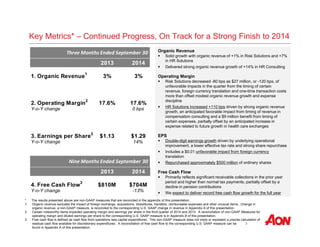

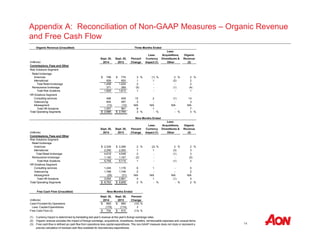

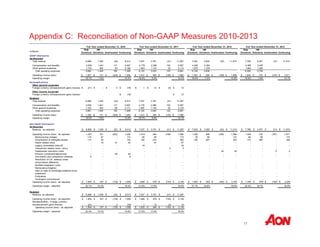

- Aon plc reported third quarter 2014 results with key metrics showing continued progress including 3% organic revenue growth, stable 17.6% operating margin year-over-year, and 14% earnings per share growth to $1.29.

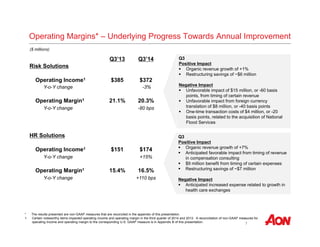

- Risk Solutions grew 1% organically while HR Solutions grew 7% organically, driven by strong 14% growth in HR Consulting.

- Operating margins were impacted by $27 million of unfavorable items in Risk Solutions but increased 110 bps in HR Solutions.

- Double-digit earnings growth was achieved through underlying performance despite currency headwinds.