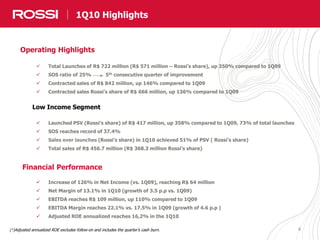

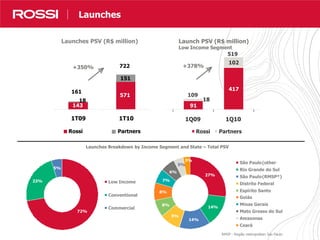

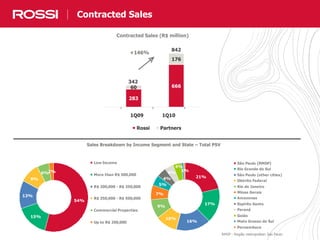

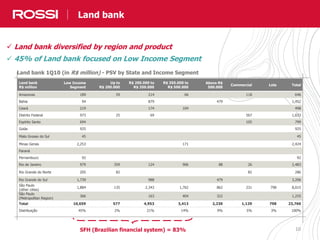

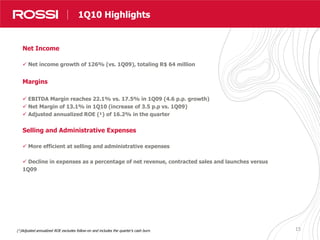

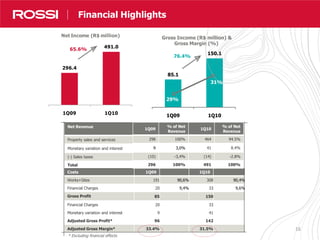

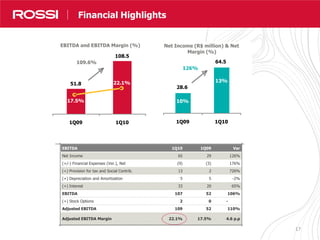

Rossi Residencial S.A. reported financial and operating results for the first quarter of 2010. Key highlights included total launches of R$722 million, up 350% from the first quarter of 2009. Contracted sales reached R$842 million, up 146% year-over-year. Net income grew 126% to R$64 million compared to the prior year quarter. EBITDA increased 110% to R$109 million and the EBITDA margin expanded by 4.6 percentage points to 22.1%.