The document provides information on various funding programs, including:

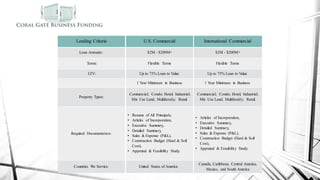

1) Commercial lending programs for debt and joint ventures ranging from $2M-$200M+ with terms up to 75% loan to value.

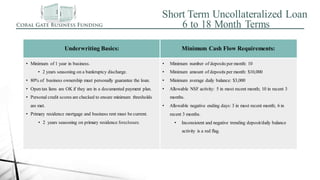

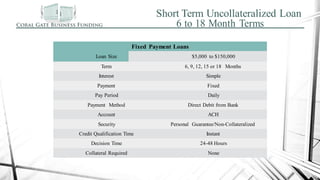

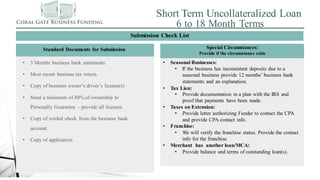

2) Short term uncollateralized loans from 6-18 months requiring minimum business cash flow and bank statement documentation for approval within 24-48 hours.

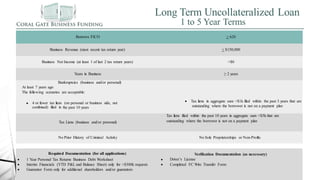

3) Long term uncollateralized loans from 1-5 years for businesses in operation over 2 years and meeting minimum revenue and income thresholds.

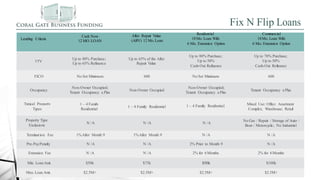

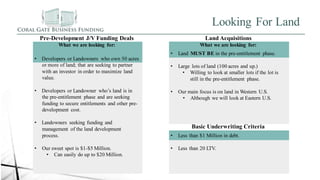

4) Specialized programs for fix and flip loans, land acquisition, medical lending, and commercial real estate collateralization. Contact information is provided for questions.