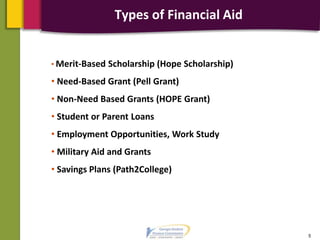

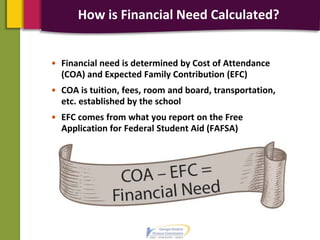

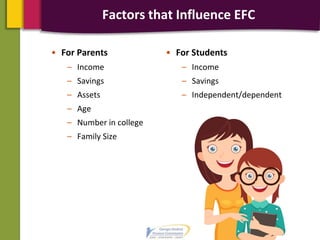

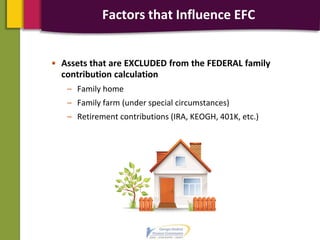

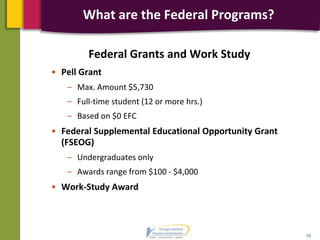

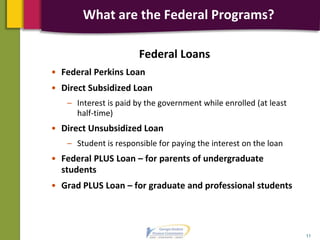

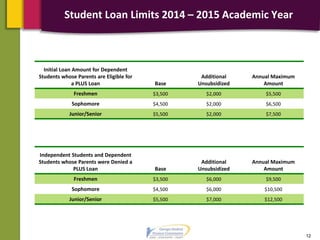

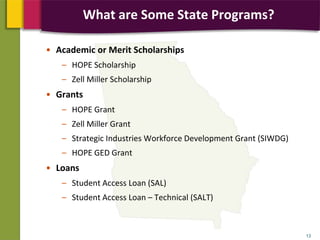

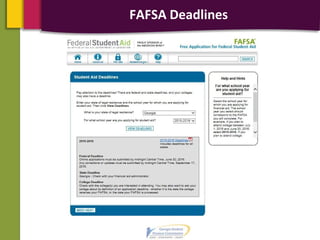

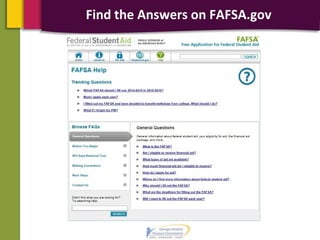

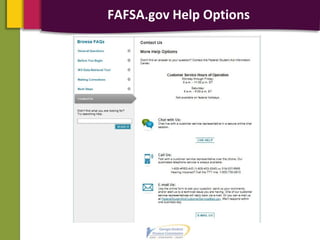

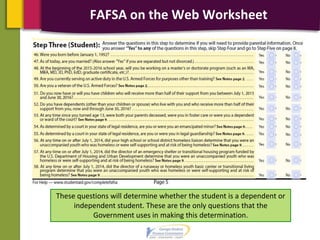

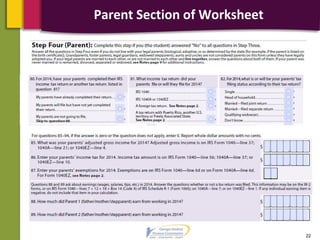

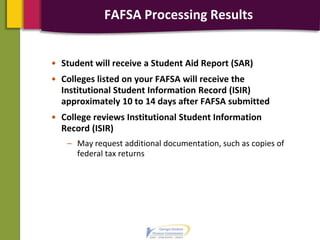

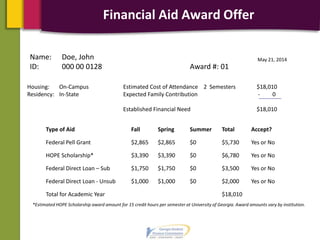

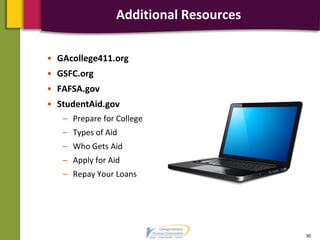

This document provides an overview of financial aid options for college. It discusses the different types of financial aid including grants, scholarships, loans, and work-study. It explains how to determine financial need by calculating the cost of attendance and expected family contribution. The document reviews the federal and state financial aid programs and how to apply for aid by filling out the Free Application for Federal Student Aid (FAFSA). It provides resources for additional financial aid information and assistance.