Credit rating agencies

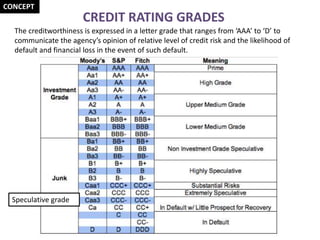

- 1. The creditworthiness is expressed in a letter grade that ranges from ‘AAA’ to ‘D’ to communicate the agency’s opinion of relative level of credit risk and the likelihood of default and financial loss in the event of such default. CREDIT RATING GRADES CONCEPT Speculative grade

- 2. CREDIT RATING AGENCIES- OLIGOPOLY IN INDIA CRISIL Limited India Ratings and Research Pvt Ltd ICRA Limited CARE Brickwork Ratings India Pvt Ltd SMERA Ratings Limited Infometrics Valuation and Rating Pvt Ltd: SEBI has permitted only seven credit rating agencies CONCEPT Eligibility criteria REASON:HIGH ENTRY BARRIERS

- 3. REVENUE MODEL OF CREDIT RATING AGENCIES UNSOLICITED RATINGS PAID RATINGS ISSUER PAY Assessment made on request of issuers SUBSCRIBER PAY/ USER PAY Available on user’s(Investor) subscription CONCEPT (VOLUNTARY)

- 4. GENERAL RATING PROCESS OF CRAs ISSUER CRA Request for rating Signs rating agreement, Provides information and Rating fees Rating Team assigned. Team conducts preliminary analysis Interaction with the management Analysis presented to the rating committee Does Issuer accept the rating? Does Issuer appeal against the rating? Rating disseminated on website. Rating kept under surveillance Details of unaccepted ratings disclosed on the website. Rating assigned and communicated to issuer YES YES NO NO CONCEPT AS PER SEBI The rating agencies have the power to downgrade, suspend or withdraw a rating.

- 5. FACTORS INVOLVED IN DETERMINING THE CREDIT GRADE Each rating agency has its own method to calculate credit ratings. At the time of calculating the rating, credit rating agencies take into consideration several factors like the financial statements, level and type of debt, lending and borrowing history, ability to repay the debt, and past debts of the entity before rating them.

- 6. RATING SHOPPING 2006 AND NOW AGAIN http://www.markadelson.com/pubs/Rating_Shopping.pdf CONCEPT •Rating shopping occurs when an issuer chooses the rating agency that will assign the highest rating or that has the most lax criteria for achieving a desired rating. COMPANIES CRA 1 CRA 2 CRA 3 CRA 4 AA AAA AA+ D+ LET’S GO RATING SHOPPING•Rating shopping refers to how, a company or a debt paper manages to get same or better rating from another agency within three months of it getting a poor rating. NEWS - RBI blasts credit rating agencies for allowing 'rating shopping' to large borrowers •Most rating shopping happened around 'BBB' or lower graded instruments, FSR suggests. https://economictimes.indiatimes.com/markets/stocks/news/rbi-blasts-credit-rating-agencies-for- allowing-rating-shopping-to-large-borrowers/articleshow/73016267.cms?from=mdr

- 7. FINANCIAL CRISIS, 2008 o During the 2008 financial crisis, a lot of worthless mortgage-related securities were given AAA ratings: the highest and safest investment grade. o In 2007, as housing prices began to tumble, Moody’s downgraded 83 percent of the $869 billion in mortgage securities it had rated at the AAA level in 2006 o The credit ratings agencies aimed for increasing profits and market share by giving inaccurately strong ratings to underperforming assets. o In connection with the financial crisis, the big three global credit ratings agencies have faced heavy fines and have come under scrutiny for playing a pivotal role in the 2008 meltdown(S&P agreed to pay $1.375 billion in a settlement) o But the fines paid for misrepresentation seem insignificant when compared to the profits generated by some of the large credit ratings agencies. o Rating shopping (Nomura) https://www.cfr.org/backgrounder/credit-rating-controversy CASE http://www.markadelson.com/pubs/Rating_Shopping.pdf

- 8. Consistently good ratings provided by Credit Rating Agencies from June 2012 to June 2018: Identified instances which indicated liquidity issues/ stress in the IL&FS group since 2015: Significant increase in debt , Decreasing profitability of IL&FS group; Supporting weaker companies in the IL&FS group; etc Potential favors/gifts provided to the representatives of the credit rating agencies: 1.Ramesh Bawa facilitated villa purchased for Ambreesh Srivastava (India Ratings), 2.Arun Saha arranged football tickets for D Ravishankar (Brickwork Ratings) relating to the matches in Real Madrid, 3.IL&FS group donated to the Sameeksha Trust INR 25 lakhs where the managing trustee D. N. Ghosh is also the chairman of ICRA. 4.Further, our email review indicates that the various key officials of rating agency were provided gifts such as smartwatches, shirts, coasters, etc SOURCE: Draft update pertaining to observations relating to Credit Rating Agencies- GRANT THORTON, 12 July 2019 SEBI levied a penalty of ₹25 lakh each on three rating agencies ICRA ltd, India Ratings & Research and Care Ratings Ltd for not exercising due-diligence and lapsing on their duties to investors by not taking timely rating actions. IL & FSCASE

- 9. DEBT FUNDS/ MUTUAL FUNDS RELYING ON CRA https://www.livemint.com/Companies/nKiB6RuSI5fXpvPVqxBr6H/Have-rating-agencies-been-caught- napping.html NEWS: Sebi warns mutual funds: Evaluate your investments, don’t just rely on ratings(2005) Debt funds holding bonds issued by the Jindal Steel & Power Ltd (JSPL) suffered a steep fall on Tuesday after Crisil downgraded the company’s credit rating to A4+ from A3+, indicating a negative outlook. The company has long-term debt of almost Rs 34,976 crore and debt mutual funds hold around Rs 3,000 crore worth of bonds. Debt funds of Franklin Templeton India were the worst hit, with some schemes falling by over 1.5 per cent on Tuesday. Similarly JPMorgan funds suffered a steep crash due to the downgrading of Amtek Auto. Debt funds are considered low-risk investments https://economictimes.indiatimes.com/markets/bonds/debt-funds-holding-jspl-bonds-crash-after- crisil-downgrade/articleshow/51015820.cms?from=mdr Fund houses should be using the rating as an additional input and not as a primary input. They should be having the skills to evaluate credit. Yes, a rated paper can help you to find companies you have to shortlist. Beyond that, there has to be an internal analysis that approves the paper. CASE

- 10. • Credit ratings, debt ratings, or bond ratings are issued to individual companies and to specific classes of individual securities. • In addition, Countries are issued sovereign credit ratings. • Sovereign credit ratings take the overall economic conditions of a country into account, including the volume of foreign, public and private investment, capital market transparency,, and foreign currency reserves . • Institutional investors rely on sovereign ratings to qualify and quantify the general investment atmosphere of a particular country. EXAMPLE-Moody’s downgrades India’s outlook to negative from stable • country's economic growth will remain materially lower than in the past. Moody’s projects a budget deficit of 3.7 per cent of GDP in the year through March 2020. • After downgrading India’s sovereign outlook, Moody’s Investors Service on Friday downgraded its view to 'negative' from 'stable' on many top Indian companies, including SBI, HDFC BankTCS, Infosys, BPCLNSE , NTPC, NHAI and GAIL. • In total, the rating agency on Friday cut outlook on 21 Indian firms. SOVEREIGN CREDIT RATING CONCEPT

- 11. EUROZONE DEBT CRISIS o EU governments and ECB policymakers accused the Big Three of being overly aggressive in rating eurozone countries’ creditworthiness, exacerbating the financial crisis. o S&P’s April 2010 decision to downgrade Greece’s debt to junk status weakened investor confidence and raised the cost of borrowing. o In 2011 private creditors were persuaded to take a “voluntary” loss on their bonds in order to reduce Greece’s overall debt. This scheme—seen as necessary to restore Greece’s financial health—was complicated by S&P’s July 2011 announcement that it would consider such debt restructuring a “selective default.” o Despite fears of a deeper crisis, the restructuring went smoothly enough for S&P to raise Greece’s sovereign credit rating back to B- by December 2012. CASE http://news.bbc.co.uk/2/hi/business/8647441.stm

- 12. REGULATING THE CREDIT RATING AGENCIES •In 2006, Congress passed the Credit Rating Agency Reform Act, which gave the Securities and Exchange Commission (SEC) the power to regulate the internal processes of credit ratings agencies regarding record-keeping. •The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act adopted new rules that allowed the SEC to annually examine the 10 credit ratings agencies operating in the United States. India’s seven rating agencies are regulated by both SEBI and RBI Over the last decade, 276 home-grown companies were assigned triple-A billings by credit rating agencies in India. This compares with nine given by Standard &Poor’s and 53 by Moody’s. Credit rating firms have put more companies under ‘rating watch’ in last one year than they did in last 12 years following loan defaults by the IL&FS Group, which heightened concerns over the health of indebted companies.

- 13. However, rating agencies have often sought to shift the blame to companies and lenders by claiming that they do not get information about the delay in meeting bank obligations and payment failures, which are considered early indicators of a default. SEBI amended its regulations for rating agencies to ensure that any listed or unlisted entity, before getting rated, gives an explicit consent to obtain from their lenders and other entities full details about their existing and future borrowings as also their repayment and delay or default of any nature and provide the same to the rating agencies. SEBI MULLS REFORMS; TIGHTER CHECK ON RATING AGENCIES It can be noted that since 2016, Sebi had changed the regulations governing raters at least six times. https://www.sebi.gov.in/legal/regulations/sep-2019/securities-and-exchange-board-of-india-credit-rating- agencies-amendment-regulations-2019_44439.html https://www.sebi.gov.in/legal/regulations/jun-2018/securities-and-exchange-board-of-india- credit-rating-agencies-regulations-1999-last-amended-on-may-30-2018-_39237.html

- 14. INDIAN COMPANIES ON GLOBAL STANDARDS CRISIL said that less than 1% of 32,500 rating Indian companies would actually be able to achieve a top credit rating of AAA. This is significantly less than China (12.8%), Taiwan (8.6%) and even Thailand (4.8%). Since India’s sovereign debt is rating BBB, the debt of any Indian company is usually assessed against a ceiling of BBB.

- 15. DECLINE OF AAA RATED COMPANIES GLOBALLY There has been a steady decline in the number of ‘AAA’ rated companies globally. At S&P Global Ratings, it reduced from 89 a decade back to 9 as of January 1, 2018. For Moody’s, it went from 170 to 53. The high cost of maintaining AAA ratings has contributed to this. For an entity to be rated AAA on the global scale, it has to enjoy an extraordinarily strong balance sheet that can withstand stresses on a world scale. That puts severe limits on debt levels and gearing headroom for growth.

- 16. •The basic objection to the “issuer pays” model is the suspicion that the issuer calls the shots, and therefore, the CRA is likely to subjugate its independent judgment to its commercial interests. •Many banking crimes are penalized with fees instead of criminal lawsuits, and the story for credit ratings agencies is no different. •At the same time, investors should rely less on such ratings, especially when these credit ratings agencies have already been a part of one of the biggest financial crises in the world. •The rating agencies have the power to downgrade, suspend or withdraw a rating. If there is high quality surveillance, no reason for an abrupt downgrade by two or three notches, unless it is the result of a corporate action, where there is some merger or acquisition or the company has suppressed some facts, which came to light later on. CONCLUSION