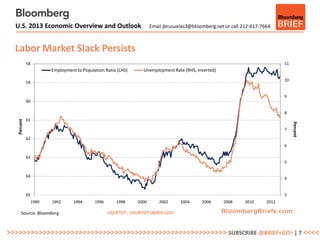

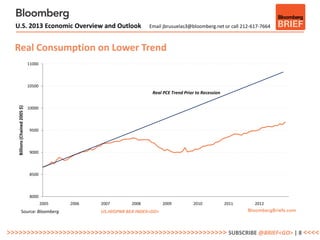

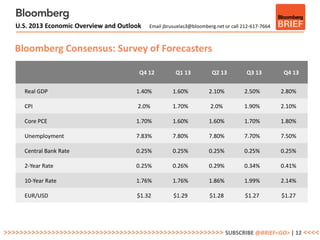

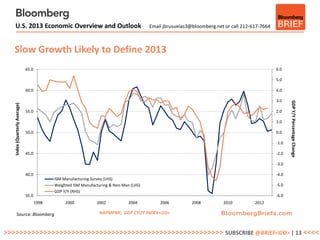

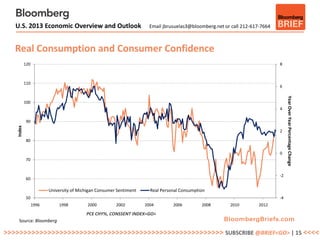

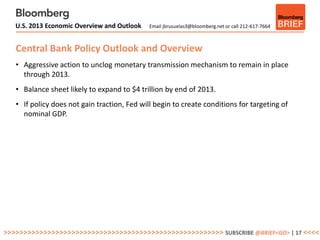

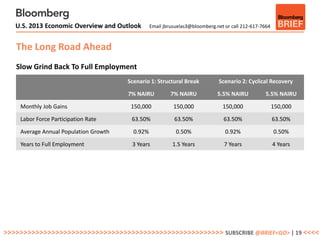

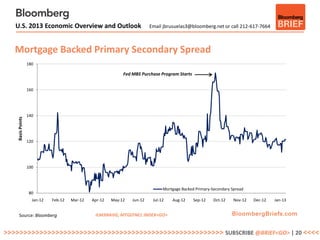

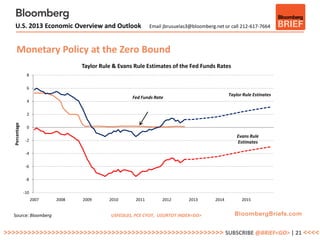

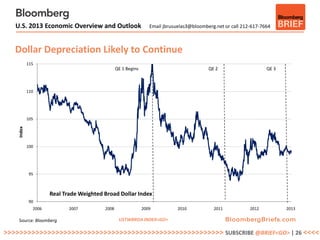

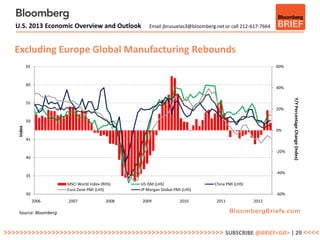

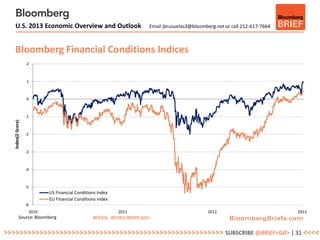

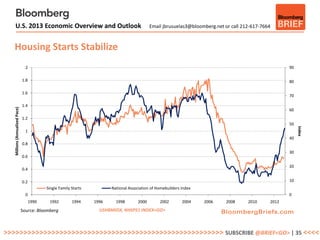

The U.S. economic outlook for 2013 suggests continued slow growth around 2% with job gains and a modest reduction in unemployment, driven by sectors like energy and housing but hampered by fiscal drag due to political and policy challenges. The Federal Reserve's policies will likely persist, focusing on liquidity measures, as risks such as global tensions and domestic fiscal disputes could impede progress. Overall, the structural adjustments in the economy indicate a prolonged path to full employment and further economic recovery.