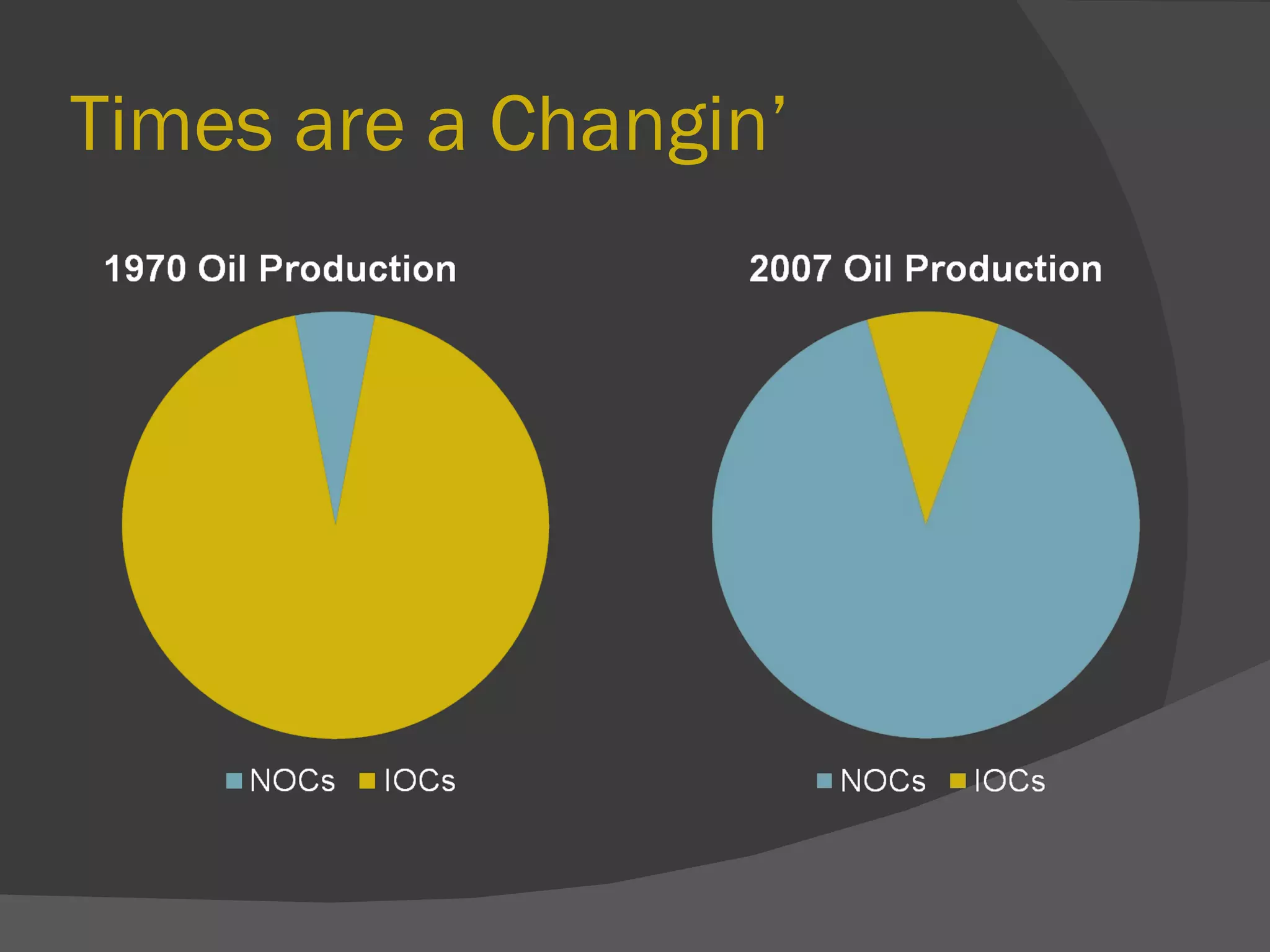

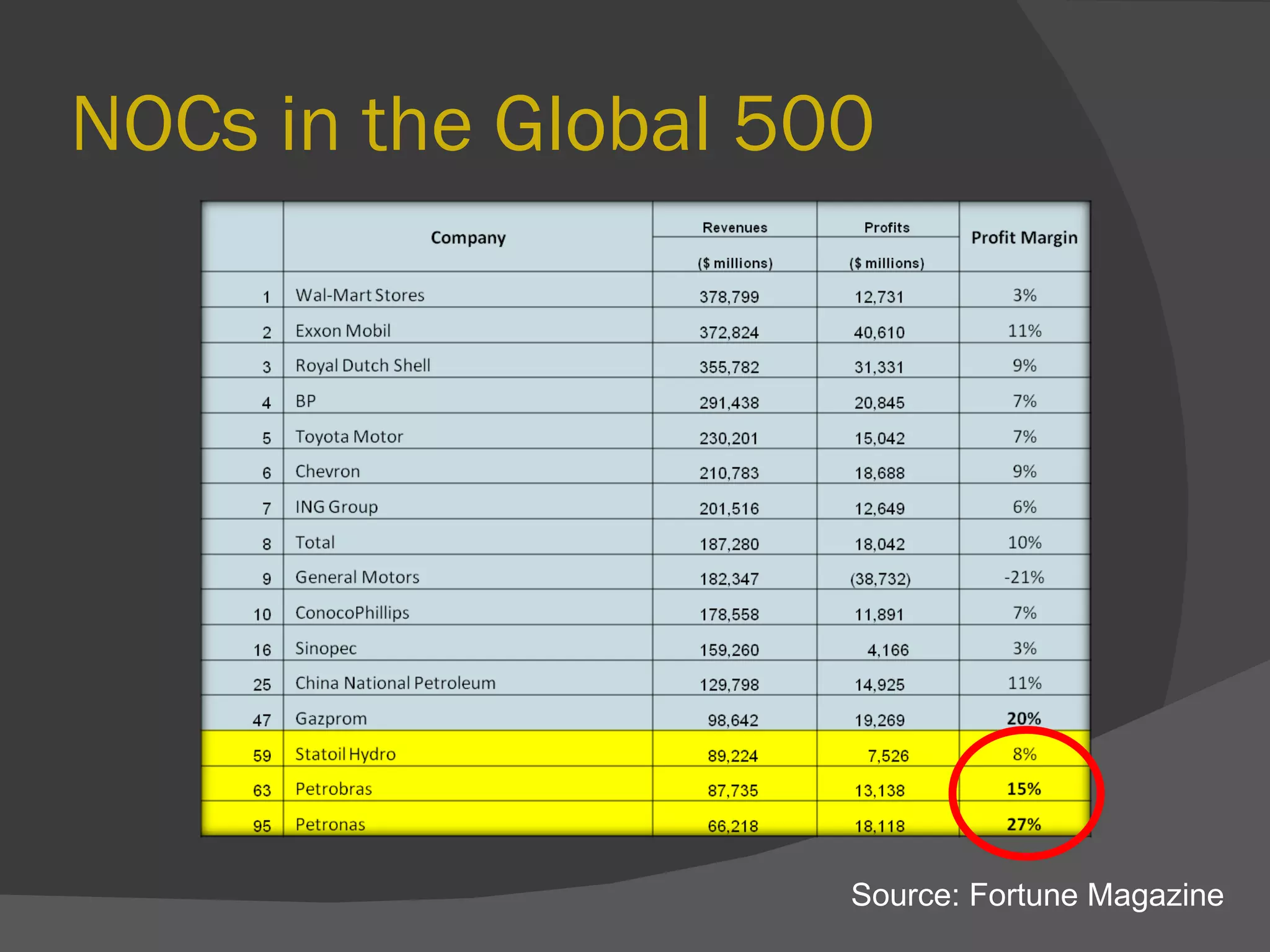

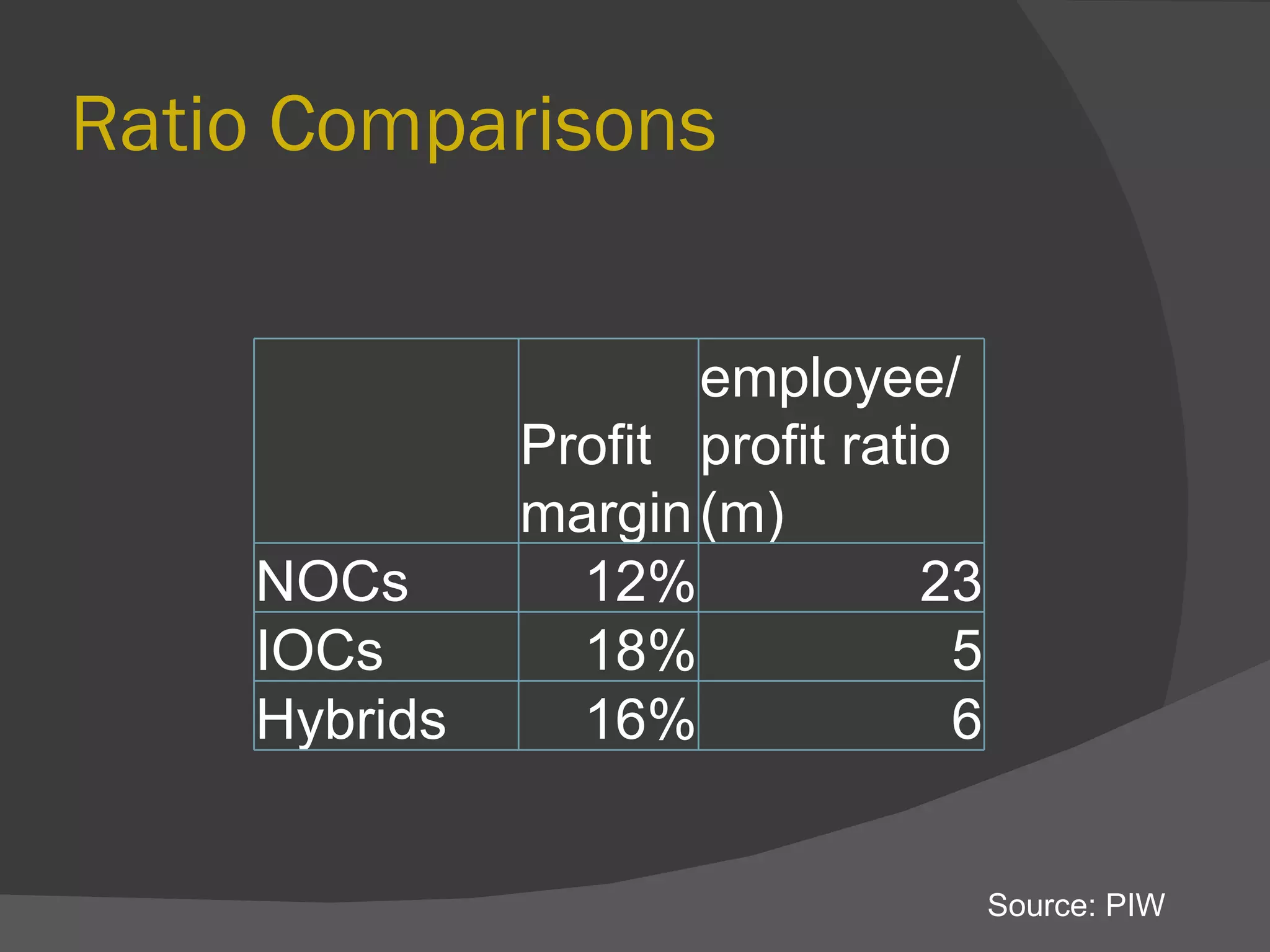

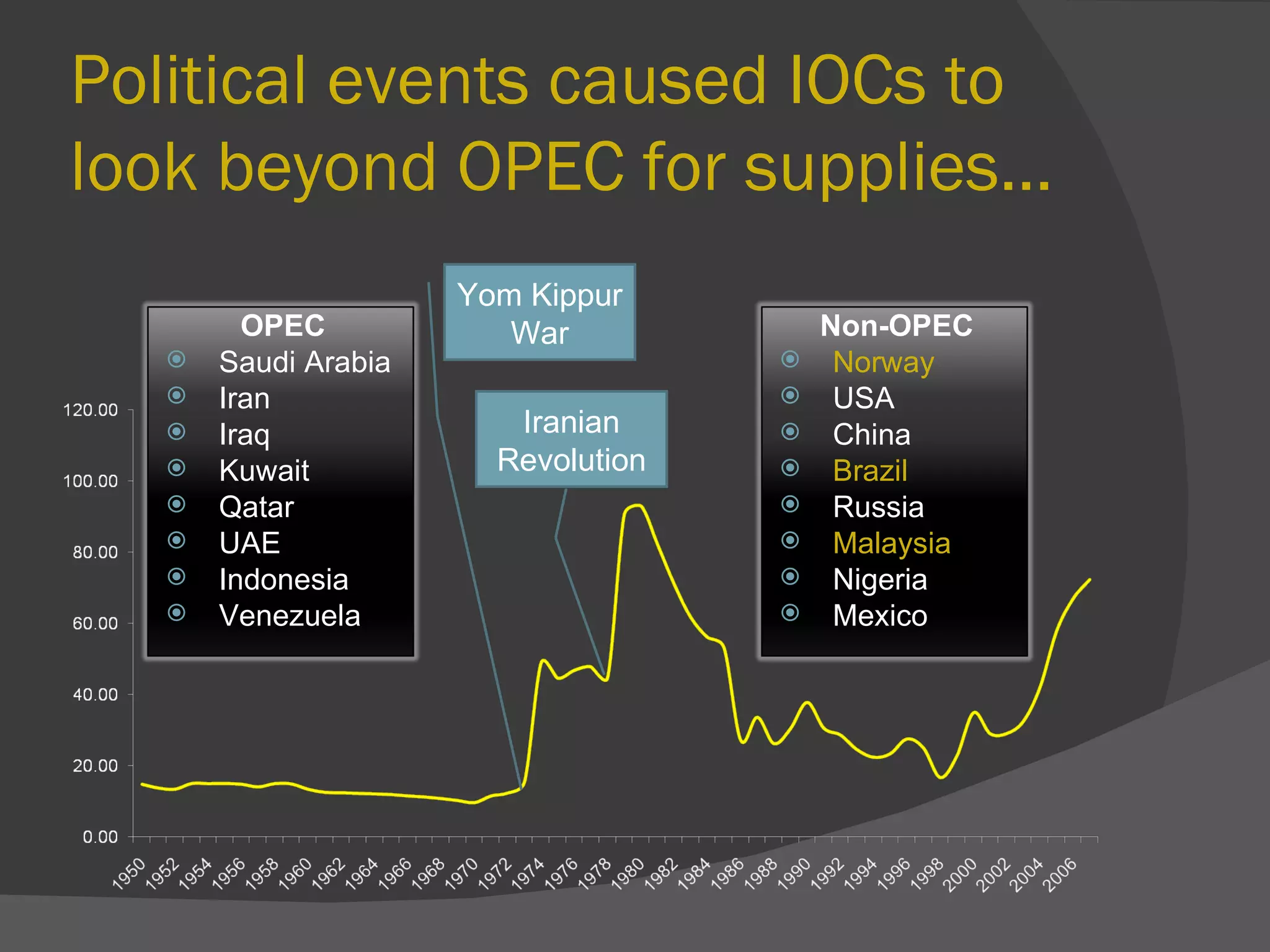

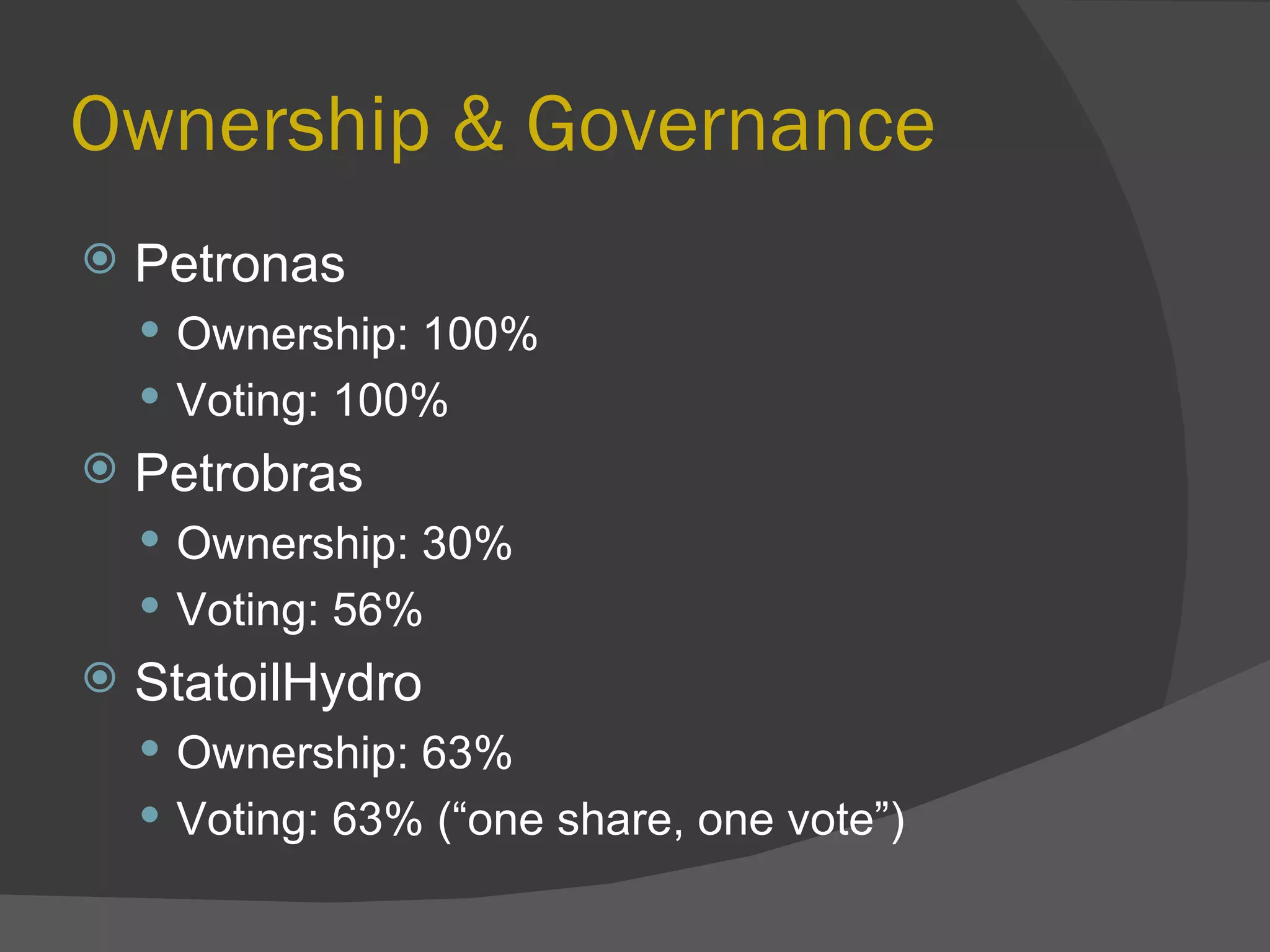

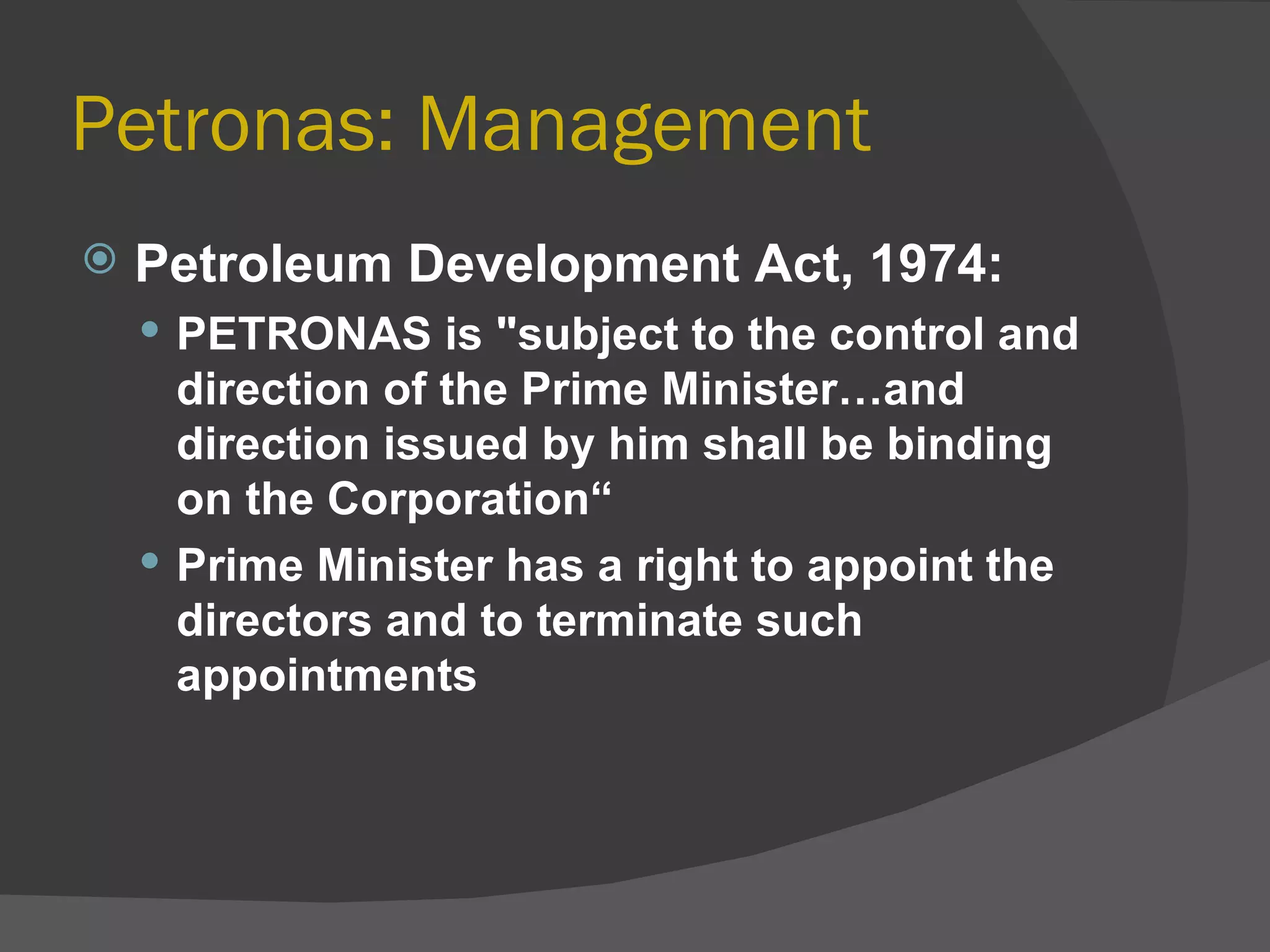

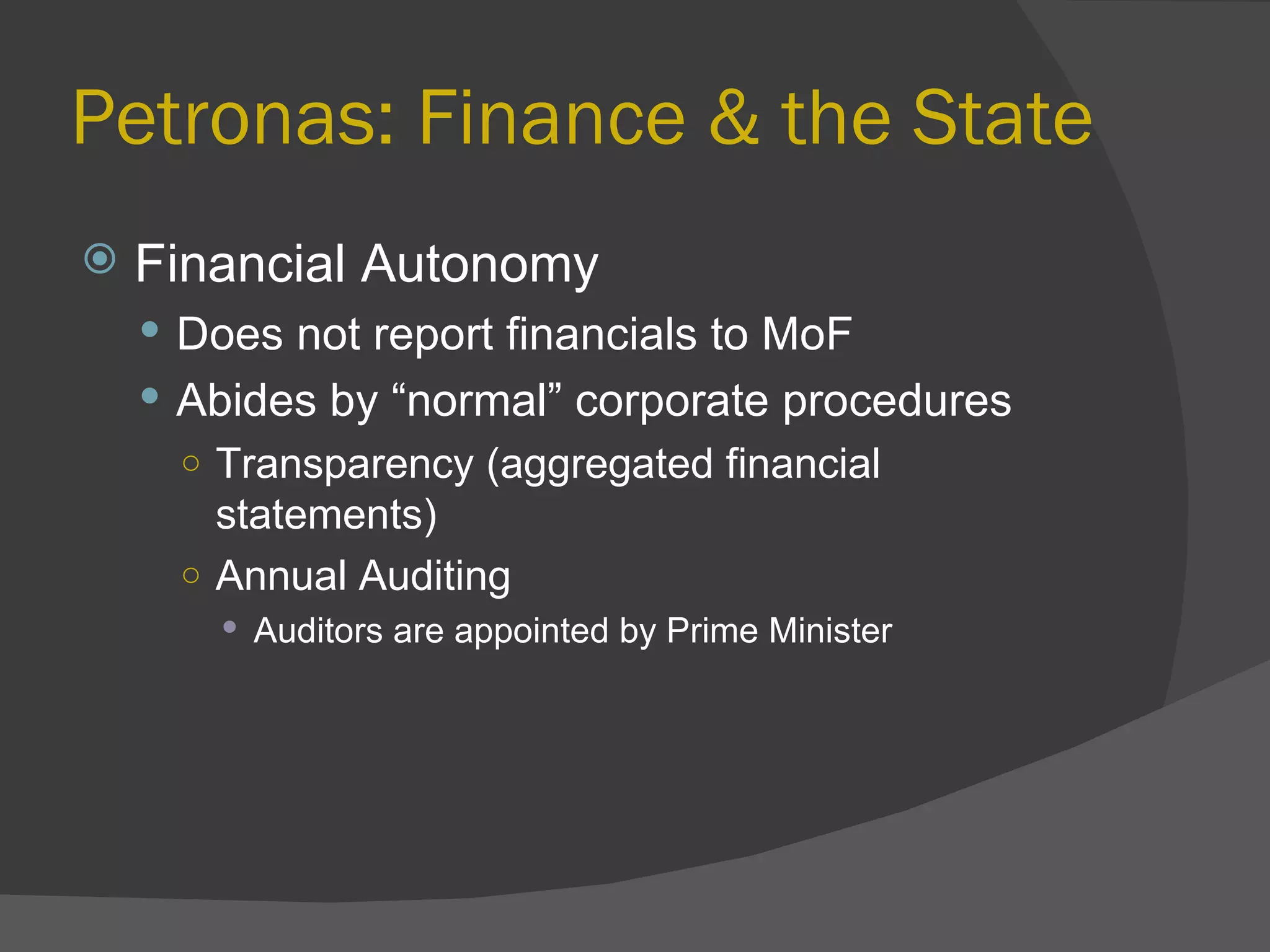

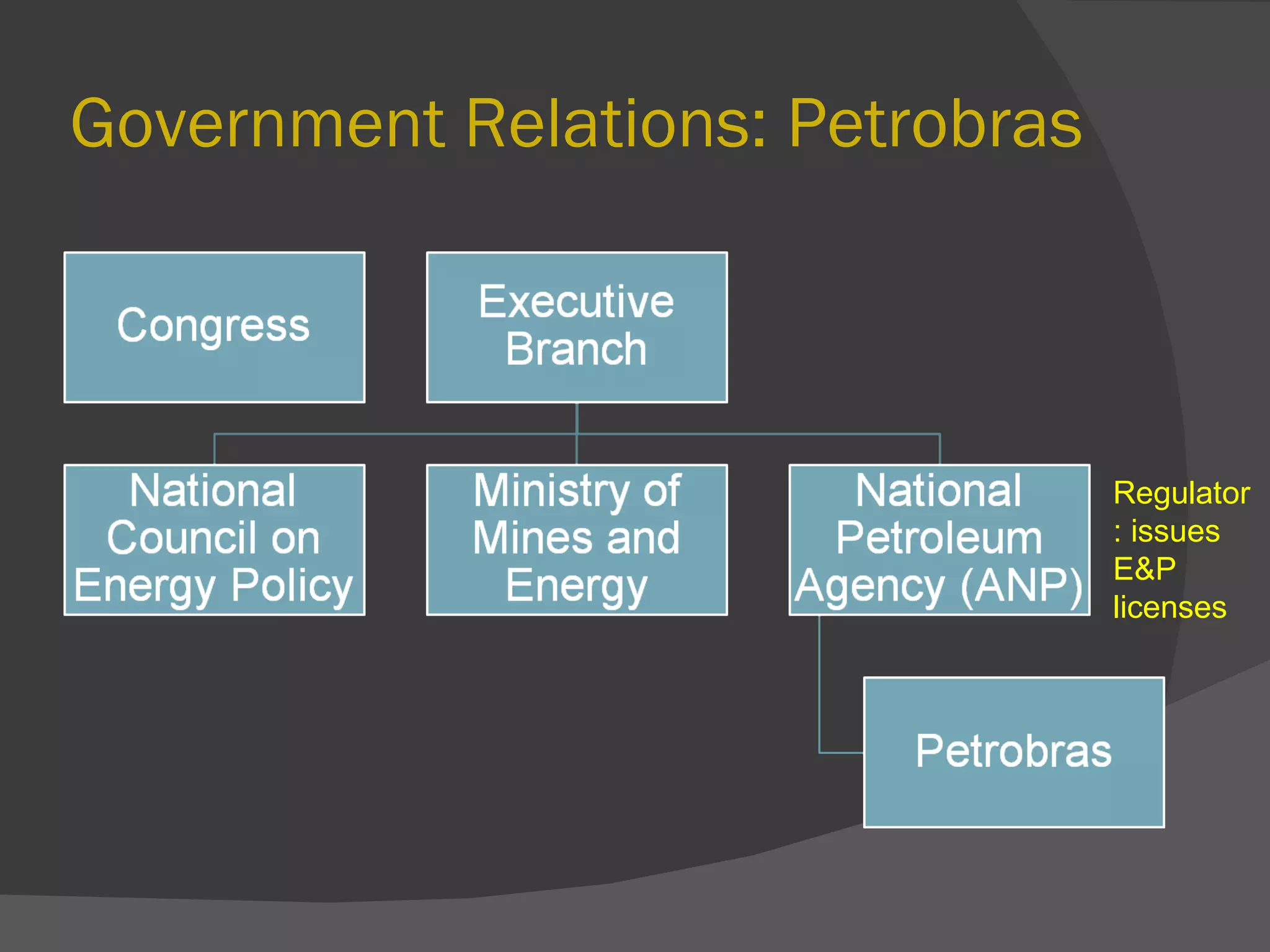

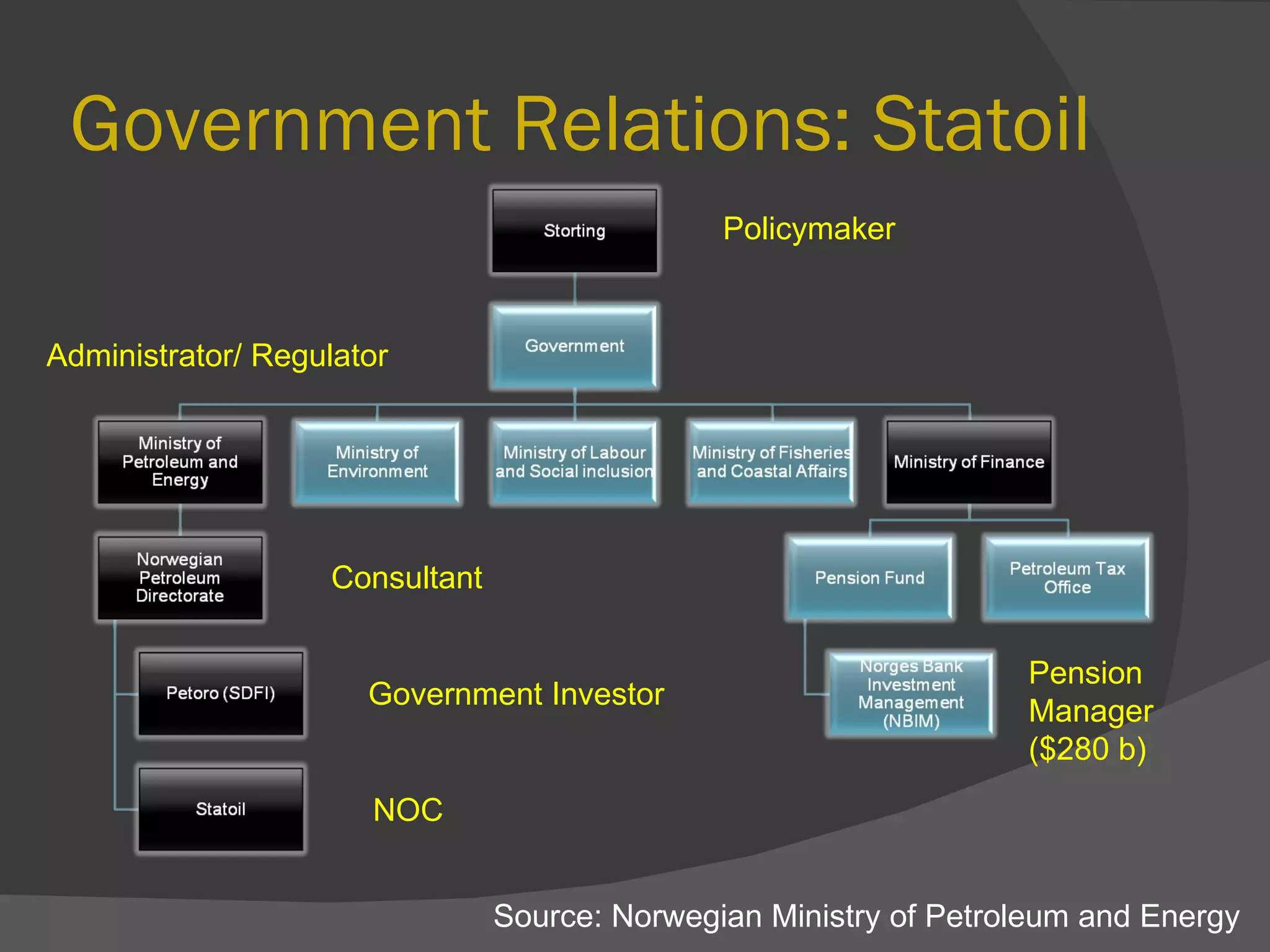

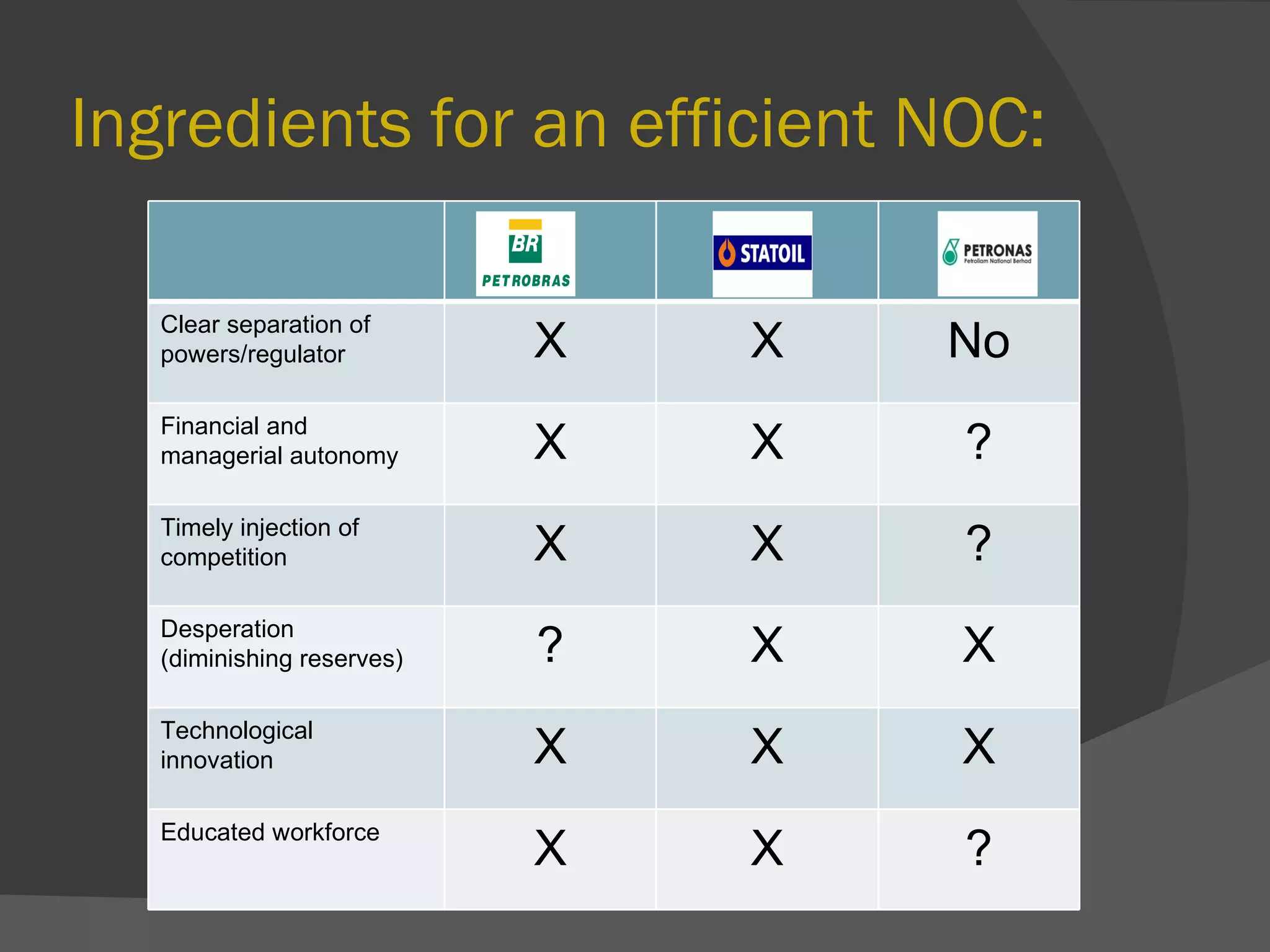

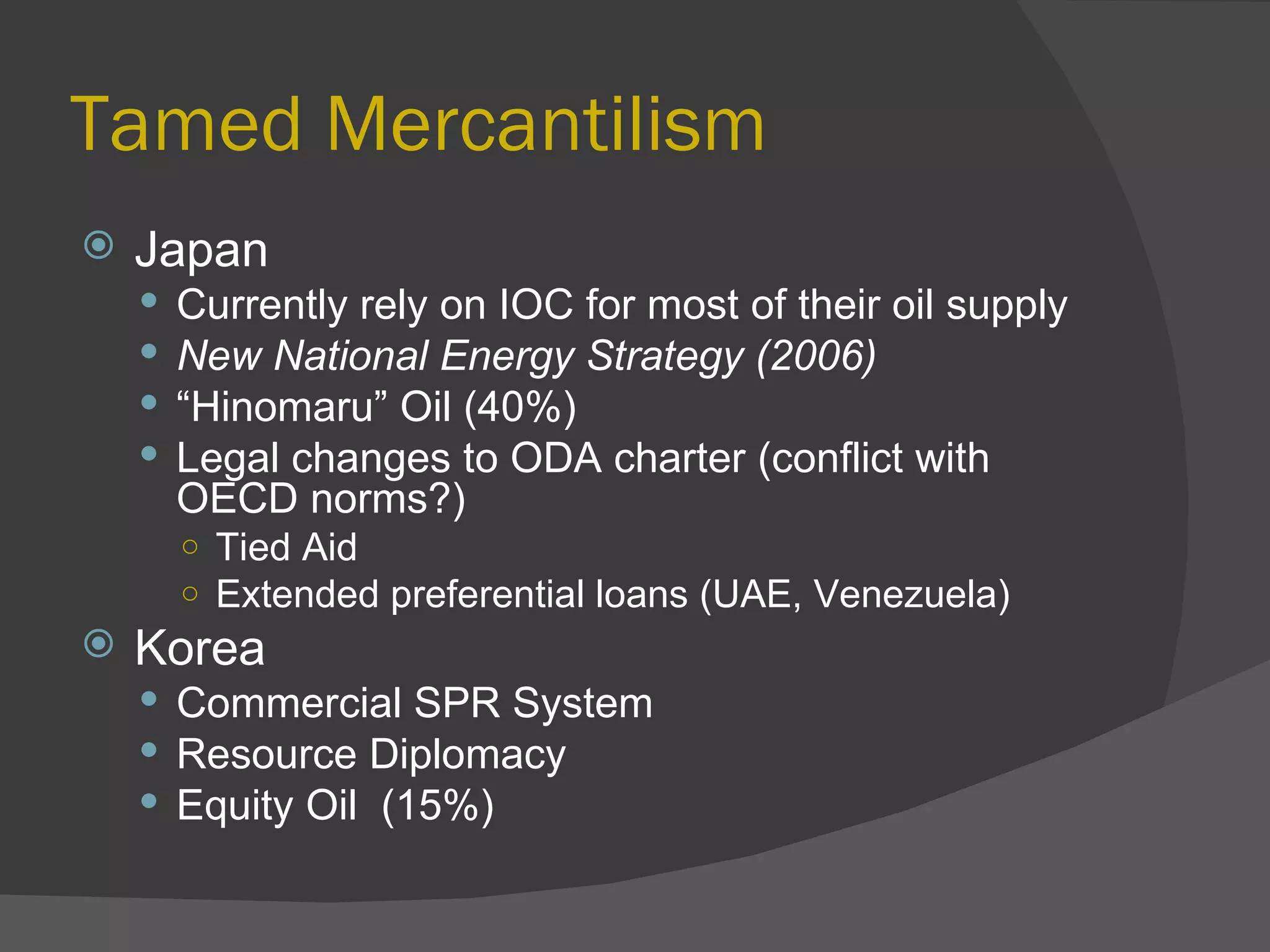

The document provides an overview of national oil companies (NOCs) and hybrid NOCs like Petronas, Petrobras, and Statoil. It discusses the reasons for establishing NOCs, common stereotypes of NOCs, different types of NOCs, and factors driving commercialization. The document also summarizes the important events, government relationships, global investments, and strengths/weaknesses of Petronas, Petrobras, and Statoil. It concludes by considering the future outlook for NOCs and some specific hybrid companies.