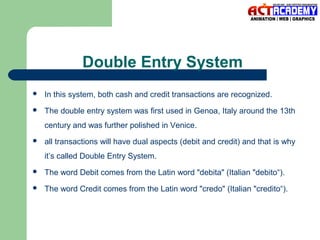

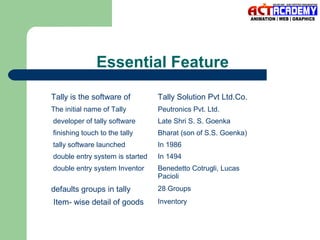

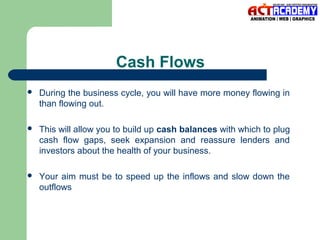

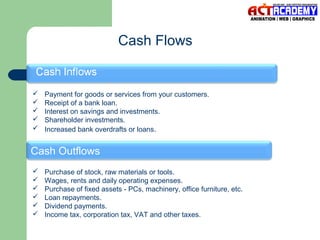

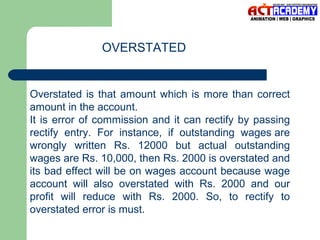

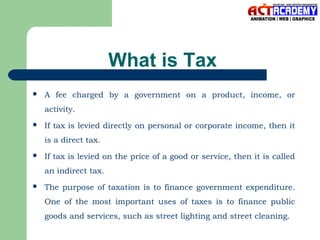

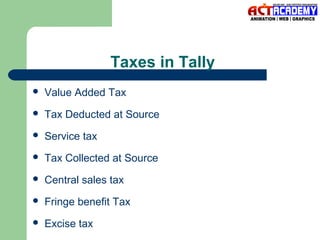

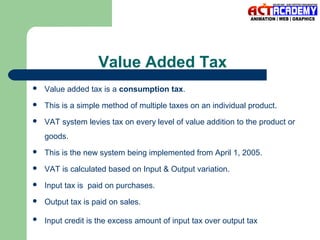

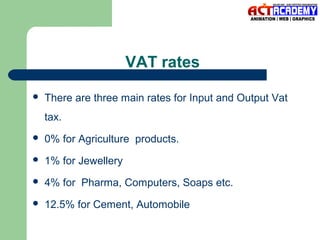

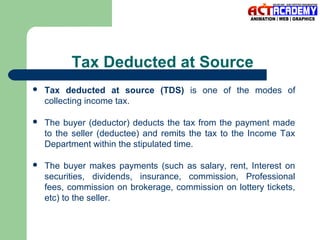

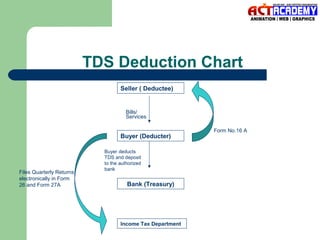

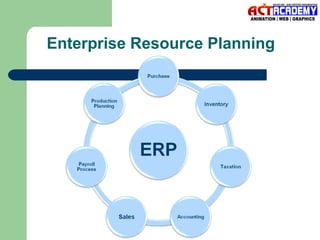

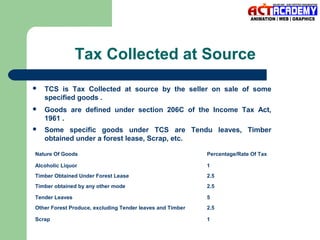

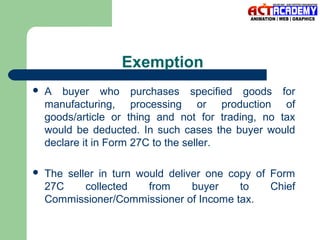

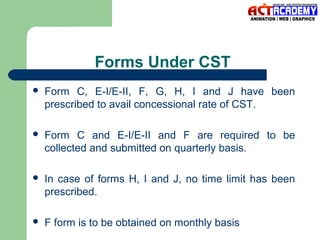

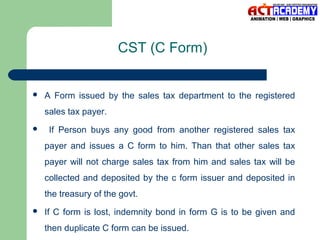

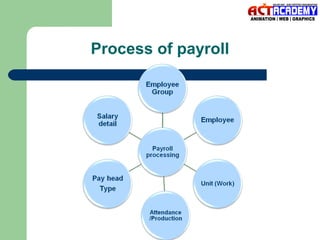

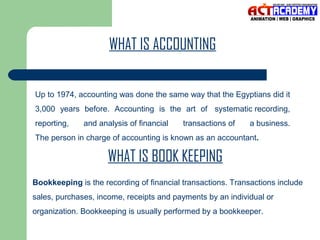

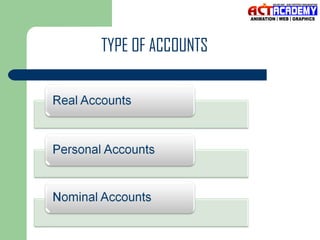

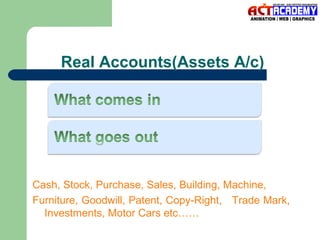

The document provides an overview of financial accounting, taxation, and their relevance to businesses, including definitions, types of accounts, and branches of accounting. It details various accounting systems, such as single entry and double entry systems, while explaining integration with software like Tally for transaction management. Additionally, it covers taxation concepts, including value-added tax, service tax, and the importance of payroll processing within business operations.

![Double Entry System

Invented by………………. “Lucas Pasioli”

of………………………… ‘Italy’

In …………………………’1494’

[ He said that every transaction have two sides……….. ]

Transactions:

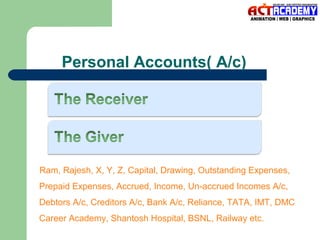

Receiver……..…. Giver

Comes in………….….Goes Out

Expenses/ Losses …. Incomes/ Gains](https://image.slidesharecdn.com/accountingppt-140122030159-phpapp01/85/Accounting-ppt-15-320.jpg)