1) The document discusses fiscal decentralization in the Philippines, focusing on local government fiscal policies and intergovernmental fiscal transfers.

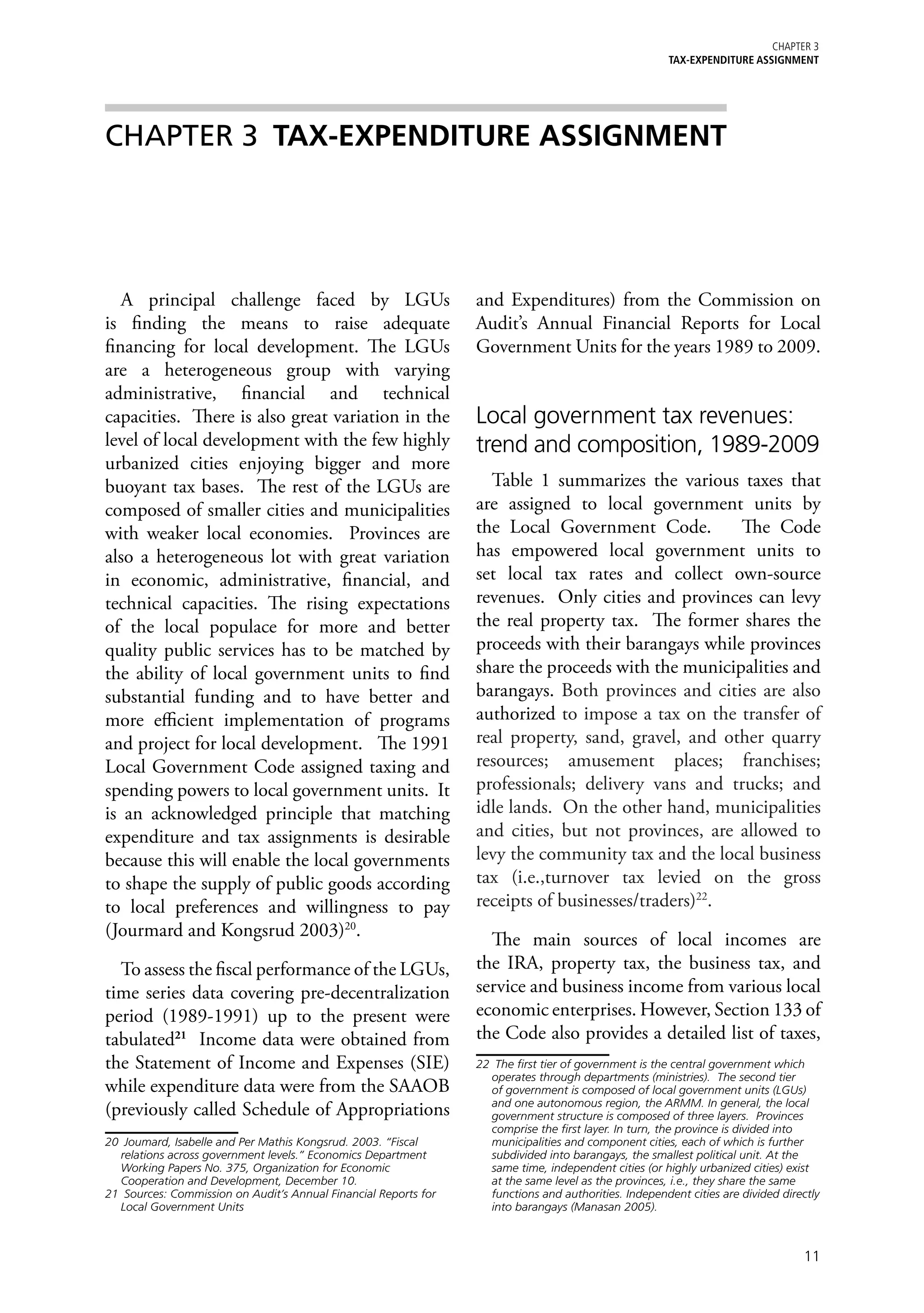

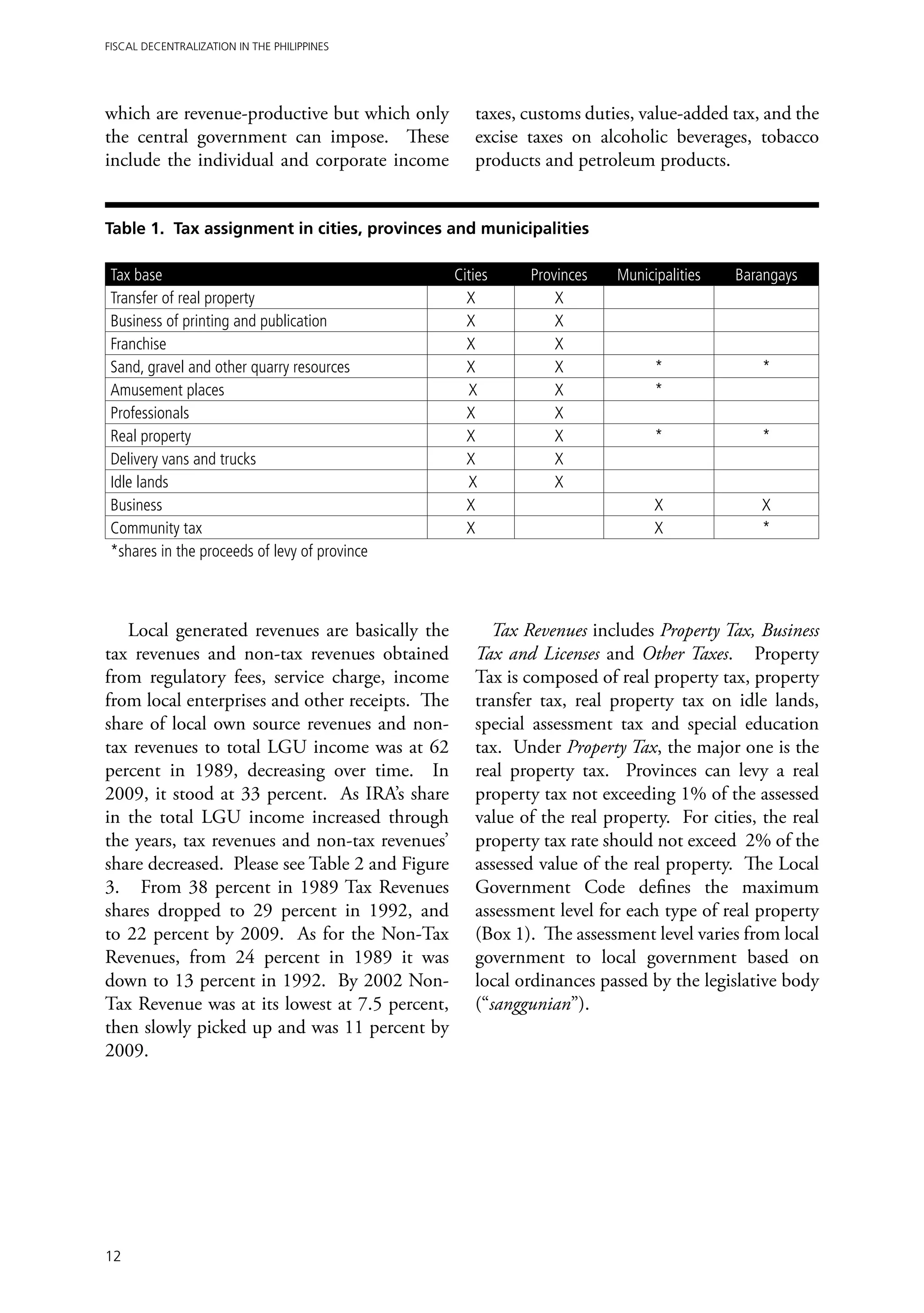

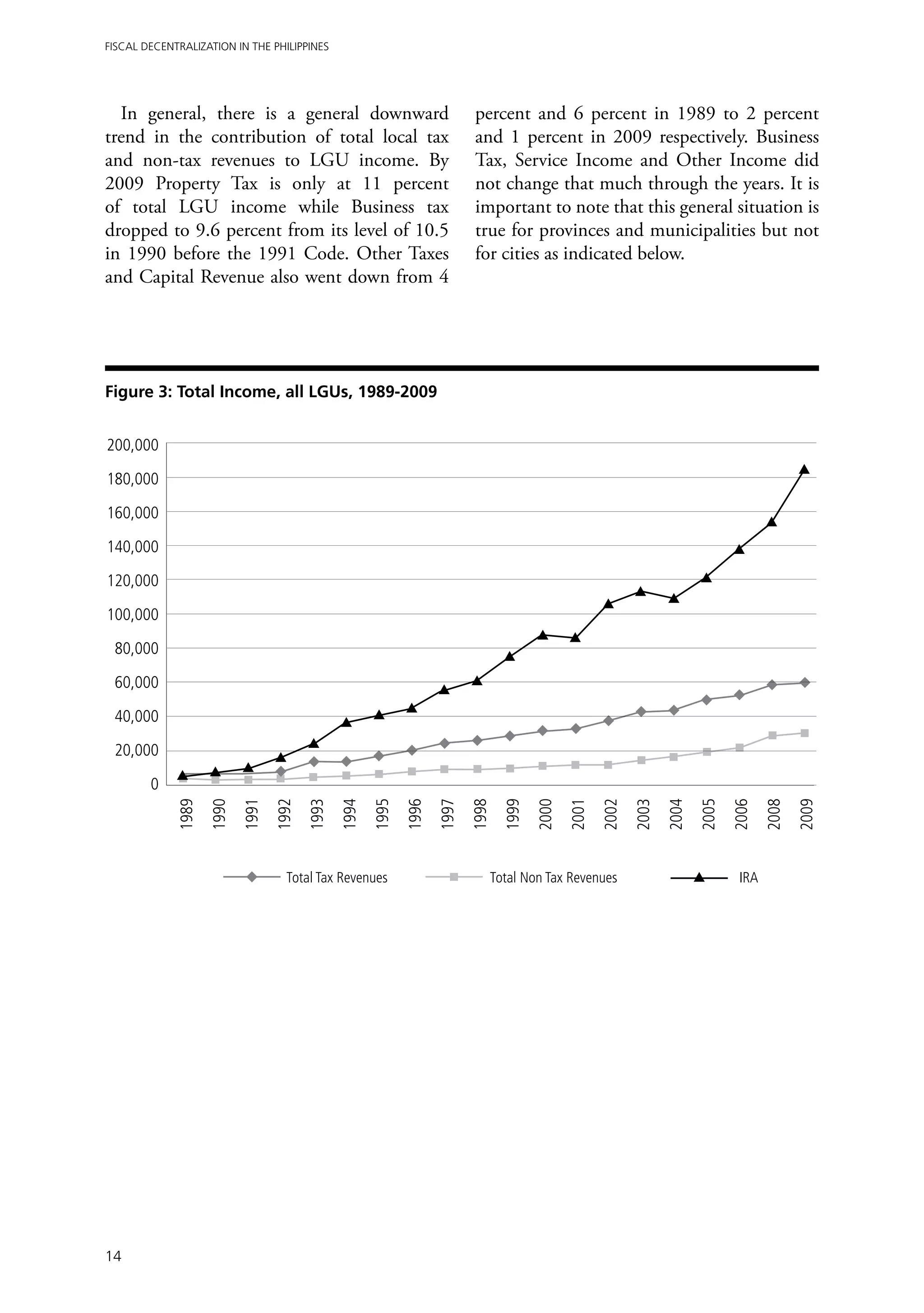

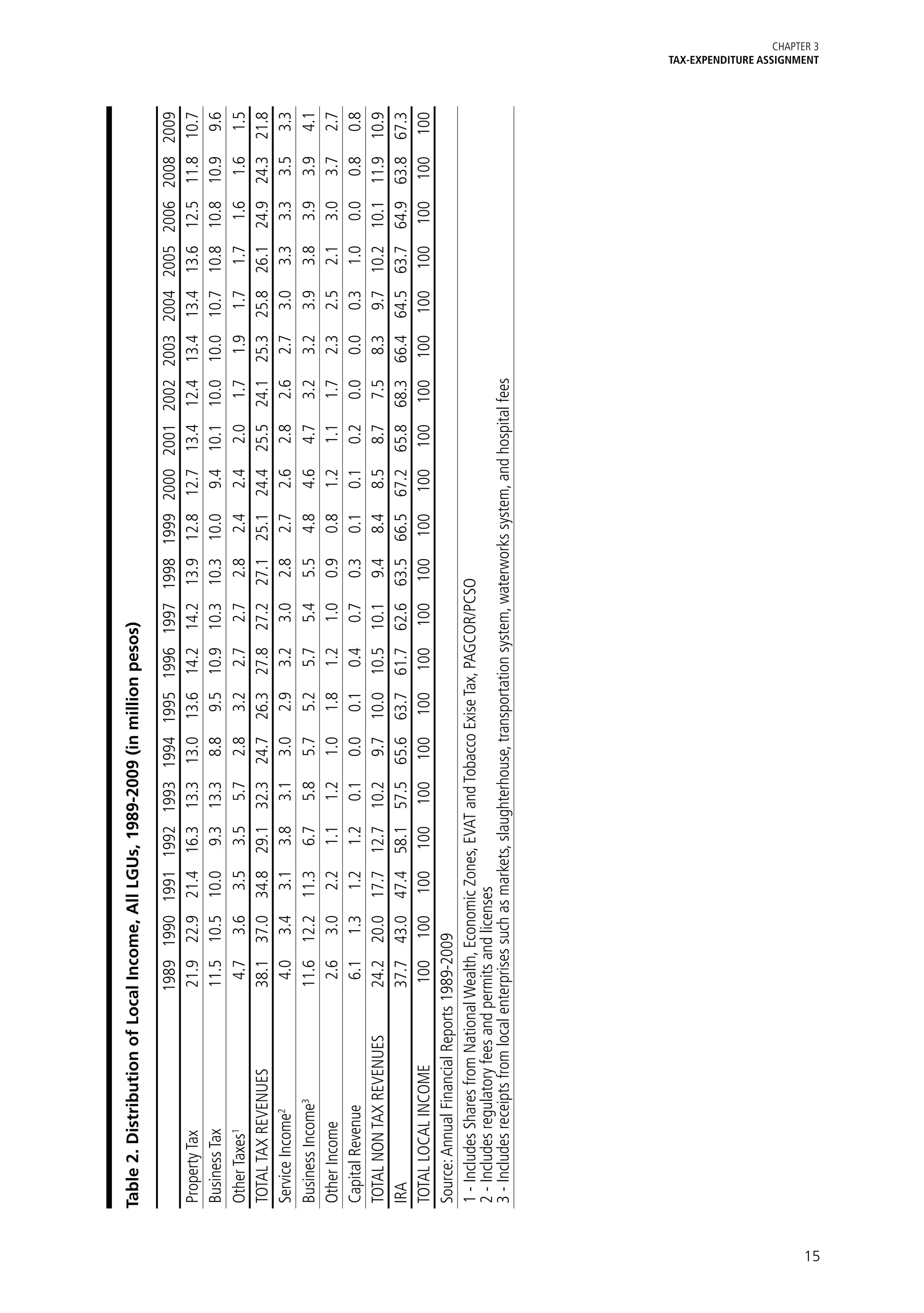

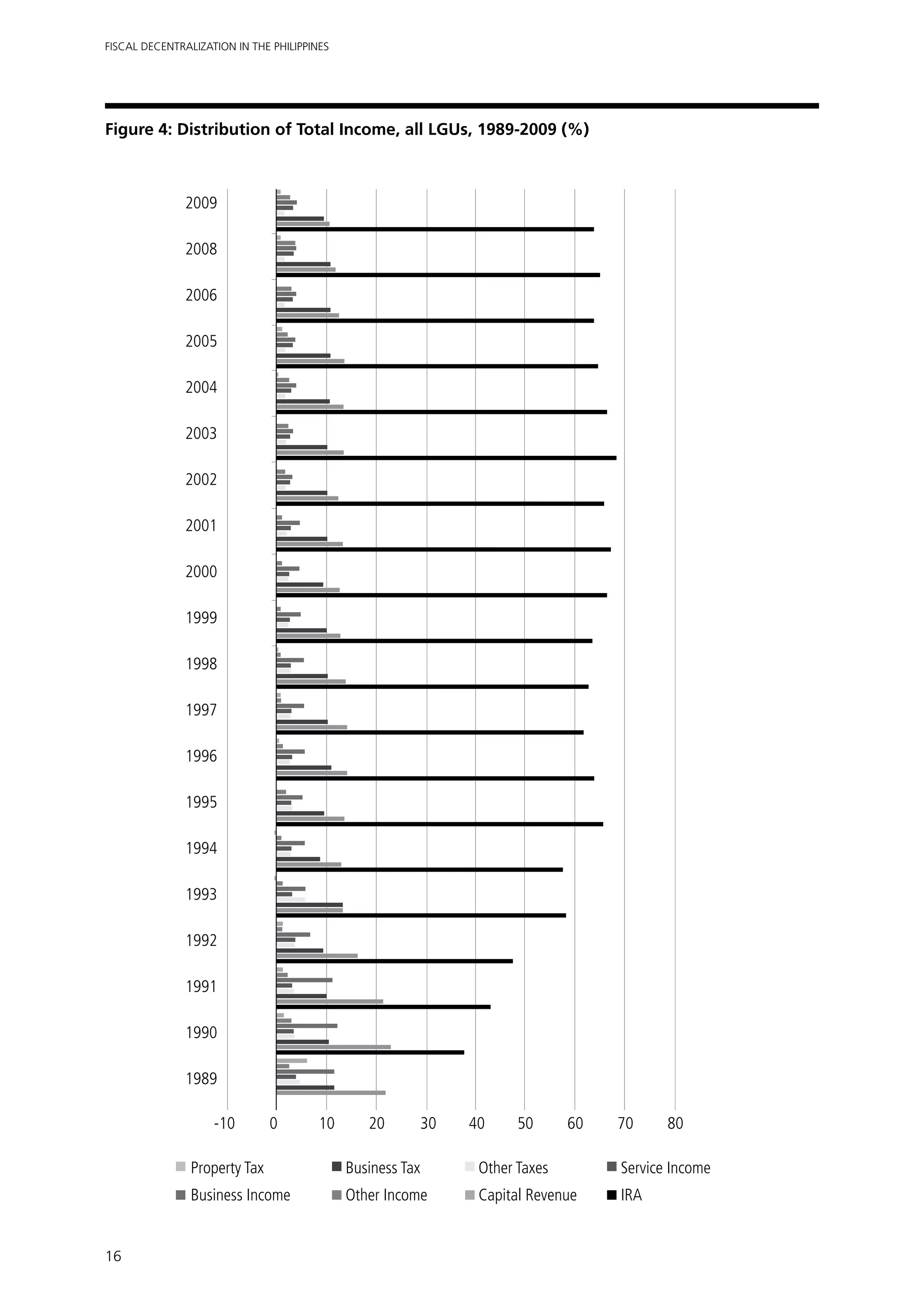

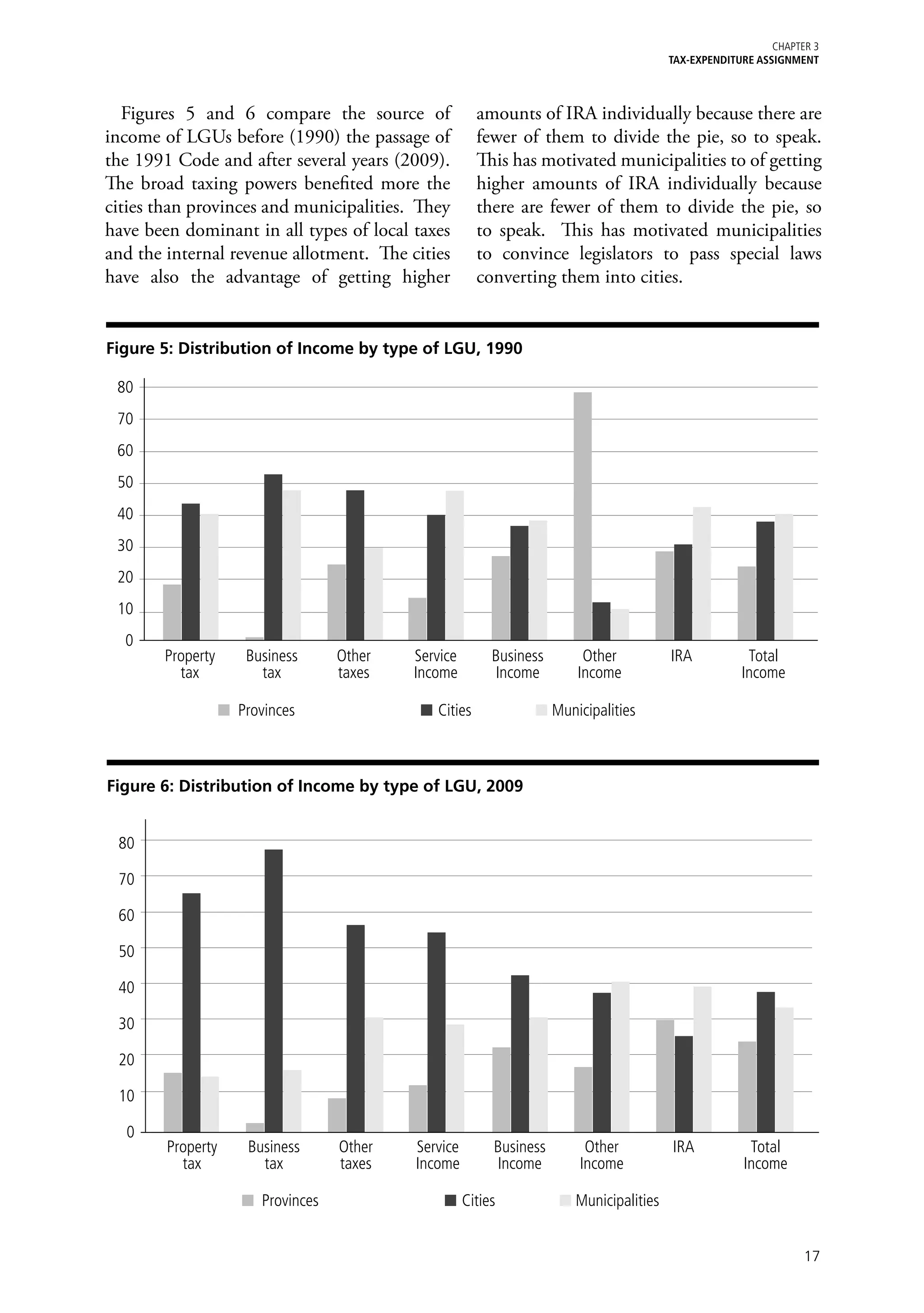

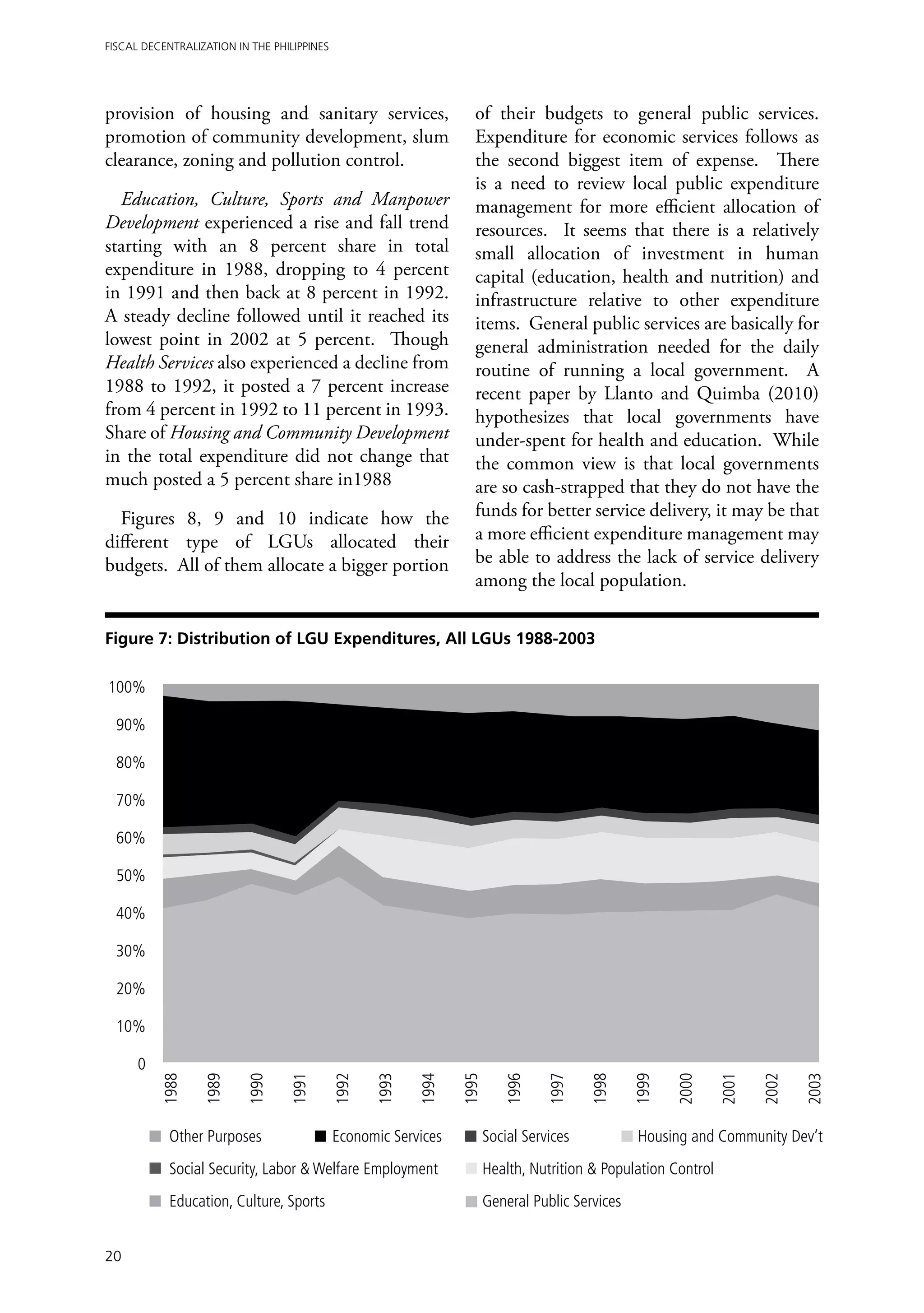

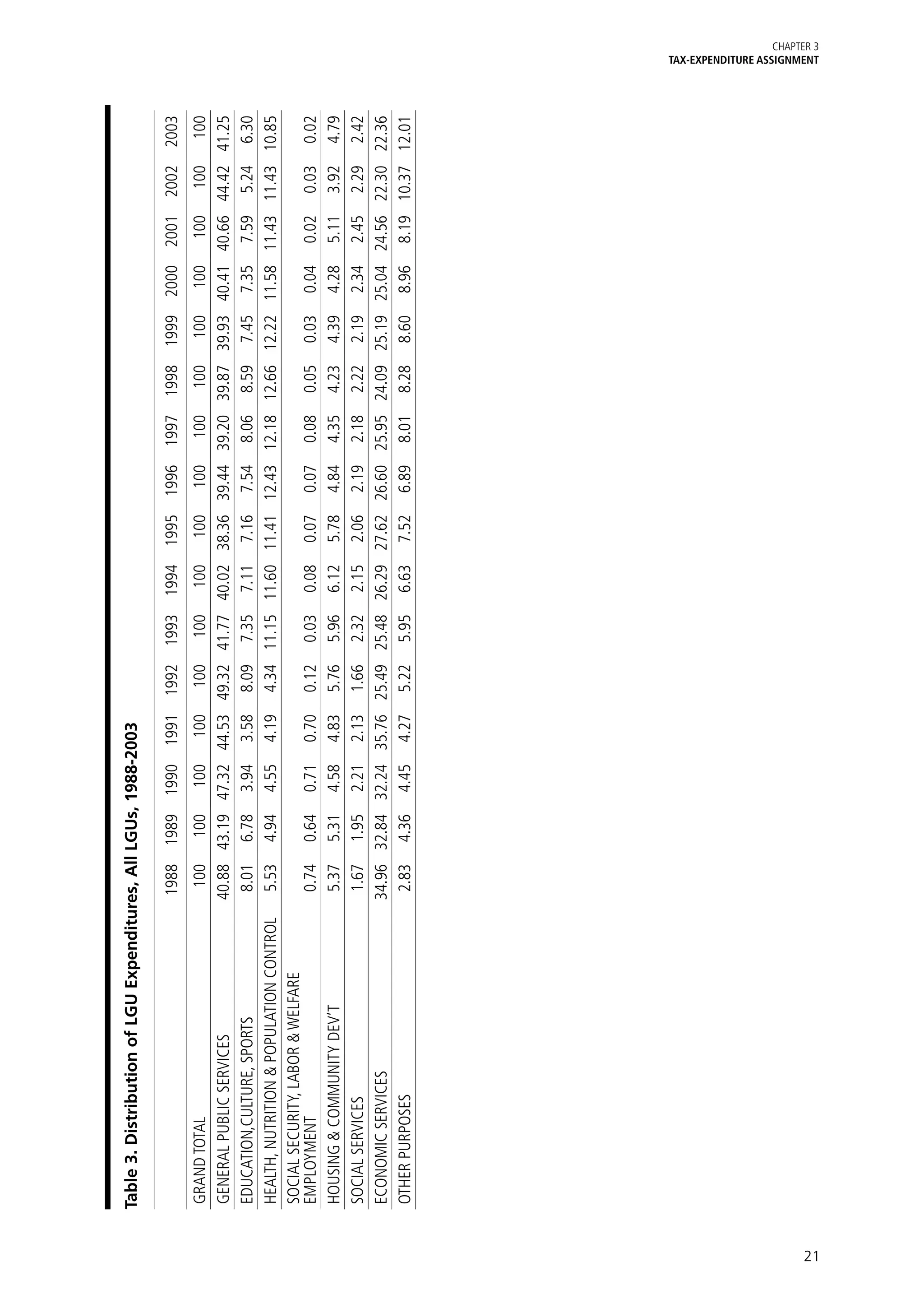

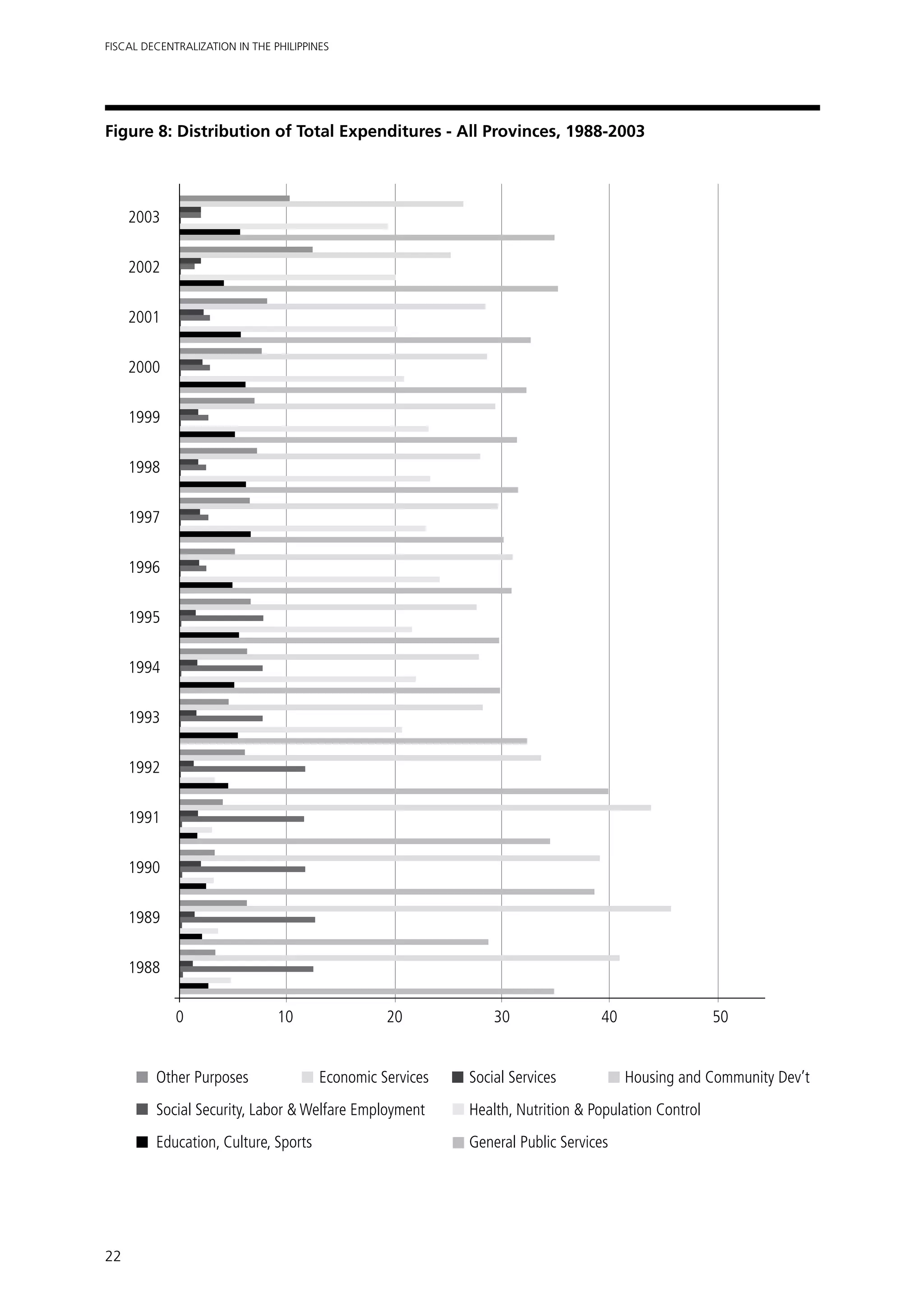

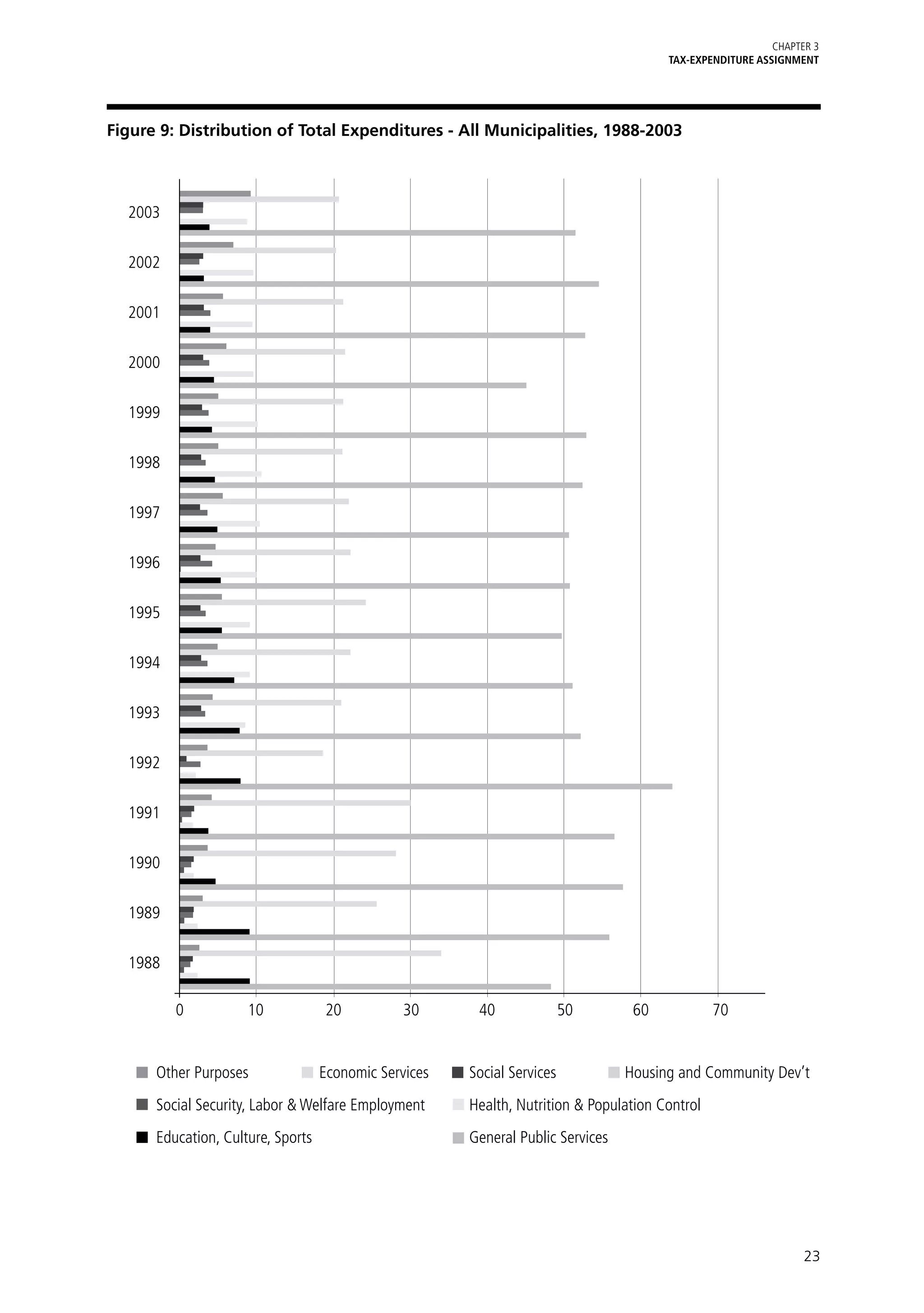

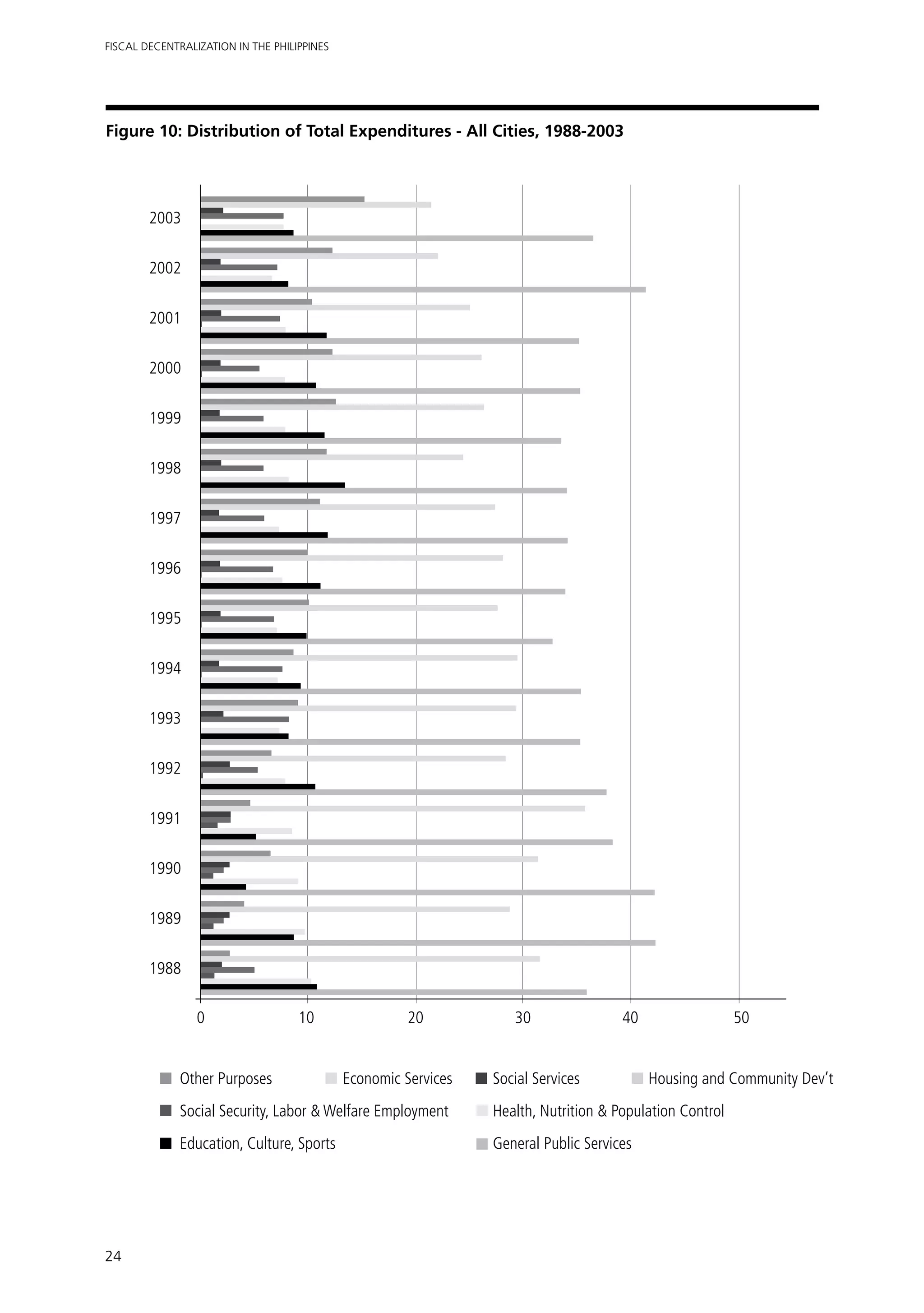

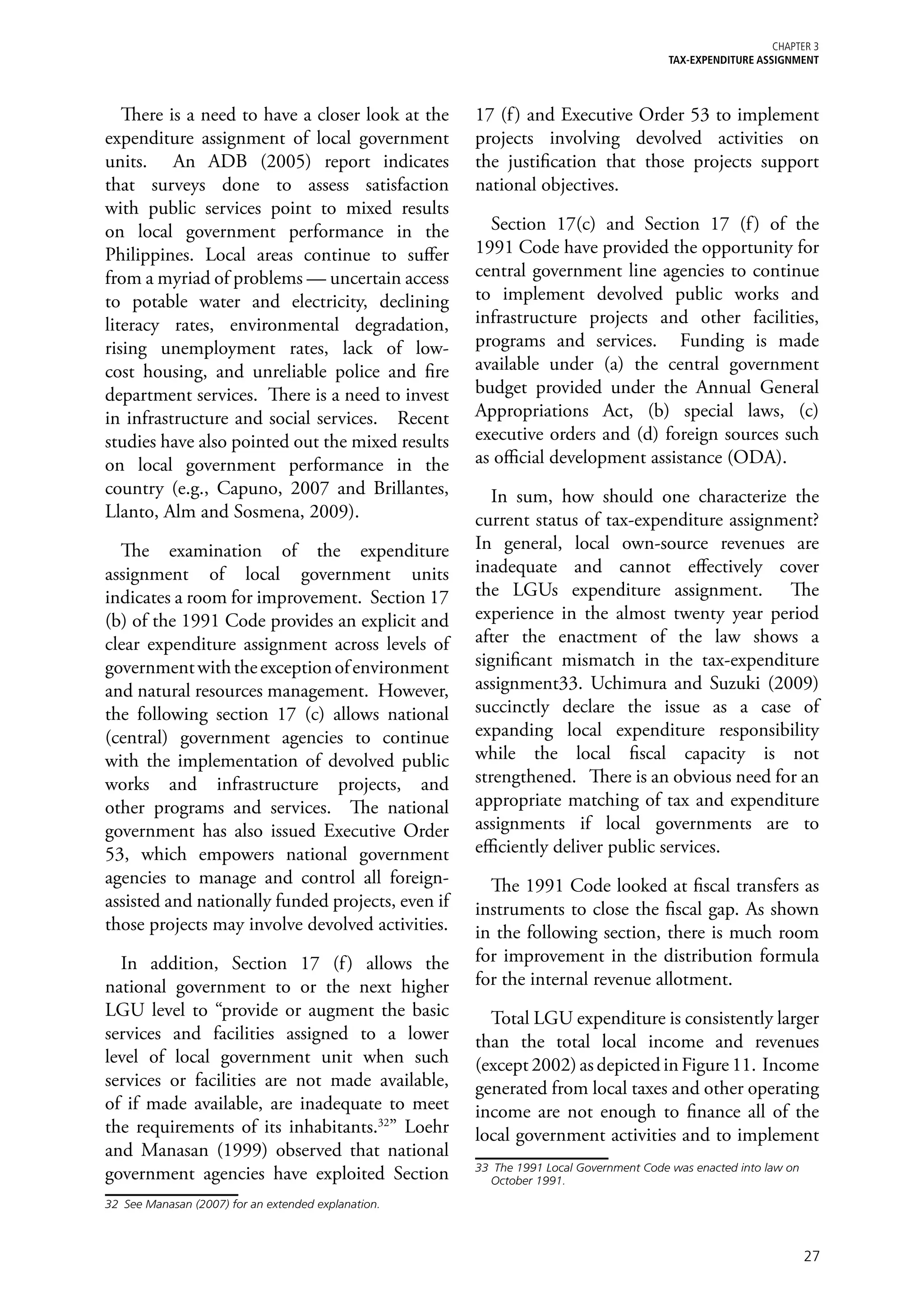

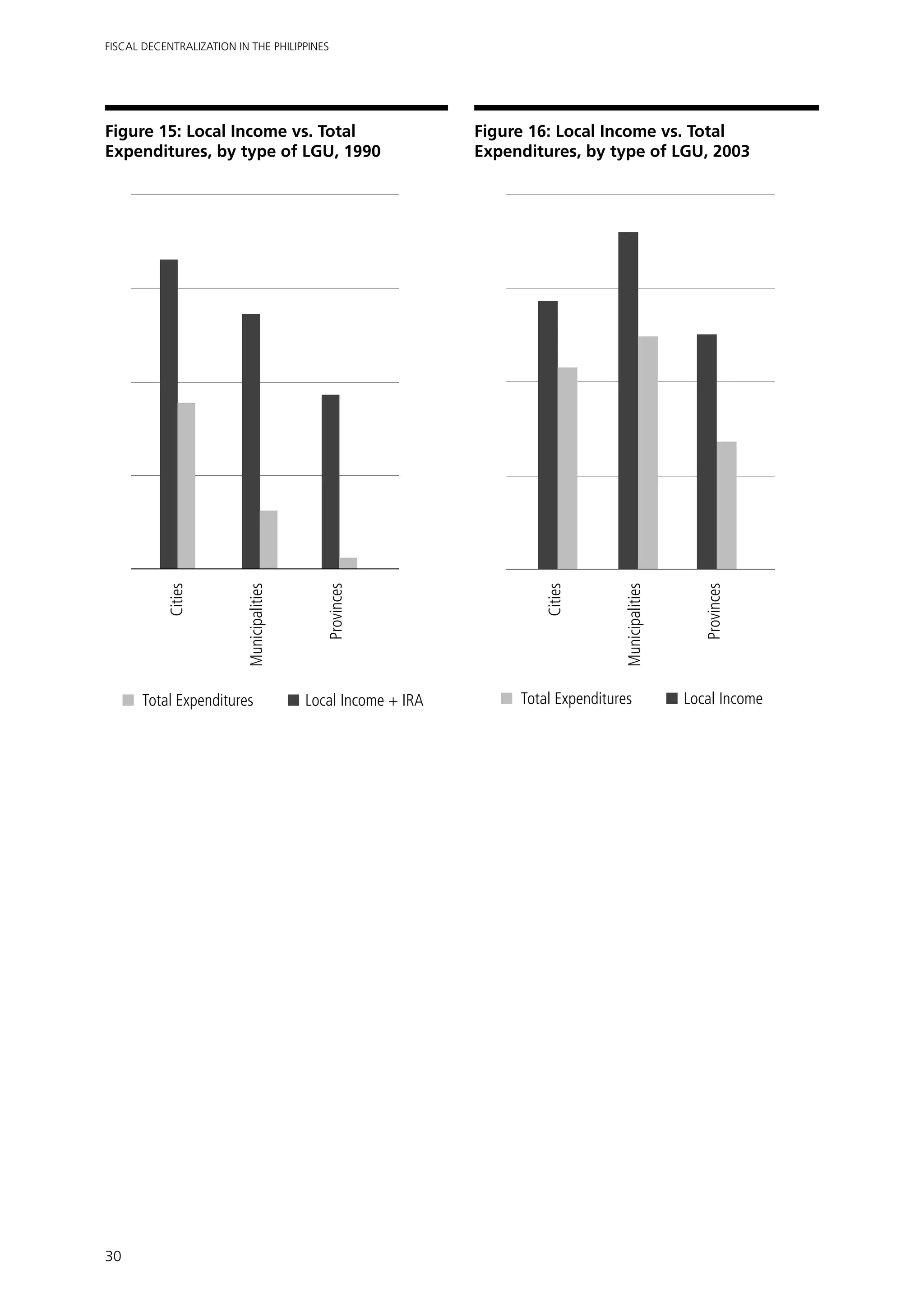

2) It analyzes the tax-expenditure assignment at the local level, examining trends in local tax revenues and expenditures on items like health and education. It finds an inefficient mismatch between revenue resources and expenditure needs.

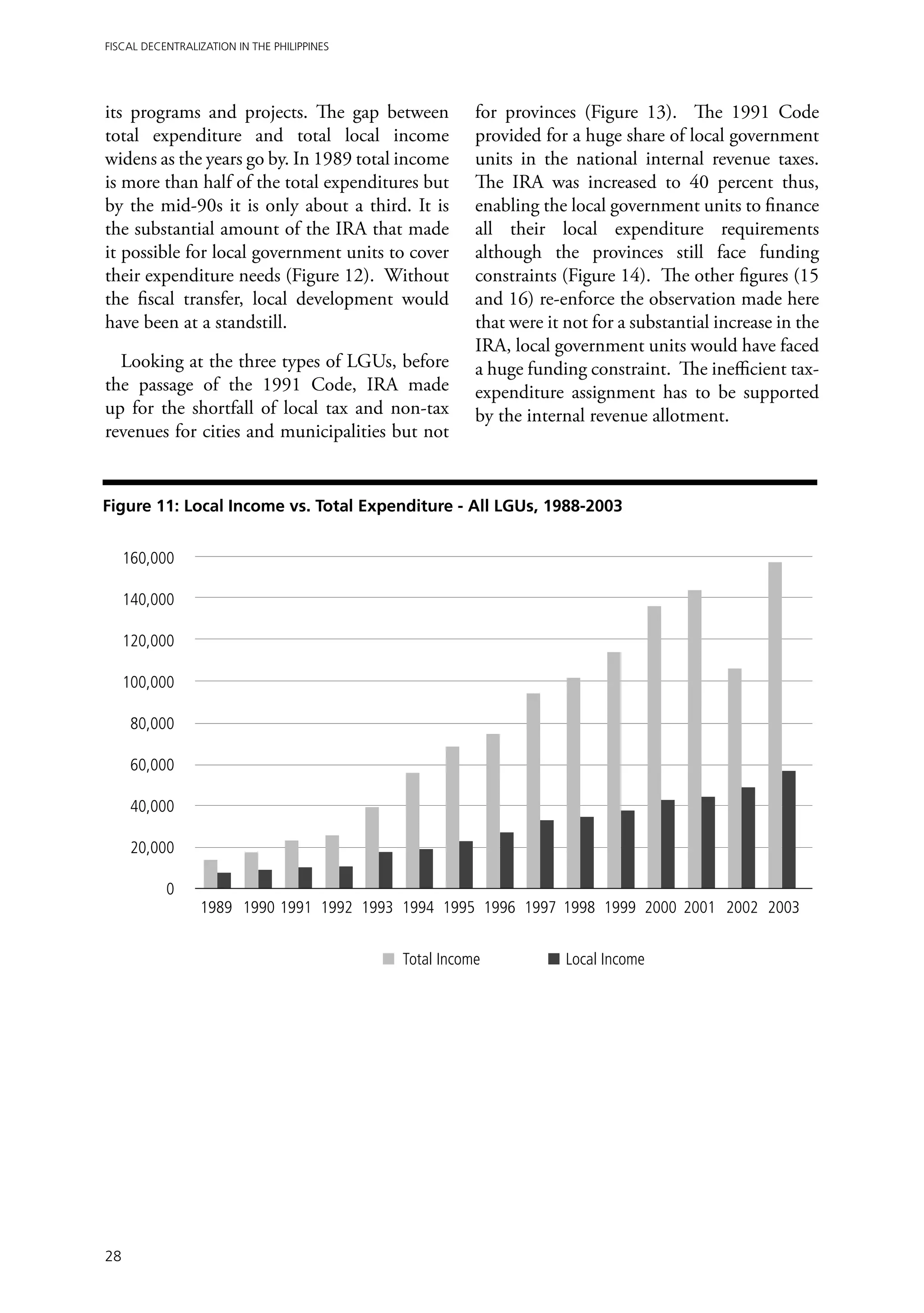

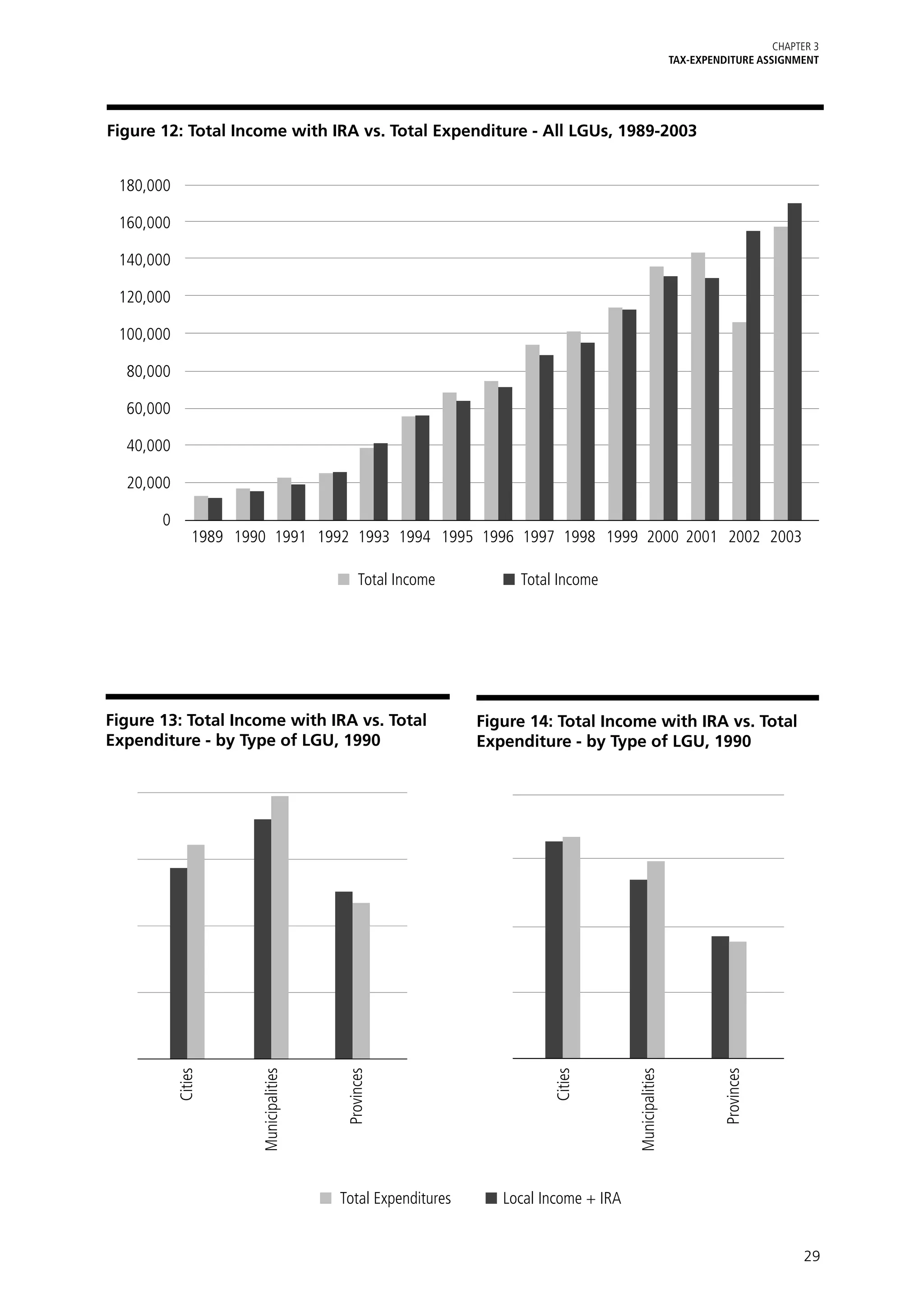

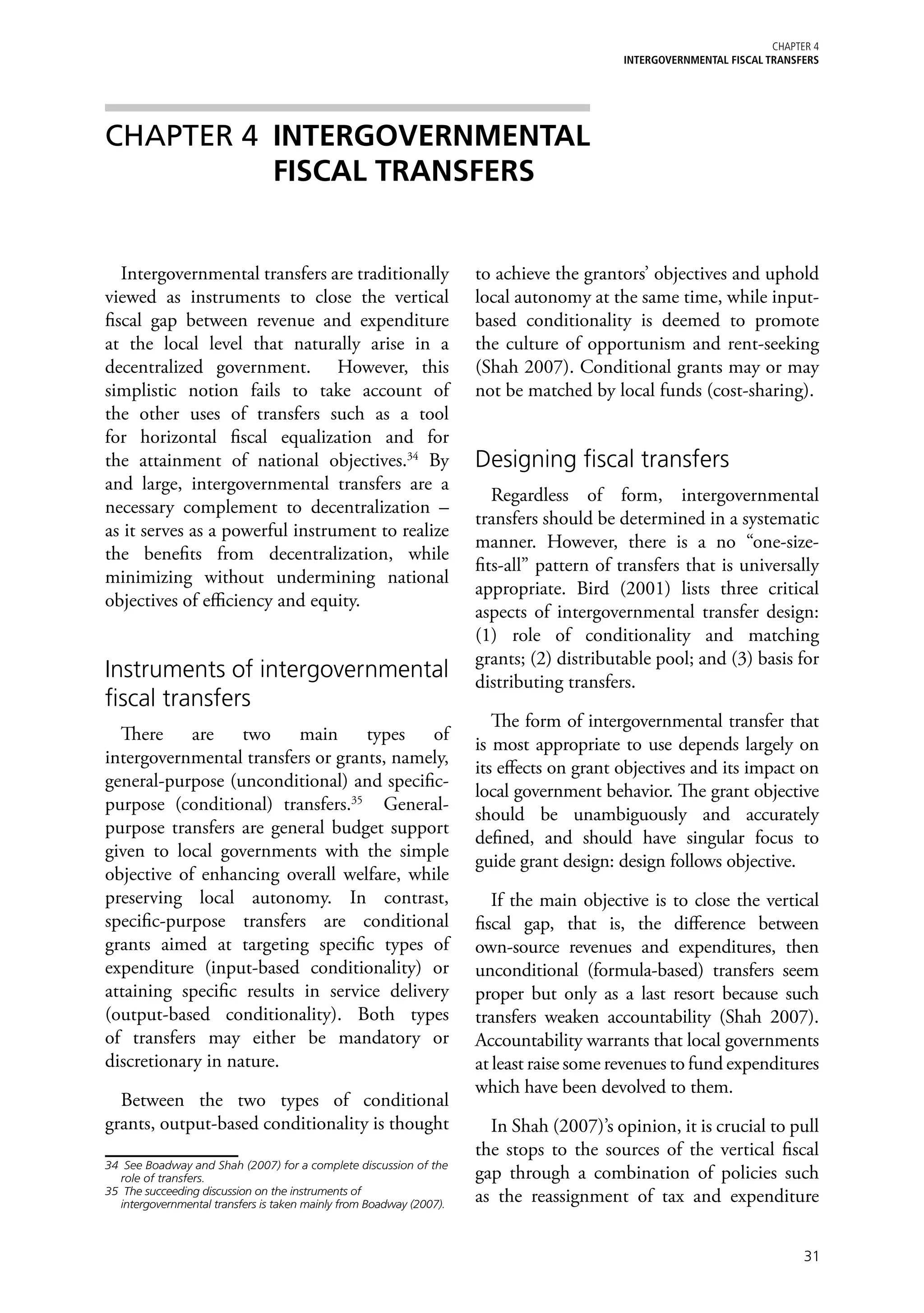

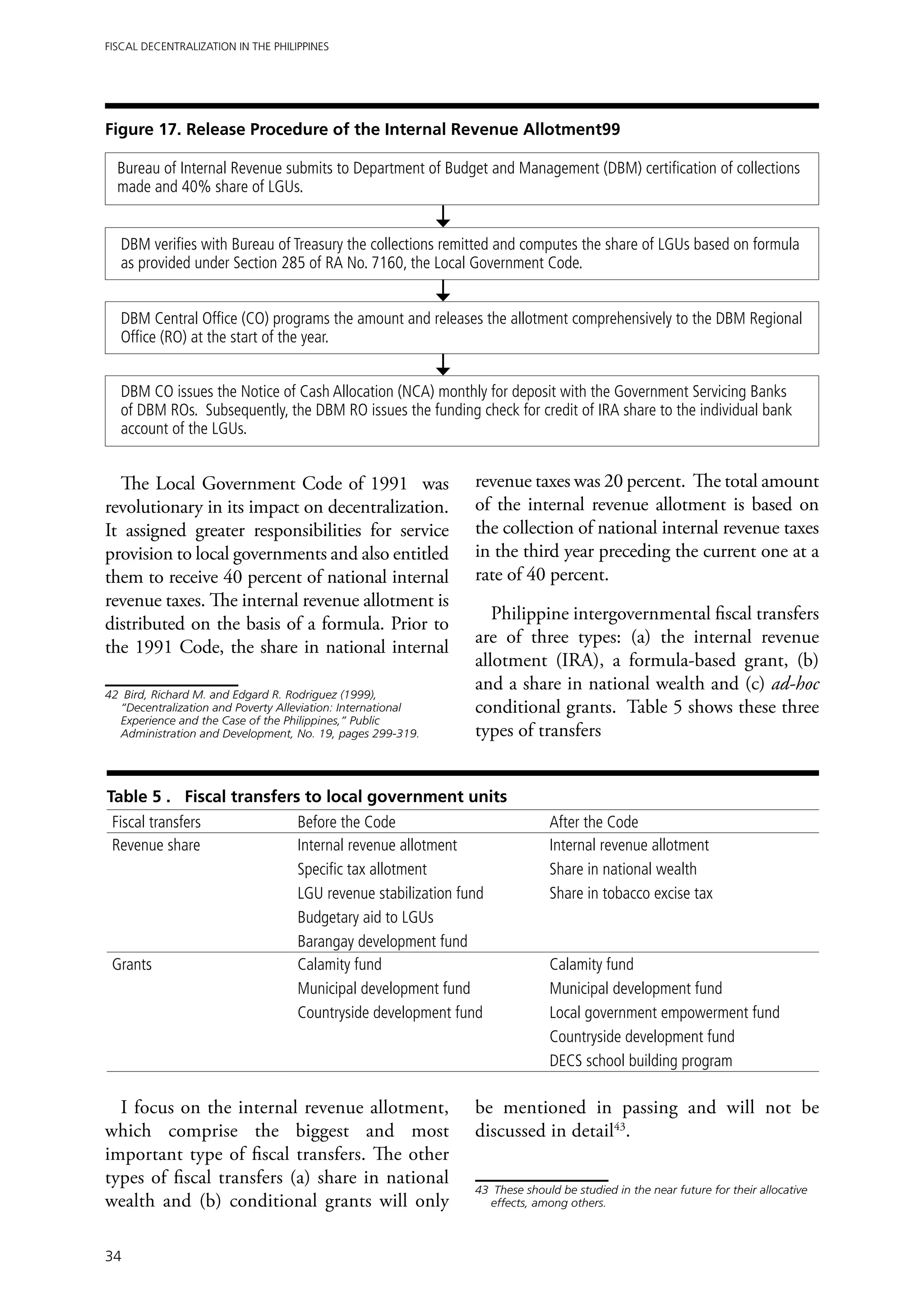

3) The document also discusses intergovernmental fiscal transfers like the Internal Revenue Allotment, which significantly supplements local revenues but may have reduced local revenue efforts. It says the allocation formula for transfers could be improved.