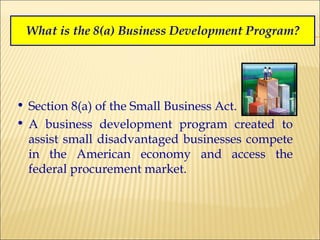

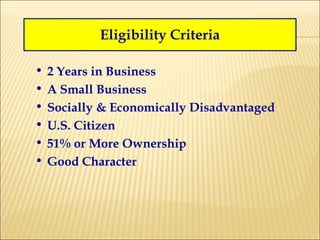

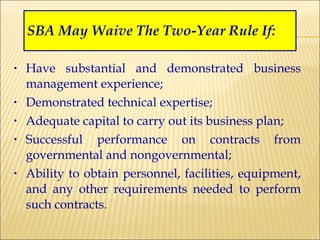

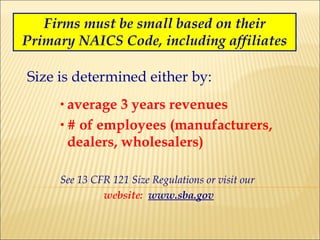

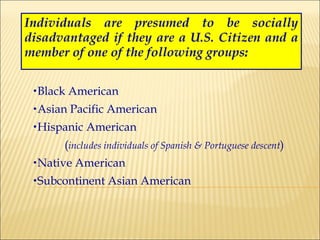

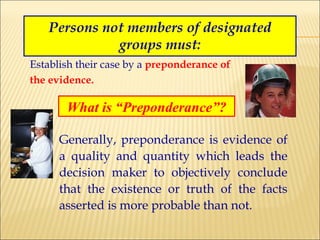

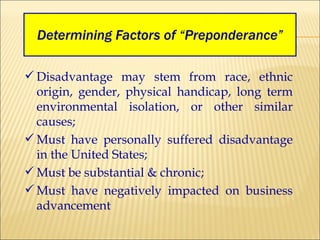

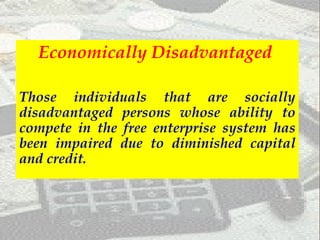

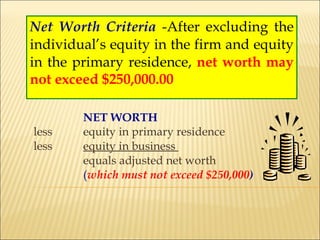

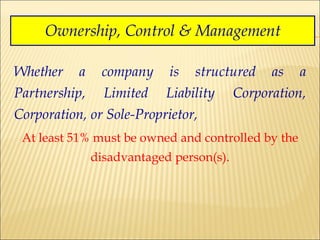

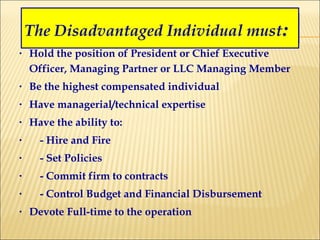

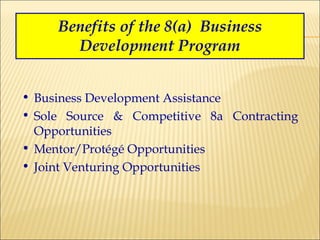

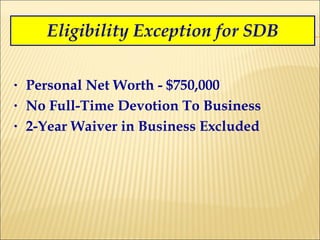

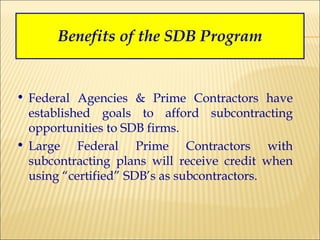

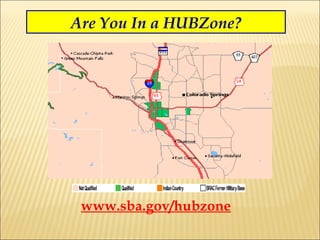

The document summarizes three programs from the U.S. Small Business Administration that provide assistance and contracting opportunities for small businesses: 1) The 8(a) Business Development Program assists socially and economically disadvantaged small businesses over 9 years, 2) The Small Disadvantaged Business Program certifies eligibility for subcontracting opportunities, and 3) The HUBZone Empowerment Contracting Program provides preferences to businesses in historically underutilized business zones. Eligibility requirements and benefits of each program are described.

![Apply for These Programs On-Line www.sba.gov/8abd www.sba.gov/hubzone Carolyn.Terrell@sba.gov 303.844.2607 ext 260 [email_address] 303.844.2607 ext 224](https://image.slidesharecdn.com/6-sba8a-sdb-hubzone-100507140433-phpapp01/85/6-sba-8-a-sdb-hubzone-29-320.jpg)