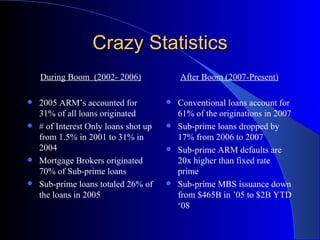

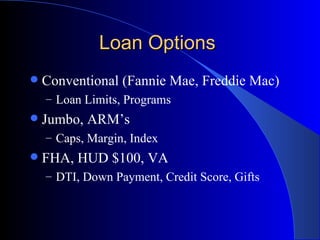

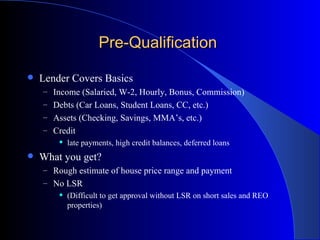

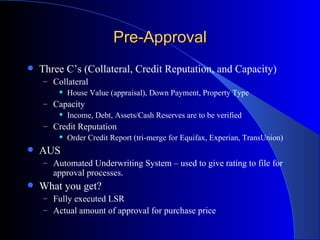

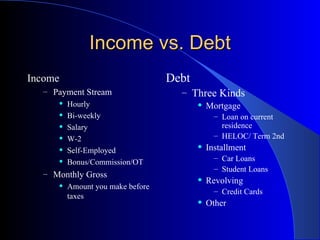

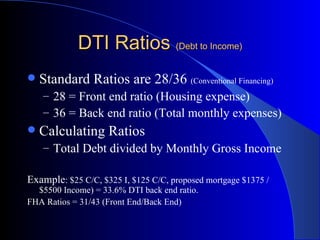

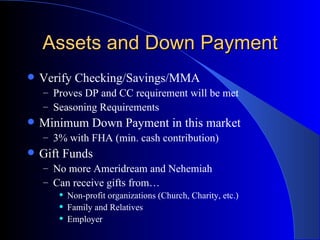

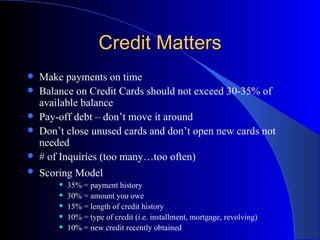

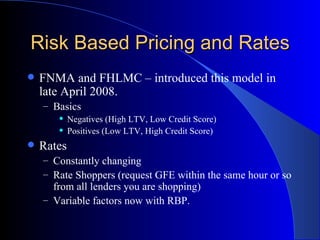

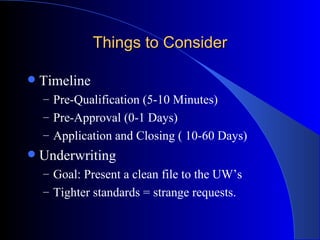

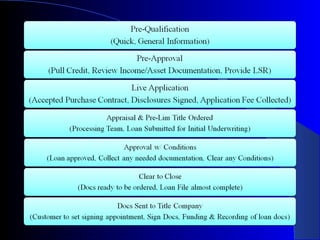

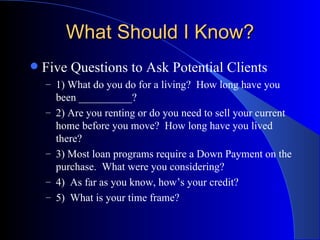

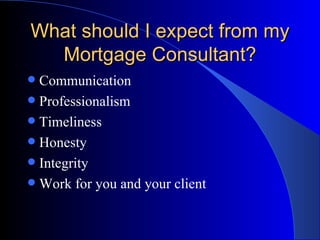

This document provides an overview of real estate loan options and the loan process. It discusses how the market has changed since the housing boom, with tighter credit standards and more conventional loans. It also outlines the steps of pre-qualification versus pre-approval, how to calculate debt-to-income ratios, the importance of assets and credit history, and factors lenders consider like risk-based pricing.