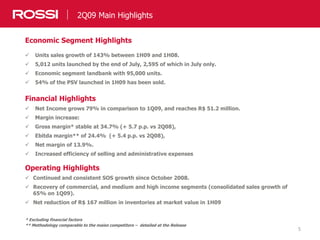

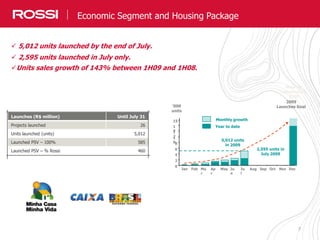

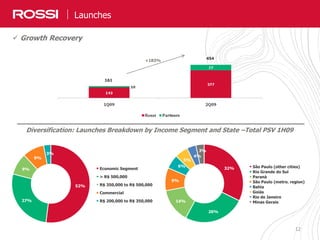

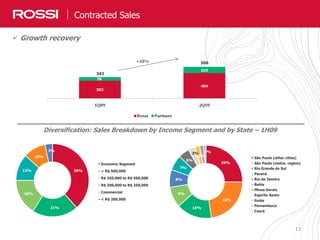

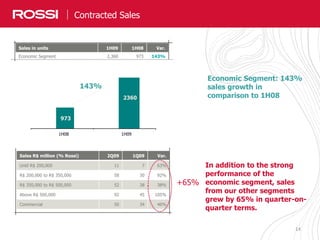

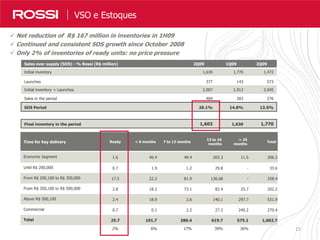

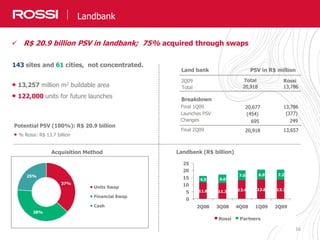

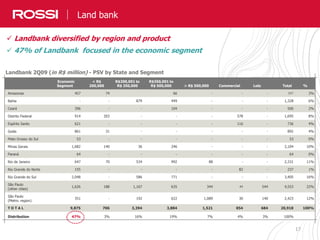

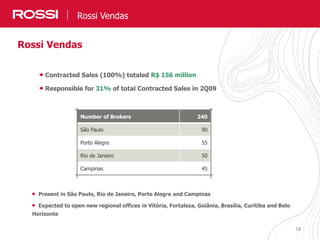

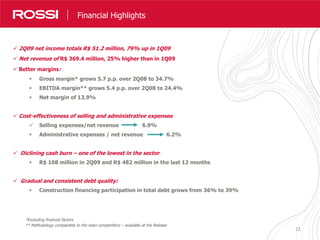

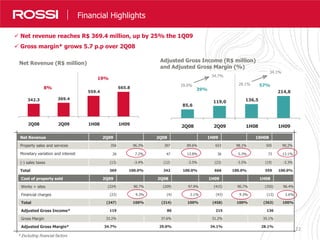

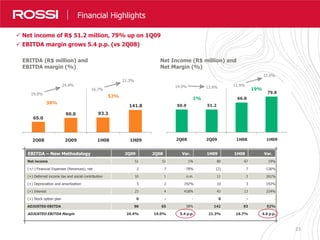

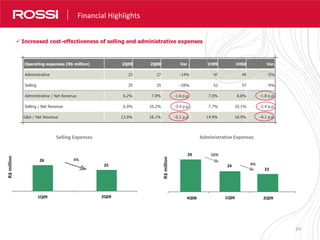

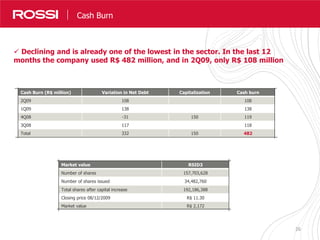

Rossi presented results for 2Q09, highlighting growth in unit sales and launches. Specifically, they launched 5,012 units by the end of July, with 2,595 units launched in July alone. Net income grew 79% compared to 1Q09, reaching R$51.2 million. The company continued to see growth in sales over supply since October 2008 and a reduction in inventories at market value in 1H09. Rossi's economic segment has a landbank of 95,000 units across multiple states in Brazil.