Aon plc reported strong financial results for the fourth quarter and full year of 2016. Some key highlights include:

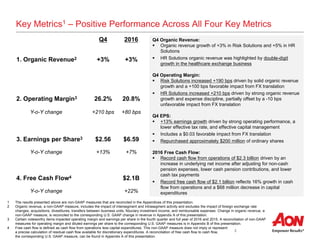

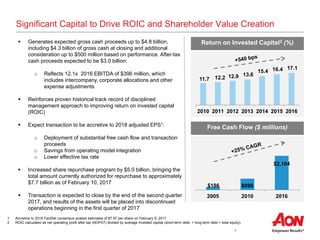

- Organic revenue growth of 3% in both segments for the fourth quarter driven by growth across regions and businesses.

- Record operating margins of 26.2% for Risk Solutions and 20.8% for HR Solutions in the fourth quarter due to organic revenue growth and expense discipline.

- Double digit earnings growth of 13% for the fourth quarter and 7% for the full year 2016 driven by strong operating performance and capital management initiatives.

- Record free cash flow of $2.1 billion for 2016, a 22% increase over 2015, demonstrating effective cash generation.