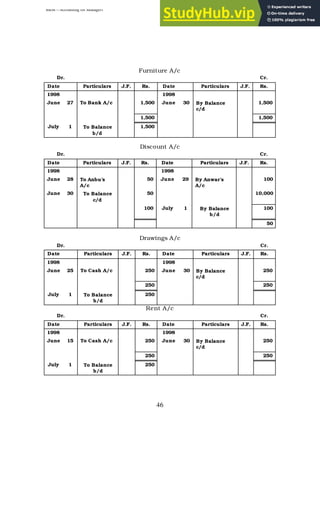

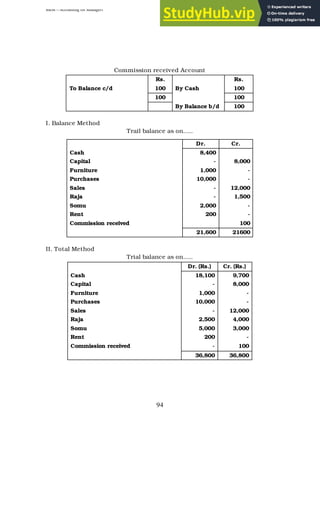

Cash Account

Rs. Rs.

To Capital 8,000 By Furniture 1,000

To Sales 7,000 By Purchases 6,000

To Somu 3,000 By Raja 2,500

To Commission 100 By Rent 200

By Balance c/d 8,400

18,100 18,100

To Balance b/d 8,400

Capital Account

Rs. Rs.

To Balance c/d 8,000 By Cash 8,000

8,000 8,000

By Balance b/d 8,000

Furniture Account

Rs. Rs.

To Cash 1,000 By Balance c/d 1,000

1,000 1,000

By Balance b/d 1,000](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-92-320.jpg)

![BBM – Accounting for Managers

115

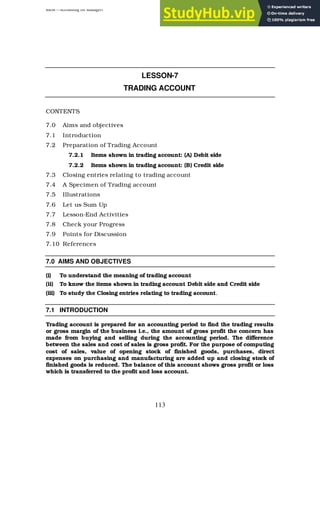

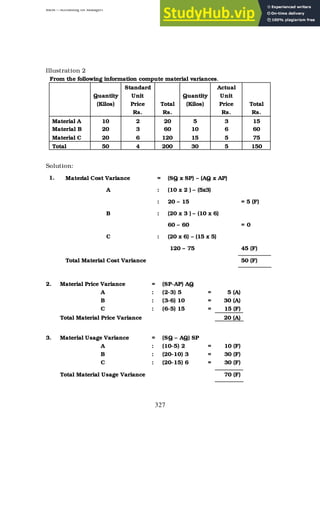

Trading A/c Dr xxx

To Opening Stock A/c xxx

To Purchases (Net) A/c xxx

To Direct expenses A/c xxx

[Being transfer of trading a/c debit side

items]

(ii) For transfer of sales (after reducing sales returns)

Sales (net) A/c Dr xxx

To Trading A/c xxx

[Being transfer of sales to Trading A/c]

(iii) For transferring gross profit

Trading A/c Dr xxx

To Profit & Loss A/c xxx

[Being transfer of gross profit to P&L A/c]

(iv) For Gross Loss

Profit & Loss A/c Dr xxx

To Trading A/c xxx

[Being transfer of gross loss to P&L A/c]

Note: Closing stock is taken into account by an adjustment journal entry along

with other adjustments.

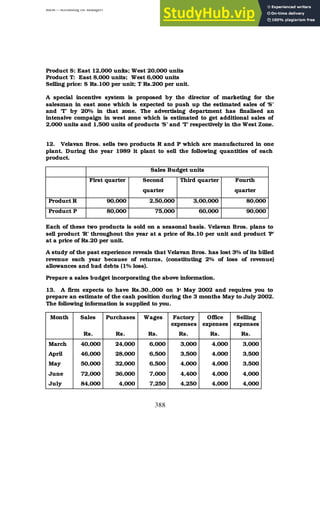

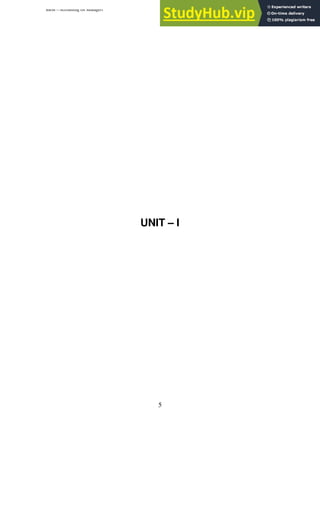

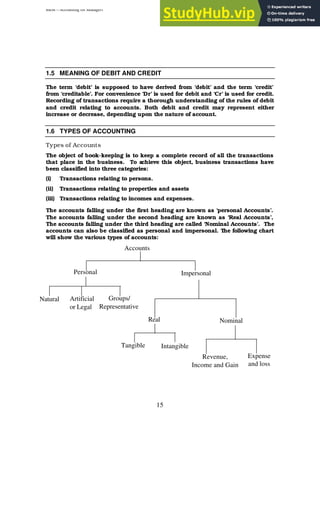

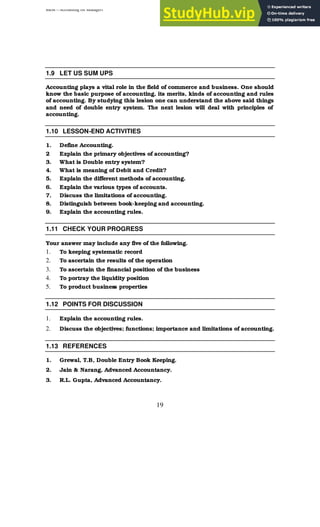

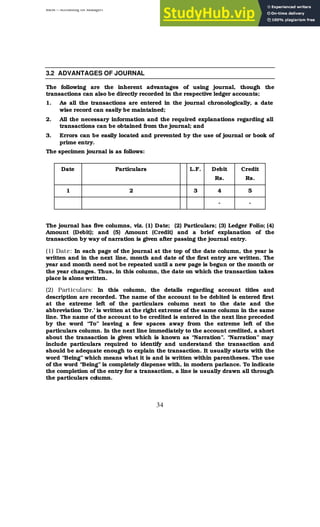

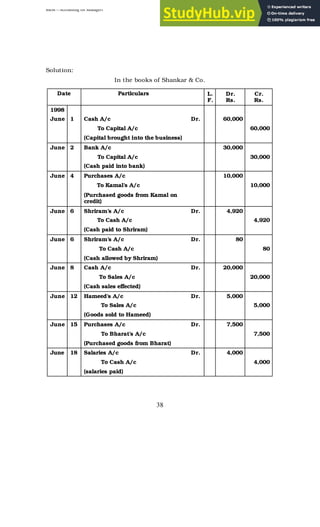

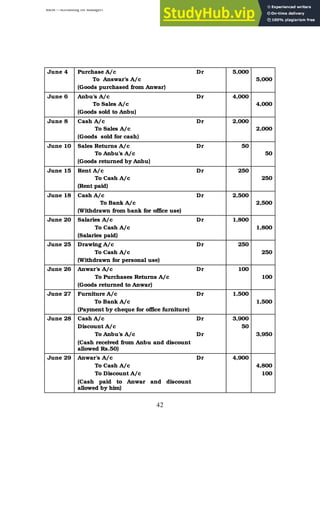

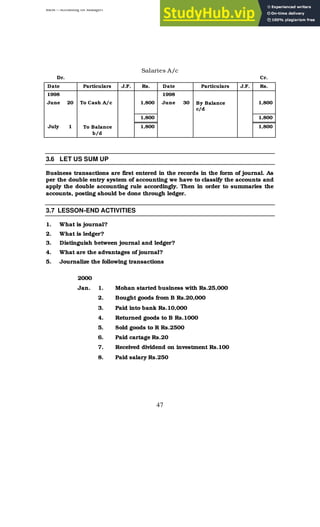

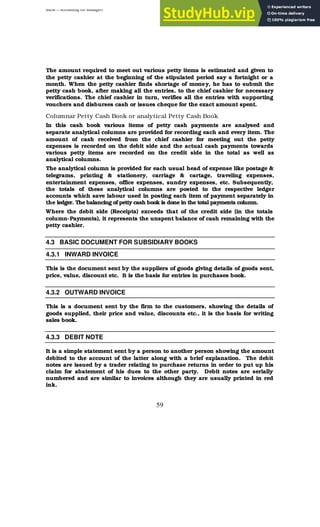

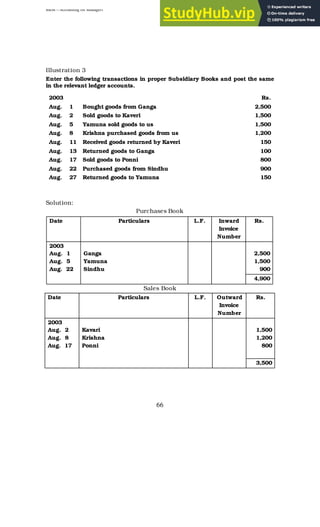

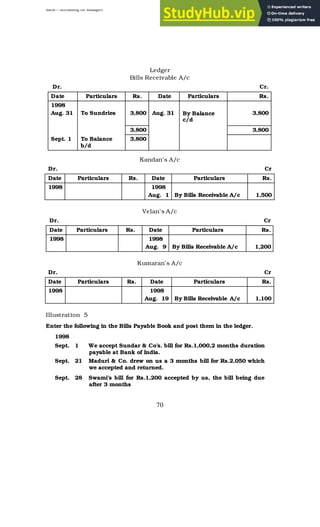

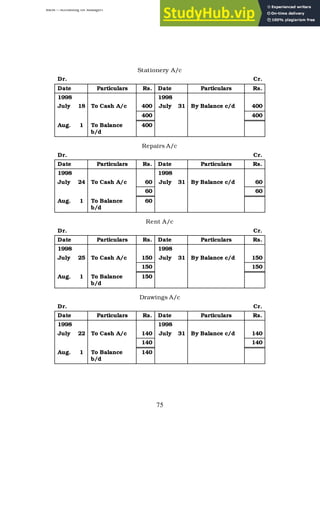

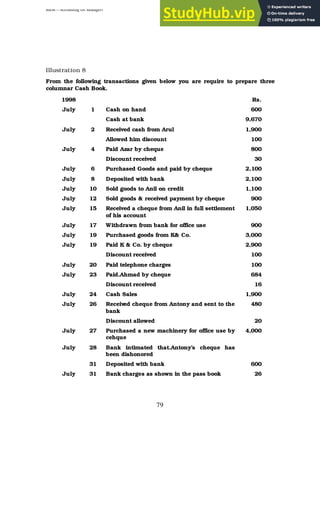

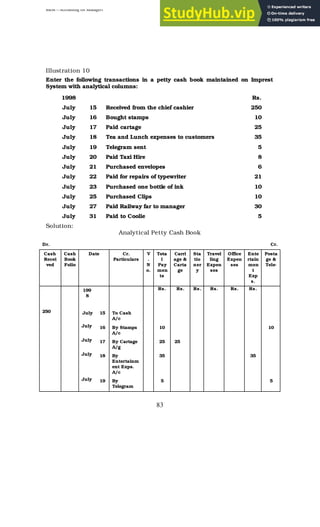

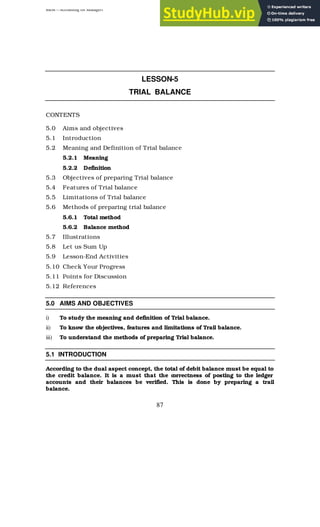

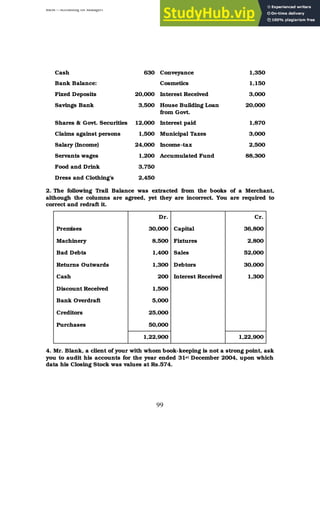

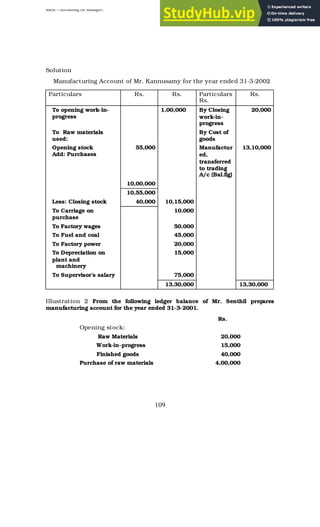

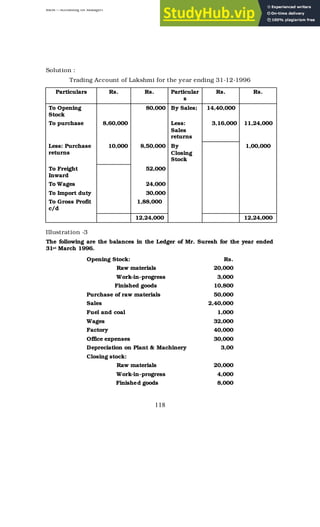

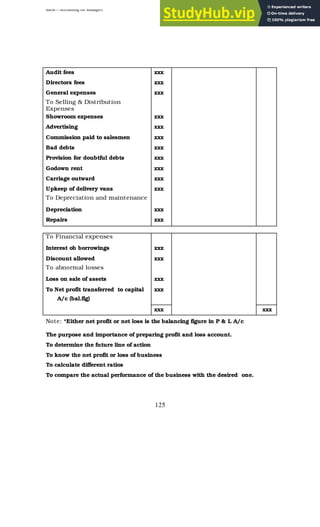

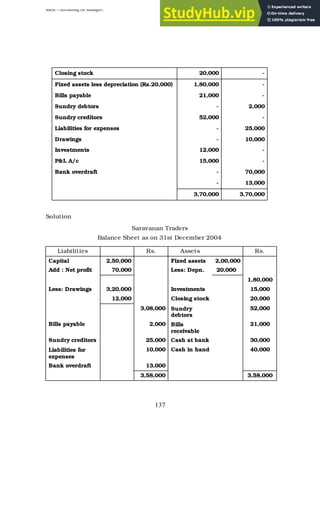

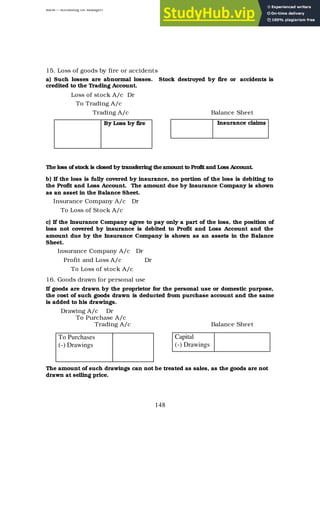

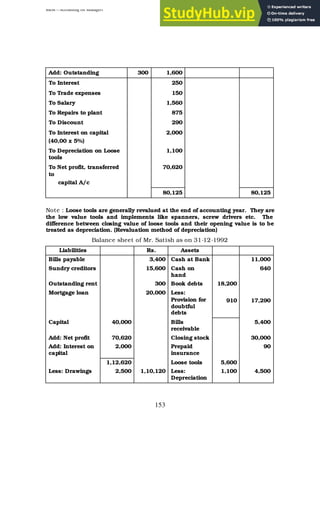

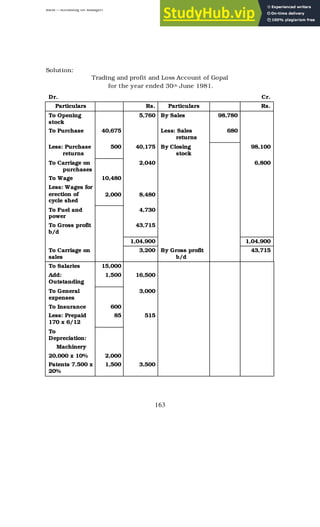

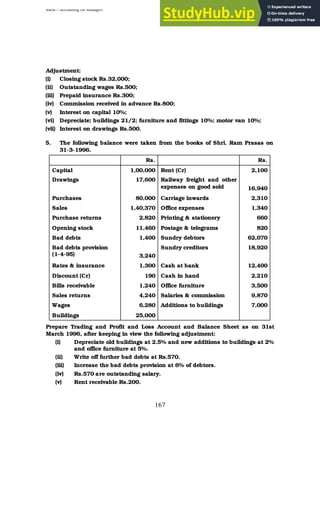

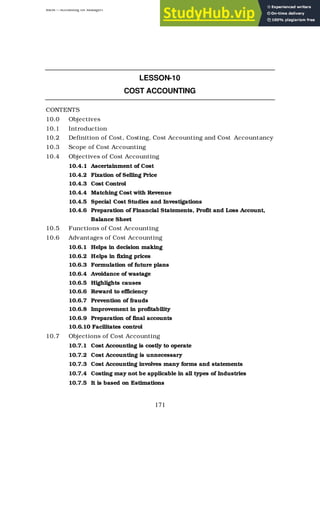

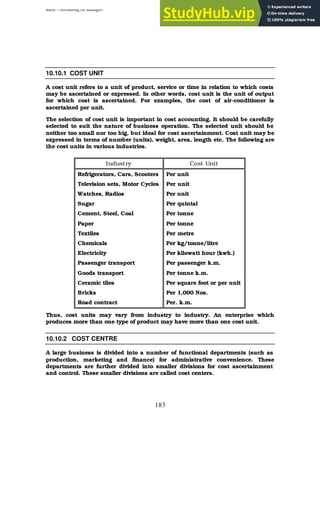

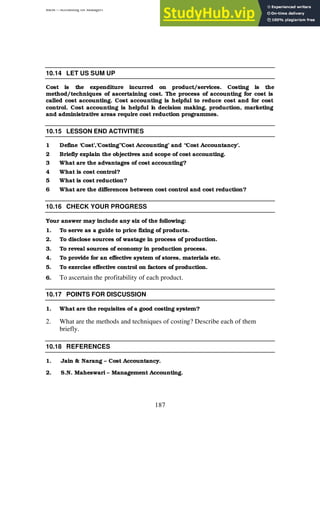

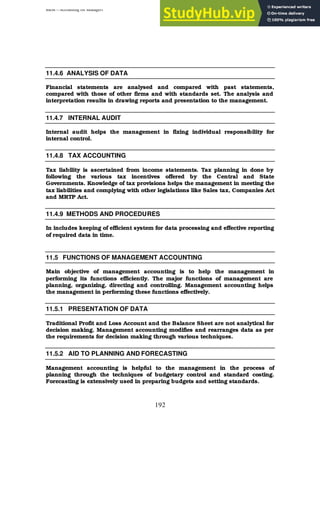

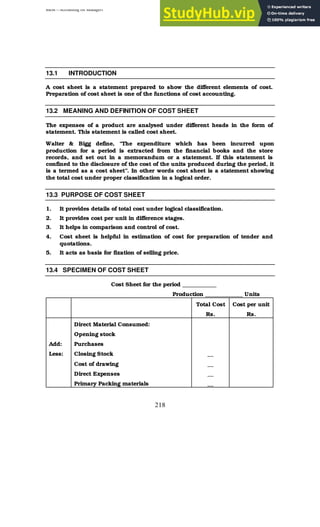

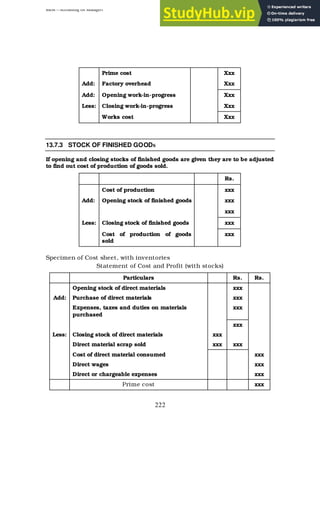

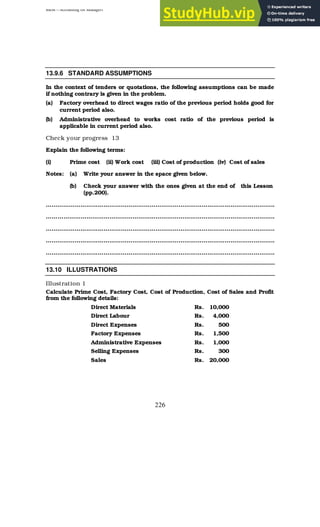

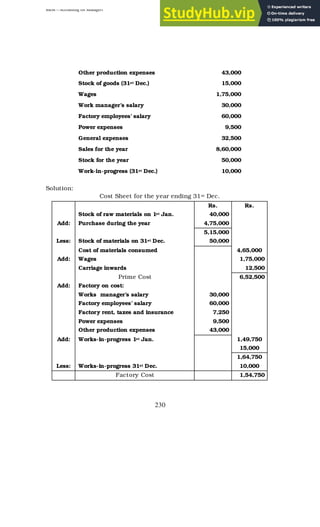

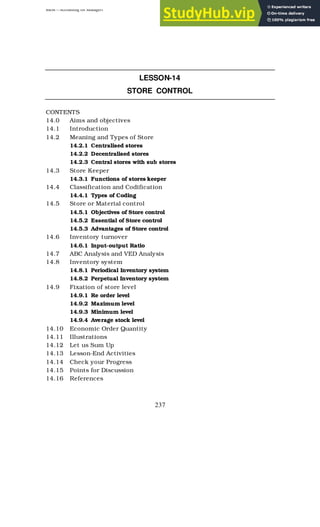

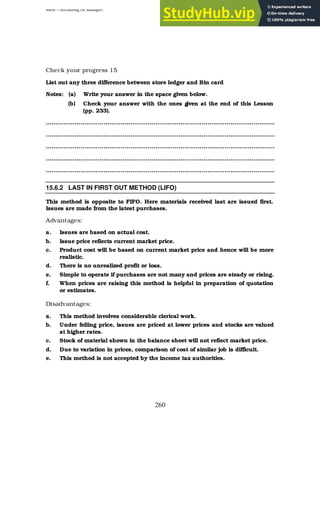

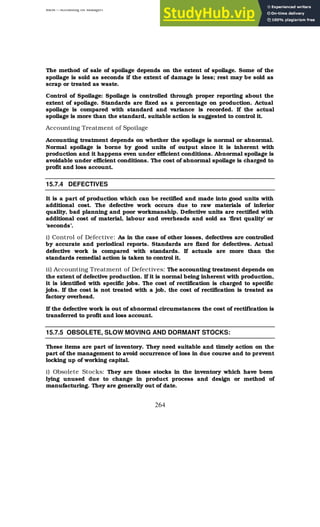

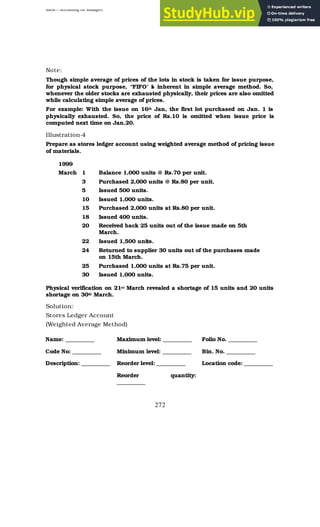

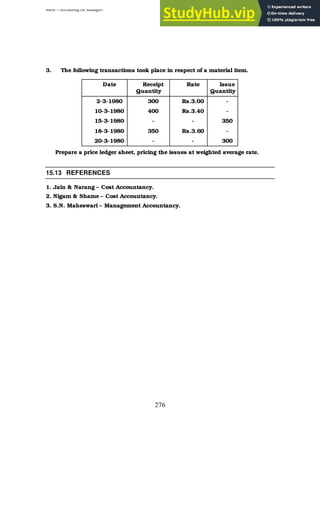

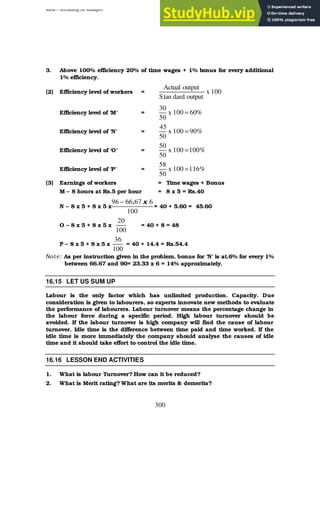

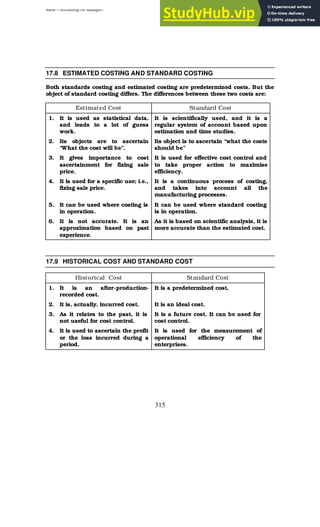

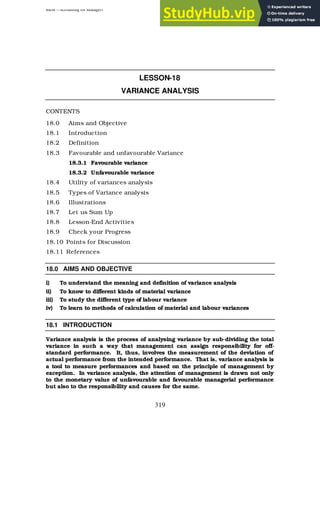

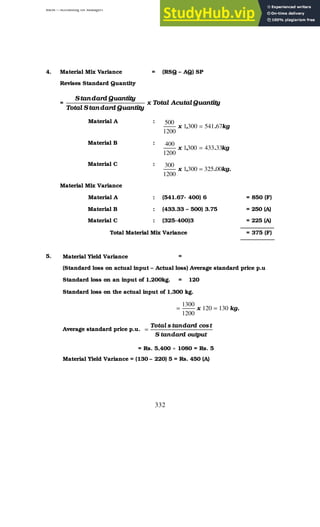

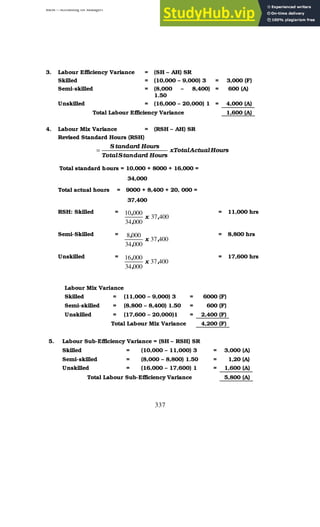

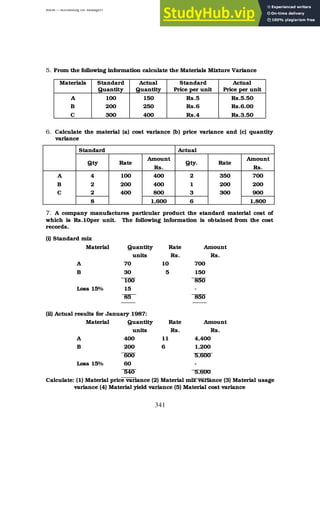

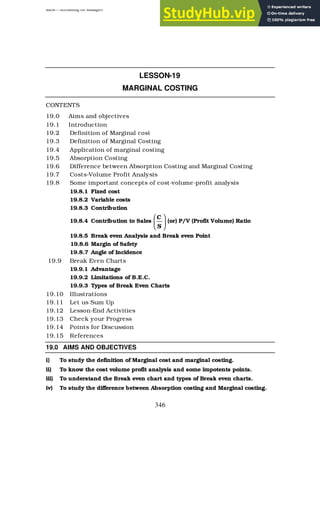

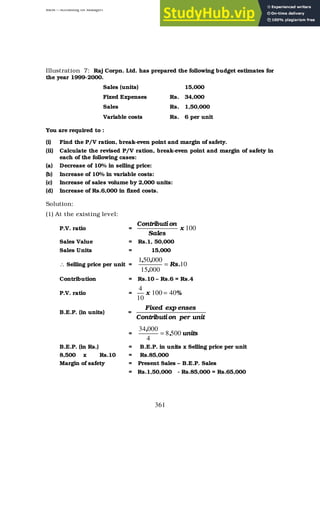

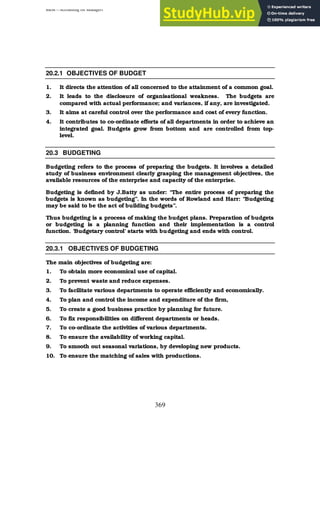

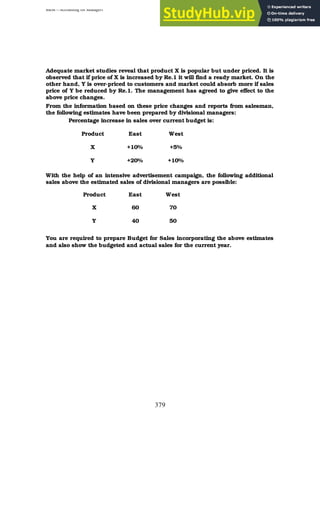

7.4 A SPECIMEN OF TRADING ACCOUNT IS SHOWN BELOW

Trading account for the year ended ……………

Particulars Rs. Rs. Particulars Rs. Rs.

To Opening stock xxx By Sales Xxx

To purchases xxx Less: Returns

inwards

(or)

Sales Returns

xxx

Less: purchase returns xxx xxx ----- xxx](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-115-320.jpg)

![BBM – Accounting for Managers

120

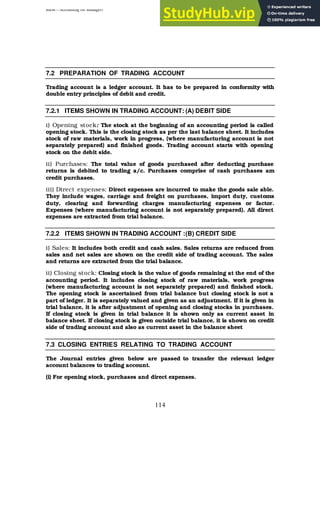

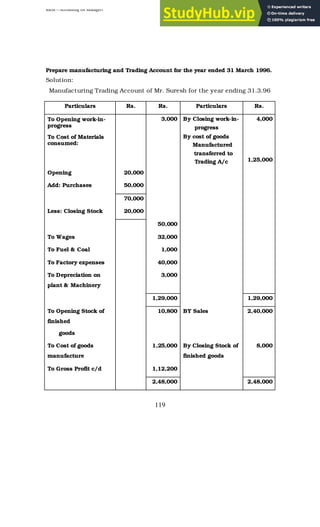

7.6 LET US SUM UP

At the end of the year, trading account is prepared to know the trading results.

Trade expenses like wages, carriage inward are considered. Cost of goods sold is

compared with sales in order to know gross profit / gross loss.

7.7 LESSON – END ACTIVITIES

1. What is trading account? Why it is prepared?

2. Distinguish between trading and manufacturing account?

7.8 CHECK YOUR PROGRESS ANSWER

Your answer may include the following :

(i) For opening stock, purchases and direct expenses.

Trading A/c Dr xxx

To Opening Stock A/c xxx

To Purchases (Net) A/c xxx

To Direct expenses A/c xxx

[Being transfer of trading a/c debit

side items]

(ii) For transfer of sales (after reducing sales returns)

Sales (net) A/c Dr xxx

To Trading A/c xxx

[Being transfer of sales to Trading A/c]

(iii) For transferring gross profit

Trading A/c Dr xxx

To Profit & Loss A/c xxx

[Being transfer of gross profit to P&L A/c]

(iv) For Gross Loss

Profit & Loss A/c Dr xxx

To Trading A/c xxx

[Being transfer of gross loss to P&L A/c]](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-120-320.jpg)

![BBM – Accounting for Managers

123

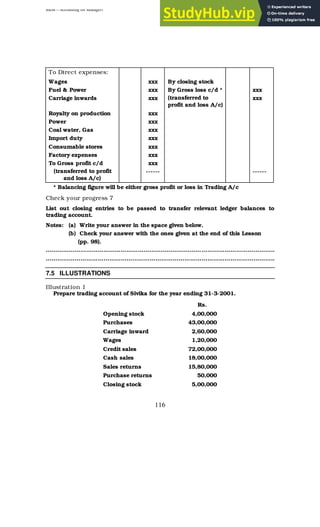

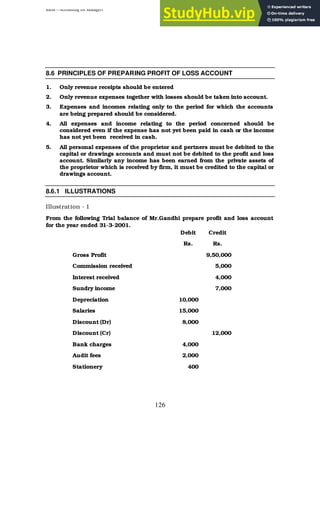

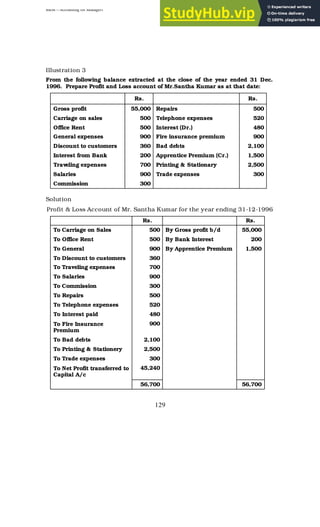

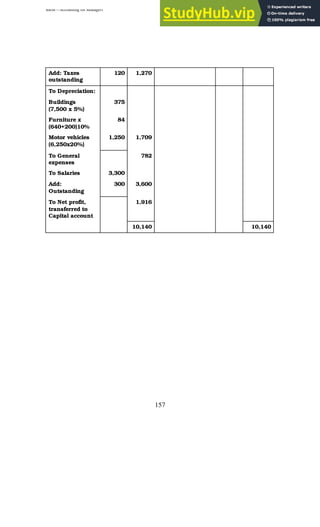

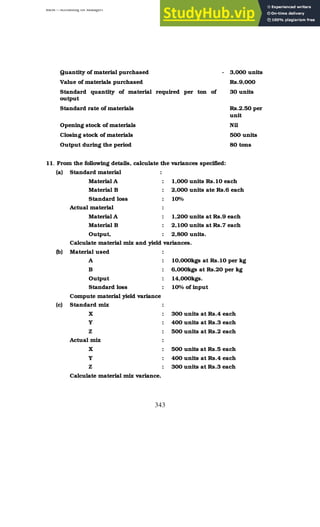

8.3 PREPARATION OF PROFIT AND LOSS ACCOUNT

Profit and loss account starts with gross profit brought down from trading

account on the credit side. (If gross loss, on the debit side). All the indirect

expenses are debited and all the revenue incomes are credited to the profit and

loss account and then net profit or loss is calculated. If incomes or credit is

more, than the expenses or debit, the difference is net profit. On the other hand

if the expenses or debit side is more, the difference is net loss.

8.3.1 DEBIT SIDE

Expenses shown on the debit side of profit and loss account are classified into

two categories

1. Operating expenses and 2. Non operating expenses

(1) Operating expenses: These expenses are incurred to operate the business

efficiently. They are incurred in running the organisation. Operating expenses

include administration, selling, distribution, finance, depreciation and

maintenance expenses.

(2) Non operating expenses: These expenses are not directly associate with day

today operations of the business concern. They include loss on sale of assets,

extraordinary losses, etc.

8.3.2 CREDIT SIDE

Gross profit is the first item appearing on the credit side of profit and loss

account. Other revenue incomes also appear on the credit side of profit and to

account. The other incomes are classified as operating incomes and non

operating incomes.

(1) Operating incomes: These incomes are incidental to business and earned

from usual business carried on by the concern. Examples: discount received,

commission earned, interest received etc.

(2) Non operating incomes: These incomes are not related to the business

carried on by the firm. Examples are profit on sale of fixed assets, refund of tax etc.

8.4 CLOSING ENTRIES FOR PROFIT AND LOSS ACCOUNT

1. For transferring expenses to profit and loss account:

Profit and Loss A/c Dr xxx

To expenses A/c xxx

[Being transfer of all P&L A/c debit

side items]](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-123-320.jpg)

![BBM – Accounting for Managers

124

2. For transfer of incomes to profit and loss account

Incomes A/c Dr xxx

To Profit and Loss A/c xxx

[Being transfer of Incomes to P&L A/c]

3. For net profit:

P&L A/c Dr xxx

To Capital A/ xxx

[Being net profit credited to capital]

4. For transfer of Net Loss

Capital A/c Dr xxx

To P&L A/c xxx

[Being net loss transferred to capital]

Note: In case of partnership, the profit or loss is divided between partners in

their profit sharing ratio and credited or debited to the individual partners. In

case of limited companies, Net profit or loss is transferred to the P&L

Appropriation A/c for disposal.

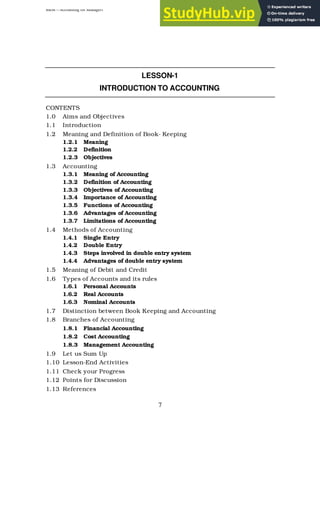

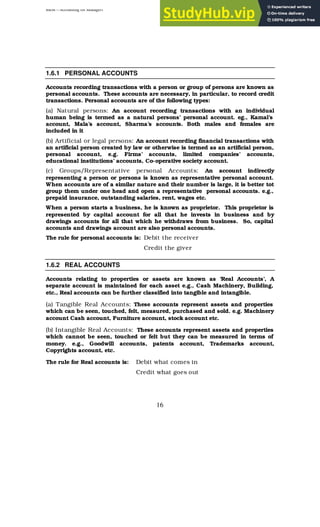

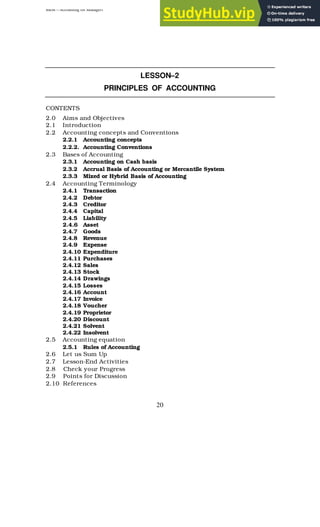

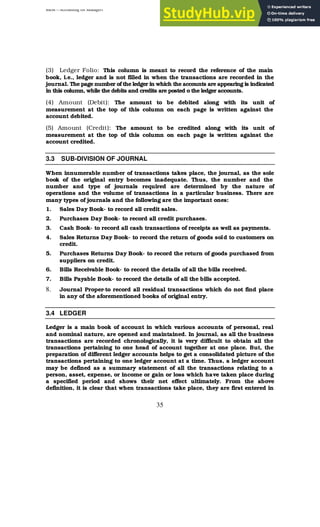

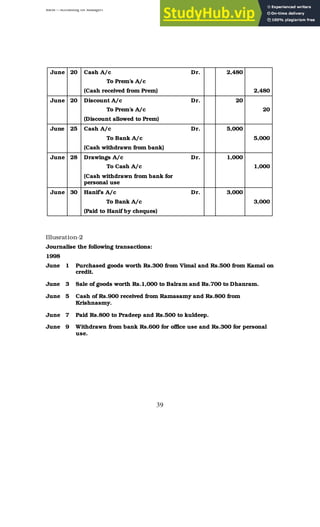

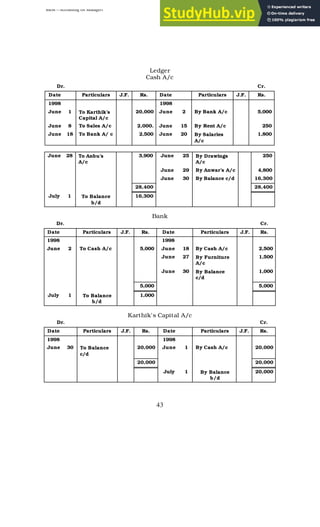

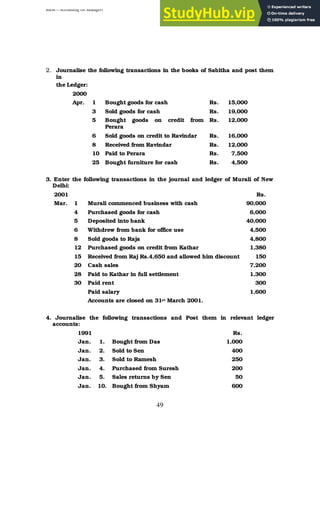

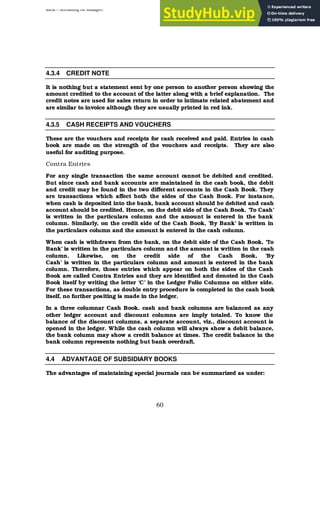

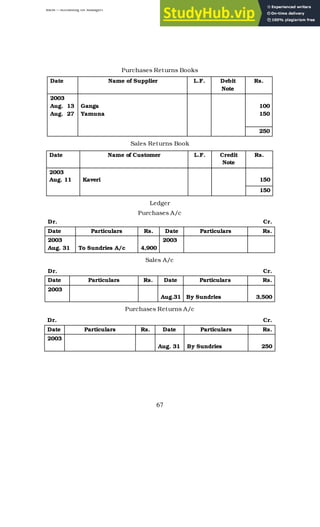

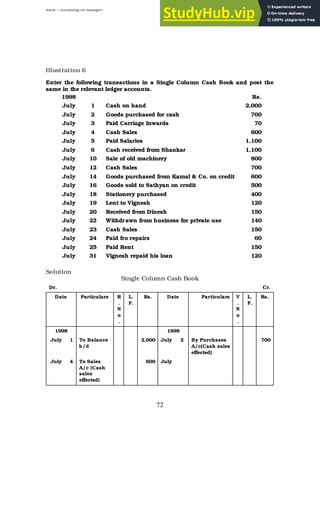

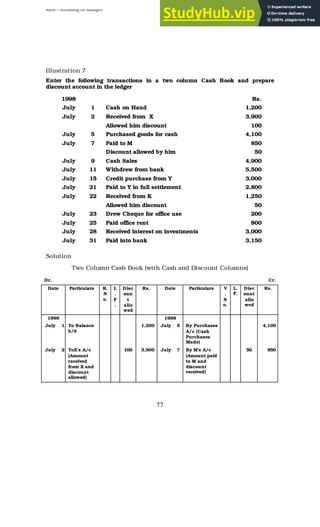

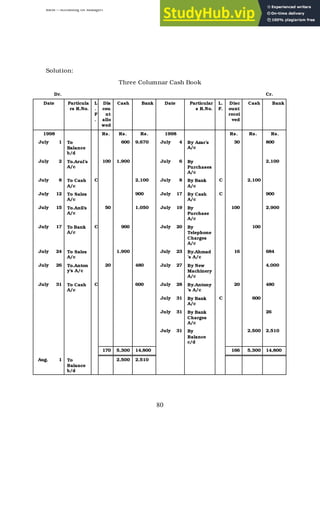

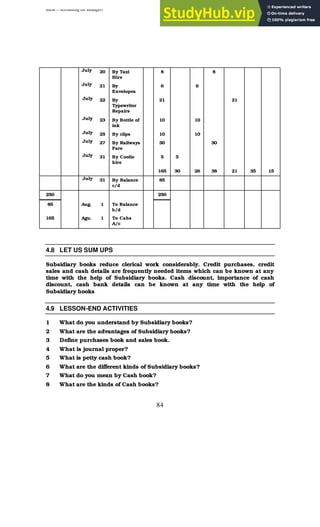

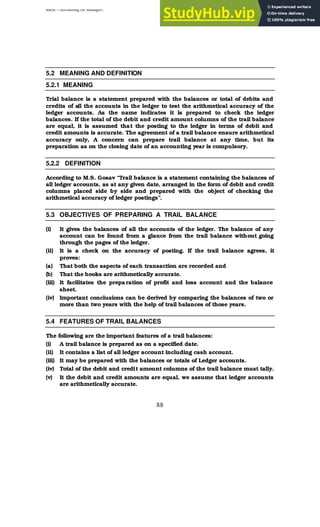

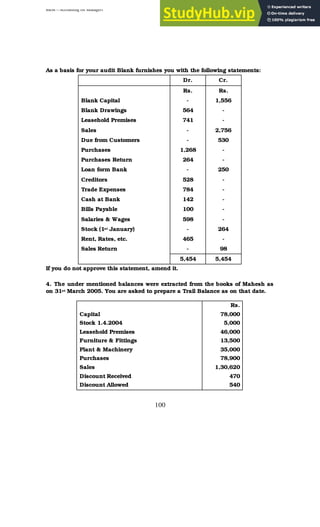

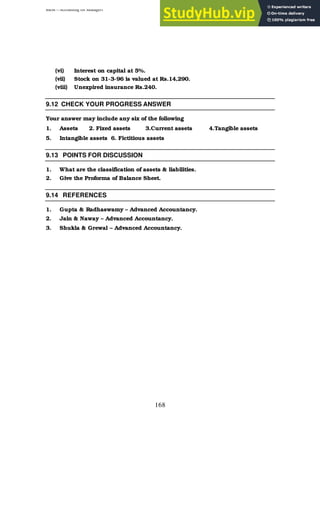

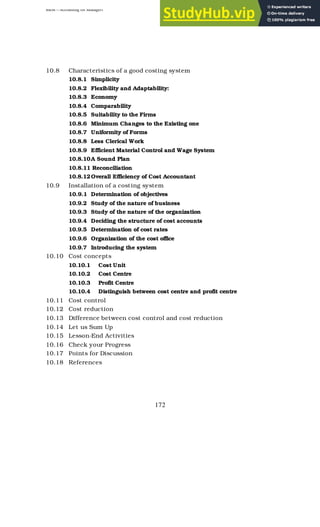

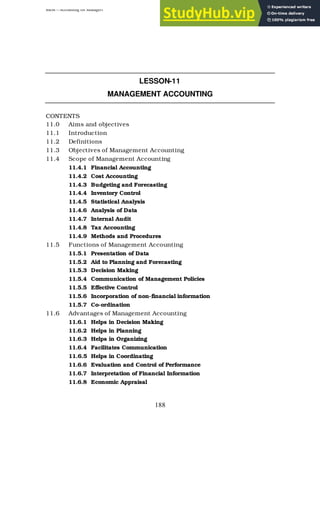

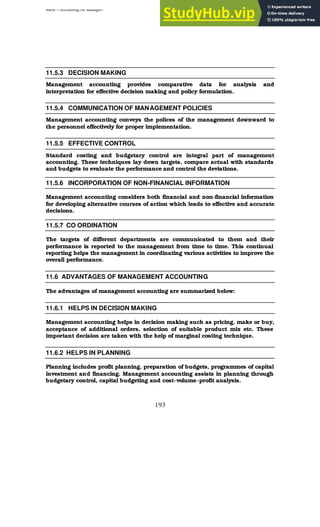

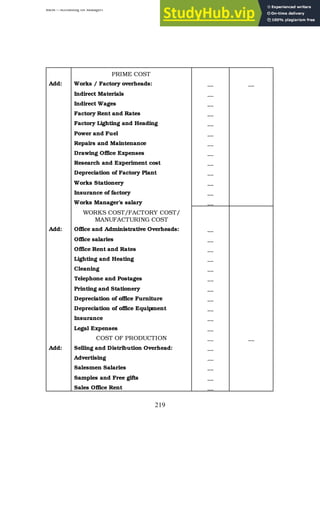

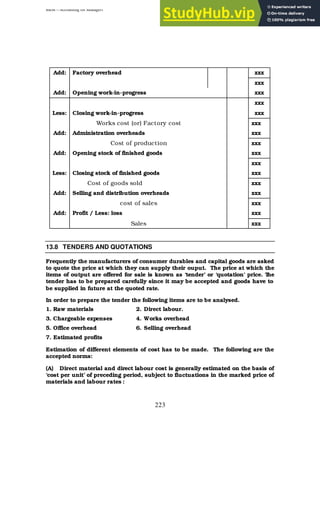

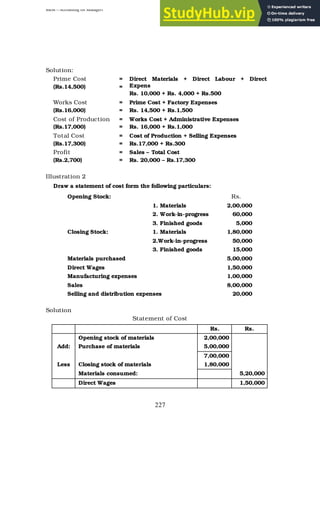

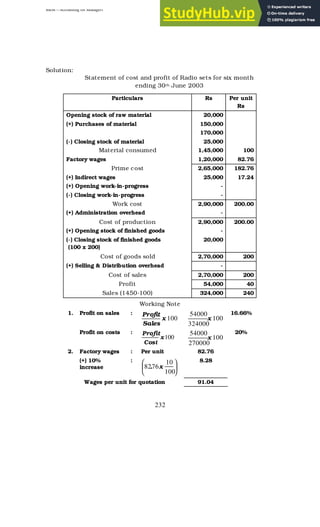

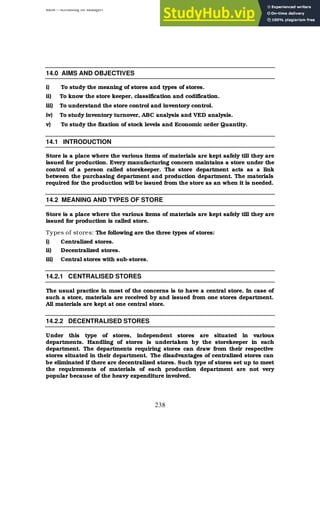

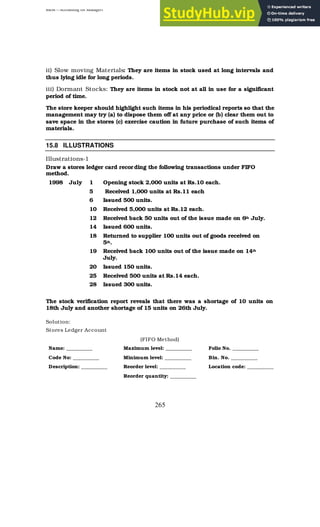

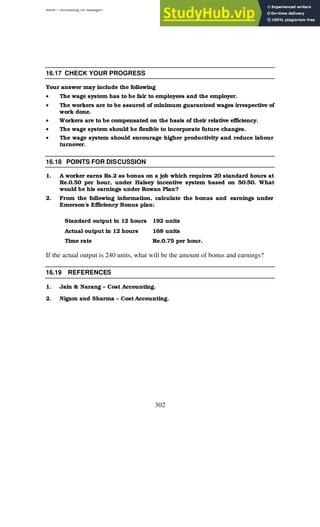

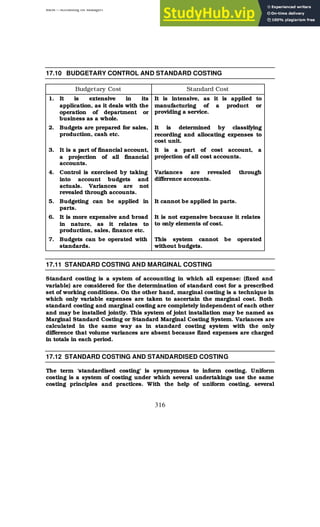

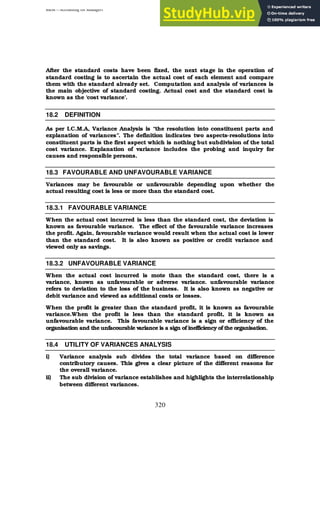

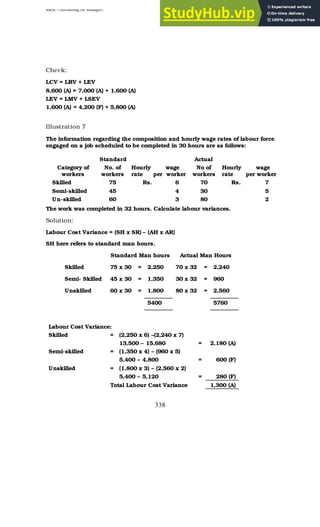

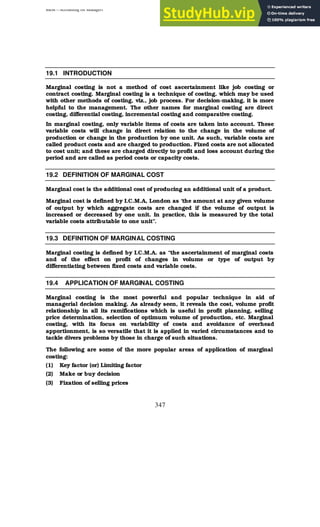

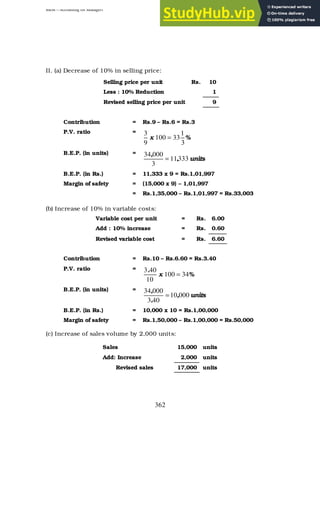

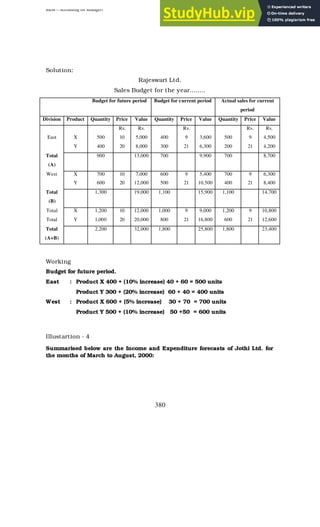

8.5 THE SPECIMEN OF PROFIT AND LOSS ACCOUNT IS SHOWN BELOW

Profit and Loss Account

For the year ended 31st March 2001

Particulars Rs. Particulars Rs.

To Gross loss b/d xxx By Gross profit b/d xxx

To Administration expenses By Dividends received xxx

Salaries xxx By Interest received xxx

Rent rates & taxes xxx By Discount received xxx

Printing & Stationery xxx By commission received xxx

Postage and Telegrams xxx By Rent received xxx

Telephone expenses xxx By Profit on sale of assets xxx

Legal charges xxx By Sundry revenue receipts xxx

Insurance xxx By Net loss transferred to

capital A/c (Bal. Fig)*

xxx](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-124-320.jpg)

![BBM – Accounting for Managers

138

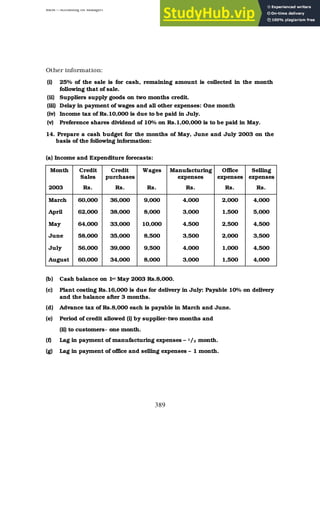

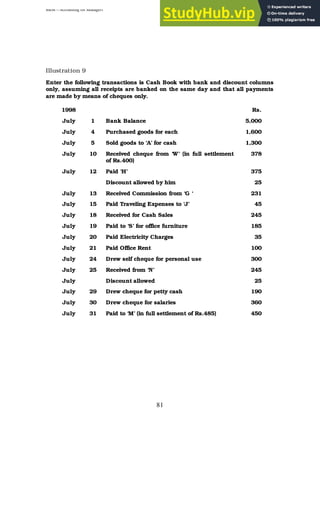

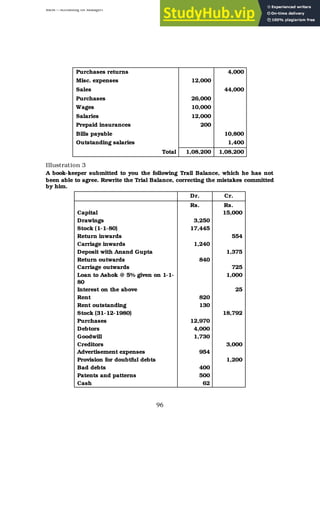

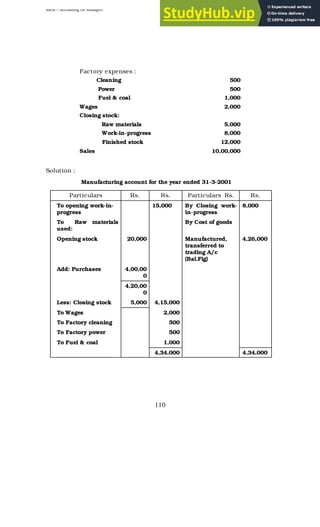

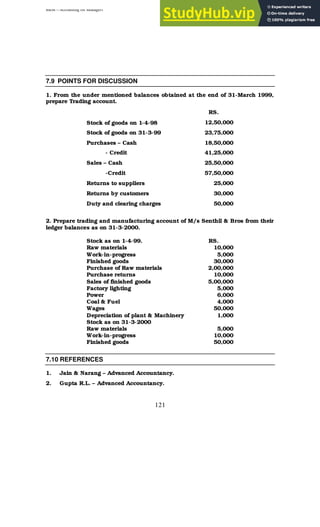

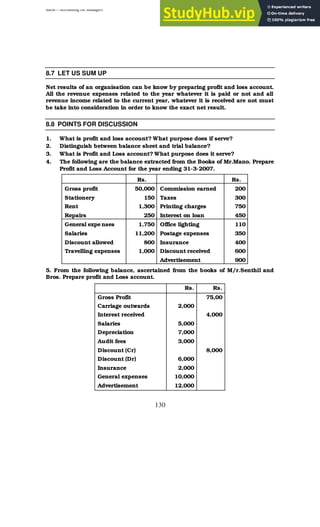

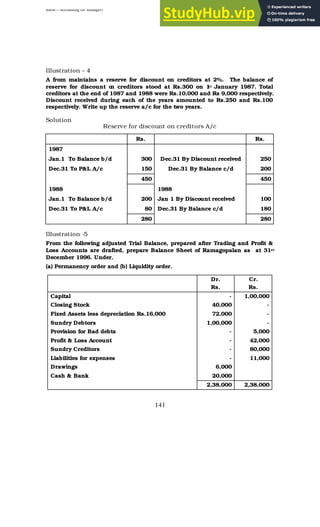

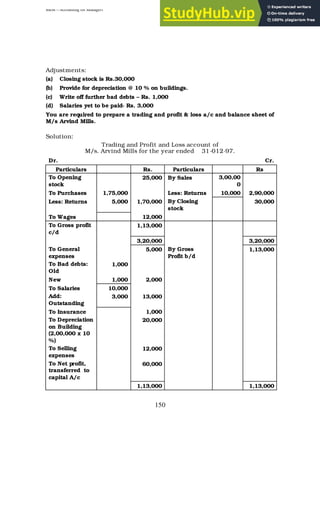

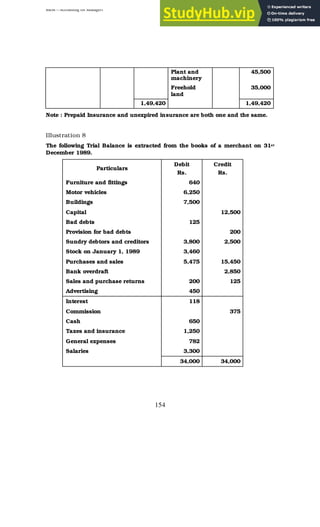

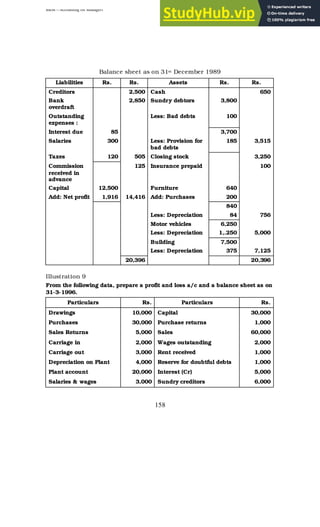

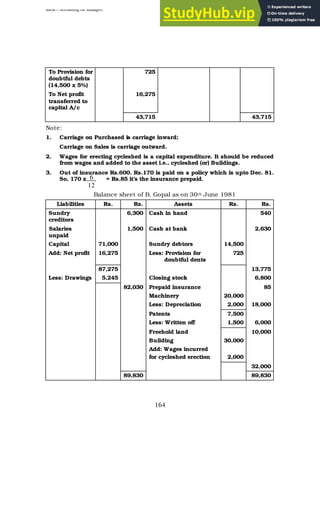

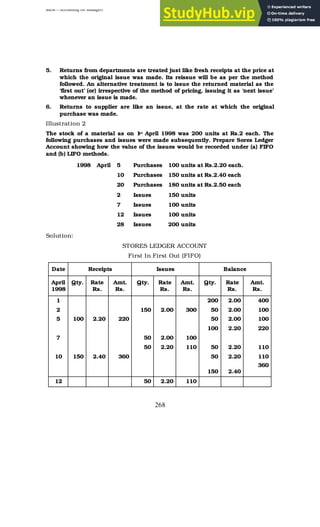

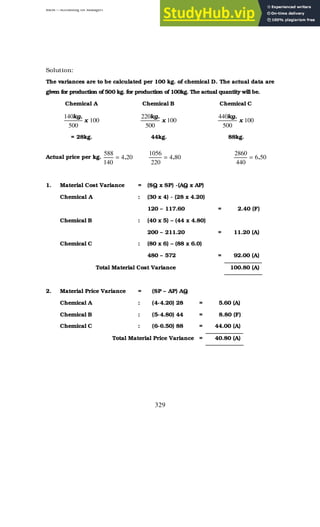

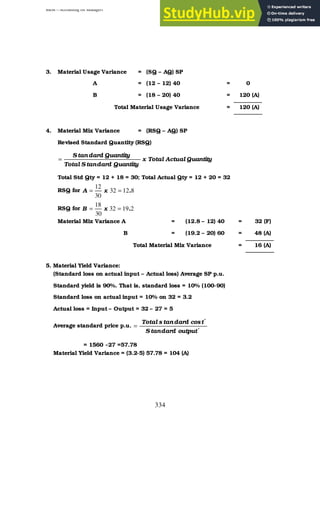

Illustrations 2

The reserve for doubtful debts account showed a credit balance of Rs.1,500 on

1.1.90. During 1990, bad debts amounted to Rs.1,100. The debtors on 31.12.90

owed Rs.40,000. Maintain a 5% reserve for doubtful debts. During 1991, bad

debts came to Rs.800. On 31.12.91 the debtors owed Rs.44,000. The bad debts

in 1992 amounted to Rs.400. On 31.12.92, the debtors owed Rs.32,000. The

same 5% reserve for doubtful debts is maintained in all the years. Pass

necessary journals and ledger accounts.

Solution

Journal Entries

Date Particulars Rs. Rs.

1990 Bad debts A/c Dr. 1,100

Dec.31 To Sundry debtors A/c 1,100

[Being bad debts written off]

” Prov. For doubtful debts A/c Dr. 1,100

To Bad debts A/c 1,100

[Being bad debts transferred]

” Profit & Loss A/c Dr. 1,600

To Provision for doubtful debts A/c 1,600

[Being amount transferred to P&L A/c

1991 Bad debts A/c Dr. 800

Dec.31 To Sundry debtors A/c 800

[Being bad debts written off]

” Prov. for doubtful debts A/c Dr. 800

To Bad debts A/c 800

[Being bad debts transferred]

” Profit & Loss A/c Dr. 1,000

To Provision for doubtful debts A/c 1,000

[Being amount transferred to P & L A/c

1992 Bad debts A/c Dr. 400

Dec.31 To Sundry debtors A/c 400

[Being bad debts written off]

” Prov. for doubtful debts A/c Dr. 400

To Bad debts A/c 400

[Being bad debts A/c]

” Prov. for doubtful debts A/c Dr. 300](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-138-320.jpg)

![BBM – Accounting for Managers

139

To Profit & Loss A/c 300

[Being excess reserve credited to P&L A/c]

Bad debts A/c

Rs. Rs.

1990 1990

Dec.31 To Sundry Debtors 1,100 Dec.31 By Prov. for

doubtful

debts

1,100

1991 1991

Dec.31 To Sundry Debtors 800 Dec.31 By Prov. for

doubtful

debts

800

1992 1992

Dec.31 To Sundry Debtors 400 Jan 1 Balance b/d 400

Provision for doubtful debts A/c

Rs. Rs.

1990 To Bad debts 1,100 1990 By Balance b/d 1,500

Dec.31 To Balance c/d 2,000 Dec.31 By P&L A/c 1,600

3,100 3,100

1991 1991

Dec.31 To Bad debts

To Balance c/d

800

2,200

Jan.31 By Balance b/d

By P&L A/c

2,000

1,000

3,000 3,000

1992 1992

Dec.31 To Bad debts

To P&L A/c

To Balance c/d

400

300

1,500

Jan 1 Balance b/d 2,200

2,200 2,200

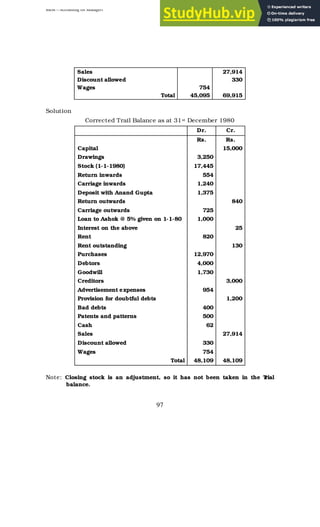

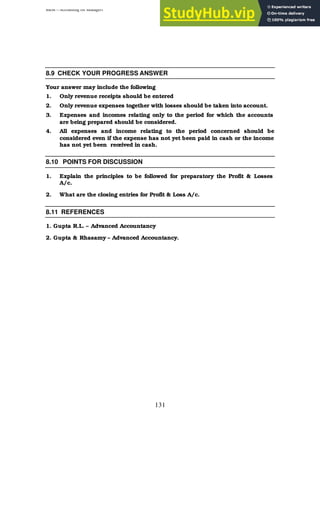

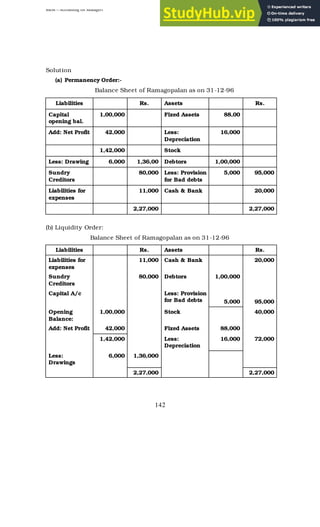

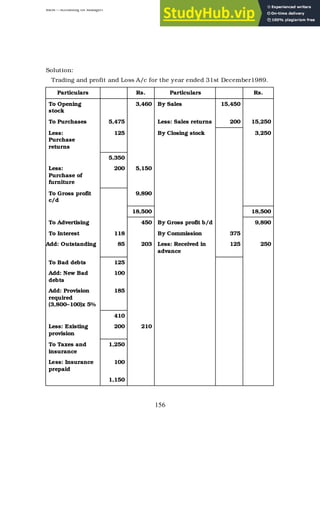

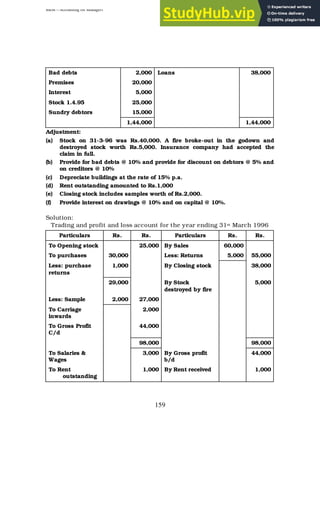

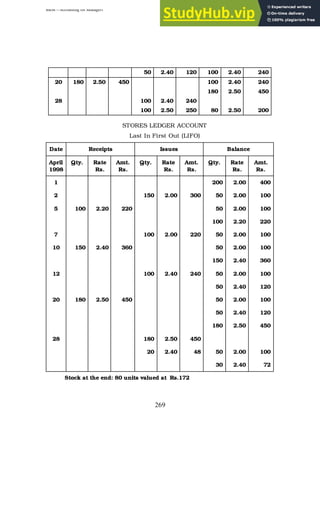

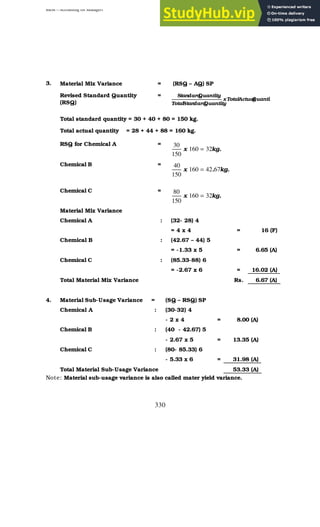

Illustration -3

The sundry debtors of a firm on 1

st December 1987 were Rs.40,000. On that

date it was decided to create a provision for discount at 2% on debtors . During

1988 the actual amount of discount allowed was Rs.400. The debtors on 31st

December 1988 were Rs30,000 and it is again decided to create a provision for](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-139-320.jpg)

![BBM – Accounting for Managers

140

discount on debtors at 2%. Show the journal entries, discount A/c and provision

for discount A/c for both the year.

Solution

Journal Entries

Date Particulars Rs. Rs.

1987 Profit & loss Dr. 800

Dec.31 To Res. For discount on debtors A/c 800

[Being 2% reserve created on Rs.40,000]

1988 Discount A/c Dr. 400

Dec.31 To Sundry debtors A/c 400

[Being the discount allowed to debtors]

” Reserve for discount on debtors A/c Dr. 400

To Discount A/c 400

[Being the transfer made]

” Profit & Loss A/c Dr. 200

To Res. For discount on debtors A/c 200

[Being the provision created]

Reserve for discount on debtors A/c

Rs. Rs.

1987 1987

Dec. 31 To Balance c/d 800 Dec.31 By P&L A/c 800

800 800

1998 1988

Dec.31 To Discount 400 Jan 1 By Balance b/d 800

” To Balance c/d 600 Dec.31 By P&L A/c 200

1,000 1,000

Discount A/c

Rs. Rs.

1998 1988

Dec.31 To Sundry Debtors 400 Dec.31 By Res. For doubtful

debts

400

400 400](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-140-320.jpg)

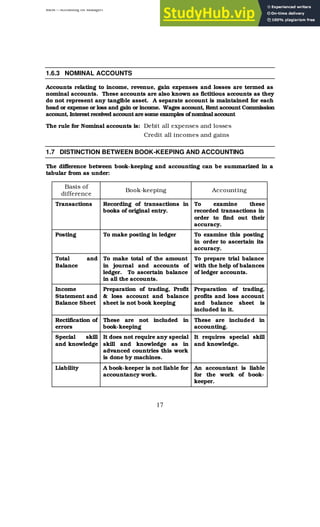

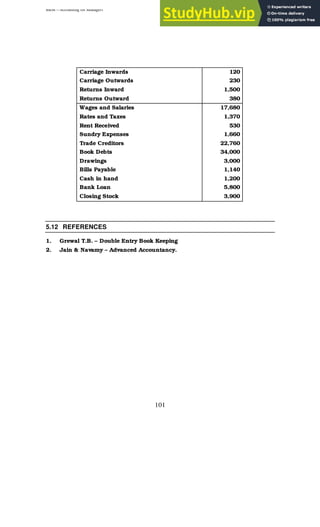

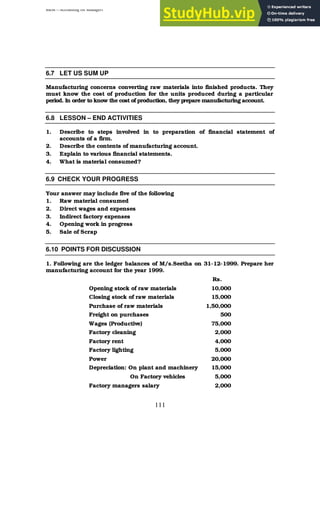

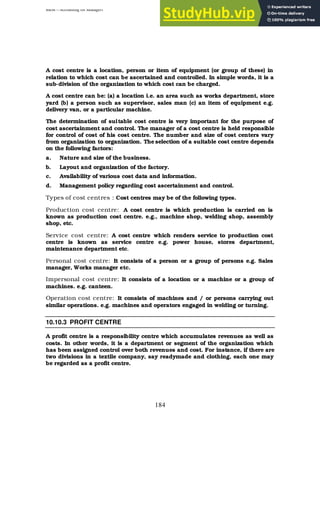

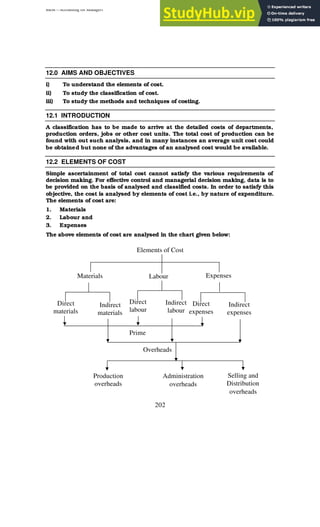

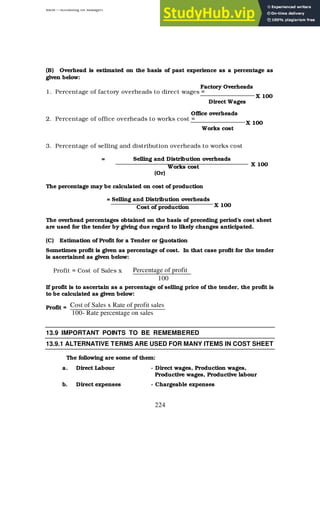

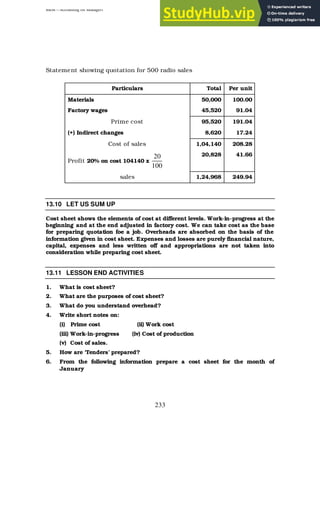

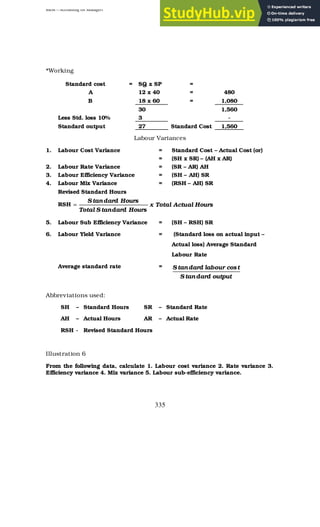

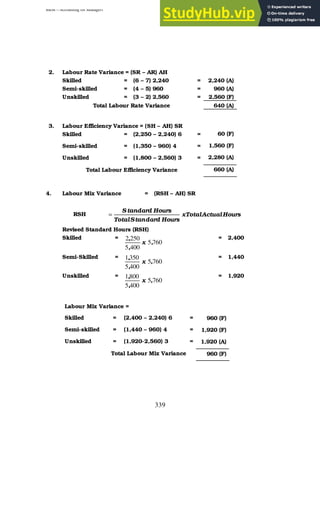

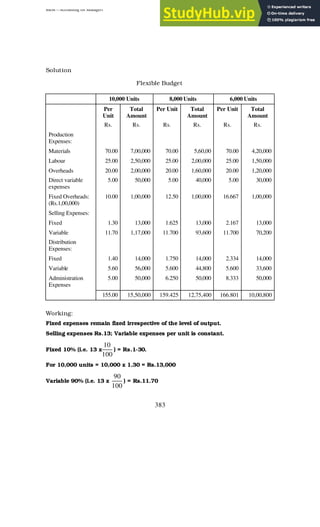

![BBM – Accounting for Managers

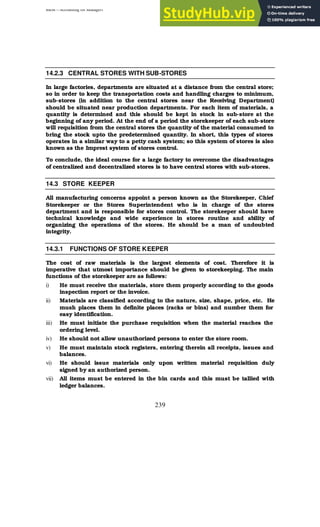

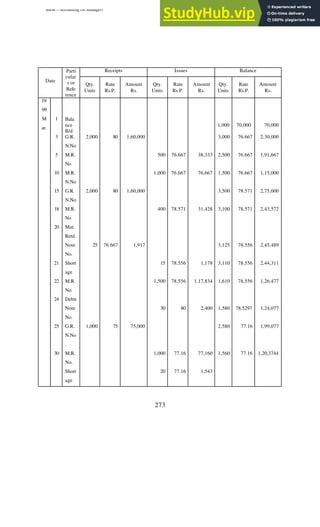

247

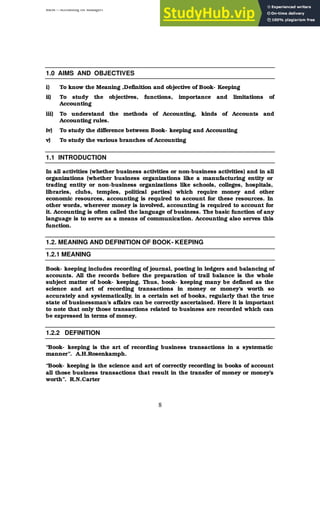

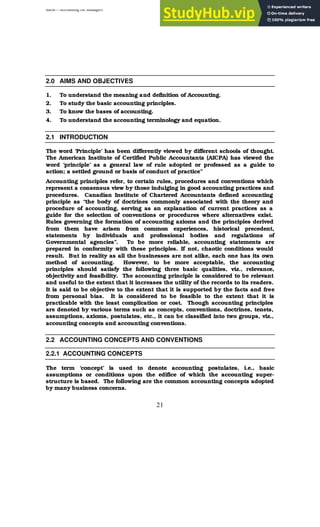

14.9.4 AVERAGE STOCK LEVEL

This stock level shows the average quantity of materials kept in the store. This is

regarded as the average of maximum and minimum stock levels.

Formula:

Average stock level =

2

level

Minimum

level

Maximum +

If maximum stock level is not available.

Average stock level = Minimum level + ½ Reorder quantity

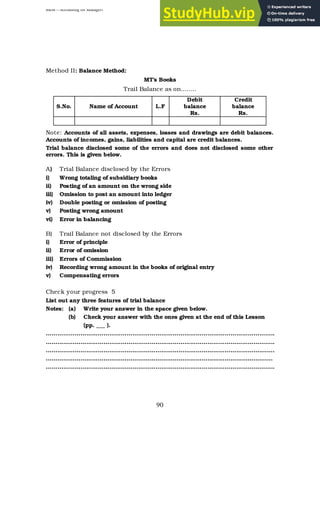

14.10 ECONOMIC ORDER QUANTITY [EOQ]

Economic ordering quantity depends on many factors like cost of purchasing

and receiving, normal consumption, interest on capital, availability of storage

accommodation, ordering and carrying costs. Economic ordering quantity is the

reorder quantity, which is the quantity to be purchased each time an order is

placed.

When the purchase price remains constants, the economic ordering quantity will

be determined based on the following formula:

EOQ =

CS

AB

2

Where

EOQ = Economic Ordering Quantity

A = Annual consumption or usage of material in units.

B = Buying cost per order.

C = Cost per unit.

S = Storage and carrying cost per annum.

Check your progress 14

What you understand about ABC analysis

Notes: (a) Write your answer in the space given below.

(b) Check your answer with the ones given at the end of this Lesson

(pp. 215).

……………………………………………………………………………………………………….

……………………………………………………………………………………………………….

………………………………………………………………………………………………………..

………………………………………………………………………………………………………..

………………………………………………………………………………………………………..](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-247-320.jpg)

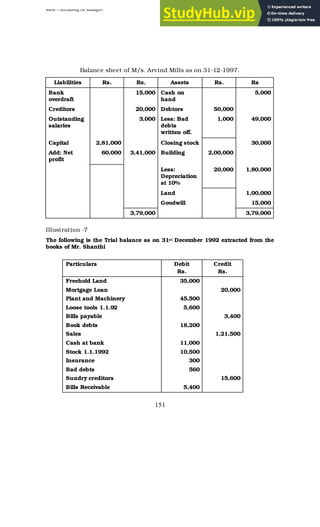

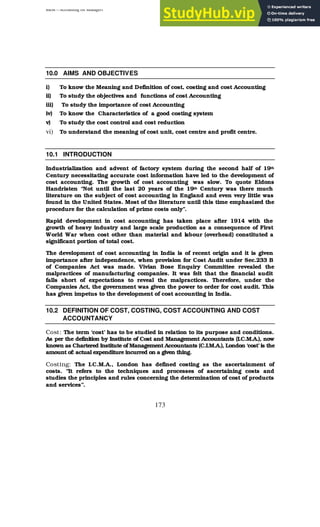

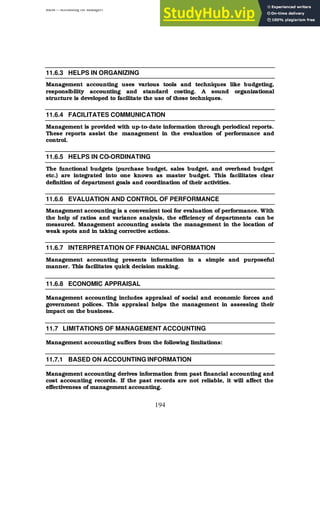

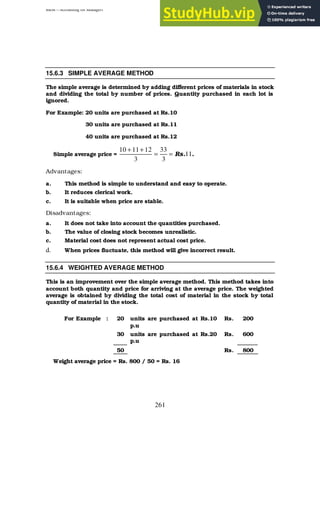

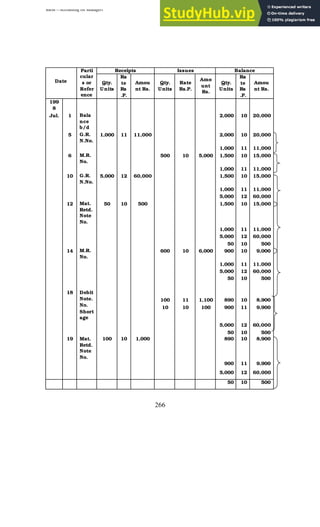

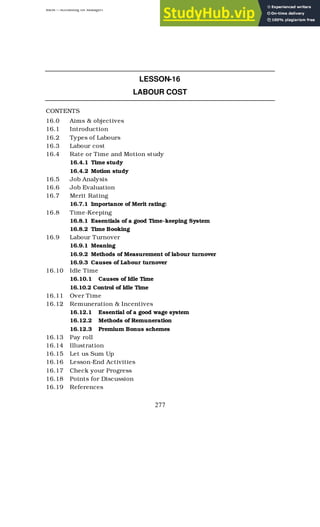

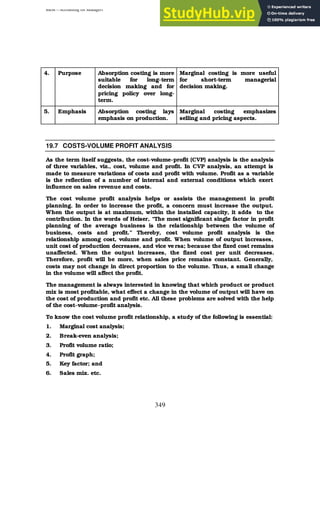

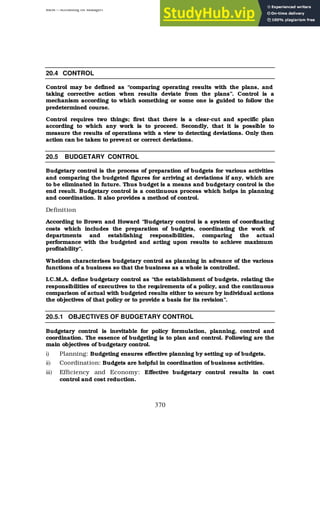

![BBM – Accounting for Managers

255

LESSON-15

STORES LEDGER

CONTENTS

15.0 Aims and objectives

15.1 Introduction

15.2 Store ledger Specimen

15.3 BIN card

15.3.1 Difference between store ledger and Bin card

15.4 Issue of material

15.4.1 Material requisition

15.4.2 Bill of material

15.5 Treatment of surplus material

15.5.1 Return of surplus Material

15.5.2 Transfer of surplus Material

15.6 Methods of pricing of material

15.6.1 First in First out method [FIFO]

15.6.2 Last in First out method [LIFO]

15.6.3 Simple Average method

15.6.4 Weighted Average method

15.7 Material losses and Types

15.7.1 Waste

15.7.2 Scrap

15.7.3 Spoilage

15.7.4 Defectives

15.7.5 Obsolete, Slow moving and Dormant Stocks

15.8 Illustration

15.9 Let us Sum Up

15.10 Lesson-End Activities

15.11 Check your Progress

15.12 Points for Discussion

15.13 References](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-255-320.jpg)

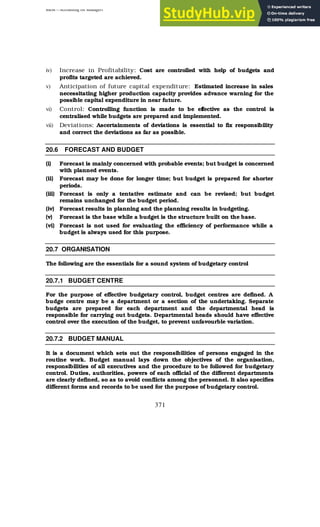

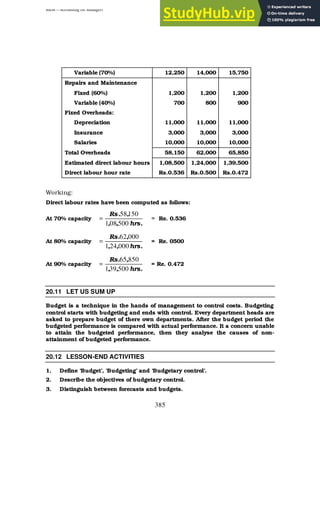

![BBM – Accounting for Managers

386

4. What are the essential requisites for successful implementation of a

budgetary control system?

5. Briefly explain the different classifications of budgets.

6. What is Z.B.B? Describe the process of preparing Z.B.B.

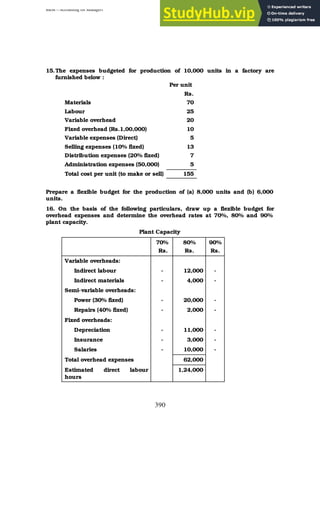

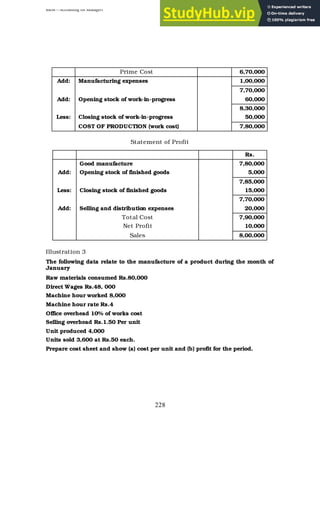

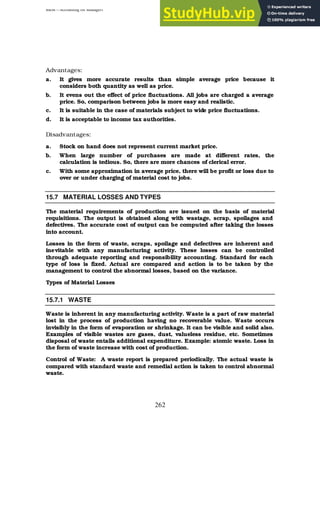

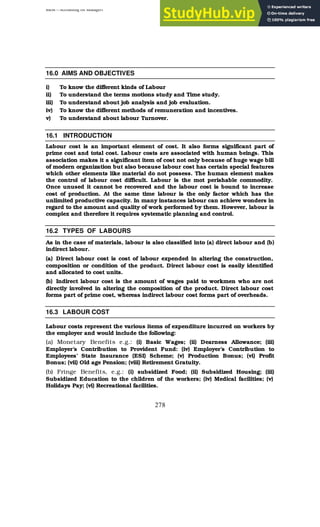

7 The following figures relating to product ‘Duper’ for the quarter ending

31.3.2001 are available:

Budgeted sales : January 3,00,000 units

February 2,40,000 units

March 3,60,000 units

Stock position : 1-1-2001 – 50% of January’s budgeted sales.

31.3.2001 – 80,000 units

31.1.2001 – 40% of February’s budgeted sales

28-2-2001 – 60% of March’s budgeted sales.

Your are required to prepare a production budget for the quarter ending

31.3.2001.

7. Prabu Engg. Co. Ltd. Manufactures 2 product X and Y. An estimate of the

number of units to be sold in the first 7 months of 2002 are given below:

Month X Y

Jan. 5,000 14,000

Feb. 6,000 14,000

Mar. 8,000 12,000

Apr. 10,000 10,000

May 12,000 8,000

June 12,000 8,000

July 10,000 9,000

It is anticipated that there will be no work-in-progress at the end of any month

and finished units are equal to half the anticipated sales for the next month will

be in stock at the end of each month (including Dec.2001). Your are required to

prepare a production budget showing the number of units to be manufactured

each month.

8. Draw a material procurement budget [quantitative] from the following

information Estimated sales of a product 40,000 units. Each unit of the

product requires 3 units of material A and 5 units of material B.](https://image.slidesharecdn.com/accountingformanagers-230807160536-33b54065/85/Accounting-for-Managers-pdf-386-320.jpg)