- A potential home buyer should get a mortgage pre-approval to know what financing is available and have an advantage over buyers who are not pre-approved.

- Programs exist for buyers putting down only 5% for a principal residence or those who are self-employed with at least 2 years of income documentation.

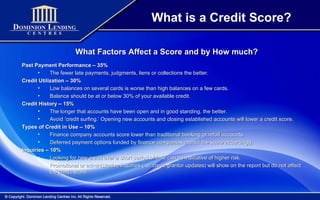

- A credit score is determined by factors like past payment history, credit utilization, credit history, types of credit used, and credit inquiries, and estimates the risk of a buyer failing to make payments.