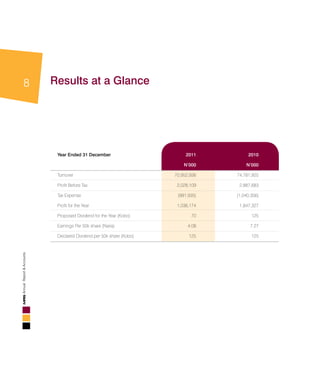

This document provides a summary of MRS Oil Nigeria Plc's annual report and financial statements for the year ended December 31, 2011. It discusses the company's operating environment, including the economic, political, and industry conditions. Some key points:

- The global economy showed signs of recovery, though developed economies lagged. Emerging markets like Nigeria saw faster growth.

- Nigeria's GDP grew 7.69% in 2011 and oil production averaged 2.3 million barrels per day. However, inflation remained in double digits and exchange rates were volatile.

- Political instability from violence, kidnappings and sectarian clashes hurt investment. However, amnesty programs stabilized the oil-rich Niger Delta region.

- Despite