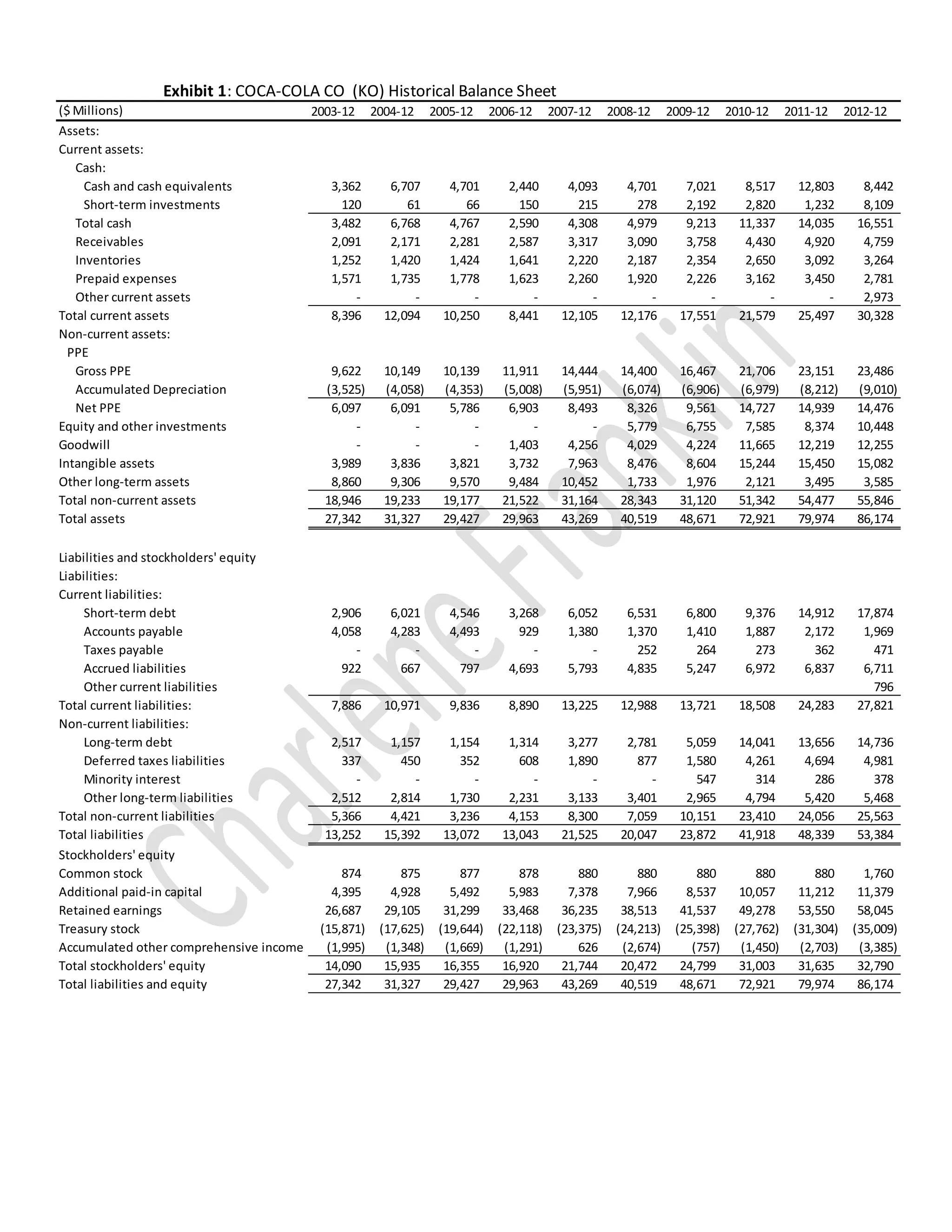

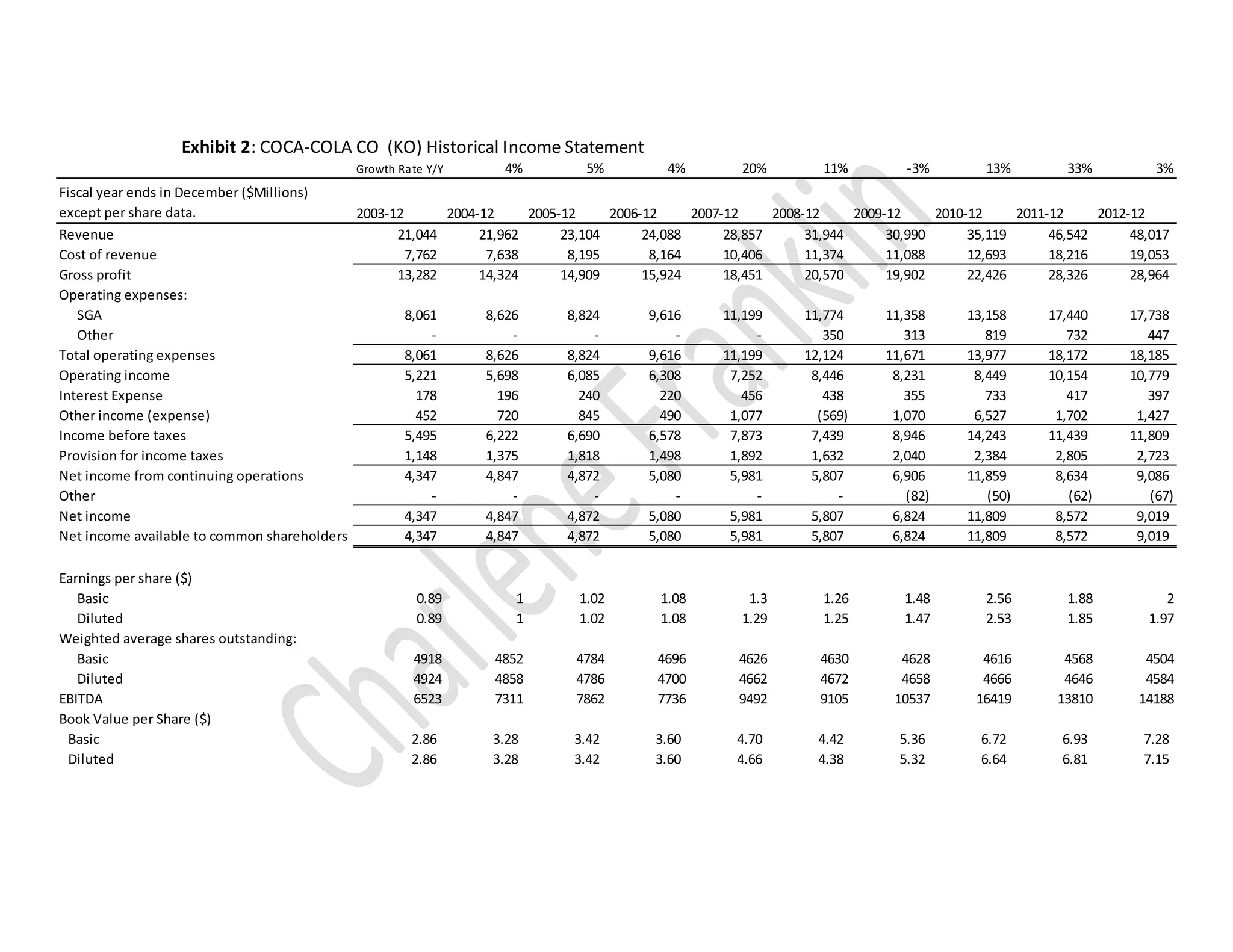

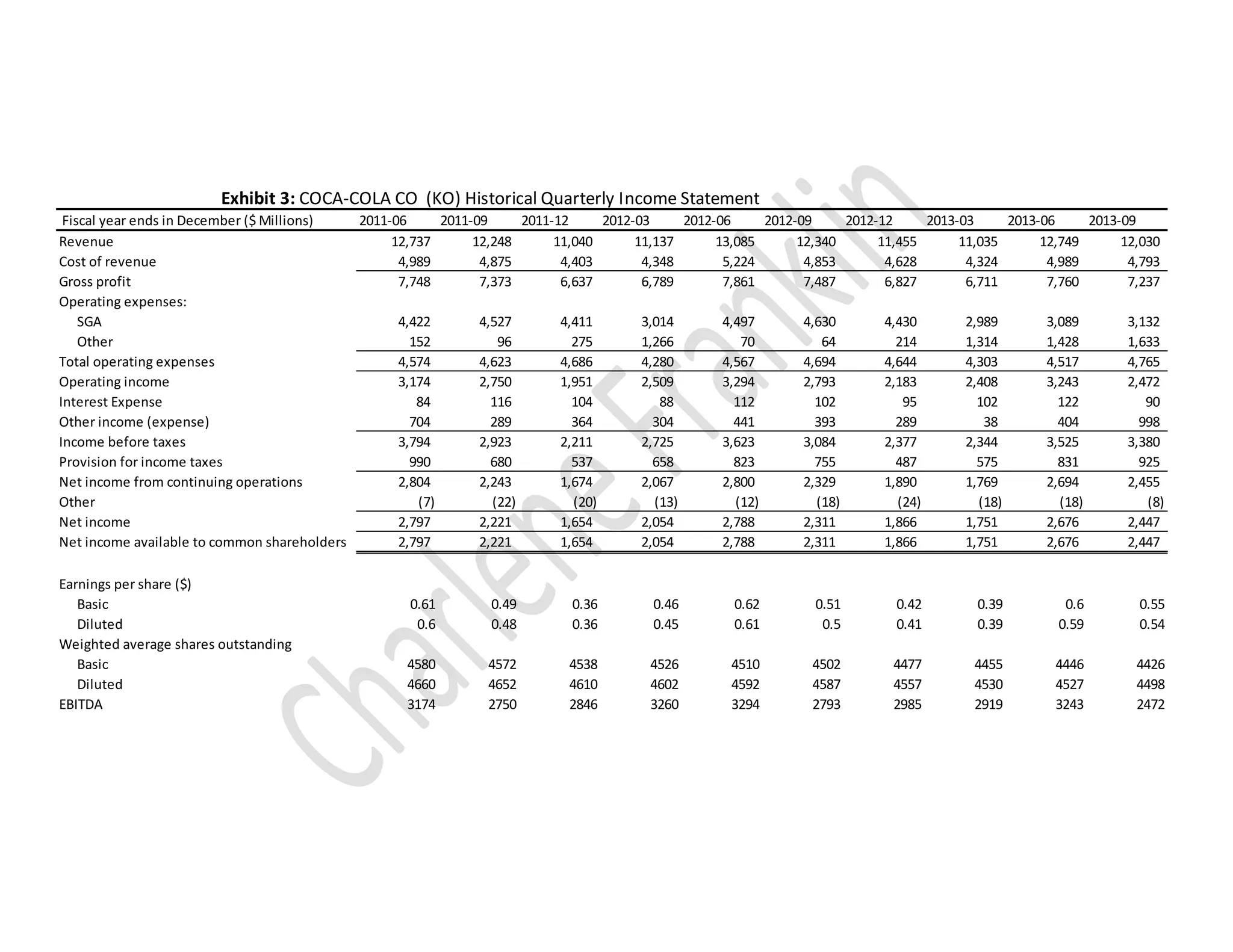

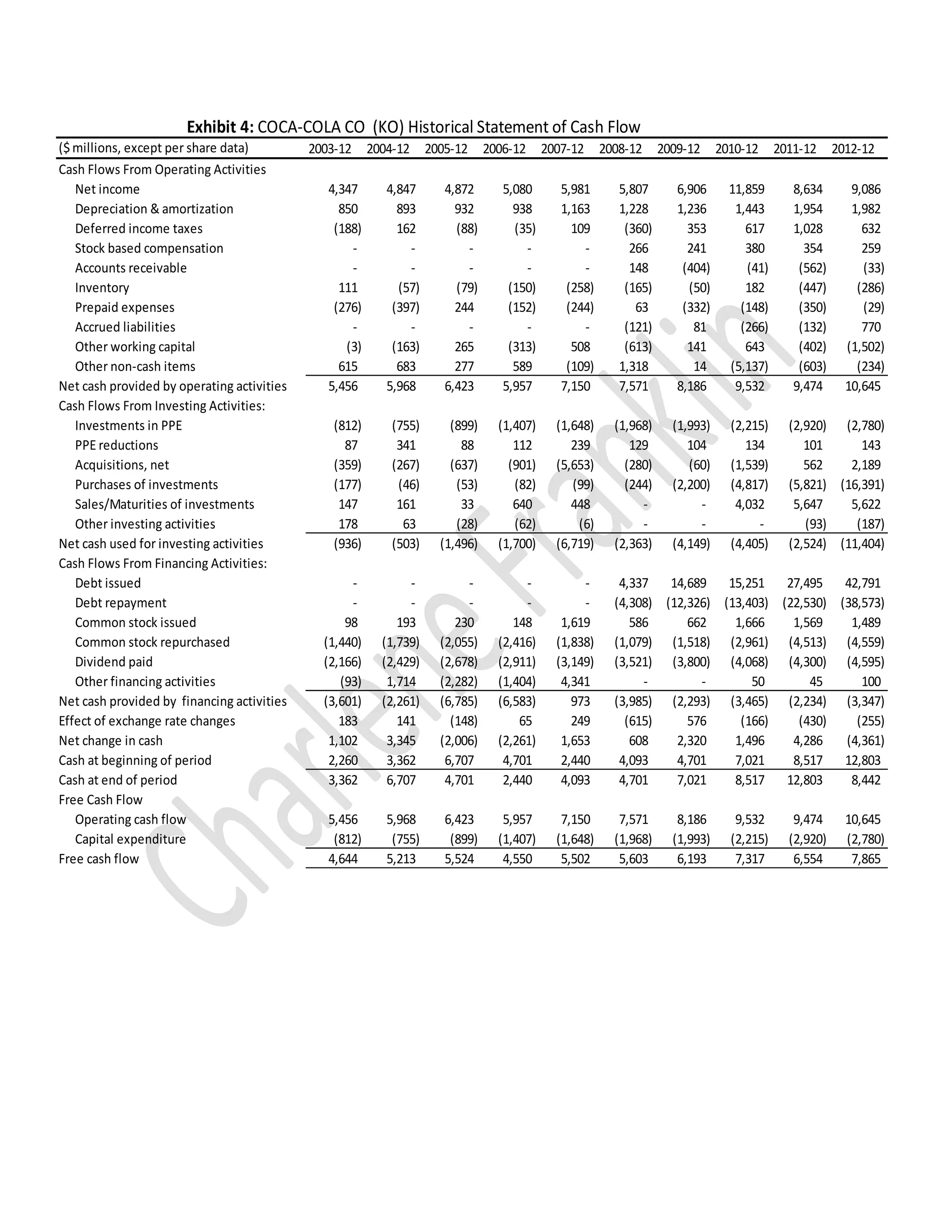

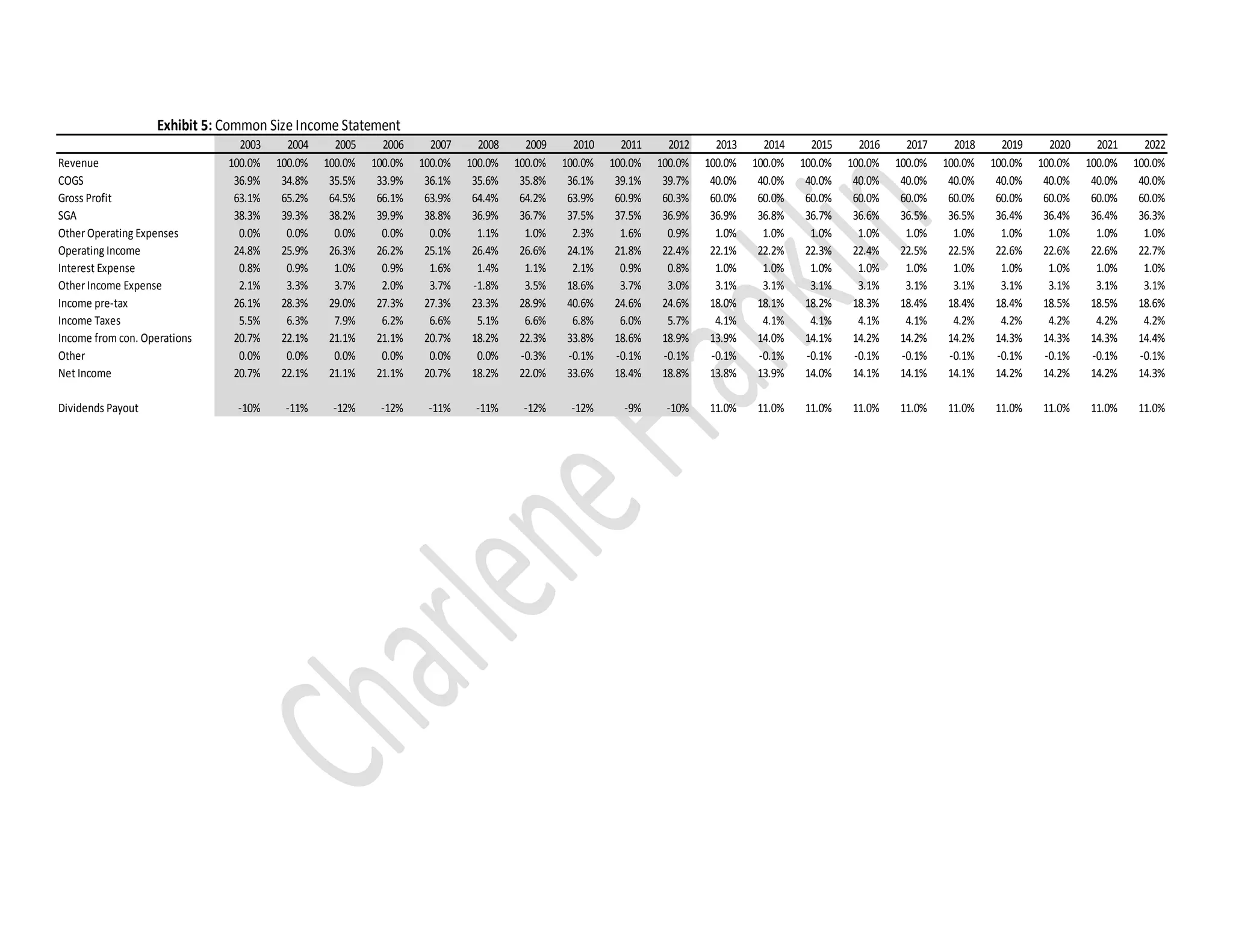

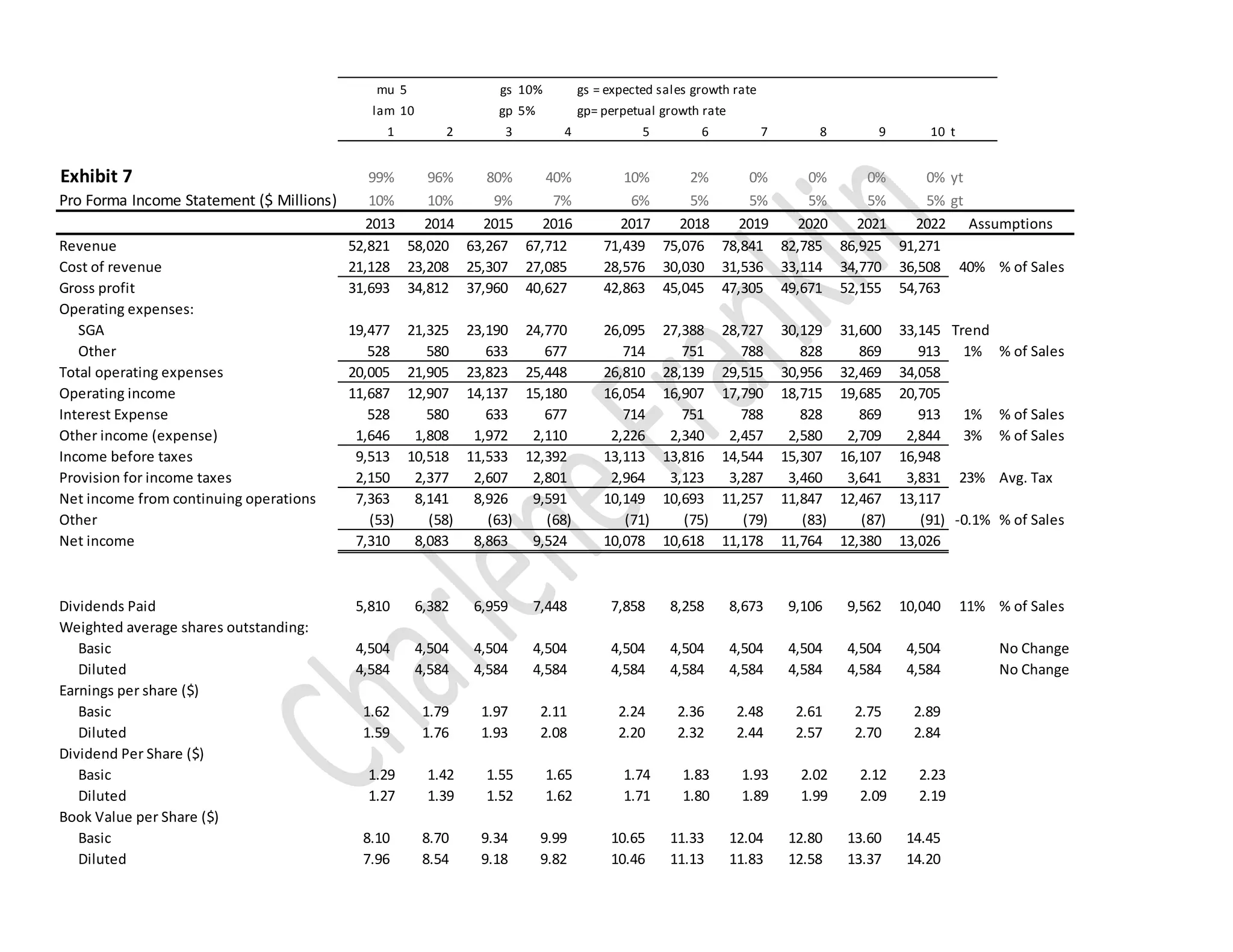

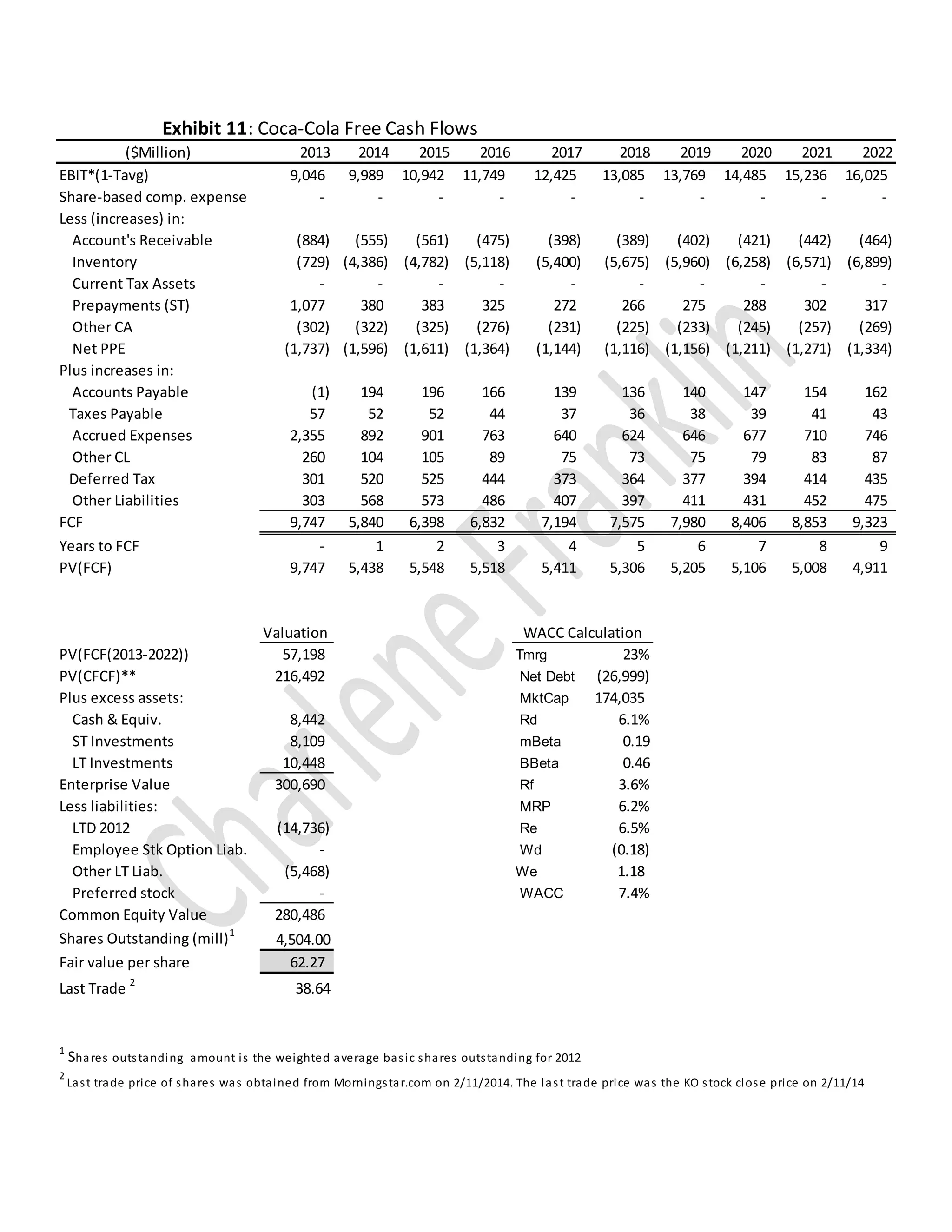

Coca-Cola was founded in 1886 and has grown to be a leading global soft drink producer. It has experienced steady revenue growth over the past 10 years except in 2009 during the economic downturn. Coca-Cola has a higher gross profit margin and lower cost of goods sold percentage than its main competitor PepsiCo. A valuation analysis determined Coca-Cola's current stock price is undervalued compared to its estimated fair value per share. Possible reasons for the undervaluation include concerns about future revenue growth and the threat from new competitors in the home beverage market.