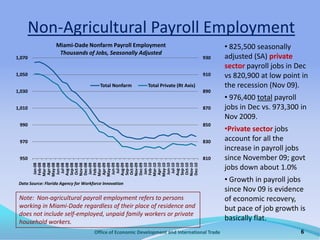

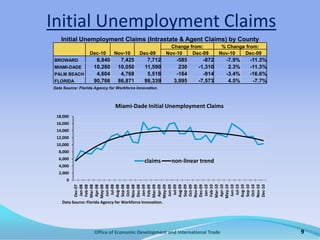

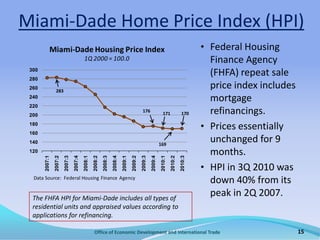

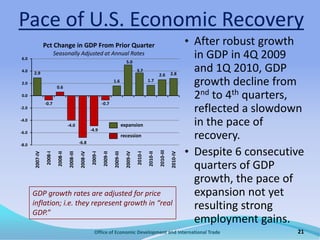

Miami-Dade's economy shows signs of slow recovery as of March 2011, with payroll employment on a gradual increase despite high unemployment rates (13.3%). Key economic indicators such as taxable sales and international trade have improved, while tourism remains strong, but public sector job losses offset private sector gains. The outlook for 2011 suggests potential acceleration in local economic growth, driven by an expected GDP growth of 2.5-3% in the U.S. and stronger ties with Latin American trading partners.