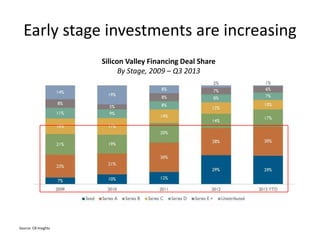

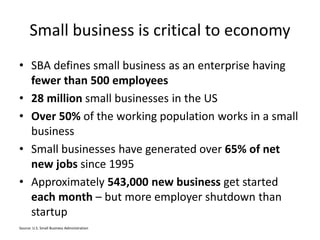

TCW/Craton is a $135.5 billion private equity firm that invests in technology and sustainability companies. It looks for teams with experience, proven track records, technologies that solve problems, and opportunities for strategic collaboration. As starting a business has become more affordable and common, there are now more investment opportunities than ever before in highly competitive early-stage markets. This requires startups to be more capital efficient and further developed with metrics like user growth and revenue from an earlier stage.