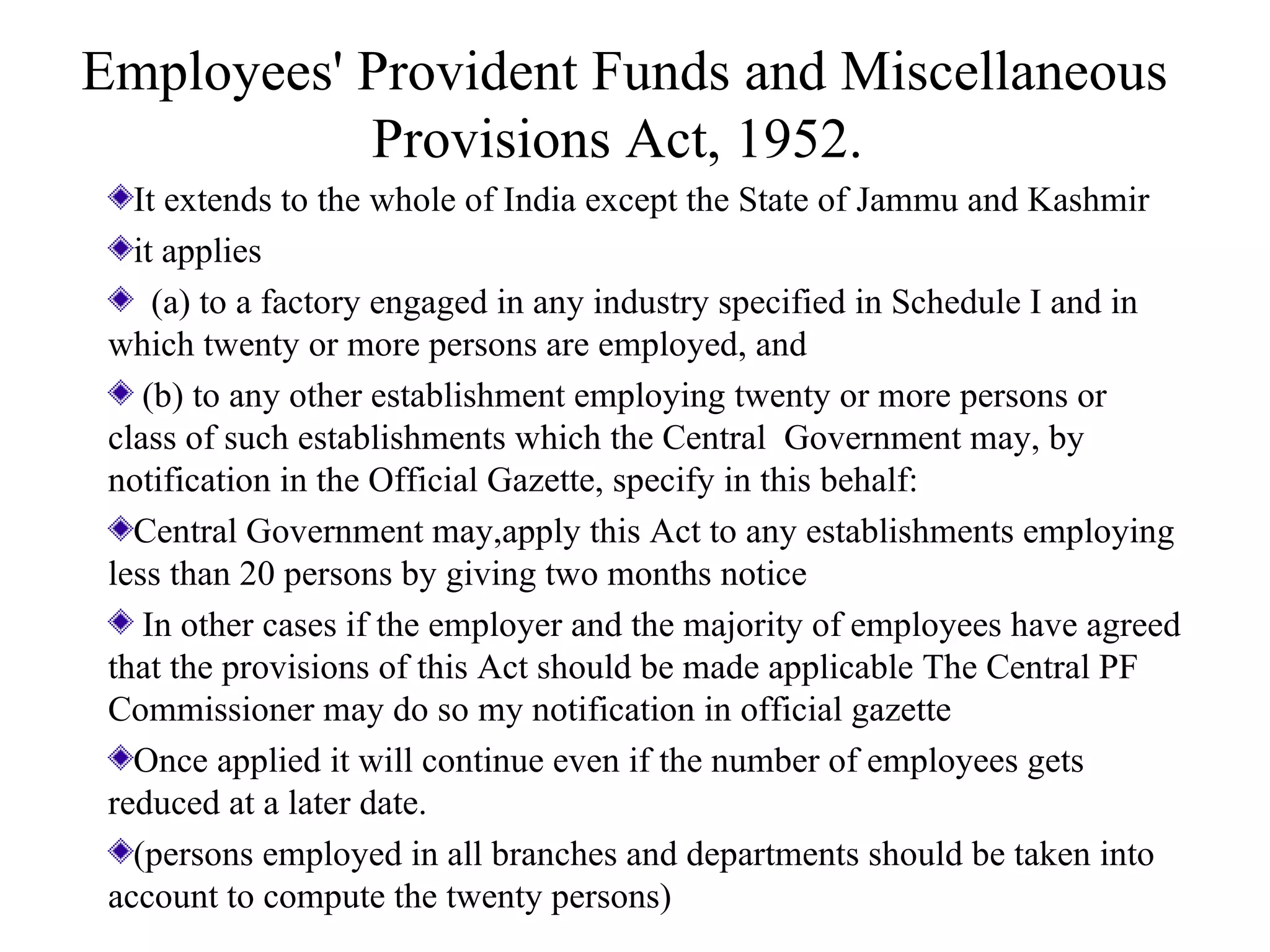

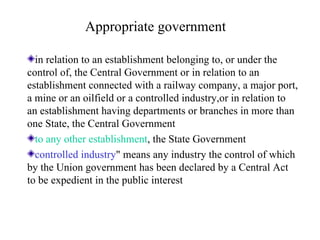

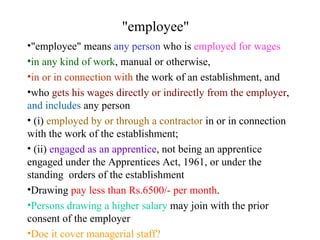

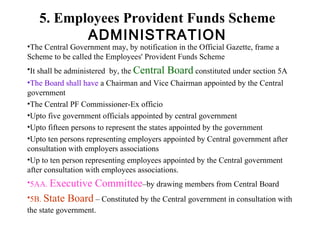

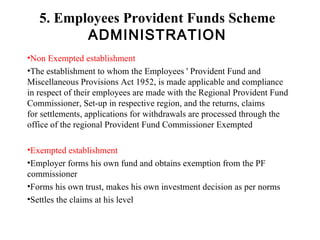

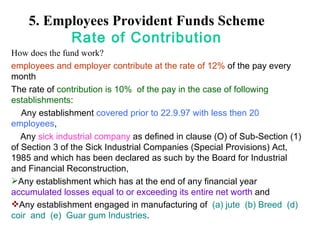

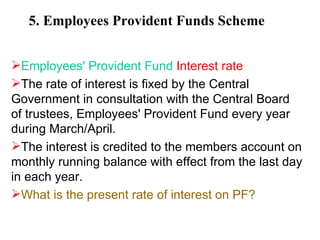

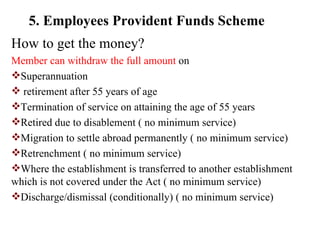

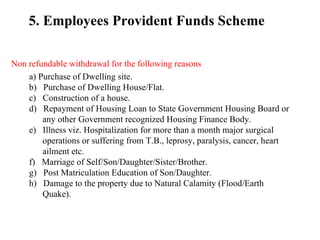

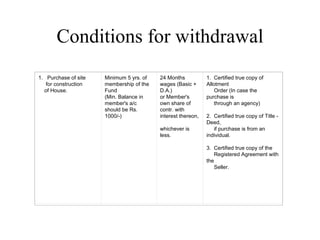

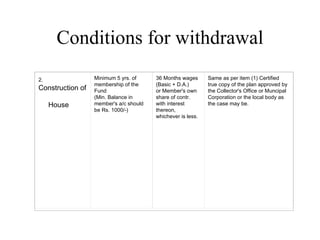

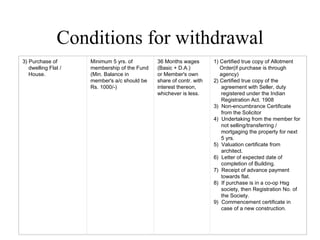

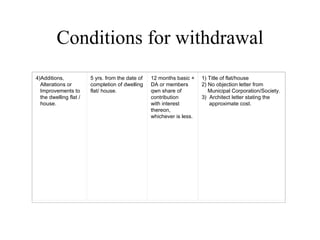

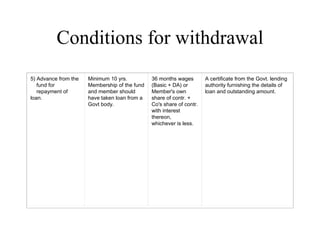

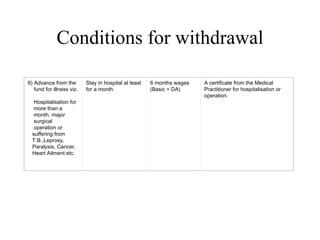

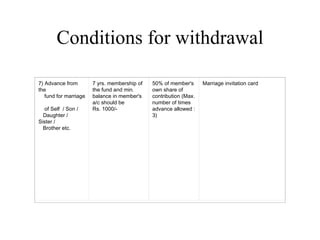

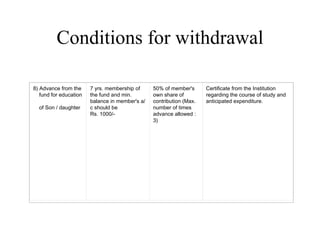

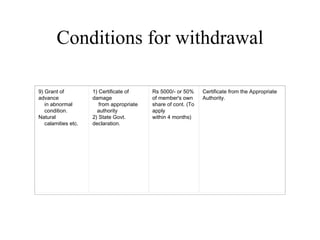

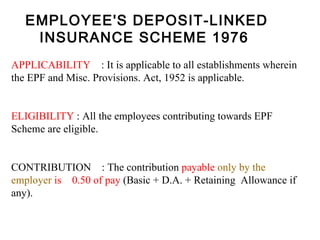

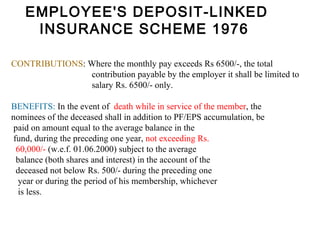

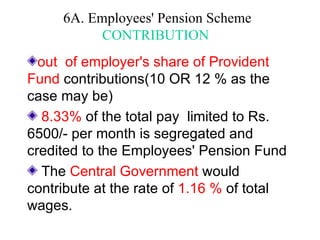

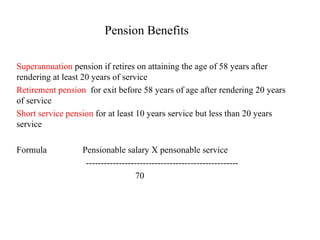

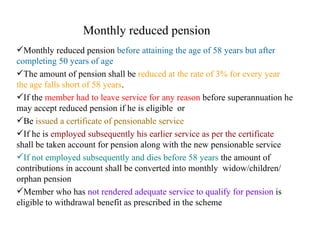

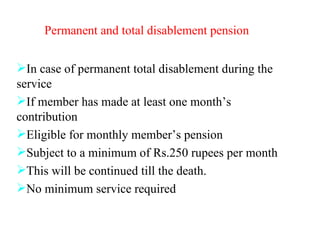

This document summarizes key aspects of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952 in India. It applies to establishments with 20 or more employees and can be extended to those with less than 20 by the central government. The appropriate government is the central government for certain establishments and the state government for others. The act covers employees earning less than Rs. 6,500 per month. It is administered by the Central Provident Fund Commissioner and establishes rules around employee and employer contribution rates, interest rates on provident funds, and conditions for withdrawal of funds for purposes like housing, education, illness, and more.