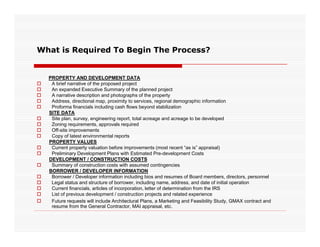

This document provides information on real estate acquisition and development/rehab financing for non-profit corporations through municipal bond financing. It explains that non-profits can obtain non-recourse debt financing through unenhanced tax-exempt municipal bonds to purchase and develop qualified projects like affordable housing, schools, and recycling plants. The financing provides a single loan for acquisition, development, and permanent financing with current market rates and 30-year terms. Projects must qualify based on providing a municipal benefit and cash flows supporting debt repayment. Redbridge Development Partners assists non-profits through this financing process.