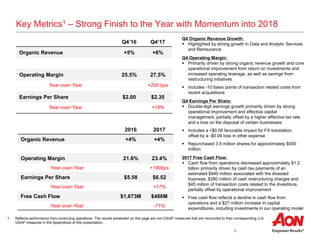

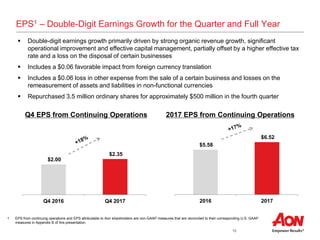

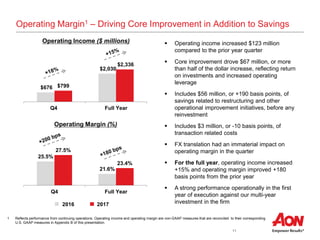

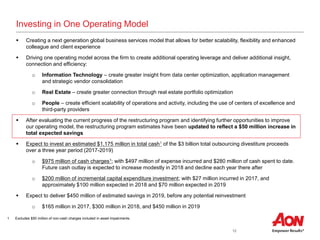

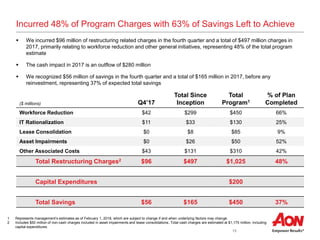

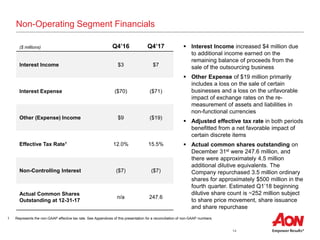

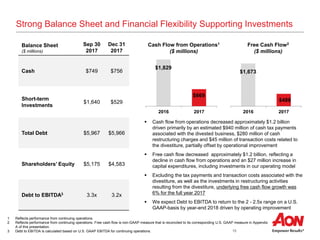

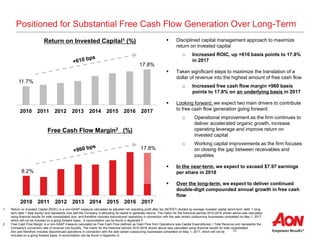

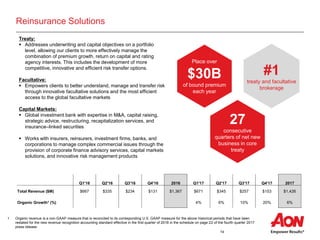

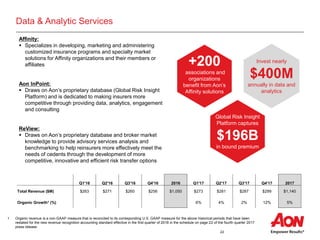

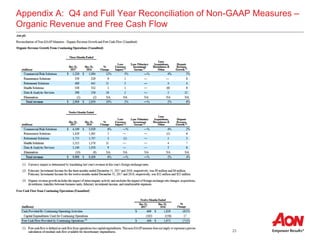

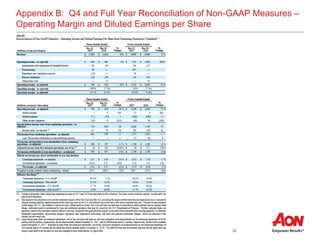

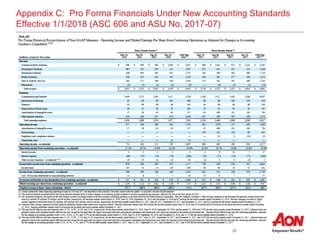

Aon reported strong fourth quarter and full year 2017 results, with organic revenue growth of 6% and 4% respectively. Earnings per share grew 18% in the quarter and 17% for the full year, driven by organic revenue growth, operational improvements, and capital management. Aon is strategically investing proceeds from divestitures of $3 billion in high-growth areas like data and analytics, cyber, and healthcare to drive future growth. The company has incurred 48% of the estimated restructuring charges for its operating model transformation and expects to realize only 63% of the total estimated savings to date, positioning Aon for continued margin expansion.