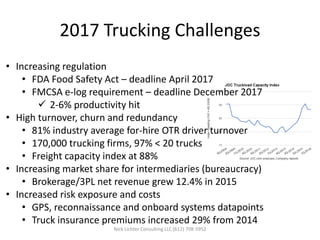

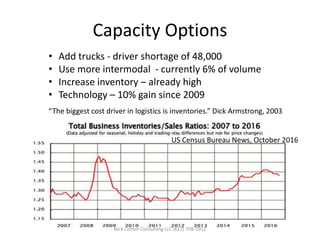

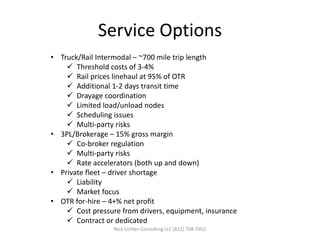

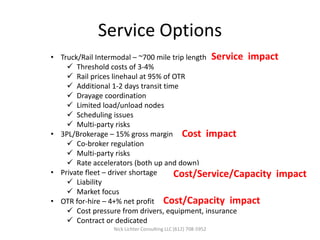

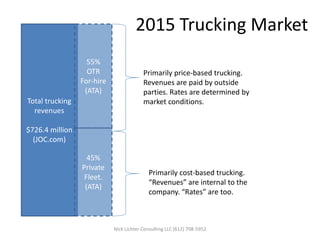

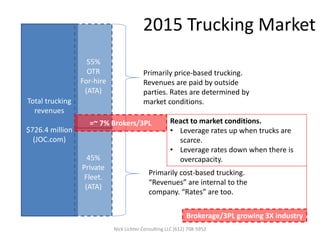

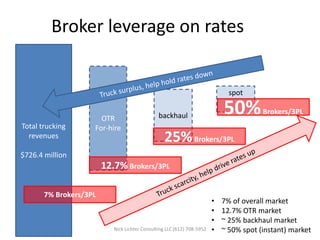

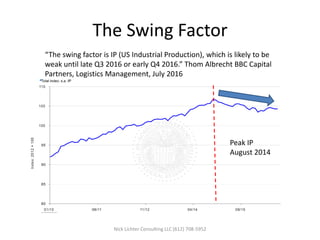

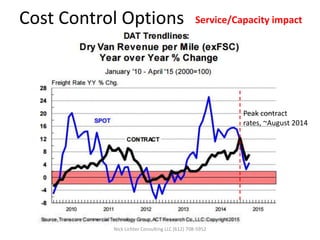

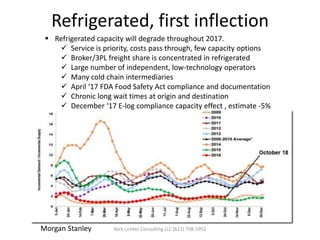

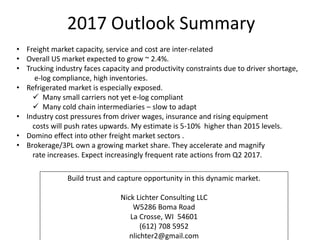

The document outlines the key challenges and opportunities in the 2017 trucking industry, highlighting issues like driver shortages, regulatory changes, and rising costs. It identifies a predicted growth of about 2.4% in the freight market, while noting the interrelationship between capacity, service, and costs. The text emphasizes the importance of building trust among shippers, carriers, and intermediaries to navigate this dynamic market.