9 income taxqr-20110601

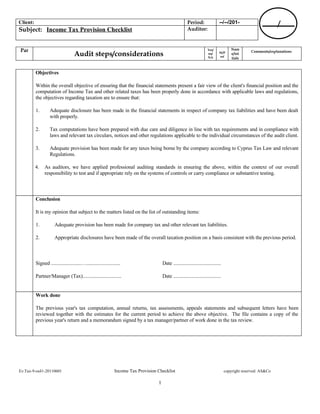

- 1. Client: Period: --/--/201- / Subject: Income Tax Provision Checklist Auditor: Par Yes/ Nam Comments/explanations Audit steps/considerations no/ NA W/P ref e/ini tials Objectives Within the overall objective of ensuring that the financial statements present a fair view of the client's financial position and the computation of Income Tax and other related taxes has been properly done in accordance with applicable laws and regulations, the objectives regarding taxation are to ensure that: 1. Adequate disclosure has been made in the financial statements in respect of company tax liabilities and have been dealt with properly. 2. Tax computations have been prepared with due care and diligence in line with tax requirements and in compliance with laws and relevant tax circulars, notices and other regulations applicable to the individual circumstances of the audit client. 3. Adequate provision has been made for any taxes being borne by the company according to Cyprus Tax Law and relevant Regulations. 4. As auditors, we have applied professional auditing standards in ensuring the above, within the context of our overall responsibility to test and if appropriate rely on the systems of controls or carry compliance or substantive testing. Conclusion It is my opinion that subject to the matters listed on the list of outstanding items: 1. Adequate provision has been made for company tax and other relevant tax liabilities. 2. Appropriate disclosures have been made of the overall taxation position on a basis consistent with the previous period. Signed ........................…........................... Date ...................................... Partner/Manager (Tax)............................... Date ...................................... Work done The previous year's tax computation, annual returns, tax assessments, appeals statements and subsequent letters have been reviewed together with the estimates for the current period to achieve the above objective. The file contains a copy of the previous year's return and a memorandum signed by a tax manager/partner of work done in the tax review. Εν.Tax-9-εκδ1-20110601 Income Tax Provision Checklist copyright reserved: AS&Co 1

- 2. Client: Period: --/--/201- / Subject: Income Tax Provision Checklist Auditor: Par Yes/ Nam Comments/explanations Audit steps/considerations no/ NA W/P ref e/ini tials A. General 1. Audited accounts for the period are available or working of provision for tax is based on latest updated draft of the accounts. 2. Details of income and expenditure is classified and apportioned under the types: I. Income from business activities II. Income from property III. Income under capital gains IV. Income from other sources V. Foreign source income 3. In case of a company, income from business has been accounted for on accrual basis. Other basis is not allowed unless specifically provided for under tax laws 4. In case of long term contracts percentage of completion method has been used. Long term contract is a contract for manufacture, installation or construction etc., which is not completed within tax year and is for a period of more than six months. 5. Specific Provision for bad debts has made during the year, has been dealt with as allowable expense for tax. 6. Bad debts written off against provisions disallowed during preceding years have been claimed as allowable deduction. 7. Where an asset has been disposed off under a non-arm’s length transaction, the fair market value of the asset at the time of disposal has been treated as its sale price of the seller and cost for the purchaser. 8. No gain or loss has been considered on the disposal of an asset other than as a genuine sale or disposal. B. Income from Business 9. Admissible deductions against business income Whether or not the following expenses have been claimed. Εν.Tax-9-εκδ1-20110601 Income Tax Provision Checklist copyright reserved: AS&Co 2

- 3. Client: Period: --/--/201- / Subject: Income Tax Provision Checklist Auditor: Par Yes/ Nam Comments/explanations Audit steps/considerations no/ NA W/P ref e/ini tials 10. All expenditure incurred for the purpose of deriving income from business chargeable to tax has been claimed as an allowable expenditure. 11. Capital allowances (on the basis of number of months used or other appropriate basis) have been claimed in accordance with tax laws. 12. Any amount of tax deducted at source under the provisions of the law has been recognized. 13. Any salary, rent, payment to non-resident, payment for services or fee from which tax required to be deducted at source has been deducted. 14. Any entertainment expenditure in excess of prescribed limits has been disallowed. 15. Any contribution made to a fund that is not a recognized provident fund, an approved superannuation fund, or an approved gratuity fund has been disallowed; 16. Any fine or penalty paid or payable for the violation of any law, rule or regulation has been disallowed; 17. Any personal expenditure incurred has been disallowed; 18. Any saloon motor vehicle expenditure has been disallowed; 19. Any ‘personal use’ of assets or other utilities has been disallowed; C. Income from Property 20. Where any rent receivable from property/other asset and irrecoverable rent subsequently recovered, have been included in taxable income; 21. Any deduction claimed in respect of income from property has not been claimed against income from any other source; Whether or not the following deductions / expenditure against property income have been claimed. 22. In respect of repairs/related expenses to the building, an allowance equal to 25% of the rent chargeable to tax has been claimed as tax deductible. 23. The amount of any insurance premium paid to cover the risk of damage or destruction to the property. Εν.Tax-9-εκδ1-20110601 Income Tax Provision Checklist copyright reserved: AS&Co 3

- 4. Client: Period: --/--/201- / Subject: Income Tax Provision Checklist Auditor: Par Yes/ Nam Comments/explanations Audit steps/considerations no/ NA W/P ref e/ini tials 24. The amount of any local tax, charge or other related expense in respect of property or income from property other than any tax payable under the Income, has been claimed. 25. Where the property has been acquired, constructed, renovated or reconstructed with borrowed capital, the amount of any interest paid on such capital; 26. Where the property is subject to mortgage or other capital charge, the amount of interest / profit paid on such mortgage or charge; 27. Any unpaid rent which is considered irrecoverable has been deducted from rent income; 28. Any rent received or receivable in respect of the lease of a building or plant and machinery has been treated as taxable income; D. Income under the head Capital Gain 29. Gain arising on the disposal of immovable property (land and buildings), other than a gain that is exempt from tax, has been accounted for as tax under “Capital Gains”. 30. The cost of acquisition of immovable property and any expenditure incurred wholly and exclusively for acquiring or developing such asset has been claimed as deduction against income capital gains. E. Income from other sources 31. Income of every kind received in the tax year, if it is not included in income from the main business activities, other than income exempt from tax, has been included in the tax computation. Including the following namely: a. dividend; b. rent from the sub-lease of land or a building; c. income from the lease of any building together with plant or machinery; d. any amount received by the owner of a property in respect of provision of amenities, utilities and any other services in respect of that property. F. Payroll G H . . 32. All payroll expenditure included in the financial statements is properly reconciled with IR 63sumbitted to Inland Revenue; 33. All PAYE deductions were properly calculated; 34. All employees have signed form IR 59 (declaring their tax status, deduction claims and other relevant information) Εν.Tax-9-εκδ1-20110601 Income Tax Provision Checklist copyright reserved: AS&Co 4

- 5. Client: Period: --/--/201- / Subject: Income Tax Provision Checklist Auditor: Par Yes/ Nam Comments/explanations Audit steps/considerations no/ NA W/P ref e/ini tials 35. Amounts described as “Subcontracting expenses” “Casual Labour” or under similar descriptions, are properly supported either by a Tax Invoice (with full details and Tax/vat Registration) or other documentation and are justified to be excepted from deduction of PAYE; G. Other matters A B . . Εν.Tax-9-εκδ1-20110601 Income Tax Provision Checklist copyright reserved: AS&Co 5