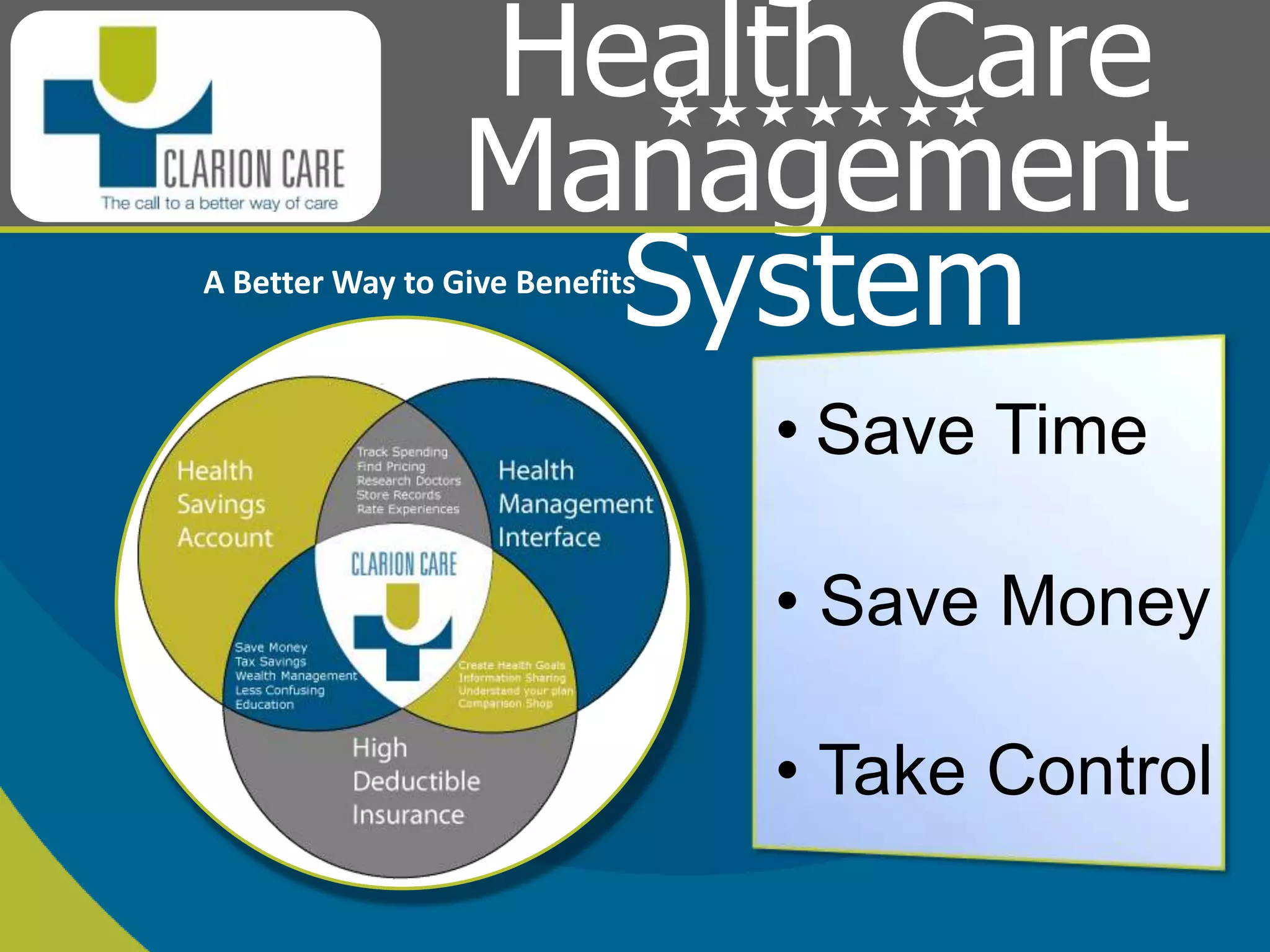

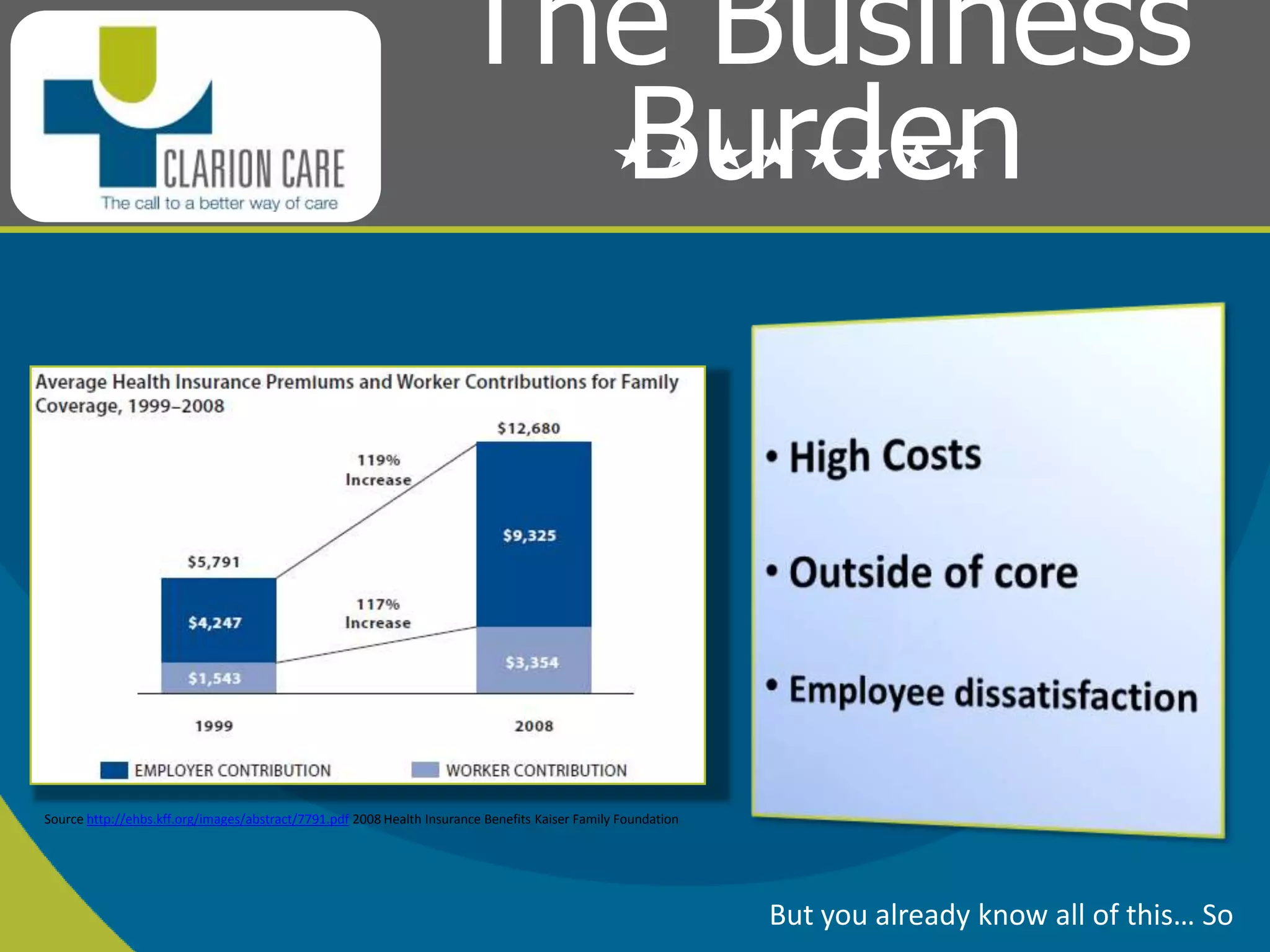

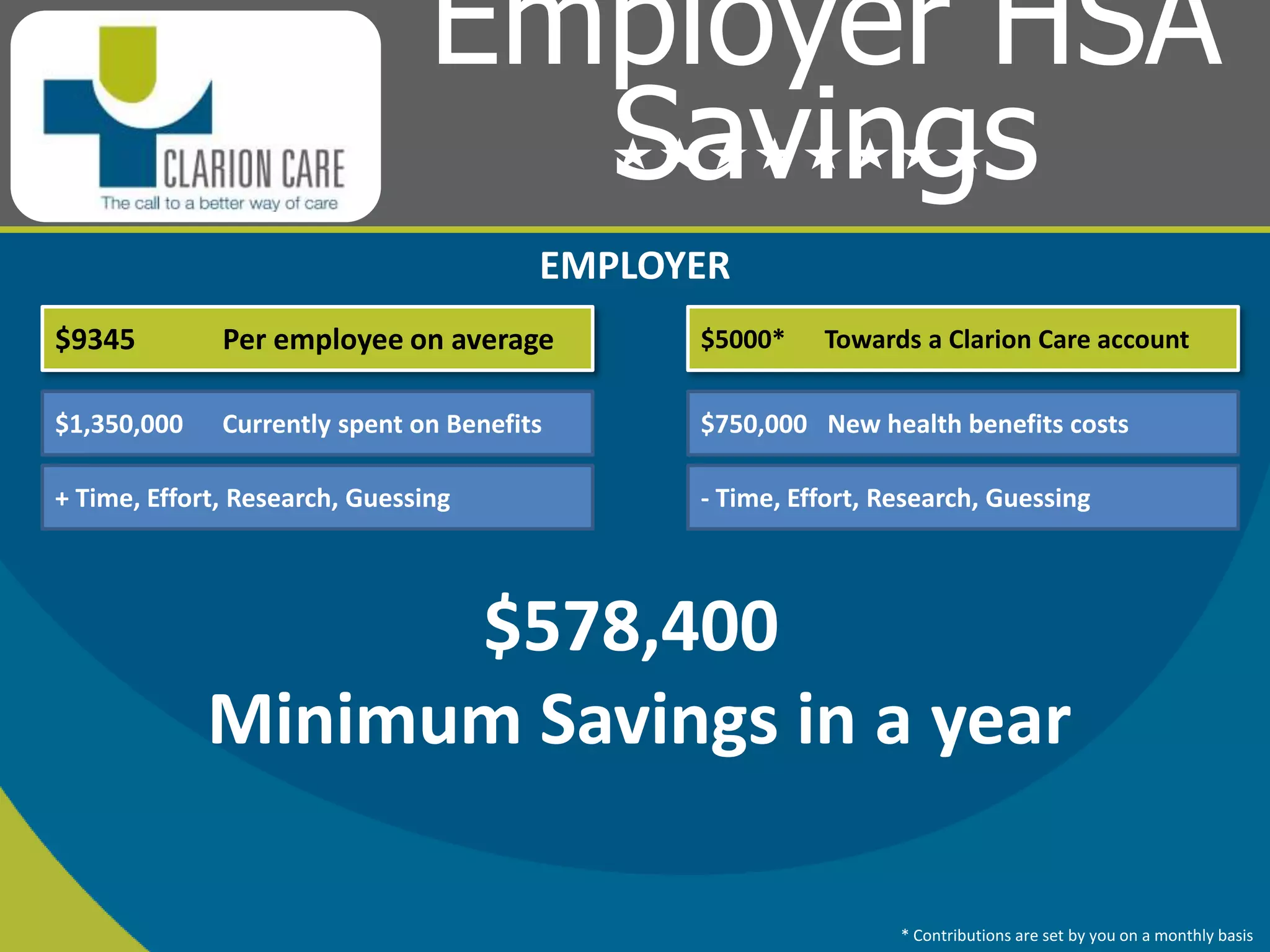

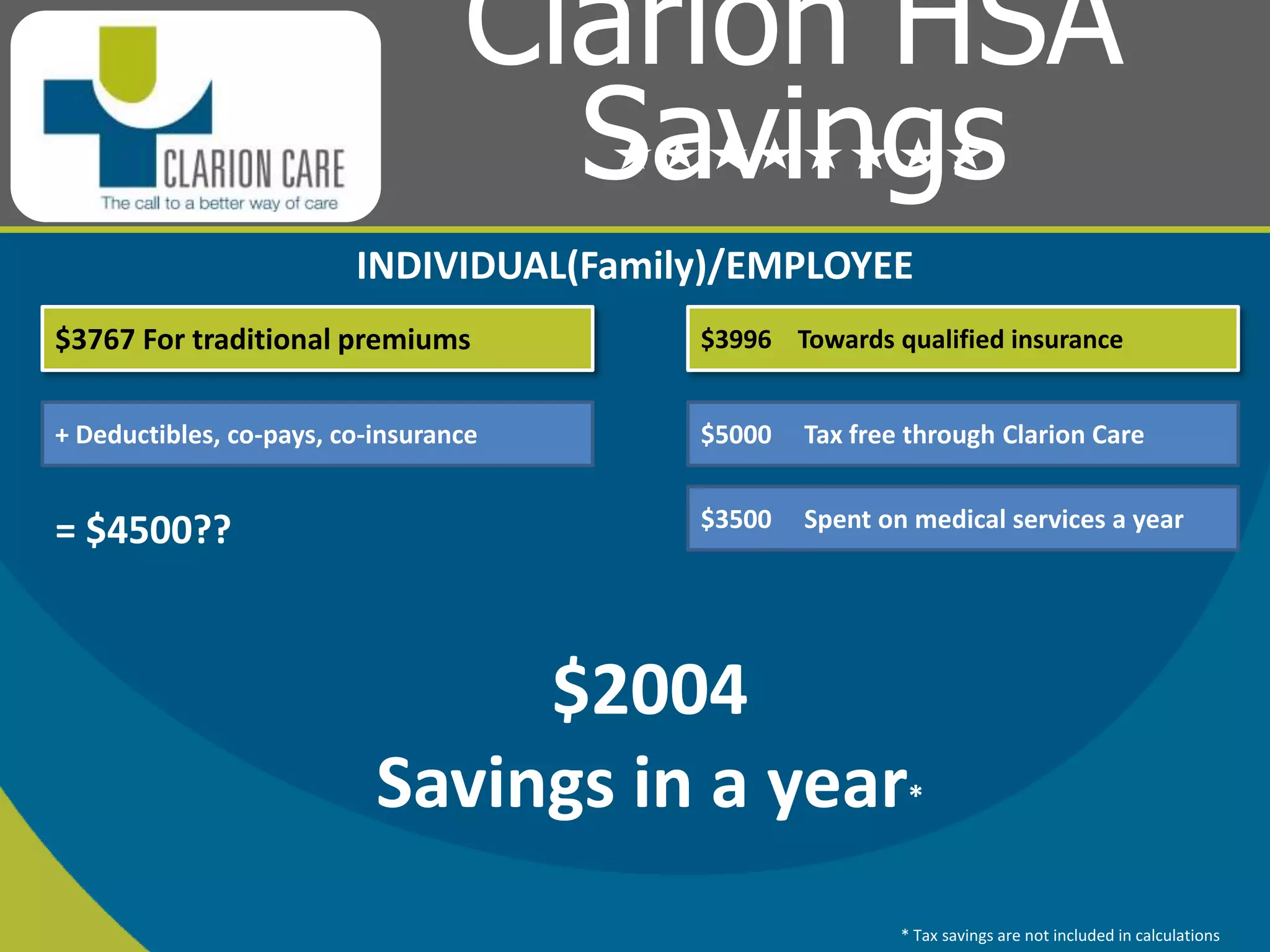

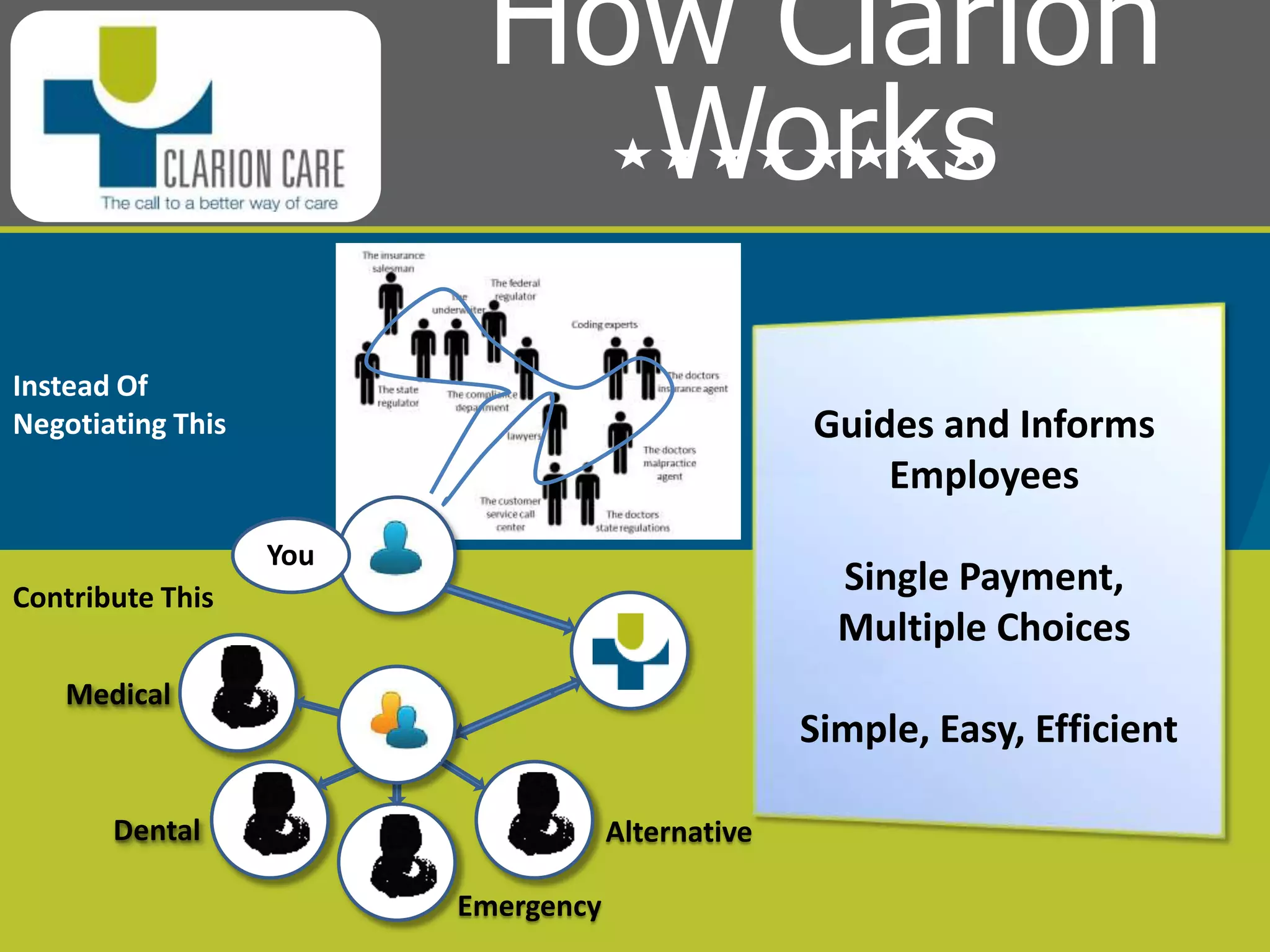

Clarion Care is a benefits administration platform that aims to save employers and employees time and money on healthcare costs. It allows employers to make a single monthly payment into employee Clarion Care accounts, giving employees tax-free money to purchase qualified health insurance and pay medical expenses. On average, employers can save over $9300 per employee annually in healthcare costs by using Clarion Care. It streamlines benefits administration and gives employees easy-to-use tools to manage their health spending and insurance choices.