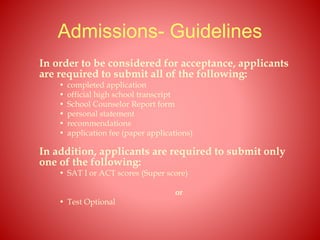

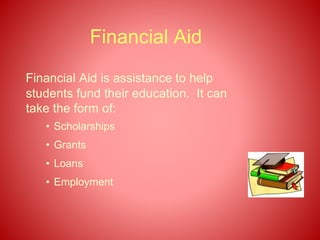

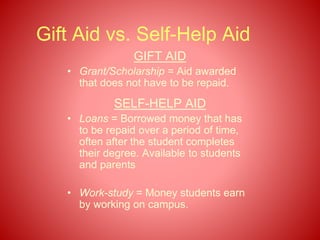

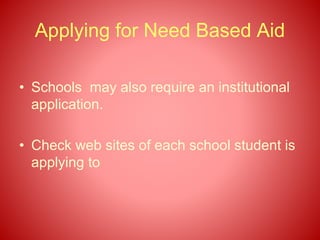

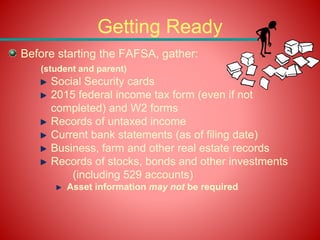

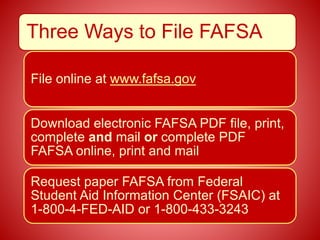

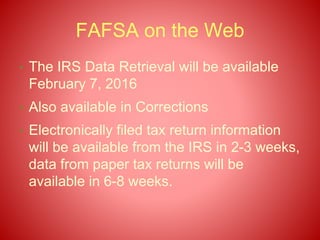

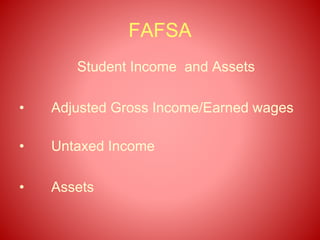

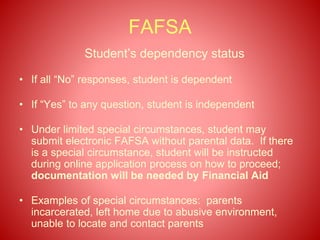

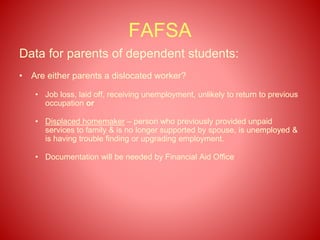

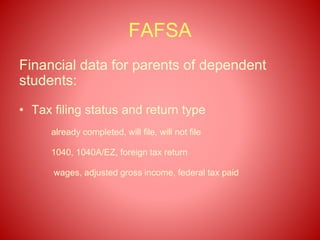

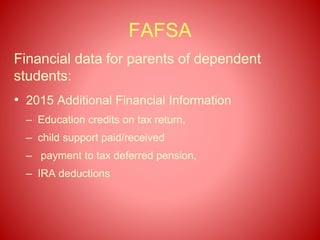

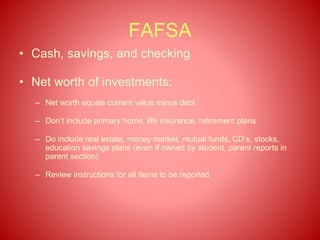

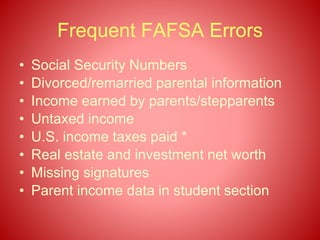

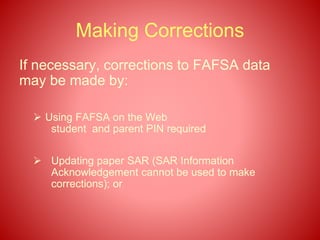

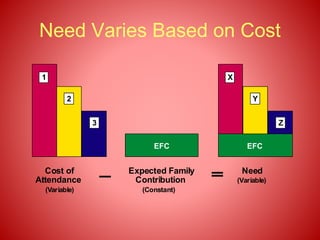

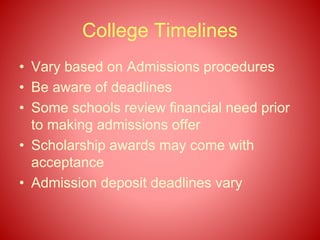

The document provides information about college admissions, financial aid, and the financial aid application process. It discusses the different ways to apply for admission, requirements for admission such as transcripts and test scores, types of financial aid including grants, loans, and work-study. It summarizes the FAFSA application and explains the difference between need-based and merit-based aid. The document aims to guide students through the admissions and financial aid processes.