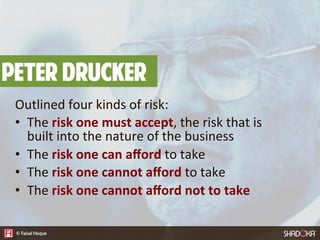

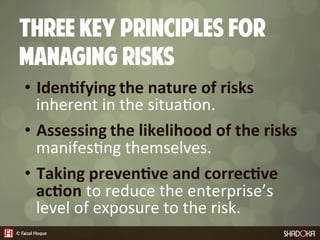

The document outlines seven types of risks that businesses should mitigate, based on Peter Drucker's framework: structural, execution, competitive, investment, integration, misalignment, and governance risks. It emphasizes the importance of effective risk management through identification, assessment, and preventive actions to minimize exposure. Continuous monitoring and reviewing are essential for successful risk management, enhancing business quality and returns.