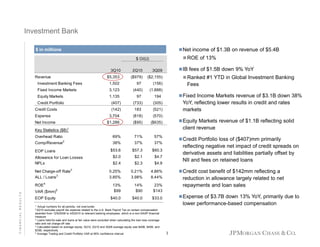

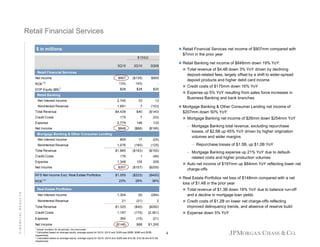

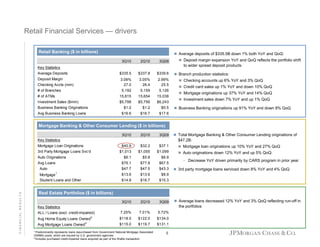

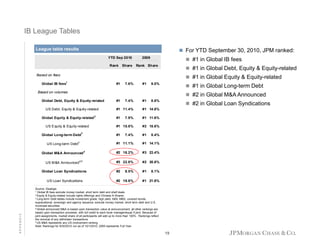

JPMorgan Chase reported third quarter 2010 net income of $4.4 billion and earnings per share of $1.01. Key business segments performed well, with the Investment Bank ranked #1 in global fees year-to-date, and Retail Financial Services reporting strong mortgage production. Credit costs declined from reductions to loan loss reserves. However, increases to litigation reserves reduced earnings. Overall, the company delivered solid results with improved credit performance.