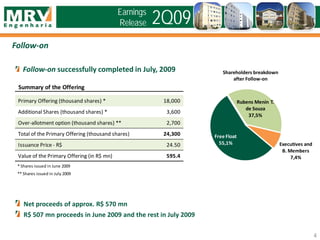

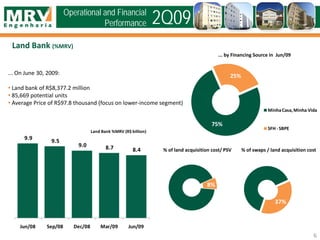

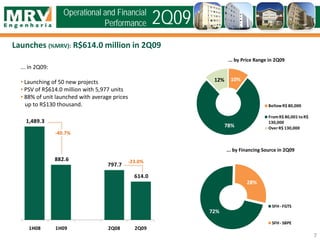

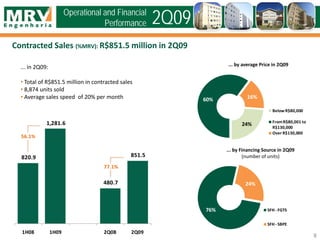

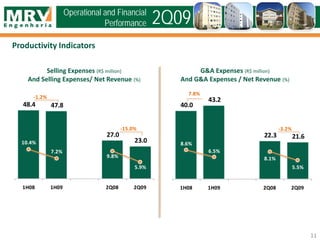

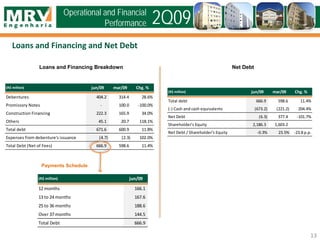

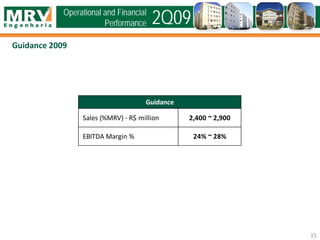

The document summarizes MRV's 2Q09 earnings release. It highlights that MRV had a record quarter for operational and financial indicators. Net income increased 82% from the previous year. Despite record contracted sales, selling expenses decreased 15% from 2Q08. MRV also successfully completed a follow-on offering that raised approximately R$570 million to further strengthen its healthy financial position. Guidance for 2009 forecasts sales between R$2.4-2.9 billion and an EBITDA margin of 24-28%.