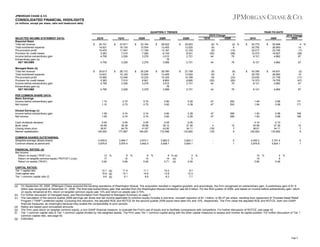

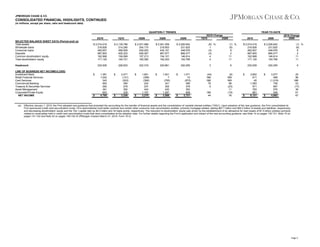

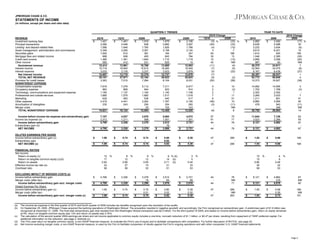

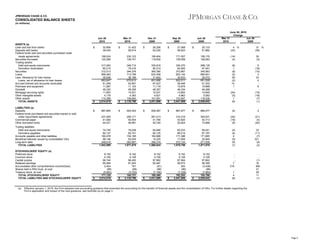

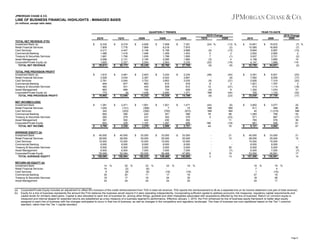

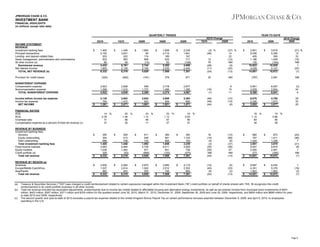

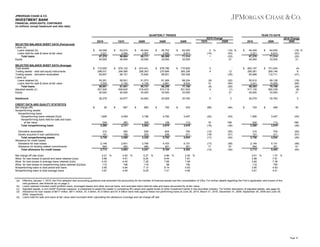

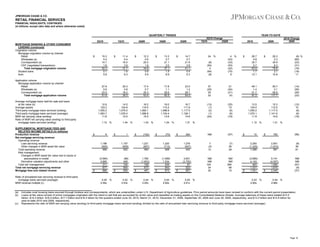

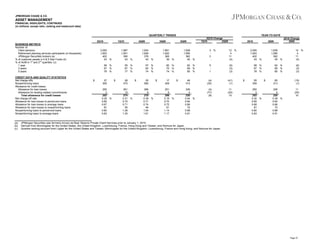

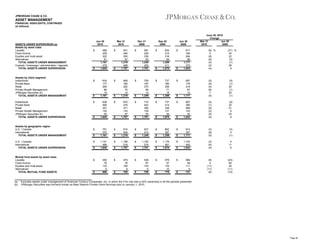

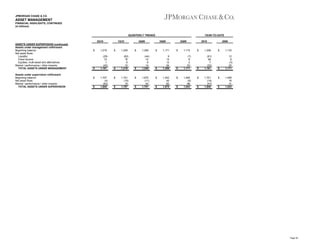

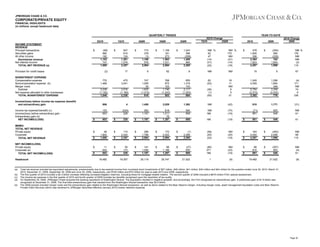

- JPMorgan Chase & Co. released its financial supplement for the second quarter of 2010 including consolidated results and business detail.

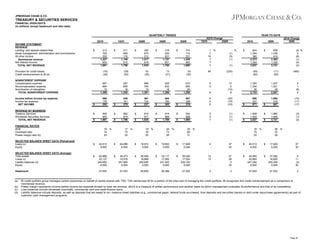

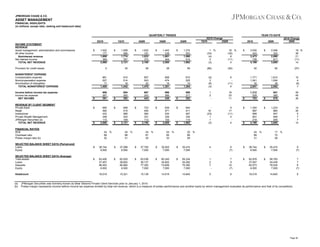

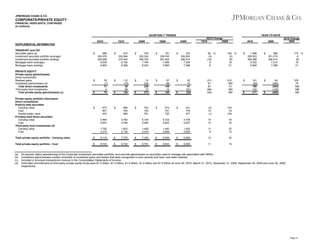

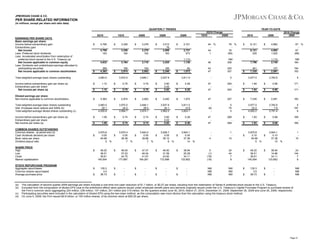

- Total net revenue was $25.1 billion for Q2 2010, down 9% from Q1 2010 but up 2% year-over-year. Net income was $4.8 billion for Q2 2010, up 44% from Q1 2010 and 76% year-over-year.

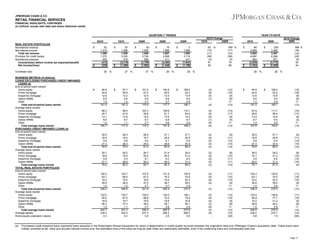

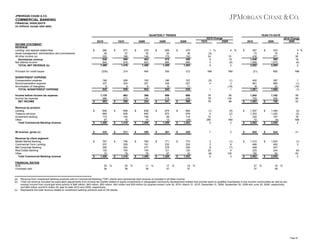

- By line of business, the Investment Bank and Commercial Banking saw the largest increases in net income quarter-over-quarter, while Retail Financial Services had a loss in Q1 2010 but profit in Q2 2010.