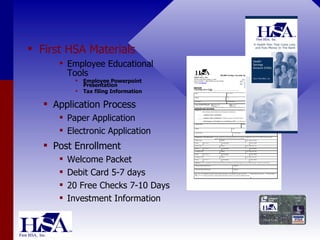

First HSA, established in 1999, is a recognized leader in HSA administration, assisting with HSA rules under U.S. Medicare reform effective January 2004. Health Savings Accounts (HSAs) allow tax-free savings for qualified medical expenses when paired with high deductible health plans, benefiting various individuals and families, while providing specific contribution limits and tax advantages. HSAs also offer flexible rollover and investment options, and funds remain with the employee, even upon changing jobs or death, with detailed customer support available.