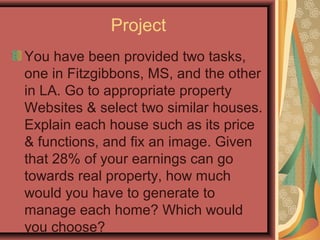

This document provides an overview of the home buying process. It discusses preparing for homeownership by saving money and improving credit. The stages of buying a home are outlined, including choosing homes that fit one's budget and criteria, obtaining financing, making an offer, and closing on the purchase. Both benefits and challenges of homeownership are described, such as higher monthly costs compared to renting but gaining equity over time.