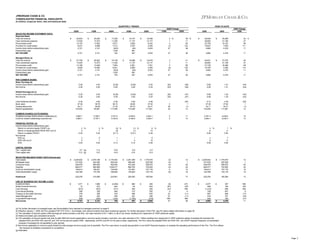

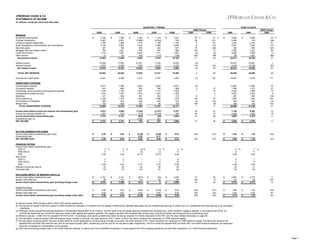

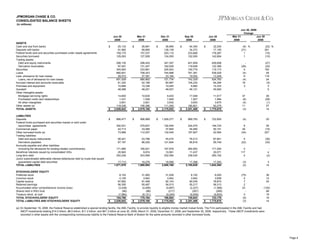

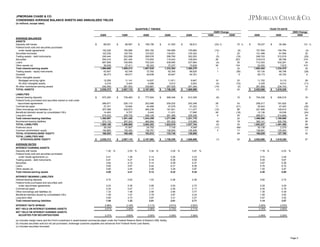

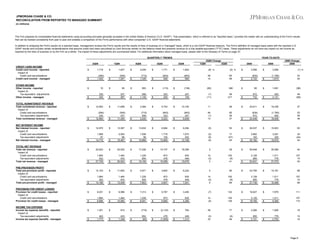

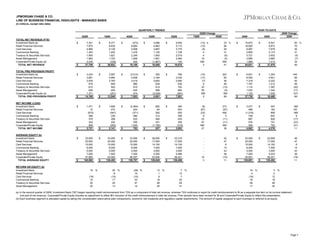

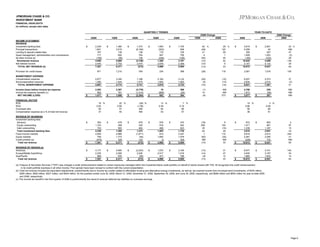

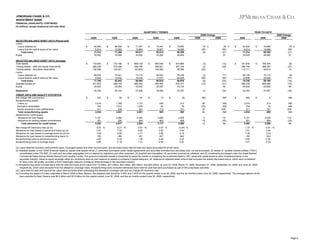

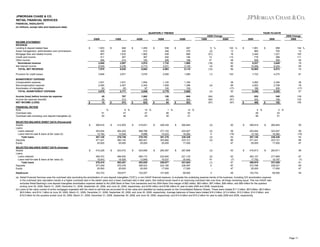

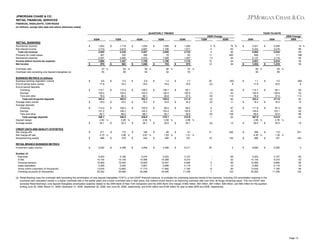

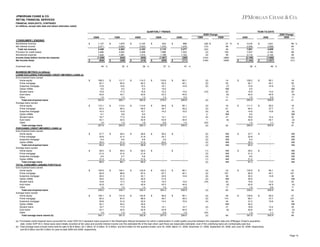

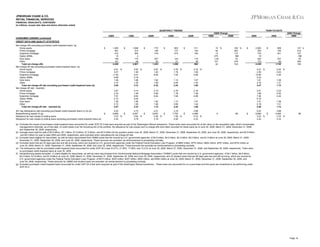

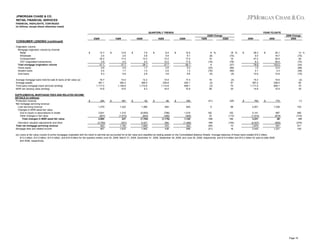

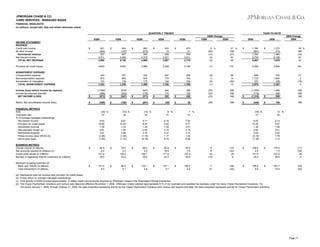

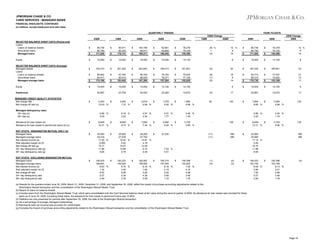

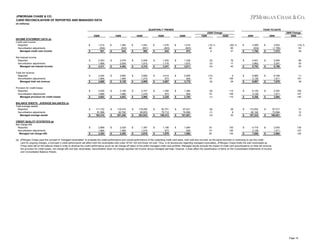

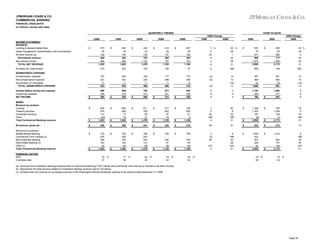

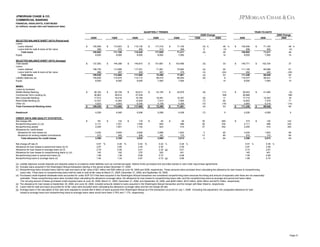

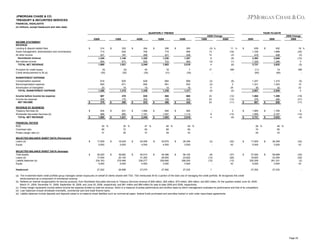

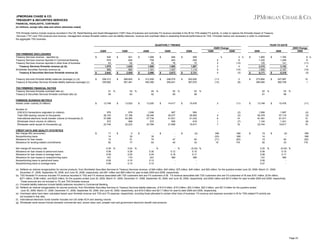

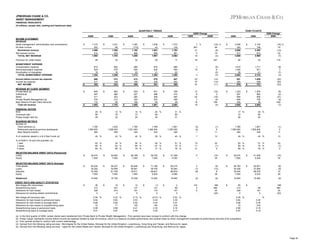

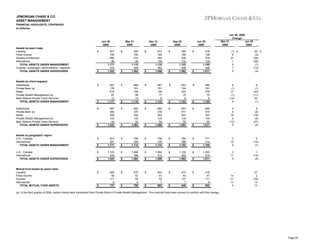

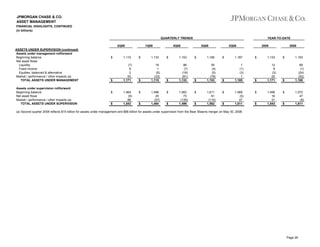

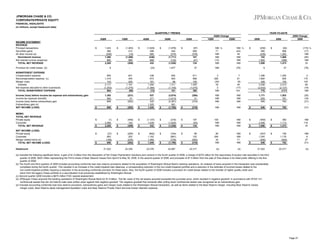

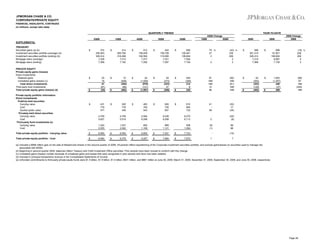

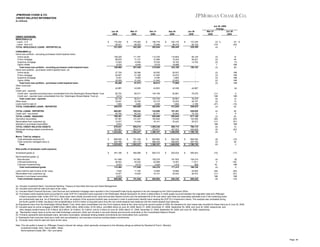

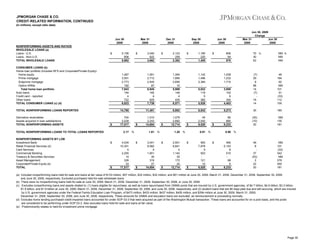

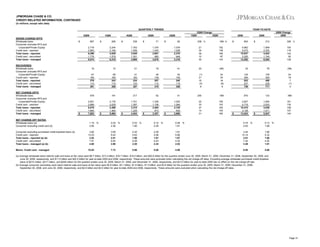

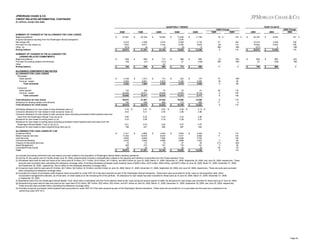

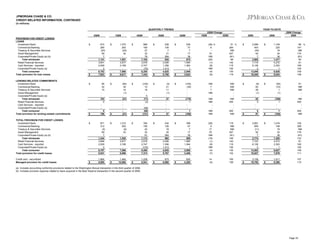

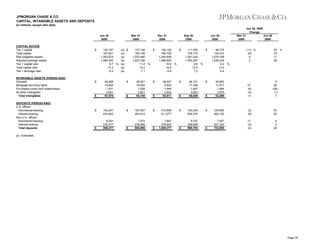

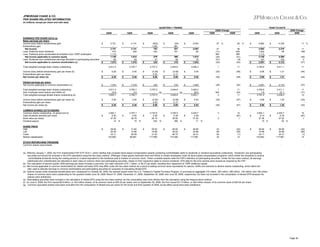

The document is JPMorgan Chase & Co.'s earnings release for the second quarter of 2009. It reported net income of $2.7 billion for Q2 2009, up 27% from Q1 2009. Total net revenue was $25.6 billion for Q2 2009, up 2% from the previous quarter. The provision for credit losses was $8 billion for Q2 2009, down 7% from Q1 2009.