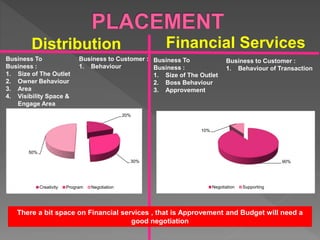

This document discusses strategies for distributing financial services products to both business and consumer customers. For business customers, key factors include volume outlets, share of selling, territory, highest profit, profit margins, competition price, size of outlet, owner behavior, and area. For consumer customers, important considerations are behavior, budget/income, occupation, territory, education, and payment. The document also outlines different composition strategies for approaching business versus consumer customers, such as emphasizing trust, selling skills, and volume for businesses and creativity, programs, and price negotiation for consumers. Overall, the key is to engage outlets and customers to achieve target areas and continuous product improvement.