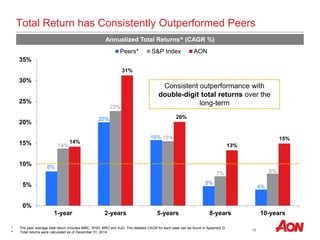

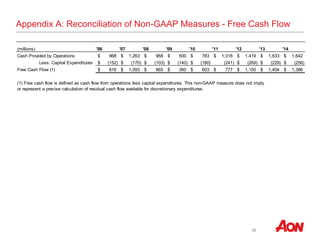

The document provides an overview of Aon plc, a global professional services firm focused on risk, retirement, and health solutions. It summarizes Aon's industry-leading position, global network of over 500 offices in 120 countries, and operations in growing insurance and HR consulting markets. The document also outlines steps Aon has taken to focus its portfolio, invest in capabilities, and deliver strong financial results including 3-4% annual organic revenue growth, 19-22% operating margins, and over $1 billion in annual free cash flow. Finally, it discusses opportunities for further value creation such as united growth efforts, continued margin expansion, effective capital allocation, and long-term shareholder returns.