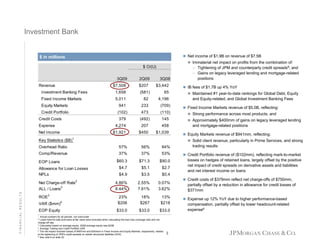

EOP Loans & Leases

Avg Deposits

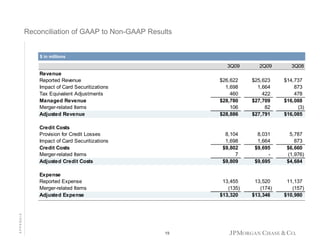

FINANCIAL RESULTS

1

Actual numbers for all periods, not over/under

2 Calculated based on average equity; 3Q09 average equity was $2B

3 Excludes loans held-for-sale and loans at fair value

4 Calculated based on average equity; 3Q09 average equity was $2B

8

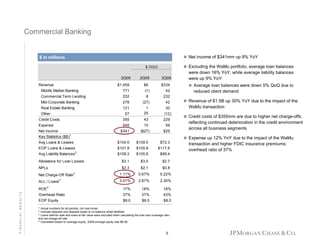

Total revenue of $1.5B up 4% YoY driven by growth in

Middle Market Banking and Real Estate Banking, partially

offset by lower Commercial Term Lending revenue

Credit costs of $43mm reflect higher net charge-offs

Expense up 10