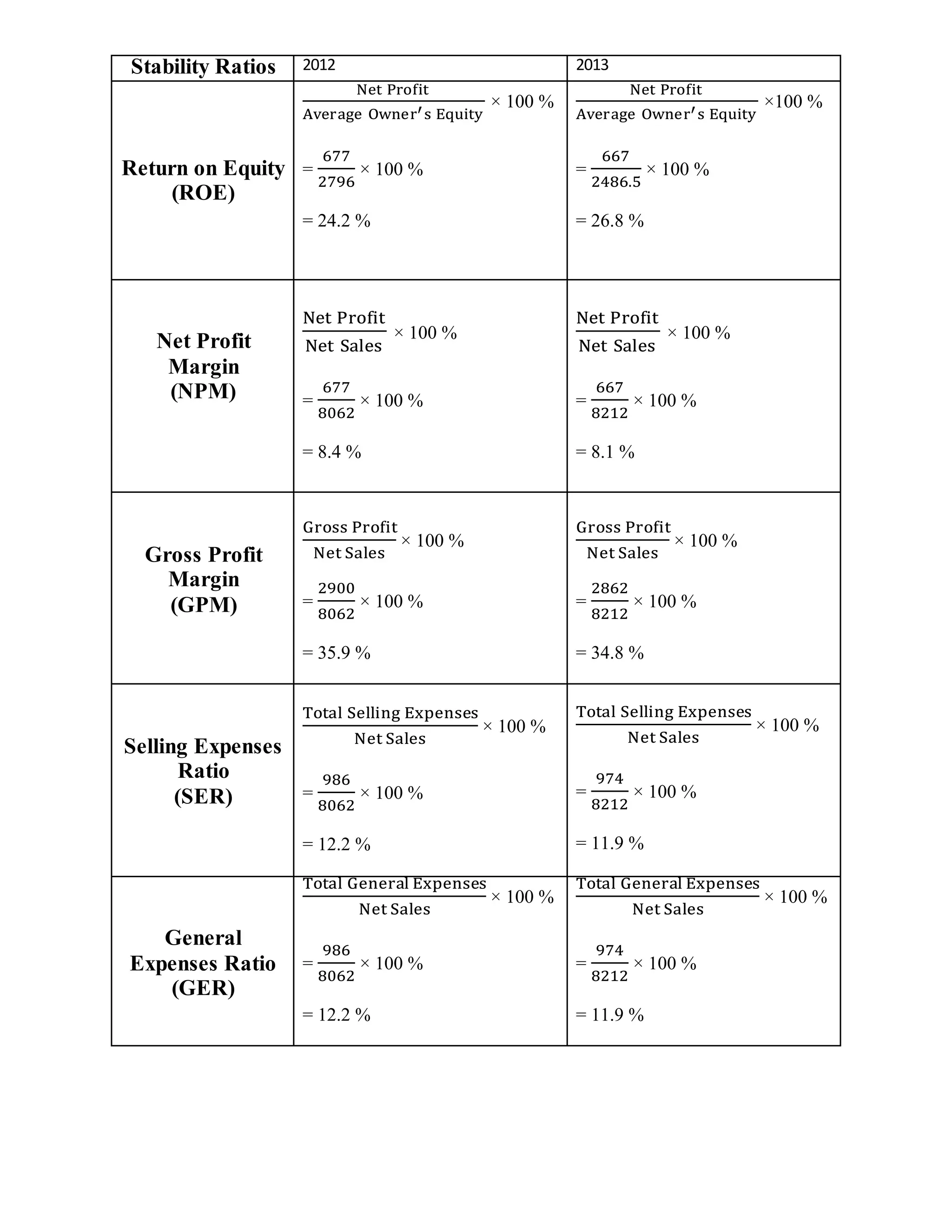

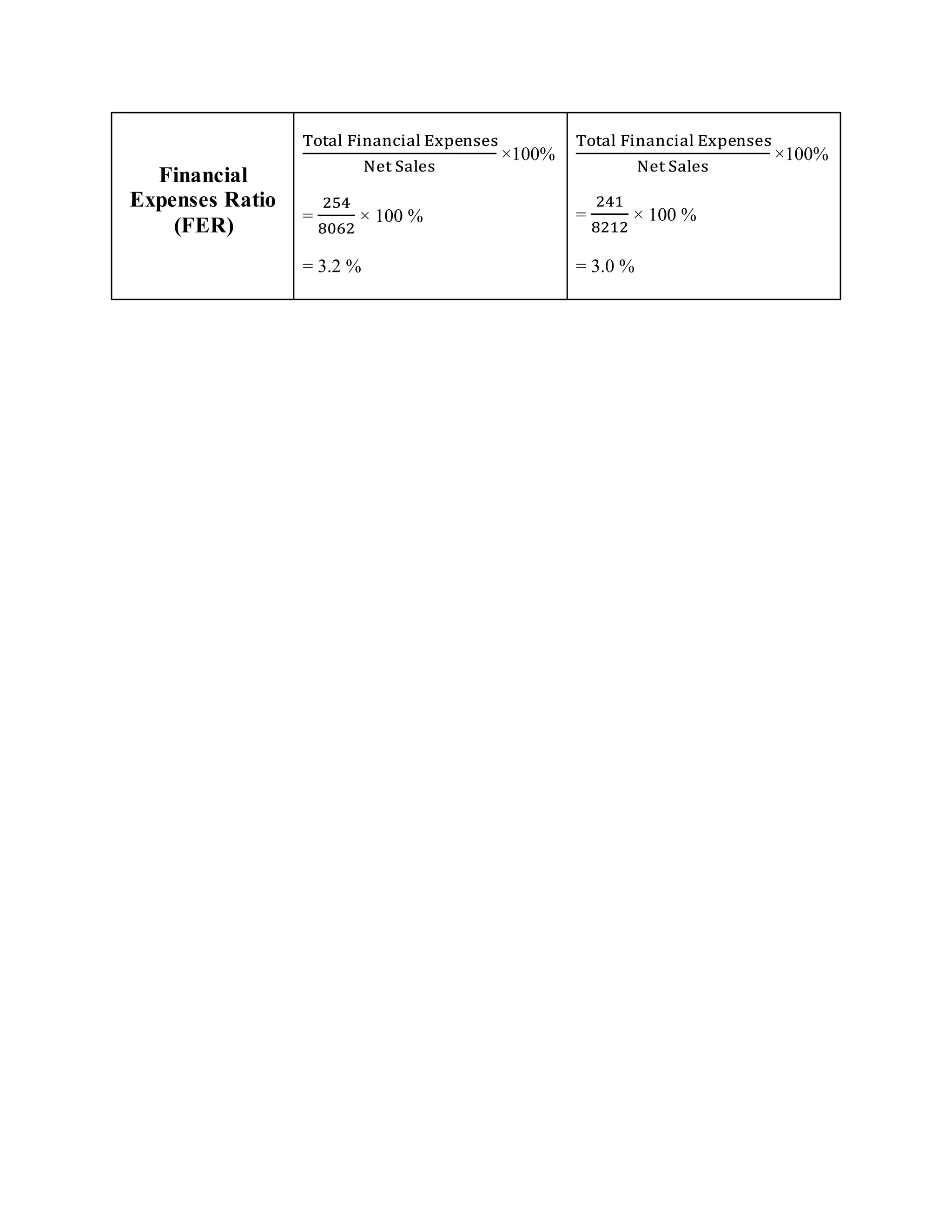

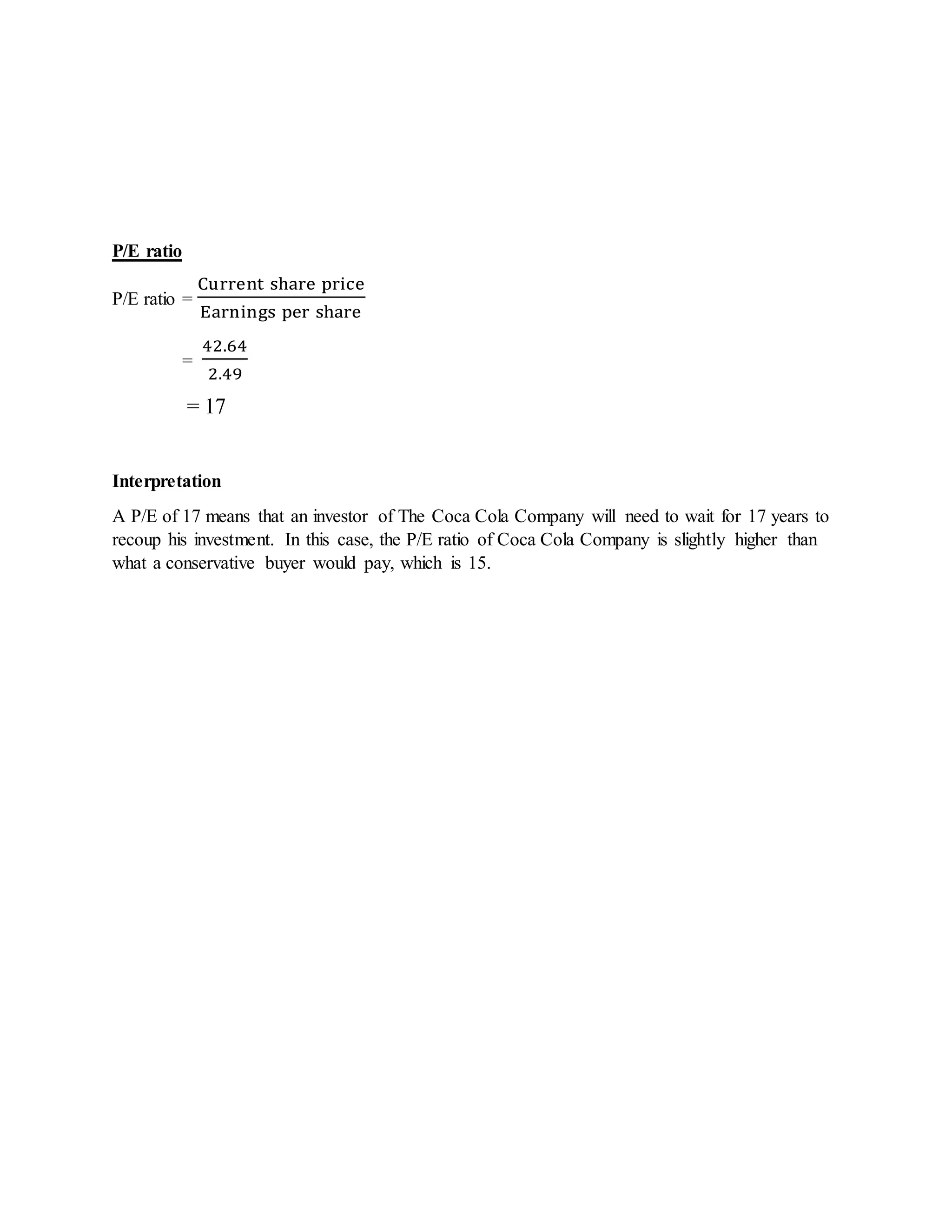

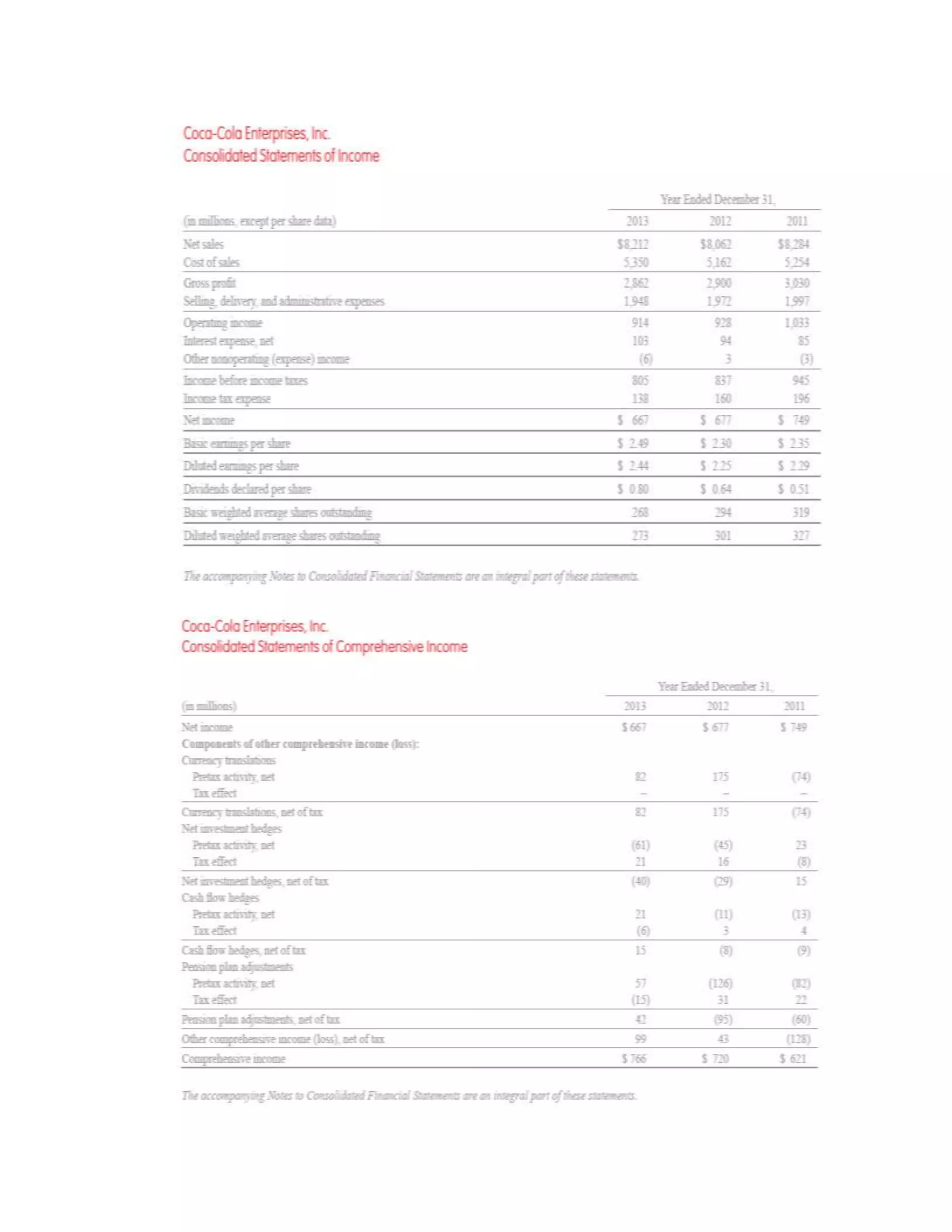

The document provides background information on Coca Cola Company. It discusses how Coca Cola was invented in 1885 and sold as a patent medicine. Over the years, different owners acquired rights to the formula and brand. By 1892, Asa Candler incorporated the current Coca Cola corporation. Recently, the company has partnered with other companies and increased investments in Africa. Financial ratios are also presented analyzing the company's profitability and stability from 2012-2013. While profitability improved, stability ratios showed increased debt levels, so the document recommends against investing in the company.

![Group member: Tan Jia Yi 0319476

Siong Jia Yii 0318239

Chong Wai Loon 0319745

Subject: Basic Accounting [ACC30205]

Lecturer: Chang Jau Ho

Assignment: Financial Ratio Analysis](https://image.slidesharecdn.com/acc-150119091933-conversion-gate02/75/Acc-1-2048.jpg)