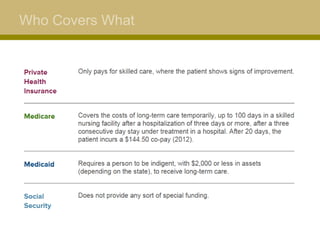

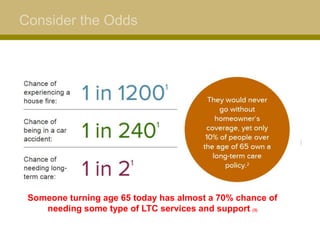

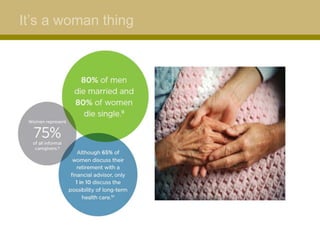

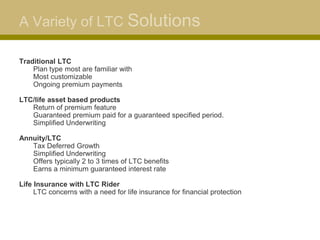

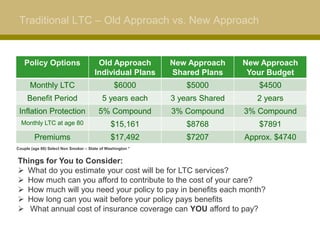

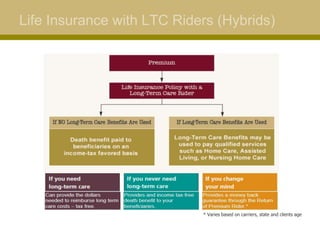

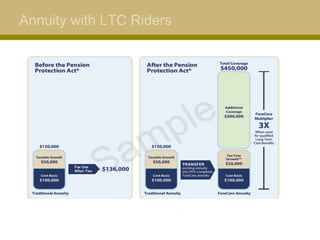

The document discusses long-term care (LTC) insurance solutions, addressing when it is appropriate, key facts, and various types of LTC options available. It highlights the substantial likelihood of needing LTC services, particularly among individuals aged 40-80, as well as the financial implications of such care, which is not typically covered by health insurance or Medicare after a limited duration. The text emphasizes the importance of planning for LTC to preserve financial well-being and offers insights on different policy types and their features.

![DISCLOSURES:

The opinions voiced in this material are for general information only and not intended

to provide specific advice or recommendations for any individual. To determine which

investment (s) may be appropriate for you, consult your financial advisor prior to

investing. All performance referenced is historical and is no guarantee of future

results. All indices are unmanaged and cannot be invested into directly.

Life insurance policies contain exclusions, limitations, reductions of benefits, and

terms from keeping them in-force. Your financial professional can provide you with

costs and complete details.

[Add one of the disclosures listed in the notes (Tahoma 16) to meet compliance

requirements: IAS – IS – Bank/Credit Union - Hybrid.]](https://image.slidesharecdn.com/lplclientltcppt-final-170706222814/85/Long-Term-Care-Planning-Solutions-27-320.jpg)